|

市场调查报告书

商品编码

1432999

纸盒包装:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Folding Carton Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

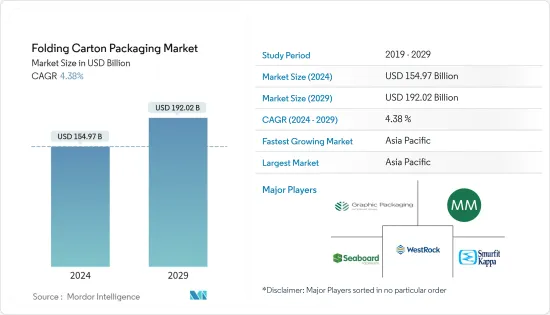

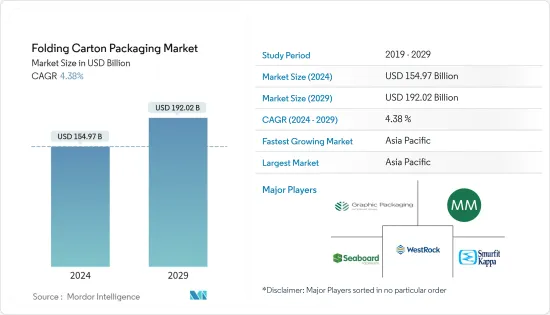

2024年折迭纸盒包装市场规模预计为1549.7亿美元,预计到2029年将达到1920.2亿美元,在预测期内(2024-2029年)复合年增长率为4.38%。

主要亮点

- 假冒是一种大批量、高收益的行业,会导致侵犯智慧财产权、药品法律规章和其他犯罪方面。药品假冒(或窜改)是一种全球性风险,需要采取有效的预防措施。假冒涉及故意歪曲药品的特性或来源,并故意规避法律规定的监管程序。在不受监管的条件下生产的药物本质上是危险的,即使它们含有正确的成分。

- 为此,一些市场相关人员已将二维矩阵码纳入药品折迭式纸盒的包装中。例如,CCL Label Montreal 设计了系列化折迭式纸盒包装解决方案,用于对折迭式纸盒印刷品质进行 100% 电子检查。每个折迭式纸盒均经过检查并给予检查状态。在最后阶段,将建立一份报告,显示所有通过/失败的最终结果。结果是专为折迭纸盒行业设计的独特、真实、100% 电子印刷检测系统。使这一概念成功的关键因素是在每个折迭纸盒上都有一个序列化标识符。生产的每个折迭纸盒都将永远独一无二,最终推动对折迭纸盒的需求。

- 2022 年 3 月,Van GenechtenPackaging 开发了 PurePac,一种可回收的巧克力折迭纸盒包装。在包装设计方面,Van GenechtenPackaging 提供多种精加工技术,包括低迁移油墨、装饰清漆以及烫金和压花等装饰。该公司使用食品安全的颜色和清漆在其包装的内部和外部进行印刷。

- 随着 COVID-19 的爆发,由于各国的封锁扰乱了供应链,折迭纸盒面临成长放缓。疫情期间,消费者方面的库存在最初阶段后有所减少,这在世界各地的杂货店都可以看到。库存的减少也减少了疫情期间对折迭纸盒製造商的需求。

- 然而,根据印度政府现有的统计数据,自 2022 年 3 月开始的过去 12 个月里,纸浆成本上涨了 25% 以上。这主要是由于新冠肺炎 (COVID-19) 疫情后品质环境标准提高以及对纸包装产品的需求增加。 COVID-19主导的停工和国际物流中断造成的供应问题增加了进口和国内废纸成本。根据业界专家介绍,目前原漂浆价格已涨至每吨900美元以上,漂白浆价格已涨至每吨1,300美元左右,造纸厂难以跟上价格的快速上涨。此外,包装产业纸张价格仅上涨14%,为2022年首次涨价。这可能会阻碍市场成长。

折迭纸盒包装市场的趋势

食品和饮料领域占据大部分市场占有率

- 消费者生活方式的改变以及对已调理食品、冷冻食品和包装产品日益增长的需求正在推动食品和饮料业务的兴起,从而推动折迭纸盒市场的发展。

- 根据美国人口普查局统计,2021年美国冷冻食品製造业销售额为338.6亿美元,预计2024年将超过365.9亿美元。这些新兴市场的开拓改善了冷冻食品市场的策略活动。

- 2023 年 5 月,芬兰斯道拉恩索推出了一款名为 Tambrite Aqua+ 的新型易于回收包装纸板。这适用于包装冷藏和冷冻食品。这种折迭式纸板解决方案最大限度地减少了石化燃料的聚合物的使用。它天然可回收,有助于促进更广泛的循环经济。 Tambrite Aqua+' 采用「分散涂层」技术製成,形成水基解决方案,可轻鬆与纸板表面融合并提供必要的保护。新的解决方案也不含氟化合物,可以承受外部湿渍和油渍,同时保护商品免受污染。

- 疫情正在推动透过线上配送媒介对冷冻食品的需求。在印度等国家,COVID-19 导致冷冻食品消费增加,儘管病例下降,但这些饮食习惯预计将保持不变。根据《经济时报》报道,全国线上食品配送规模预计将从2020年的29亿美元增加到2025年的128亿美元。此外,随着塑胶容器和包装在该国被禁止,用于包装冷冻食品的折迭式纸盒的需求正在增加。

- 此外,在英国,2022年4月生效的塑胶税(对不含至少30%再生塑胶的塑胶包装征收)也将课税冷冻食品品牌和製造商对纸质包装的需求开关。可能会增加。

- 由于这些因素,预计纸容器的需求不仅在食品和饮料行业而且在其他领域也会增加。 Suzano预计,2022年纸板消费量将达5,400万吨,2032年将增加1,200万吨。预计未来十年对纸箱纸板的需求将进一步增加。纸箱纸板是一种用于折迭纸箱製造的纸板。

亚太地区占最大市场占有率份额

- 在该地区食品和饮料消费成长的推动下,折迭纸盒包装行业正在经历健康成长。该地区专注于永续和可重复使用的包装,以遏制全球暖化并遵守政府提案的环境保护法。

- 此外,根据Oizuru介绍,日本瓦楞纸箱的回收率已达95%,纸箱工厂的回收率为90%。此外,瓦楞纸箱的弹性日益增强,推动了该地区的需求,瓦楞纸箱用作覆材,并被製造成复杂的建筑内部。

- 时尚、化妆品、消费性电子产品、食品等领域直接面向消费者 (D2C) 品牌的兴起也推动了这种需求成长。这些新时代的数位优先品牌采用直接面向消费者的方式并直接与不断增长的数位消费者互动,现在正在挑战成熟品牌。这些案例预计将推动市场成长。

- 市场上也有供应商的产品创新和扩张活动等各种开拓。例如,2022年3月,海德堡与日本AN公司签署了Kawahara TXS-1100和Kawahara BMS-1100自动印后系统的分销协议,扩大了其套模标籤和折迭纸盒生产的产品组合。

- 2022 年 3 月,总部位于东京的 Think of Things Shop & 咖啡馆推出了一款功能强大的纸板箱,称为“CARTON 2.0”,它具有防水功能,内部可容纳液体。该计划是与生产贵重纸板的 IZAK 合作的。这些箱子由环保的冷却和防水材料製成,特别适合运输海鲜和冷藏产品。然而,它不是永久防水产品,因为随着时间的推移,表面上的针孔可能会渗透。

折迭纸盒包装产业概况

折迭纸盒包装市场竞争中等,主要企业包括 Westrock Company、Smurfit Kappa Group、Graphic Packaging LLC 和 Stora Enso Oyj。从市场占有率来看,目前该市场由几家大型企业占据主导地位。然而,许多公司正在透过创新和永续的包装来扩大其市场份额,赢得新契约并开拓新市场。

2022年5月,纸包装产品综合製造商Smurfit Kappa United Kingdom Limited宣布收购Atlas Packaging。 Atlas Packaging 总部位于北德文郡巴恩斯特珀尔,是一家独立的纸板包装公司,在英国市场拥有强大的影响力。

2022 年 4 月,WestRock Company 与 Recipe Unlimited 合作推出了一套可回收纸板包装,旨在每年从加拿大垃圾掩埋场转移 3,100 万个塑胶容器。包装于 2021 年 10 月开始在 Swiss Chalet 餐厅使用,目前已在所有地点使用。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 对尖端包装设计服务和永续性的需求推动市场

- 市场限制因素

- 木浆需求波动和供需缺口阻碍市场成长

第六章市场区隔

- 按最终用户产业

- 食品和饮料

- 家庭使用

- 个人护理和化妆品

- 医疗保健和製药

- 烟草

- 电力/硬体

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- WestRock Company

- Graphic Packaging International LLC(graphic Packaging Holding Company)

- Mayr Meinhof Packaging International Gmbh(mayr-melnhof Karton Ag)

- Smurfit Kappa Group

- Seaboard Folding Box Company Inc.(vidya Brands Group)

- American Carton Company

- All Packaging Company

- Essentra Plc(essentra Group)

- Stora Enso Oyj

- Unipak Inc.

- DS Smith PLC

- Edelmann Gmbh

第八章市场的未来

The Folding Carton Packaging Market size is estimated at USD 154.97 billion in 2024, and is expected to reach USD 192.02 billion by 2029, growing at a CAGR of 4.38% during the forecast period (2024-2029).

Key Highlights

- Counterfeiting is a high-volume, high-profit business that causes the infringement of intellectual property rights, medicine legislation, and other criminal law aspects. Medicine counterfeiting (or falsification) presents a global risk that requires effective preventive responses. Falsification involves the knowing misrepresentation of a pharmaceutical product's characteristics and provenance and the deliberate avoidance of legally instituted regulatory processes. Even if they contain the right ingredients, medicines produced in unregulated circumstances are inherently hazardous.

- Owing to this, several market players are incorporating 2D matrix codes on folding carton packages for medicines. For instance, CCL Label Montreal designed a serialized folding carton packaging solution to achieve 100% electronic inspection of each folded carton's print quality. Each folding carton would be inspected and given an inspection status. A report would be generated at the final stage showing all accepted and rejected cartons' final results. The result would be a unique and real 100% electronic print inspection system designed for the folding carton industry. The critical element for this concept to succeed is to have a serialized identifier on each folding carton. Each folding carton generated will be forever unique, eventually propelling the demand for Folding Cartons.

- In March 2022, Van GenechtenPackaging developed a recyclable folding carton packaging for chocolate, PurePac, with an inside anti-grease barrier that eliminates the need for aluminum or plastic inner packaging. As for packaging design, Van GenechtenPackaging offers a range of finishing techniques, including low-migration inks, decorative varnishes, and embellishments like hot and cold foil and embossing. The company uses food-safe colors and varnishes for printing inside and outside packaging.

- With the outbreak of COVID-19, folding cartons faced slow growth due to lockdowns imposed by various countries that disrupted the supply chain. During the pandemic, the stockpiling from consumers' end reduced after the initial phases and was witnessed by grocery stores across the globe. This disappearing behavior of stockpiling also reduced the demand for folding carton manufacturers during the pandemic.

- However, as per available Indian government statistics, the cost of pulp has increased by over 25% in the last 12 months from March 2022. This was mainly due to higher-quality environmental standards after COVID-19 and the growing demand for paper-packaged products. Due to supply problems brought on by COVID-19-led lockdowns and international logistics disruptions, import and domestic waste paper costs rose. According to an industry expert, the unbleached pulp prices increased to over USD 900 and bleached pulp to around USD 1,300 a tonne, a sharp hike that paper mills found tough to handle. Also, Paper prices just went up 14% for the packaging industry, the first increase of 2022. This could hinder the market growth.

Folding Cartons Packaging Market Trends

Food and Beverage Segment to Hold a Major Market Share

- The changing lifestyles of the public and the rising demand for ready-to-eat, frozen, and packaged items have fueled the rise of the food and beverage business, which, in turn, is driving the folding cartons market.

- According to the US Census Bureau, the industry revenue from frozen food manufacturing in the United States was USD 33.86 billion in 2021 and is expected to cross USD 36.59 billion by 2024. Such developments have improved the strategic activities in the frozen food market.

- In May 2023, Stora Enso, a Finnish company, launched a new easy-to-recycle packaging board called Tambrite Aqua+. It is appropriate for packing chilled and frozen food. The use of polymers derived from fossil fuels has been minimized with the help of this folding box board solution. It is naturally recyclable and will help to advance the circular economy more generally. Tambrite Aqua+ is created utilizing 'dispersion coating' technology, making it a water-based solution readily integrated with the paperboard surface and offering the necessary protection. Also, devoid of fluorochemicals, the novel solution can endure exterior wetness or grease while protecting the goods from contamination.

- The pandemic has driven the demand for frozen foods through online delivery mediums. In Countries like India, COVID-19 expanded the consumption of frozen foods, and these food habits were expected to remain the same despite the drop in cases. According to the Economic Times, the size of online food delivery across the country is expected to increase from USD 2.9 billion in 2020 to USD 12.8 billion by 2025. The country is also witnessing an increased demand for folding cartons for packaging frozen foods due to the ban on plastic counterparts.

- Further, in the UK, the plastic tax, which came in April 2022 (taxing any plastic packaging not comprising at least 30% recycled plastic), is also likely to increase demand for paper-based packaging as frozen food brands and manufacturers switch.

- Owing to such factors, the demand consumption of folding cartons is expected to increase not only in the food and beverage segment but also in other segments. According to, Suzano, carton board consumption reached 54 million tons in 2022 and is forecast to increase by 12 million tons in 2032. The demand for carton boards is expected to increase further over the next decade. Cartonboard is a type of paperboard used for manufacturing folding cartons.

Asia-Pacific to Hold the Largest Market Share

- The folding carton packaging industry is experiencing healthy growth, fueled by the increase in the region's consumption of beverages and packaged food. The region focused on sustainable and reusable packaging to reduce global warming and abide by the environmental protection act proposed by the Government.

- Furthermore, according to the company Oizuru, the collection rate of boxes in Japan is as high as 95%, with a recycling rate of 90% at corrugated cardboard facilities, driving manufacturers to reduce costs and increase processing capacity. Additionally, driving demand in the region is the enhanced flexibility of carton boxes, which may be utilized as exterior materials and processed into the interiors of complicated constructions.

- The emergence of direct-to-consumer (D2C) brands in fashion, cosmetics, consumer electronics, and food has also aided this increase in demand. Using a D2C approach and engaging directly with the expanding number of digital shoppers, these new-age digital-first brands are now challenging established brands. Such instances are anticipated to drive market growth.

- Also, there have been various developments, such as product innovations and expansion activities by vendors in the market. For instance, in March 2022, Heidelberg expanded its portfolio for in-mold label and folding carton production by entering into a distribution agreement with Japanese company AN Corporation for the Kawahara TXS-1100 and Kawahara BMS-1100 automated post-press systems.

- In March 2022, Tokyo-based Think of Things shop and cafe offered high-functional cardboard boxes dubbed CARTON 2.0 that are waterproof enough to contain liquid inside. The project is a collaboration with IZAK, a company that produces valuable cardboard boxes. Environmentally sustainable cooling and waterproofing materials are employed in such boxes, which are especially useful for transporting fishery and refrigerated items. However, this is not a permanently waterproof product due to the possibility of pinholes on the surface becoming permeable over time.

Folding Cartons Packaging Industry Overview

The Folding Carton Packaging Market is moderately competitive and has several major players, such as Westrock Company, Smurfit Kappa Group, Graphic Packaging LLC, Stora Enso Oyj, and more. In terms of market share, few major players currently dominate the market. However, many companies increase their market presence with innovative and sustainable packaging by securing new contracts and tapping new markets.

In May 2022, Smurfit Kappa United Kingdom Limited, an integrated manufacturer of paper-based packaging products, announced the acquisition of Atlas Packaging. Based in Barnstaple, North Devon, Atlas Packaging is an independent corrugated packaging company that provides rand and has a strong market presence in the United Kingdom.

In April 2022, WestRock Company partnered with Recipe Unlimited to implement a suite of recyclable paperboard packaging intended to divert 31 million plastic containers from landfills across Canada each year. The packaging began appearing at Swiss Chalet restaurants in October 2021 and is now available across all locations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment Of The Impact Of COVID-19 On The Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Leading-edge Packaging Design Services And Sustainability Demand to Drive the Market

- 5.2 Market Restraints

- 5.2.1 Fluctuations In Wood Pulp Demand And Gap between Supply And Demand to Hinder the Market Growth

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Food and Beverages

- 6.1.2 Household

- 6.1.3 Personal Care and Cosmetics

- 6.1.4 Healthcare and Pharmaceuticals

- 6.1.5 Tobacco

- 6.1.6 Electrical and Hardware

- 6.1.7 Other End-user Industries

- 6.2 Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Australia

- 6.2.3.5 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Mexico

- 6.2.4.4 Rest of Latin America

- 6.2.5 Middle East and Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 South Africa

- 6.2.5.3 Egypt

- 6.2.5.4 Rest of Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 WestRock Company

- 7.1.2 Graphic Packaging International LLC (graphic Packaging Holding Company)

- 7.1.3 Mayr Meinhof Packaging International Gmbh (mayr-melnhof Karton Ag)

- 7.1.4 Smurfit Kappa Group

- 7.1.5 Seaboard Folding Box Company Inc. (vidya Brands Group)

- 7.1.6 American Carton Company

- 7.1.7 All Packaging Company

- 7.1.8 Essentra Plc (essentra Group)

- 7.1.9 Stora Enso Oyj

- 7.1.10 Unipak Inc.

- 7.1.11 DS Smith PLC

- 7.1.12 Edelmann Gmbh