|

市场调查报告书

商品编码

1641860

工业空气压缩机:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Industrial Air Compressors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

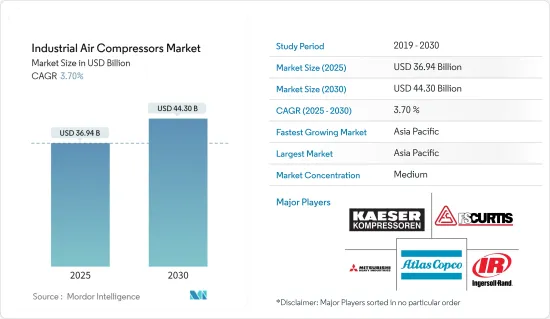

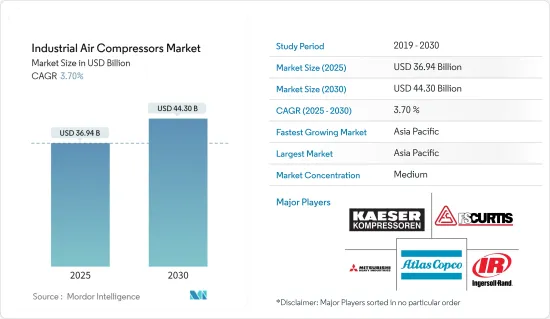

预计2025年工业空气压缩机市场规模为369.4亿美元,预计2030年将达到443亿美元,预测期间(2025-2030年)的复合年增长率为3.7%。

全球石油天然气、石化、运输、农业和汽车行业的蓬勃发展以及政府对工业压缩机技术发展的支持力度不断增加是大幅加速市场扩张的关键原因。

关键亮点

- 世界各地的公司都使用空气压缩机来提供压缩空气,为复杂的工业过程提供动力。重型工业空气压缩机依靠大马力马达和重型组件,因此能够提供更高的压力水平。它们用于农业设施中的作物喷洒和筒仓通风、製造业中为气动机械提供动力以及石油和天然气作业。

- 空气压缩机因其灵活性、安全性和低维护成本而优于电动或液压压缩机。与电动或液压驱动的系统相比,空气压缩机的运动部件较少。然而,空气压缩机需要对其供给的空气进行特殊处理。空气中的污垢会损坏供水管道,导致洩漏腐蚀并最终导致产量降低。

- 市场上的企业也不断投入研发节能空压机。例如,阿特拉斯科普柯表示正专注于开发注油技术,以整合智慧控制和监控系统,提供节能压缩机解决方案。

- 此外,这些压缩机是根据压缩机的应用和位置来使用的。例如往復式压缩机要求将飞轮安装在墙侧,加装密封的皮带防护罩,并要求在方面留有维护空间。对于旋转压缩机,吸入栅和排气风扇的安装方式必须确保它们不会将冷却空气重新循环到压缩机。

- 这些工业用的空气压缩机需要特殊的冷却装置来消散其产生的热量,这增加了公司的初始安装成本。因此,该公司正在寻求性能更高的压缩机来降低能源和维护成本。

- 除了这些应用之外,空气压缩机还用于石油精製、石化合成、管道输送和气体注入。扩大石油和天然气探勘以及增加行业投资是推动市场成长的主要因素。

- 根据恩格索兰的说法,输入压缩空气系统的能量中只有 10% 到 20% 能够到达使用点,其余的都以热量或洩漏的形式浪费掉了。其余能量则因热和洩漏而浪费掉。对于大型组织来说,这个数字可能高达数十万美元。

- 安装和维护空气压缩机的成本非常高。维护各种空气压缩机的复杂监控和控制系统的成本不断增加。因此,预计近期市场扩张将会放缓。

- 然而,由于新冠肺炎疫情爆发,中国供应商已经关闭了工厂并暂停了生产设施。随着中国新冠肺炎病例数量的下降,由于工厂关闭导致供不应求,在该地区设有製造工厂的供应商正在将零件价格提高近 2-3%。这影响了来自中国的整个供应链。 COVID-19 的蔓延也促使了压缩机领域的技术创新,供应商扩大了生产规模以满足突然增长的需求。

工业空气压缩机市场趋势

旋转式空气压缩机占很大市场份额

- 旋转式空气压缩机,也称为旋转螺桿式空气压缩机,是一种正排量压缩系统,可显着减轻重量、易于维护(因为可简化维护程序)、低消费量,并且不会影响恶劣的工业条件。

- 旋转式空气压缩机主要受到需要长时间恆定压力的使用者的青睐。它们用于各种工业环境,包括物料输送、喷漆和工具机使用。此外,製造业、食品饮料业和製药业等多个行业正在转向无油空气压缩机,以优化流程并降低生产成本。

- 此外,需要大量中压空气的使用者通常使用油润滑空气压缩机。例如,全球BIC集团的墨西哥子公司No Sabe Fallar,SA de CV,采用GA型压缩机、节能的ES控制系统和AirConnect视觉化系统,製造安全可靠的BIC产品。油润滑空气压缩机具有相同的可靠性,并且透过更聪明地利用能源显着降低成本。

- 无油旋转螺桿模型用于生产、工业或医疗应用,以防止油进入气流,如食品包装或医用氧气。无油旋转空气压缩机价格昂贵,因为它们需要两个压缩阶段才能达到与油润滑旋转系统相同的压力。

- 工业空气压缩机在现代石油和天然气工业的大型和小型业务中发挥着至关重要的作用。例如,根据 Q Air-California 的说法,95% 的石油气在通过管道运输之前都经过压缩。

- 石油和天然气产业需要永续、可靠的压缩空气设备。各下游石油和天然气公司都感受到了新冠疫情的影响,导致石化产品和精製产品的需求放缓。精製利润率下降将导致BPCL、HPCL、IOCL和RIL等下游石油公司的利润下降。相较之下,由于旅行和工业活动的减少,印度石油公司和印度石油天然气公司等上游公司的石油和天然气需求成长放缓,影响了石油和天然气行业的工业空气压缩机。

亚太地区占较大市场占有率

- 中国有望成为亚太地区乃至全球最大的工业空气压缩机生产和消费市场之一。中国占主导地位的关键因素是该国拥有多家空气压缩机製造商,包括浙江开山压缩机、VMAC 公司、江苏 DHH 压缩机和德耐尔节能科技(上海)股份有限公司。

- 其他对该地区成长有重大贡献的因素包括政府法规和倡议,预计这些法规和倡议将进一步促进市场发展并提高空气压缩机的能源效率。例如,《能源政策与保护法》为各种消费产品以及商业和工业设备(包括空气压缩机)制定了节能标准。

- 此外,由于国内产业的发展和随之而来的出口加速、严格标准的出台以及快速的都市化,中国正成为一个有吸引力的国家。中国的工业生产力非常高,位居全球成长最快的28个国家之一。这些因素正在推动该国製造工厂采用工业空气压缩机。

- 此外,还计划进行多项投资以提高该地区的成长品质、解决环境问题并减少产能过剩。该公司在食品饮料、电子、建筑和采矿等多个终端用户行业中占据主导地位。

- 儘管替代能源不断发展,但随着世界人口的成长,对石油和石油产品的需求仍在增加,主要是在中国、印度和日本。因此,为了满足这一需求,工业空气和气体压缩机已变得非常有价值,以确保这些任务的正确压力水平,并保持竞争优势,技术创新集中在降低能源需求、提高速度和更具有显着的抵御恶劣钻井环境的能力。

- 此外,预计到2021年终,印度将成为世界第五大製造业国家。西门子、通用电气和波音等製造业巨头已经或正在印度建立新的製造工厂,作为扩大策略的一部分。这些趋势表明,我国工业空气压缩机的采用日益广泛。

- 根据 OPEC 最近的预测,印度将首次成为未来能源需求的最大单一贡献者,其次是中国和其他国家,预计石油产品日需求量为 2,200-2,300 万桶。将这些精製和储存设施设在沿海和气候恶劣的地区预计将增加该国对工业空气压缩机的需求。

工业空气压缩机产业概况

工业空气压缩机市场竞争激烈,有多家参与企业竞争。阿特拉斯·科普柯集团、英格索兰公司(Gardner Denver Inc.)、凯撒压缩机公司和三菱重工压缩机公司等市场竞争对手正努力维持市场竞争力。因此,市场竞争企业之间的敌意情绪不断加剧,市场集中度较低。

2022 年 5 月,ELGi 推出了两个新系列,这是其 AB 系列无油螺桿空压机的最新成员——ELGi AB 11-22kW。该装置特别满足食品和饮料、小型製药和乳製品产业的压缩空气需求。我们还有 LD 系列 2.2 至 11 kW 润滑直驱往復式空气压缩机。新型 LD 系列是活塞空气压缩机技术的创新。

2022 年 6 月,英格索兰推出了新型 MSG TurboAir NX 1500(NX 1500)压缩机,这是其离心式压缩机产品组合中的最新创新。凭藉成熟的技术和功能,NX 1500 可满足能源密集型场所的需求,同时真正提高您企业的收益。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 全球对石油和天然气的投资增加

- 节能压缩机的需求

- 市场限制

- 环境和安全问题

第六章 市场细分

- 按类型

- 旋转式空气压缩机

- 往復式空气压缩机

- 离心式空气压缩机

- 按最终用户

- 石油和天然气

- 饮食

- 製造业

- 医疗

- 发电

- 建筑和采矿

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Atlas Copco Group

- Ingersoll Rand Inc.

- FS-Curtis

- Howden Group Ltd.

- Gardner Denver Inc.

- Mitsubishi Heavy Industries Compressor Corp.

- Kaeser Kompressoren

- Zhejiang Kaishan Compressor Co. Ltd(Kaishan Group)

- Sullair, LLC(Hitachi Group)

- Bauer Kompressoren GmbH

- Aerzener Maschinenfabrik GmbH

- Hanwha Power Systems

第八章投资分析

第九章 市场机会与未来趋势

The Industrial Air Compressors Market size is estimated at USD 36.94 billion in 2025, and is expected to reach USD 44.30 billion by 2030, at a CAGR of 3.7% during the forecast period (2025-2030).

Increases in the oil and gas, petrochemical, transportation, agricultural, and automotive industries globally, as well as increased government support for developing industrial compressor technology, are some important reasons that significantly speed up market expansion.

Key Highlights

- A wide range of businesses worldwide generally uses air compressors to deliver compressed air to power complex industrial processes. Heavy-duty industrial air compressors are developed to provide higher pressure levels, as they rely on high horsepower motors and heavy-duty components. In agricultural facilities, these are used to spray crops and ventilate silos, power pneumatic machinery in the manufacturing industries, and oil and gas operations, among others.

- Air compressors have an advantage over electric power and hydraulic power due to their capability to offer flexibility, safety, and low-maintenance cost. Air compressors require fewer moving parts than electrical and hydraulic power systems. However, air compressors need special treatment for the supplied air, as any contamination in the air can damage the supply pipes, leading to corrosion in leakages, ultimately resulting in power output.

- The companies in the market are also continuously investing in developing energy-efficient air compressors. For instance, Atlas Copco mentioned that it is focusing on developing oil-injected technology for offering energy-saving compressor solutions by integrating intelligent control and monitoring systems.

- Moreover, these compressors are used based on the application and location of the compressor to be installed. For instance, reciprocating-type compressors must be installed with flywheels on the side of the wall and an enclosed belt guard, and they need spaces on the sides for maintenance. In the case of the rotary type, the compressors need to be installed so that their inlet grids and ventilation fan may not recirculate the cooling air to the compressor.

- These air compressors used in industries require special cooling units to dispense the heat generated, adding to the companies' initial setup cost. Hence, the companies are looking forward to better-performance compressors to cut down on energy and maintenance costs.

- Apart from these applications, air compressors are also used for petroleum refining, petrochemical synthesis, pipeline transportation, and gas injection. The increasing expansion of oil and gas exploration and investment in the industry are the major factors driving the market growth.

- According to Ingersoll Rand, only 10% to 20% of the energy input to the compressed air systems reaches the point of use, whereas the rest of the energy gets wasted in heat or leaks. This may account for millions of dollars for organizations having large operations.

- Air compressor installation and maintenance costs are very high. Due to the upkeep of intricate monitoring and control systems for various air compressors, the price keeps increasing. This is anticipated to slow market expansion in the near future.

- However, due to the outbreak of COVID-19, Chinese vendors closed their factories, temporarily suspending production facilities. Since the number of COVID-19 cases has reduced in China, the vendors having manufacturing plants based in the region have increased component prices by nearly 2-3%, owing to a shortage of supplies due to factory shutdown. Therefore, this has impacted the entire supply chain from China. The COVID-19 spread has also driven innovations in the compressors segment, with vendors ramping up their production to meet the sudden demand increase.

Industrial Air Compressor Market Trends

Rotary Air compressors to Hold Significant Share

- Rotary air compressors, also known as rotary screw air compressors, are a positive displacement compression system and are adopted above other compressors due to several advantages it offers, like a significant reduction in weight and easier maintenance (owing to the availability of simplified maintenance procedures), lesser overall oil consumption, proven reliability in harsh environments, and less heat generation.

- Rotary air compressors are mainly preferred by users requiring constant pressure for usually extended periods. It is used in various industrial settings for applications such as material handling, spray painting, and use with machine tools. In addition, multiple industries, such as manufacturing, food, beverage, and pharmaceutical, are deploying oil-free air compressors to optimize their processes and reduce costs in production.

- Moreover, Oil-injected air compressors are generally used by users requiring large volumes of medium-pressure air. For instance, No Sabe Fallar, SA de CV, the Mexican subsidiary of the global BIC Group, manufactures safe, reliable BIC products and uses a group of GA-type compressors, an energy-saving ES control system, and the AirConnect Visualization System. The oil-lubricated air compressor provides equal levels of reliability and substantially drives down costs through the smart use of energy.

- Oil-free rotary screw models are used in production, industrial, or medical applications to disable oil from entering the airflow, like food packaging or medical oxygen. Oil-free rotary air compressors are expensive as they require two compression stages to reach the same pressures as an oil-injected rotary system.

- Industrial air compressors play a significant role in the modern oil and gas industry for large and small operations. For instance, according to Q Air-California, 95% of petroleum gas is processed through compression before transporting in a pipeline.

- The oil and gas industry demands sustainable and reliable compressed air equipment. Various downstream oil & gas companies are impacted due to a slowdown in demand for petrochemical and refined products due to the COVID-19 pandemic. Lower refining margins lead to lower profits for downstream oil companies such as BPCL, HPCL, IOCL, and RIL. In contrast, upstream companies such as Oil India and ONGC are impacted due to less gas and oil demand growth due to a reduction in travel and industrial activities, thereby affecting industrial air compressors in the oil and gas industry.

Asia-Pacific to Account for a Significant Market Share

- China is expected to be one of the largest markets in the Asia-Pacific region and globally for industrial air compressors in terms of production and consumption. The primary factor for the country's dominance is the presence of several air compressor manufacturers in the country, such as Zhejiang Kaishan Compressor Co. Ltd, VMAC Company, DHH Compressor Jiangsu Co. Ltd, and DENAIR Energy Saving Technology (Shanghai) PLC, among others.

- The other factors that are highly responsible for the growth in the region are the Government regulations and policies expected to boost the market further, increasing air compressors' adoption for energy efficiency. For instance, The Energy Policy and Conservation Act prescribed energy conservation standards for various consumer products and commercial and industrial equipment, including air compressors.

- Moreover, China has become attractive by developing indigenous industries and subsequent acceleration in exports, the introduction of stringent standards, and rapid urbanization. China has a very high industrial production rate and ranks among the 28 fastest-growing nations. These factors act as drivers for adopting industrial air compressors in manufacturing facilities in the county.

- In addition, Several investments are being planned to aid the quality of growth in the region, address environmental concerns, and reduce overcapacity, for the same. It has a leading presence in several end-user industries, such as food and beverage, electronics, construction, and mining.

- Despite enormous development in alternative energy sources, oil and oil-based products' demand increases with the rising global population, predominantly in China, India, and Japan. Consequently, to keep up with the demand, industrial air and gas compressors have become invaluable for ensuring the appropriate pressure levels for these operations, with innovations focused on lower energy requirements, increased speed, and a more remarkable ability to withstand harsh drilling environments to maintain a competitive edge.

- Furthermore, India is expected to become the fifth-largest manufacturing country globally by the end of 2021. Manufacturing giants, such as Siemens, GE, and Boeing, have either set up or are setting up new manufacturing plants in India as part of their expansion strategy. These trends indicate the growth in the country's adoption of industrial air compressors.

- According to the recent forecast of OPEC, for the first time in current projections, India is expected to stand as the single most significant contributor to future energy demand, followed by China and other countries, standing in the product range of oil from 22 to 23 mboe/d. Establishing these refineries and storage in seashore areas and areas of harsh climatic conditions is expected to push industrial air compressor demand in the country.

Industrial Air Compressor Industry Overview

The Industrial Air Compressors Market is competitive, with several players in the market. The players in the market, such as Atlas Copco Group, Ingersoll Rand Inc.(Gardner Denver Inc.), Kaeser Kompressoren, Inc., and Mitsubishi Heavy Industries Compressor Corp, are engaged in maintaining a competitive edge in the market. This has intensified the competitive rivalry in the market, and therefore, the market concentration is low.

In May 2022, ELGi introduced two new ranges of Air Compressors, ELGi AB 11 - 22kW, the latest addition to the AB-Series range of oil-free screw air compressors. The units specifically address the compressed air requirements of the food and beverage, small pharmaceutical, and dairy industry, and LD Series 2.2 - 11kW lubricated direct drive range of reciprocating air compressors. The new LD Series is an innovation in piston air compressor technology.

In June 2022, Ingersoll Rand unveiled the latest innovation in its centrifugal portfolio, the new MSG Turbo-Air NX 1500 (NX 1500) compressor, engineered to deliver the lowest total cost of ownership for sites seeking a long-lasting, low-maintenance and 100 percent oil-free solution. The NX 1500 can meet the demands of energy-intensive sites while making a substantial difference to a business's bottom line through a range of proven technologies and features.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter Five Forces

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Global Investment in Oil and Gas

- 5.1.2 Demand for Energy Efficient Compressors

- 5.2 Market Restraints

- 5.2.1 Environmental and Safe Use Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Rotary Air Compressors

- 6.1.2 Reciprocating Air Compressors

- 6.1.3 Centrifugal Air Compressors

- 6.2 By End-user

- 6.2.1 Oil and Gas

- 6.2.2 Food and Beverages

- 6.2.3 Manufacturing

- 6.2.4 Healthcare

- 6.2.5 Power Generation

- 6.2.6 Construction and Mining

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia- Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Atlas Copco Group

- 7.1.2 Ingersoll Rand Inc.

- 7.1.3 FS-Curtis

- 7.1.4 Howden Group Ltd.

- 7.1.5 Gardner Denver Inc.

- 7.1.6 Mitsubishi Heavy Industries Compressor Corp.

- 7.1.7 Kaeser Kompressoren

- 7.1.8 Zhejiang Kaishan Compressor Co. Ltd (Kaishan Group)

- 7.1.9 Sullair, LLC (Hitachi Group)

- 7.1.10 Bauer Kompressoren GmbH

- 7.1.11 Aerzener Maschinenfabrik GmbH

- 7.1.12 Hanwha Power Systems