|

市场调查报告书

商品编码

1433009

HPC 软体 -市场占有率分析、产业趋势与统计、成长预测 (2024-2029)HPC Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

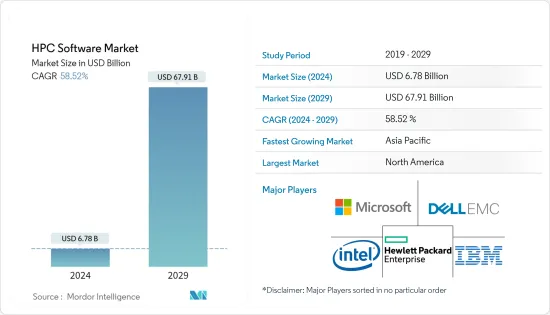

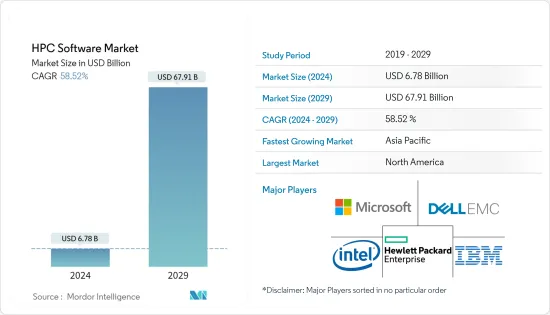

HPC 软体市场规模预计到 2024 年为 67.8 亿美元,预计到 2029 年将达到 679.1 亿美元,在预测期内(2024-2029 年)复合年增长率为 58.52%。

人工智慧(AI)、物联网(IIoT)投资的增加以及电子设计自动化(EDA)的工程需求等因素正在预测期内推动市场发展。

主要亮点

- 如果没有合适的工具和先进技术,对短产品开发週期 (PLC) 的快速成长的需求和持续品质维护的需求将几乎不可能即时满足。

- 包括德国、美国、英国、日本和中国在内的世界各国正在认识到这些技术作为经济成长关键驱动力的重要性,而 HPC 正在支持这些努力,同时保持成本和性能效率。成为软体的潜在市场。

- 汽车、离散製造和医疗机器人等行业越来越多地采用高效能运算 (HPC) 系统和电脑辅助工程 (CAE) 软体进行高保真建模和模拟。

- 此外,云端基础的HPC 解决方案因其经济高效的计量收费模式而越来越受欢迎。政府机构、研究机构和大学是云端基础的HPC 解决方案的主要受益者。

HPC软体市场趋势

云端基础的高效能运算软体推动成长

- 该地区的公司决定透过云端租用 HPC 应用程式来解决复杂的数学建模问题。因此,云端高效能运算(HPC)近年来经历了快速成长。

- 云端 HPC 提供了一种可扩展且经济高效的方法来处理大量资料和运行复杂的应用程式。云端处理供应商正在投资研发以推出新软体来满足企业的需求。

- 例如,2023 年 2 月,亚马逊网路服务 (AWS) 的调查团队宣布了一个新的软体框架,用于在量子计算硬体上运行电磁模拟。它的开发是为了利用 AWS 上提供的云端基础的高效能运算 (HPC) 产品和服务。

- 云端 HPC 供应商透过保持有竞争力的成本、快速创新和扩展其产品组合获得了丰厚的回报。

- 例如,2023年5月,全球技术和HPC供应商CGG宣布推出爱尔兰製药软体公司CGG,利用人工智慧(AI)大幅提高开发新药已签署协议,成为Biosimulytics 的独家HPC 云端合作伙伴。

- 2022 年 11 月,洛克希德马丁公司和微软宣布扩大战略合作关係,以支持国防部 (DOD) 的技术进步。该协议预计将重点关注云端创新、数位转型和其他先进技术创新。主要供应商的这些以云端为中心的合作伙伴关係预计将推动对云端 HPC 的需求。

亚太地区是一个快速成长的地区

- 亚太地区是中国、日本、印度等大型新兴经济体的所在地。这些经济体正在大力投资高效能运算以加速经济发展。此外,製造业和医疗保健等各行业也越来越多地使用仿真,也推动了对 HPC 的需求。

- 该地区强大的製造业以及对物联网和人工智慧等 HPC 驱动技术的投资,使其成为云端 HPC 供应商利润丰厚的市场。

- 供应商正在进行大量投资,以支持亚太地区强劲的製造业。为了降低製造成本并维持在全球市场的竞争力,我们越来越依赖模拟和云端运算来提高业务效率。

- 中国、日本、韩国、印度和澳洲在未来几年为 HPC 软体提供了巨大的潜力。中国政府承诺在半导体产业投资470亿美元,并减少製造和设计中的非国产设备,最终将在预测期内增加该国高效能运算技术的潜力,创造空间。

- 2022年4月,富士通宣布推出富士通计算即服务(CaaS),这是一个新的服务组合,透过云端提供对商业用途的尖端计算技术的访问,加速数位转型(DX)。 `。该公司计划于 2022 年 10 月开始向日本市场提供这些新服务。

HPC软体产业概况

一些区域和全球参与者凭藉高效能运算软体解决方案的技术专长主导了市场。全球高效能运算软体市场预计将会整合。 Amazon Web Services Inc.、ANSYS, Inc.、Dassault Systemes、Dell EMC、Google Inc.、Hewlett Packard Enterprise Development LP、IBM Corporation、Intel Corporation、Microsoft Corporation、Oracle Corporation 是当前市场的一些主要参与者。所有这些参与者都参与制定竞争策略,例如联盟、新产品创新和市场扩张,以获得全球高效能运算软体市场的主导地位。

2023 年 5 月,IBM 宣布 Cadence Design Systems, Inc. 将利用高效能运算 (HPC) 和 IBM Cloud HPC 来协助快速开发晶片和系统设计软体。 Cadence 在其 HPC混合云解决方案中引入了整合的 IBM Spectrum LSF,使其能够灵活地管理本地和云端中的运算密集型工作负载。

2023 年 5 月,Quantum Machines 宣布与 ParTec 合作,推出共同开发的通用软体解决方案,将量子电脑紧密整合到高效能运算 (HPC) 环境中。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进与市场约束因素介绍

- 市场驱动因素

- 云端基础的高效能运算软体推动成长

- 虚拟技术创新

- IT产业的扩张与多元化

- 市场限制因素

- 高可用性云端模型中的资料安全问题

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 依部署类型

- 本地

- 云

- 按工业用途

- 航太/国防

- 能源/公共产业

- BFSI

- 媒体与娱乐

- 製造业

- 生命科学与医疗保健

- 设计与工程

- 其他工业应用

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 公司简介

- Amazon Web Services Inc.

- ANSYS, Inc.

- Dassault Systemes

- Dell EMC

- Google Inc.

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Oracle Corporation

第七章 投资分析

第八章 市场机会及未来趋势

The HPC Software Market size is estimated at USD 6.78 billion in 2024, and is expected to reach USD 67.91 billion by 2029, growing at a CAGR of 58.52% during the forecast period (2024-2029).

Factors such as rising investments in the Artificial Intelligence (AI), the Industrial Internet of Things (IIoT), and engineering demand for Electronic Design Automation (EDA) are driving the market over the forecast period.

Key Highlights

- The surging demand for short product development cycles (PLCs) and a need to maintain persistent quality becomes nearly impossible to address in real time without using the right tools and advanced technologies.

- Countries across the globe, including Germany, the United States, the United Kingdom, Japan, and China, among others, have recognized the importance of such technologies as a significant driver of economic growth and are potential markets for HPC software, which support these initiatives while maintaining cost and performance efficiencies.

- The adoption of high-performance computing (HPC) systems with computer-aided engineering (CAE) software for high-fidelity modeling simulation is rising among various industries, such as automotive, discrete manufacturing, and healthcare robotics.

- Moreover, cloud-based HPC solutions are gaining traction due to their cost-effective pay-as-you-go pricing model. Predominantly, government agencies, research institutions, and universities are likely to benefit from cloud-based HPC solutions.

HPC Software Market Trends

Cloud Based High-Performance Computing Software is Driving the Growth

- Enterprises across regions are deciding to rent HPC applications via the cloud to solve complex mathematical modeling problems, as they see benefits beyond costs. As a result, cloud high-performance computing (HPC) has seen an uptick in the past few years.

- Cloud HPC offers scalable and cost-effective ways to process a large amount of data and run complex applications. Cloud computing providers are investing in research and development to introduce new software to meet the needs of businesses.

- For instance, in February 2023, Researchers at Amazon Web Services (AWS) launched a new software framework that can be used to create electromagnetic simulations on quantum computing hardware. It was developed to leverage the cloud-based high-performance computing (HPC) products and services available on AWS.

- Cloud HPC providers gain significant returns by maintaining competitive costs, rapid innovation, and portfolio expansions.

- For instance, in May 2023, CGG, a global technology, and HPC provider, announced that it signed a contract to be the exclusive HPC cloud partner of Biosimulytics, an Irish pharma software company that uses artificial intelligence (AI) to dramatically improve the speed, cost, novelty, and success rate in new drug development.

- In November 2022, Lockheed Martin and Microsoft announced the expansion of their strategic relationship to support the advancement of technology for the Department of Defense (DOD). The agreement was expected to focus on Classified Cloud innovations, Digital Transformation, and other advanced technological innovations. Such cloud-focused partnerships by the major vendors are expected to boost the demand for cloud HPC.

Asia-Pacific is the Fastest Growing Region

- The region is home to several large and emerging economies, including China, Japan, and India. These economies are heavily investing in HPC to accelerate their economic development. Moreover, the growing use of simulation in various industries, including manufacturing, healthcare, and others, drives the demand for HPC.

- The region's strong manufacturing industry and investments in technologies driving HPC, such as IoT and AI, will likely make it a lucrative market for cloud HPC vendors.

- Vendors have made significant investments to cater to Asia-Pacific's robust manufacturing sector, which increasingly relies on simulation and cloud computing to lower production costs and improve operational effectiveness to maintain their competitiveness in the global market.

- Specifically, China, Japan, South Korea, India, and Australia are creating huge potential for HPC software in the coming years. The Chinese government has declared to invest USD 47 billion in its semiconductor industry to cut out non-indigenous devices in manufacturing and design, which will eventually create potential space for high-performance computing technology in the country for the forecast period.

- In April 2022, Fujitsu announced the launch of its new service portfolio, "Fujitsu Computing as a Service (CaaS)," to accelerate digital transformation (DX) by offering access to the most advanced computing technologies via the cloud for commercial use. The company was expected to begin delivery of these new services to the Japanese market in October 2022.

HPC Software Industry Overview

Some regional and global players dominate the market with their technological expertise in high-performance computing software solutions. The global market for high-performance computing software is expected to be consolidated in nature. Amazon Web Services Inc., ANSYS, Inc., Dassault Systemes, Dell EMC, Google Inc., Hewlett Packard Enterprise Development LP, IBM Corporation, Intel Corporation, Microsoft Corporation, and Oracle Corporation are some of the major players in the current market. All these players are involved in competitive strategic developments such as partnerships, new product innovation, and market expansion to gain leadership positions in the global high-performance computing software market.

In May 2023, IBM announced Cadence Design Systems, Inc. is leveraging high-performance computing (HPC) with IBM Cloud HPC to help develop its chip and system design software faster. Cadence can flexibly manage its compute-intensive workloads on-premises and in the cloud with the integrated IBM Spectrum LSF deployed in a hybrid cloud solution for HPC.

In May 2023, Quantum Machines announced its partnership with ParTec to launch a co-developed universal software solution for tightly integrating quantum computers into high-performance computing (HPC) environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Cloud Based High-Performance Computing Software is Driving the Growth

- 4.3.2 Innovation in Virtualization Technology

- 4.3.3 Expansion and Diversification of IT Industry

- 4.4 Market Restraints

- 4.4.1 Data Security Concerns in High Availability Cloud Model

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers/Consumers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Deployment Type

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Industrial Application

- 5.2.1 Aerospace & Defense

- 5.2.2 Energy & Utilities

- 5.2.3 BFSI

- 5.2.4 Media & Entertainment

- 5.2.5 Manufacturing

- 5.2.6 Life-science & Healthcare

- 5.2.7 Design & Engineering

- 5.2.8 Other Industrial Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amazon Web Services Inc.

- 6.1.2 ANSYS, Inc.

- 6.1.3 Dassault Systemes

- 6.1.4 Dell EMC

- 6.1.5 Google Inc.

- 6.1.6 Hewlett Packard Enterprise Development LP

- 6.1.7 IBM Corporation

- 6.1.8 Intel Corporation

- 6.1.9 Microsoft Corporation

- 6.1.10 Oracle Corporation