|

市场调查报告书

商品编码

1433014

雾网:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Fog Networking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

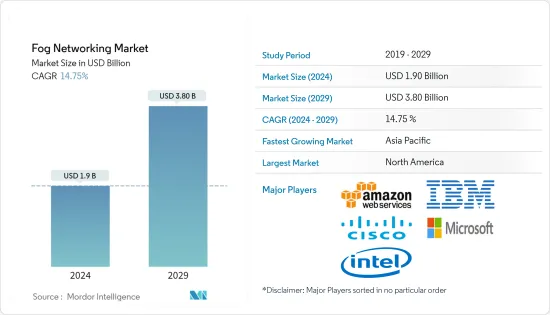

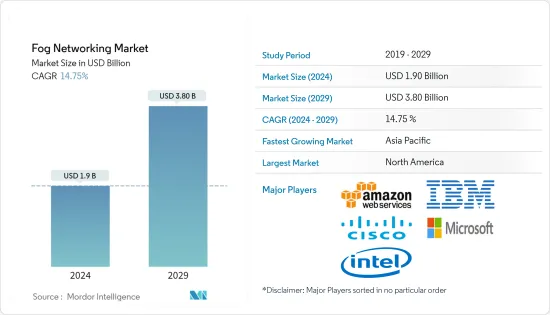

雾网路市场规模预计到 2024 年为 19 亿美元,预计到 2029 年将达到 38 亿美元,在预测期内(2024-2029 年)复合年增长率为 14.75%。

雾网路对于科技市场来说是新事物,但它已经在市场上站稳了脚步。

主要亮点

- 雾网路将云端运算技术扩展到网路边缘,使其成为物联网、5G、人工智慧和许多其他需要更快即时分析资料的技术的理想选择。例如,花旗银行利用信标技术了解ATM用户的购买行为,并为客户在当地使用花旗卡进行交易提供奖励。

- 雾节点靠近终端设备放置,充当智慧处理器,能够分析即时资料并提供即时结果。

- 从个人穿戴装置和家用电器到工业感测器,设备会产生大量资料,必须对这些数据进行处理才能获得见解。雾网路不仅提供低延迟和即时分析,还解决了云端运算中普遍存在的安全性问题。

- 雾网路在许多需要低延迟的应用中非常有用,例如联网汽车、连线健诊和交通管理。例如,如果延迟太长,智慧交通将不起作用。

雾联网市场趋势

智慧电錶实现高成长

- 智慧电錶是一种记录电能消费量并将其传送给供应商公司的电子设备。

- 全球许多电力公司正计划部署智慧电錶来远端监控消费者的能源消耗情况并防止能源消耗诈欺。此外,智慧能源和计量解决方案在企业和家庭中变得越来越普及。

- 智慧电錶收集的资料足以推断消费者行为、睡眠週期、家庭占用、用餐习惯等。然而,为了使其有意义,必须即时分析资料。

- 在家庭层级收集的资料可供各种组织使用。例如,电力公司可以根据消耗的能源单位销售产品和服务。

- 智慧电錶会产生大量资料,即使使用云端运算也很难处理和分析,因此我们提供一个地方来收集、计算和储存智慧电錶资料,然后再将其发送到云端,这就需要雾运算。

北美占最大市场占有率

- 北美地区占据了最大的市场份额,因为大多数雾网路公司都位于那里。此外,该地区营运的大多数云端处理供应商已经开始提供雾网路硬体和软体解决方案,并且与该技术相容。

- OpenFog联盟由思科、戴尔、英特尔、微软等公司组成,是联盟,旨在标准化和普及各种能力和领域的雾运算。更多的公司正在加入这个联盟,以深入了解雾计算。

- 北美地区也是物联网和 5G 技术的领导者,产生大量必须即时处理的资料。

- 随着该地区联网汽车的出现,预计该市场将显着成长,因为车辆不仅需要相互通讯。此外,这些车辆需要即时分析资料才能准确运作。

雾网产业概况

雾网络市场本质上与许多国际公司竞争激烈。市场集中,各跨国公司纷纷采取产品创新、併购等策略来扩大影响力,在竞争中生存。

- 2018 年 4 月 - Amazon 开发技术,透过 AWS Greengrass 将机器学习的智慧引入边缘运算。最新版本(v1.5.0)可以在基于NVIDIA Jetson TX2和Intel Atom架构的边缘设备上本地运行Apache MXNet和TensorFlow Lite。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进因素与市场约束因素介绍

- 市场驱动因素

- 即时运算的需求不断增长

- 由于物联网设备的普及,资料迅速增加

- 市场限制因素

- 结构和安全问题

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章技术蓝图

第六章市场区隔

- 按成分

- 硬体

- 软体和服务

- 按最终用户应用程式

- 智慧电錶

- 楼宇/家庭自动化

- 智慧製造

- 连网型医疗保健

- 连网型车辆

- 其他最终用户应用程式

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争形势

- 公司简介

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Dell Inc.

- IBM Corporation

- Intel Corporation

- Microsoft Corporation

- Nebbiolo Technologies

- Nokia Corporation

- Qualcomm Corporation

- Tata Consultancy Services Limited

第八章投资分析

第九章 市场机会及未来趋势

The Fog Networking Market size is estimated at USD 1.9 billion in 2024, and is expected to reach USD 3.80 billion by 2029, growing at a CAGR of 14.75% during the forecast period (2024-2029).

Although fog networking is a new technology in the technological market, it is, however, already making its mark in the market.

Key Highlights

- Fog networking enlarges the technology of cloud computing to the network edge, and thus makes it ideal for IoT, 5G, AI, and many more technologies that require real-time analysis of data, at a faster pace. For instance, Citi Bank uses beacon technology to understand ATM users' purchasing behavior and provides incentives to customers to use Citi cards in local areas for transactions.

- Fog nodes are deployed close to end devices, and they act as smart processors that have the capability to analyze real-time data and give instant results.

- Devices, ranging from personal wearables and home appliances to industrial sensors, generate a vast amount of data that needs to be processed, in order to gain insights. Fog networking not only provides real-time analysis with low latency, but also addresses security concerns that prevail in cloud computing.

- Fog networking is useful in applications like connected vehicles, connected healthcare, traffic management, and many other that require low latency. For instance, smart traffic will not work if the latency is too high.

Fog Networking Market Trends

Smart Meter to Witness Higher Growth

- A smart meter is an electronic device that records the consumption of electrical energy units and communicates it to the power company from which the power is supplied.

- Many power companies across the world are planning to adopt smart meters to remotely monitor consumers' energy consumptions and to prevent fraudulent energy consumption. Moreover, smart energy and metering solutions are becoming more prevalent in both businesses and households.

- The data collected by smart meters is sufficient to draw inferences, such as the behavior, sleeping cycle, home occupancy, eating routines, etc. of the consumers. However, for it to make sense, the data needs to be analyzed in real-time.

- The data collected per household can be used by various organizations. For instance, an electric or power company can sell its products or services based on energy units consumed.

- As smart meters produce a tremendous amount of data, which is hard to process and analyze, even with cloud computing, there is a need for fog computing, which offers a place for collecting, computing, and storing smart meter data before transmitting it to the cloud.

North America Occupies the Largest Market Share

- The North American region occupies the largest share in the market, as most fog networking enterprises are based out of North America. Moreover, most cloud computing providers working in this region have already started offering fog networking hardware and software solutions, to stay up to date with the technology.

- The OpenFog Consortium, which is a consortium of high tech companies and academic institutions across the world, aiming at the standardization and promotion of fog computing in various capacities and fields, including companies like Cisco, Dell, Intel, and Microsoft, is also headquartered in the United States. More companies are joining this consortium, to gain insights about fog computing.

- The North American region is also the leader in IoT and 5G technology, which generates a huge amount of data to be processed in real time.

- With the emergence of connected cars in the region, the market is expected to witness huge growth, as the cars will need to communicate with not only each other but also traffic lights, where traffic lights will act as fog nodes. Moreover, these cars will require real-time analysis of data to function accurately.

Fog Networking Industry Overview

The fog networkingmarket is competitive in nature, with many international players. The market is concentrated, with the presence of various multinationals focusing on strategies like product innovation, mergers, and acquisitions, to expand their reach and stay ahead of the competition.

- April 2018 - Amazon developed a technology tobring machine learning smarts to edge computing, through AWS Greengrass. The latest version (v1.5.0) can run Apache MXNet and TensorFlow Lite models locally on edge devices based on NVIDIA Jetson TX2 and Intel Atom architectures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growing Demand for Real-time Computing

- 4.3.2 Proliferation of IoT Devices, Leading to an Exponential Increase in Data

- 4.4 Market Restraints

- 4.4.1 Structural and Security Issues

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 TECHNOLOGY ROADMAP

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software and Service

- 6.2 By End-user Application

- 6.2.1 Smart Meter

- 6.2.2 Building and Home Automation

- 6.2.3 Smart Manufacturing

- 6.2.4 Connected Healthcare

- 6.2.5 Connected Vehicle

- 6.2.6 Other End-user Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services, Inc.

- 7.1.2 Cisco Systems, Inc.

- 7.1.3 Dell Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Intel Corporation

- 7.1.6 Microsoft Corporation

- 7.1.7 Nebbiolo Technologies

- 7.1.8 Nokia Corporation

- 7.1.9 Qualcomm Corporation

- 7.1.10 Tata Consultancy Services Limited