|

市场调查报告书

商品编码

1433486

资料科学平台:市场占有率分析、产业趋势、成长预测(2024-2029)Data Science Platform - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

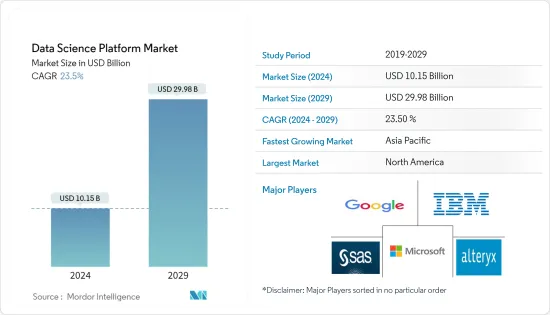

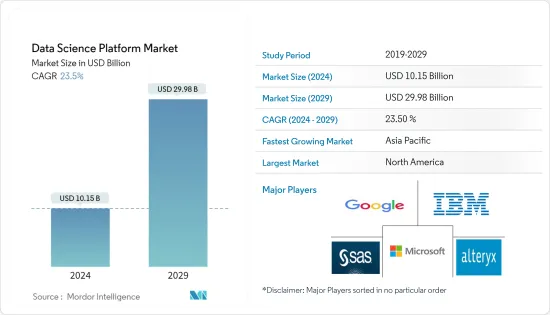

资料科学平台市场规模预计到 2024 年为 101.5 亿美元,预计到 2029 年将达到 299.8 亿美元,在预测期内(2024-2029 年)增长 23.5%,复合年增长率增长。

资料科学的兴起为组织提供了解决方案,将资料集转化为宝贵的资源,帮助他们透过可行的见解获得商业价值。随着商业企业和组织数量的指数级增长,资料科学已成为商业各个方面不可或缺的一部分,并在经营模式中发挥关键作用。

主要亮点

- 资料科学平台提供了一组工具和服务,使组织能够管理、存取和分析资料,简化资料分析流程并扩展资料分析能力。由于预测分析、明智决策以及更好地利用资料进行自动化机器学习流程等优势,资料科学平台的采用正在增加。

- 公司越来越注重增加内部资料科学资源,以建立机器学习模型并缩小所需专业人员的招募差距,导致资料科学即服务 (DSaaS) 的采用率不断上升。它对许多企业来说变得至关重要,因为它可以帮助他们扩展分析能力以满足关键需求并实现期望的业务成果。

- 随着人工智慧(AI)和机器学习(ML)等技术的快速发展,企业正在接收极其大量的资料,包括基于先前存在的数据集的新资料集和新格式的资料。因此,为了使用这些资料,公司倾向于实施适合其要求的资料科学解决方案。

- 缺乏熟练劳动力造成的主要障碍之一是组织无法从其产生的大量资料中获得有意义的见解。资料科学平台旨在帮助使用者分析和解释复杂的资料集,但缺乏能够指导这些平台的熟练专业人员会降低其有效性。组织努力弥合资料科学平台的先进功能与最佳利用这些功能所需的专业知识之间的差距。

- COVID-19感染疾病加速了商业和工业的数位化,对资料驱动的见解的需求激增。来自各行业的组织已转向资料科学来管理资源和风险,并就客户行为做出明智的决策。此外,向远端工作的转变促进了云端基础的资料科学平台和工具的采用,使资料科学家能够在任何地方进行有效协作。这种弹性和可访问性进一步增加了对资料科学专业知识的需求。

资料科学平台市场趋势

中小企业实现显着成长

- 小型组织的员工人数少于 100 人,中型公司的员工人数在 100 至 999 人之间。资料科学在中小型企业中的主要用途之一是利用资料科学在销售週期的各个阶段追踪客户。小型企业可以使用资料分析来确定可能购买的特定消费者群体。资料主导产业的发展将使企业能够透过基于证据的结论来实现永续发展,从而提高销售、绩效、营运等。

- 小型企业的营运资源通常有限,因此每个决策都很重要。资料科学平台使中小型企业能够做出更准确、更明智的决策并降低风险。该平台可协助中小型企业识别其业务和供应链中的低效率问题并降低成本。

- 2023 年 8 月,Infor Nexus 与星展银行合作宣布为 Infor Nexus 供应链生态系统内的中小企业 (SME) 供应商推出出货前融资。该解决方案利用 Infor Nexus 平台的历史资料提供基于资料库的融资解决方案,帮助供应商满足营运成本需求。

- 云端的采用预计将推动市场成长。它彻底改变了中小型企业存取和利用资料科学平台的方式。云端基础设施是扩充性的,允许小型企业根据需求的变化无缝地扩展或缩减其资料科学能力。 2023 年 11 月,AnniQ 推出了一项专注于资料分析的新服务,以支援中小企业 (SME) 的策略能力。该服务旨在增强中小型企业在业务运营中参与和利用资料的方式,重点是提供可行的见解并推动策略执行。

北美占有很大的市场占有率

- 在资料量和复杂性不断增加的推动下,美国不断创新其资料科学平台并加强其在全球市场的地位。在所研究的市场中采用高级分析、人工智慧 (AI) 和机器学习 (ML) 等先进技术也对国家经济产生直接影响。

- 根据 Telecom Advisory Services 的数据,美国的网路流量预计已从 2021 年的每月 6,400 万Exabyte跃升至 2023 年的每月 9,864 万Exabyte。资料流量的显着增加需要更先进的资料科学解决方案来大规模管理资料流量。了解您的资料量并根据提取的资料改进您的解决方案。此外,组织正在产生比以往更多的资料,而这些资料变得越来越复杂和多样化。这使得使用传统方法分析资料和提取见解变得困难。资料科学平台提供了用于管理和分析大型复杂资料库的工具和基础设施。

- 而且,市场上接受调查的主要供应商均位于美国。此外,该国正处于第四次工业革命的边缘,资料被用于大规模生产,整合整个供应链中不同的製造系统和资料。这正在加速日本先进技术的引进。

- 该地区各国政府也透过努力支持市场中新兴技术的成长来加速机器人技术的采用。例如,美国联邦政府启动了国家机器人倡议(NRI)计划,以加强美国国内机器人建立能力并鼓励该领域的研究活动。预计这些倡议将为市场成长带来积极的前景。

- 此外,加拿大非常注重医疗保健、人工智慧和可再生能源等领域的研究和创新,这需要资料科学平台来分析复杂的资料集并得出研究见解,为市场提供支援。加拿大的科技产业蓬勃发展,并齐心协力吸引科技人才。银行、医疗保健、金融、保险、媒体和娱乐、通讯、电子商务等行业都需要合格的资料科学家和人工智慧专家。目前对专家的需求量超出了能力范围。不断扩大的技术力和对高端 IT 解决方案、人工智慧和机器学习的需求将推动加拿大资料科学平台市场的发展。

资料科学平台产业概述

资料科学平台市场是半整合的,其特点是产品差异化程度高、产品普及不断提高、技术进步迅速,导致难以保持竞争优势和解决方案的持续开发。创新。主要参与者包括 Alteryx、IBM 公司、Google LLC (Alphabet Inc.)、SAS、Alteryx 和微软公司。

- 2023 年 11 月 - IBM 与 Amazon Web Services (AWS) 合作推出 Amazon for Db2,这是一款完全託管的云端产品,旨在协助资料库客户管理人工智慧 (AI)资料。关联式资料库服务(Amazon RDS) 现已全面推出。跨混合云端环境的工作负载。这将使用户能够利用公司在 AWS 上整合的资料和人工智慧功能集来管理资料并扩展他们的人工智慧工作负载。

- 2023 年 8 月 - Google Cloud 和 NVIDIA 推出新技术来推进 AI 运算、软体和服务,帮助客户建置和部署用于产生 AI 的大规模模型并加速资料科学工作负载。我们宣布扩大合作伙伴关係。此次合作将为全球最大的 AI 客户提供端到端机器学习服务,包括使用基于 NVIDIA 技术构建的 Google Cloud 服务轻鬆运行 AI超级电脑的能力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 宏观经济趋势的影响

第五章市场动态

- 市场驱动因素

- 巨量资料的爆炸

- 资料科学和机器学习有前景的使用案例的出现

- 组织转向资料集中方法和决策

- 市场限制因素

- 劳动力缺乏技能

- 资料安全和可靠性问题

- 主要使用案例

- 生态系分析

- 定价及定价模式分析

- 资料科学平台的主要功能(人工智慧和机器学习、分析、视觉化、探索、建模)

第六章市场区隔

- 透过提供

- 平台

- 按服务

- 按配置

- 本地

- 云

- 按公司规模

- 中小企业

- 大公司

- 按行业分类

- 资讯科技/通讯

- BFSI

- 零售/电子商务

- 石油/天然气/能源

- 製造业

- 政府/国防

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 希腊

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 东南亚

- 印尼

- 菲律宾

- 马来西亚

- 新加坡

- 其他东南亚

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 沙乌地阿拉伯

- GCC

- 阿拉伯聯合大公国

- 其他海湾合作委员会

- 南非

- 其他中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- IBM Corporation

- Google LLC(Alphabet Inc.)

- Microsoft Corporation

- SAS

- Alteryx

- The MathWorks Inc.

- RapidMiner

- Databricks

- Amazon Web Services Inc.(AMAZON.COM INC.)

- DataRobot Inc.

第八章厂商市场占有率分析

第九章 厂商地域排名

第十章投资分析

第十一章投资分析市场的未来

The Data Science Platform Market size is estimated at USD 10.15 billion in 2024, and is expected to reach USD 29.98 billion by 2029, growing at a CAGR of 23.5% during the forecast period (2024-2029).

Data Science is emerging to provide solutions to organizations to transform data sets into a valuable resource that helps get business value with actionable insights. As the number of business enterprises and organizations grows exponentially, data science is becoming essential in various aspects of business and plays a pivotal role in business models.

Key Highlights

- The data science platforms offer a suite of tools and services that allow organizations to manage, access, and analyze their data and enable organizations to streamline their data analysis processes and scale their data analysis capabilities. The adoption of data science platforms is growing due to benefits such as predictive analytics to automated machine learning processes, informed decisions, and better utilization of their data.

- There is an increasing emphasis on businesses boosting their internal data science resources to build machine learning models and fill the hiring gap of in-demand professionals, resulting in increased adoption of data science as a service (DSaaS). For many businesses, it becomes essential as it helps them scale their analytics capabilities to meet critical needs and get the desired outcomes of business.

- As technologies such as artificial intelligence (AI) and machine learning (ML) are advancing rapidly, businesses are receiving a significantly larger amount of data, including new data based on previously existing datasets and new forms of data altogether. Thus, to use these data, businesses are moving to adopt data science solutions that are compatible with their requirements.

- One of the primary obstacles arising from the lack of a skilled workforce is the inability to derive meaningful insights from the vast volumes of data organizations generate. Data science platforms are designed to allow users to analyze and interpret complex datasets, but the shortage of skilled professionals capable of guiding these platforms diminishes their effectiveness. Organizations struggle to bridge the gap between the advanced functionalities of data science platforms and the expertise needed to leverage these functionalities optimally.

- The COVID-19 pandemic accelerated the digitization of businesses and industries, leading to a surge in the need for data-driven insights. Organizations across sectors turned to data science to make informed decisions about resource and risk management and customer behavior. Further, the shift to remote work spurred the adoption of cloud-based data science platforms and tools, enabling data scientists to collaborate effectively from any location. This flexibility and accessibility further fueled the demand for data science expertise.

Data Science Platform Market Trends

Small and Medium Enterprises to Witness Major Growth

- Small-sized organizations have less than 100 employees, whereas medium-sized enterprises have between 100 to 999 employees. One of the major applications of data science for small businesses is using it to track clients throughout the various stages of the sales cycle. Small businesses can utilize data analytics to determine a particular segment of consumers willing to buy. Data-driven industry growth is making evidence-based conclusions to enhance sales, performance, and operations, among others, through which businesses can achieve sustainable development.

- SMEs often operate with limited resources, making every decision critical. Data science platforms empower SMEs to make more precise and informed decisions, reducing risks. The platforms help SMEs identify inefficiencies in their operations and supply chains, reducing costs.

- In August 2023, Infor Nexus and DBS Bank, in partnership, announced the launch of pre-shipment financing for small and medium-sized enterprises (SME) suppliers in the Infor Nexus supply chain ecosystem. This solution utilizes historical data from the Infor Nexus platform to provide data-based lending solutions that help suppliers meet their working capital requirements.

- Cloud adoption is expected to boost the market's growth. It has revolutionized how SMEs access and utilize data science platforms. Cloud infrastructure offers scalability, allowing SMEs to seamlessly scale their data science capabilities up or down based on their changing needs. In November 2023, AnniQ launched a new service focusing on data analytics to support the strategic capabilities of small and medium-sized enterprises (SMEs). This service is designed to enhance how SMEs engage with and utilize data in their business operations, emphasizing providing actionable insights and facilitating strategic execution.

North America to Hold Significant Market Share

- Fueled by data's increasing volume and complexity, the United States continues to innovate and consolidate its position in the global market in the data science platforms. The embracing of advanced technologies such as advanced analytics, Artificial Intelligence (AI), and Machine Learning (ML) in the market studied has also directly impacted the national economy.

- According to Telecom Advisory Services, the estimated Internet traffic in the United States has jumped from 64 million exabytes per month in 2021 to 98.64 million exabytes per month in 2023. Such a significant increase in data traffic needs more advanced data science solutions to manage a large amount of data and improve the solutions based on extracted data. Additionally, organizations are generating more data than ever, which is becoming increasingly complex and diverse. This makes it difficult to analyze and extract insights from data using traditional methods. Data science platforms provide the tools and infrastructure to manage and analyze large and complex databases.

- Moreover, all the major vendors studied in the market are US-based. Additionally, the country is on the brink of the fourth industrial revolution, where data is being utilized in large-scale production while integrating the data with a wide variety of manufacturing systems throughout the supply chain. This is accelerating the adoption of advanced technologies in the country.

- The government in the region is also promoting the adoption of robotics by taking initiatives to support the growth of modern technologies in the market. For instance, the US federal government has launched the National Robotics Initiative (NRI) program to strengthen the capabilities of building domestic robots in the nation and encourage research activities in the field. Such initiatives are further expected to create a positive outlook for the market growth.

- In addition, the strong focus on research and innovation in Canada in sectors like healthcare, artificial intelligence, and renewable energy supports the market requiring data science platforms to analyze complex data sets and gain research insights. Canada's tech industry is flourishing, and the country has made a concerted effort to attract technological know-how. A rising number of sectors, including banking, healthcare, finance, insurance, media and entertainment, telecom, and e-commerce, need qualified Data Scientists and AI experts. Professionals are in greater demand right now than they are available. Expanding technological capabilities and the demand for high-end IT solutions, AI, and ML will drive the market for data science platforms in Canada.

Data Science Platform Industry Overview

The Data Science Platform Market is semi-consolidated and is characterized by high product differentiation, growing levels of product penetration, and rapid advancements in technology, leading to difficulty in maintaining a competitive advantage, forcing them to continuously adopt and innovate solutions. Some of major players include Alteryx, IBM Corporation, Google LLC (Alphabet Inc.), SAS, Alteryx, Microsoft Corporation.

- November 2023 - IBM collaborated with Amazon Web Services (AWS) on the general availability of Amazon Relational Database Service (Amazon RDS) for Db2, a fully managed cloud offering designed to make it easier for database customers to manage data for artificial intelligence (AI) workloads across hybrid cloud environments. It will allow the users to leverage an array of the company's integrated data and AI capabilities on AWS to manage data and scale AI workloads.

- August 2023 - Google Cloud and NVIDIA announced a partnership expansion to advance AI computing, software, and services for customers to build and deploy massive models for generative AI and speed data science workloads. The partnership will bring end-to-end machine learning services to some of the largest AI customers in the world - including by making it easy to run AI supercomputers with Google Cloud offerings built on NVIDIA technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Increase in Big Data

- 5.1.2 Emerging Promising Use Cases of Data Science and Machine Learning

- 5.1.3 Shift of Organizations Toward Data-intensive Approach and Decisions

- 5.2 Market Restraints

- 5.2.1 Lack of Skillset in Workforce

- 5.2.2 Data Security and Reliability Concerns

- 5.3 Key Use Cases

- 5.4 Ecosystem Analysis

- 5.5 Analysis of Pricing and Pricing Models

- 5.6 Key Capabilities of Data Science Platforms (AI & Ml, Analytics, Visualization, Exploration, Modelling)

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Platform

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Size of Enterprises

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By Industry Vertical

- 6.4.1 IT and Telecom

- 6.4.2 BFSI

- 6.4.3 Retail and E-commerce

- 6.4.4 Oil Gas and Energy

- 6.4.5 Manufacturing

- 6.4.6 Government and Defense

- 6.4.7 Other Industry Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Italy

- 6.5.2.5 Spain

- 6.5.2.6 Greece

- 6.5.2.7 Rest of Europe

- 6.5.3 Asia Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Australia

- 6.5.3.5 Southeast Asia

- 6.5.3.5.1 Indonesia

- 6.5.3.5.2 Philippines

- 6.5.3.5.3 Malaysia

- 6.5.3.5.4 Singapore

- 6.5.3.5.5 Rest of Southeast Asia

- 6.5.3.6 Rest of Asia Pacific

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Argentina

- 6.5.4.3 Mexico

- 6.5.4.4 Rest of Latin America

- 6.5.5 Middle East and Africa

- 6.5.5.1 Saudi Arabia

- 6.5.5.2 GCC

- 6.5.5.2.1 United Arab Emirates

- 6.5.5.2.2 Rest of GCC

- 6.5.5.3 South Africa

- 6.5.5.4 Rest of Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Google LLC (Alphabet Inc.)

- 7.1.3 Microsoft Corporation

- 7.1.4 SAS

- 7.1.5 Alteryx

- 7.1.6 The MathWorks Inc.

- 7.1.7 RapidMiner

- 7.1.8 Databricks

- 7.1.9 Amazon Web Services Inc. (AMAZON.COM INC.)

- 7.1.10 DataRobot Inc.