|

市场调查报告书

商品编码

1433492

发泡-市场占有率分析、产业趋势与统计、成长预测(2024-2029)Blowing Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

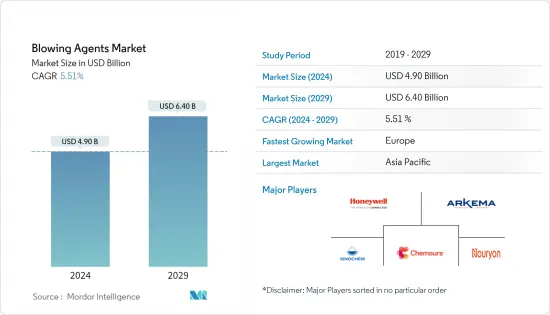

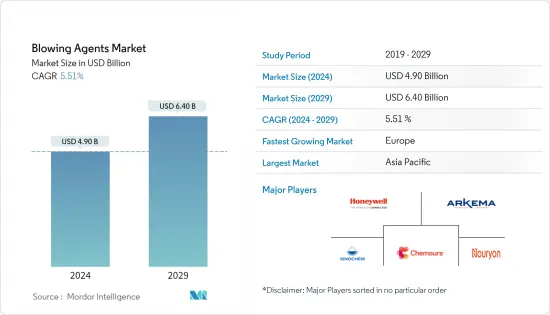

发泡市场规模预计到2024年为49亿美元,预计到2029年将达到64亿美元,在预测期内(2024-2029年)复合年增长率为5.51%。

推动所研究市场的主要因素是建筑、汽车和家用电器对聚合物绝缘泡棉的需求不断增长。有关发泡的严格环境法规预计将阻碍所研究市场的成长。

主要亮点

- 对零臭氧消耗潜值 (ODP) 和低全球暖化潜势 (GWP)发泡的高需求可能代表未来的机会。

- 就收益而言,北美在预测期内主导了调查市场。就销量而言,亚太地区主导了全球市场。

发泡市场趋势

建设产业的需求不断成长

- 发泡不含挥发性有机化合物,不会消耗臭氧层,全球暖化潜势值较低,且消费量的能源很少,因此在环境上可接受并用于建筑和施工。它有助于创建更均匀的组件,从而实现更好、更紧密的绝缘、更高的能源效率和有限的能源消耗。

- 发泡用作建筑隔热材料的成分,例如管道、屋顶隔热材料、门、覆材和需要基础的结构。它也用作门窗密封剂。

- 它们主要用于聚氨酯泡棉,经常用于管道中,以防止热量损失,在寒冷地区保持温度,并在远距加热时防止冻结和破裂。

- 它们也用于酚醛发泡,但其应用受到限制。酚醛发泡主要用于充当屋顶、墙体空腔和地板隔热隔热材料隔热层的面板。由于全球建设活动的增加,发泡市场预计将显着扩大。

- 亚太地区在建筑领域占据主导地位,其中印度、中国和其他东南亚国家显着推动了市场成长。

- 上述积极因素预计将在整个预测期内推动市场成长。

中国主导亚太市场

- 中国作为第一组成员,预计到 2024 年将氢氟碳化合物的生产和使用冻结在商定的基准水平,到 2029 年产量将分阶段控制在冻结水平以下 10%。我们计划逐步减少其使用。

- 儘管CFC-11因其对臭氧层破坏的影响而于2010年在国际上被禁止使用,但已发现证据证明CFC-11作为硬质聚氨酯泡棉保温材料领域的发泡存在非法生产和使用。英国非政府组织环境研究机构进行的实地研究发现,中国空气中CFC-11的浓度明显高于预期,证明CFC-11是有害的。

- 除了禁用的CFC和HCFC(其使用受到监管併计划到2040年逐步淘汰)外,中国正在开发替代发泡,例如预混CP(环戊烷)、HFO混合物和水的使用。

- 中国拥有全世界最大的建筑业。然而,随着中国政府旨在向服务主导经济转型,该产业的成长速度变得越来越慢。

- 中国拥有世界第二大包装产业,由于客製化包装的兴起,对微波食品、休閒食品、冷冻食品等需求的增加,预计在预测期内将持续成长。

- 中国拥有世界上最大的纺织服装业,是该国经济的重要参与者。然而,由于与美国的贸易战和市场的成熟,该国在美国服装出口市场的份额有所下降。

- 因此,上述因素可能会影响预测期内中国发泡的需求。

发泡产业概况

全球发泡市场较为分散。市场上有许多国际参与者和本地参与者。主要企业包括霍尼韦尔国际公司、科慕公司、阿科玛、中化集团、诺力昂等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑、汽车和家用电器对聚合物绝缘泡棉的需求增加

- 聚氨酯泡棉生产中对发泡的需求增加

- 抑制因素

- 关于发泡的严格环境法规

- COVID-19 的影响

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 监管和政策

第五章市场区隔

- 产品类别

- 氟烃塑胶(HCFC)

- 氢氟碳化合物 (HFC)

- 碳氢化合物(HC)

- 氢氟烯烃 (HFO)

- 其他产品类型

- 表格类型

- 聚氨酯泡棉

- 聚苯乙烯泡沫

- 酚醛发泡

- 聚丙烯泡沫

- 聚乙烯泡沫

- 其他形式

- 目的

- 建筑/施工

- 车

- 寝具/家具

- 家用电器

- 包装

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 合併、收购、合资、合伙和协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- A-Gas

- Americhem

- Arkema

- Form Supplies Inc.(FSI)

- Harp International Ltd

- HCS Group GmbH

- Honeywell International Inc.

- Huntsman International LLC

- Lanxess

- Nouryon

- Sinochem Group Co. Ltd

- Solvay

- The Chemours Company

- The Linde Group

- Zeon Corporation

第七章 市场机会及未来趋势

- 对臭氧消耗潜能值 (ODP) 为零且全球暖化潜势 (GWP) 较低的发泡的需求量很大

- 发泡包装用聚苯乙烯挤塑板消费量大

The Blowing Agents Market size is estimated at USD 4.90 billion in 2024, and is expected to reach USD 6.40 billion by 2029, growing at a CAGR of 5.51% during the forecast period (2024-2029).

Major factors driving the market studied is rise in demand for polymeric insulation foams for buildings, automotive, and appliances. stringent environmental regulations regarding blowing agents is expected to hinder the growth of the market studied.

Key Highlights

- High Demand for Zero Ozone Depletion Potential (ODP) and Low Global Warming Potential (GWP) Blowing Agents is likely to act as an opportunity in the future.

- In terms of revenue, North America dominated the market studied during the forecast period. In terms of volume, Asia-Pacific dominated the global market.

Blowing Agents Market Trends

Increasing Demand from the Building and Construction Industry

- Owing to their non-VOC, non-ozone depleting, low global warming potential, and reduced energy consumption, blowing agents are environmentally acceptable, and are thus, used in building and construction. They help to create better uniform components, resulting in better, tighter insulation, higher energy efficiency, and limited energy consumption.

- Blowing agents are used as a component in building insulation, such as block pipe and roof insulation, doors, sheathing, and in structures that require foundation. They are also used as sealants for windows and doors.

- They are majorly used in polyurethane foams that have high utilization in pipes to prevent loss of heat and to maintain temperatures even during cold climates, to avoid freezing or cracking for long-distance heating.

- They are also used in phenolic foams, but with limited usage. Phenolic foams are majorly used in panels to act as insulating barriers in roofing, wall cavities, and floor insulation. The increasing construction activities worldwide is expected to significantly boost the blowing agents market.

- The Asia-Pacific region dominates the building and construction sector, with India, China, and various other South East Asian countries driving the market growth significantly.

- The positive factors like the aforementioned ones are expected to drive the market growth through the forecast period.

China to Dominate the Asia-Pacific Market

- As a Group I member, China is expected to freeze HFC production and use at agreed baseline levels, by or before 2024, and is expected to phase down the production and use, beginning with a 10% phasedown below freeze levels, by 2029.

- Though the usage of CFC-11 was banned internationally in 2010, owing to the ozone depletion effects of the substance, evidence has been found proving the illegal production and usage of CFC-11 as a blowing agent in the rigid polyurethane foam insulation sector. According to a field study carried out by the Environmental Investigative Agency, a UK-based NGO, the atmospheric levels of CFC-11 in China are significantly greater than expected, proving the harmful nature of CFC-11.

- Apart from the banned CFCs and HCFCs (whose usage is regulated and is expected to phase out by 2040), China has been using alternative blowing agents, like preblended CP (cyclopentane), HFO blends, and water.

- China has the world's largest construction industry. However, the growth rate of the industry has become increasingly modest, as the Chinese government is looking to shift toward a services-led economy.

- China has the second-largest packaging industry in the world and is expected to witness a consistent growth during the forecast period, owing to the rise of customized packaging, increased demand for microwave food, snack foods, and frozen foods, among others.

- China has the world's largest textile and apparel industry, which is also a key player for the country's economy. However, there has been a drop in the market share occupied by the country in the global apparel export market, owing to the trade war with the United States and maturation of the market.

- Hence, the aforementioned factors are likely to affect the demand for blowing agents in China during the forecast period.

Blowing Agents Industry Overview

The global market for blowing agents is fragmented. There are many local players in the market along with international players. The major companies include Honeywell International Inc., The Chemours Company, Arkema, Sinochem Group Co. Ltd, and Nouryon, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rise in Demand for Polymeric Insulation Foams for Buildings, Automotive, and Appliances

- 4.1.2 Increasing Demand for Foam Blowing Agents in the Manufacturing of Polyurethane Foams

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding Blowing Agents

- 4.2.2 Impact of COVID-19

- 4.2.3 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Policies and Regulations

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Hydrochlorofluorocarbons (HCFCs)

- 5.1.2 Hydrofluorocarbons (HFCs)

- 5.1.3 Hydrocarbons (HCs)

- 5.1.4 Hydrofluoroolefin (HFO)

- 5.1.5 Other Product Types

- 5.2 Foam Type

- 5.2.1 Polyurethane Foam

- 5.2.2 Polystyrene Foam

- 5.2.3 Phenolic Foam

- 5.2.4 Polypropylene Foam

- 5.2.5 Polyethylene Foam

- 5.2.6 Other Foam Types

- 5.3 Application

- 5.3.1 Building and Construction

- 5.3.2 Automotive

- 5.3.3 Bedding and Furniture

- 5.3.4 Appliances

- 5.3.5 Packaging

- 5.3.6 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 A-Gas

- 6.4.2 Americhem

- 6.4.3 Arkema

- 6.4.4 Form Supplies Inc. (FSI)

- 6.4.5 Harp International Ltd

- 6.4.6 HCS Group GmbH

- 6.4.7 Honeywell International Inc.

- 6.4.8 Huntsman International LLC

- 6.4.9 Lanxess

- 6.4.10 Nouryon

- 6.4.11 Sinochem Group Co. Ltd

- 6.4.12 Solvay

- 6.4.13 The Chemours Company

- 6.4.14 The Linde Group

- 6.4.15 Zeon Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 High Demand for Zero Ozone Depletion Potential (ODP) and Low Global Warming Potential (GWP) Blowing Agents

- 7.2 High Consumption of Extruded Sheets of Polystyrene for Packaging Foam