|

市场调查报告书

商品编码

1433519

全球行动加速器市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Mobile Accelerator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

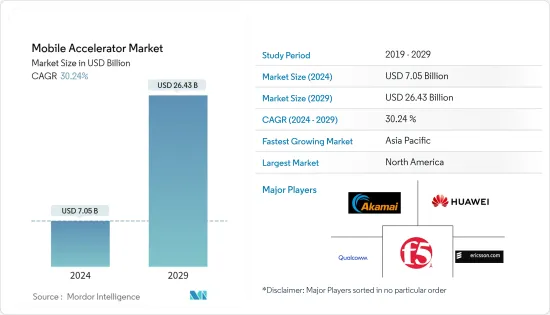

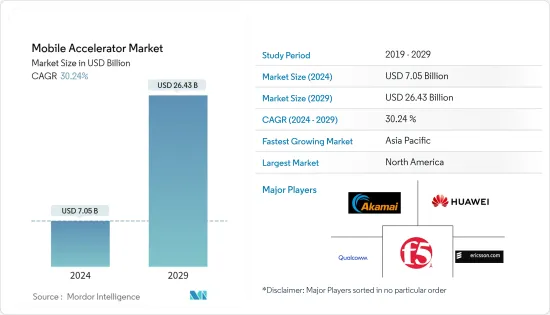

根据预测,2024年全球行动加速器市场规模预估为70.5亿美元,2029年达到264.3亿美元,在预测期间(2024-2029年)复合年增长率为30.24%。

主要亮点

- 行动加速器使用各种技术来提高应用程式效能,包括资料压缩、内容优化和快取。它还有助于减少行动应用程式使用的资料量,这对于资料方案有限的用户特别有用。

- 随着行动装置使用的增加以及行动应用程式对组织的重要性的增加,对行动加速器的需求也在增加。随着越来越多的企业依靠行动应用程式与消费者互动,对行动加速器优化应用程式效能的需求将会增加。

- 近年来,行动流量急剧增加,推动了行动加速器市场的发展。随着越来越多的人使用智慧型手机和平板电脑上网,一些国家的行动流量已超过桌面流量。这一市场开拓的重点是针对不断增长的受众的行动行销策略和方法。

- 由于资料与第三方供应商共用,行动加速器市场面临重大的安全挑战。这些挑战可能会限制市场成长并阻止企业和个人采用行动加速器。

- 在 COVID-19 大流行期间,行动加速器计划透过为新兴企业提供虚拟支援来适应新常态。此次疫情也加速了数位技术的采用,为行动加速器计画创造了新的机会,以支持和指导行动应用领域的新兴企业。

行动加速器市场趋势

行动流量的增加和行动行销趋势预计将推动市场成长

- 行动使用量的增加和行销趋势正在推动对行动加速器的需求。行动加速器优化行动应用程式效能并改善用户体验。

- 行动使用量的增加和行销趋势导致对行动加速器的需求增加。行动加速器是允许行动应用程式在行动装置上更快、更有效率地运行的软体工具。爱立信表示,预计 2019 年至 2027 年间,全球整体5G 用户数将从超过 1,200 万增加到超过 40 亿。东北亚、东南亚、印度、尼泊尔和不丹的订阅量预计将增加。

- 行动装置已成为日常生活中不可或缺的一部分,人们将其用于多种目的,包括通讯、娱乐、购物和社交媒体。因此,对行动应用程式的需求不断增加,企业正专注于开发行动应用程式来吸引客户。

- 行动行销也已成为数位行销策略不可或缺的一部分。这涉及使用智慧型手机和平板电脑等行动装置透过简讯、行动应用程式、社交媒体和行动网站等各种管道推广您的产品和服务。

- 行动加速器用于确保行动应用程式以最佳方式运作。这些加速器有助于减少行动应用程式载入时间、提高效能并提供更好的用户体验。它还优化了行动装置资源(如 CPU、记忆体和电池)的使用,延长电池寿命并减少资料使用量。

亚太地区预计成长最快

- 亚太地区行动加速器市场是一个快速成长的市场,包括各种行动技术、应用程式和服务。行动加速器是指旨在增强行动应用和服务效能的技术。这些技术优化了行动装置和网路的效能,使行动应用程式和服务能够更流畅、更有效率地运作。

- 由于行动技术的日益采用以及对高效能行动应用程式和服务的需求不断增长,预计亚太地区行动加速器市场将在未来几年快速成长。该市场由中国、日本、印度和韩国等国家主导,这些国家拥有全球最大、最先进的行动市场。

- 此外,中国政府正在对新兴市场的基础设施开发进行大量投资,包括5G网路的推出,预计这将在未来几年进一步推动中国行动加速器市场的成长。

- 根据中国国家统计局的数据,截至2023年2月,中国行动电话用户约16.9亿户。根据政府官方统计,中国行动上网普及为99.7%。中国企业和社会由此实现了高度数位化。

- 由于行动技术的日益采用以及对高效能行动应用程式和服务的需求不断增长等因素,预计该市场将继续成长。随着市场的不断发展,新技术和服务将会出现,这将进一步增强该地区的行动应用和服务能力。

行动加速器产业概况

行动加速器市场高度分散,主要参与者包括 Akamai Technologies Inc.、Qualcomm Inc.、Telefonaktiebolaget LM Ericsson、华为技术有限公司和 F5 Networks Inc.。由于主要参与者的存在,市场上的公司高度分散例如Akamai Technologies Inc .、Qualcomm Inc.、Telefonaktiebolaget LM Ericsson、华为技术有限公司和F5 Networks Inc.。透过采取合约和收购等策略,我们正在加强我们的产品组合併获得永续的竞争优势。

2022年12月,爱立信与总部位于加州圣荷西的着名物联网(IoT)解决方案供应商Aeris Communications同意收购爱立信的物联网加速器业务和车连网型云端业务。超过 9,000 家公司将使用爱立信物联网加速器来处理全球超过 9,500 万个连网设备和超过 2,200 万个 eSIM 连线。

2022年9月,Qualcomm Technologies, Inc.开始为全球客户和合作伙伴提供Qualcomm X100 5G RAN加速卡和Qualcomm QRU100 5G RAN平台样品,以进行下一代5G行动基础设施整合和检验。这是朝着全面开放和虚拟5G网路演进和最终实用化迈出的重要一步。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 行动流量的增加和行动行销趋势

- 市场限制因素

- 与第三方供应商共用资料带来的安全挑战

第六章市场区隔

- 按设备

- 智慧型手机

- 药片

- 其他设备

- 按类型

- 内容/网页应用程式

- 加速内容传输网路

- 广域网路优化

- 行动应用加速器

- 设备/用户端加速

- 其他类型

- 按用途

- 游戏

- 行动商务

- 定位服务

- 社群网路

- 音乐和讯息

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Akamai Technologies Inc.

- Qualcomm Inc.

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd.

- F5 Networks Inc.

- Juniper Networks Inc.

- Riverbed Technologies Inc.

- Ascom Holding AG

- Rockstart Inc.

- Flash Networks Inc.

- Mobidia Technology Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Mobile Accelerator Market size is estimated at USD 7.05 billion in 2024, and is expected to reach USD 26.43 billion by 2029, growing at a CAGR of 30.24% during the forecast period (2024-2029).

Key Highlights

- Mobile accelerators use various techniques to improve app performance, including data compression, content optimization, and caching. They can also help reduce the amount of data mobile apps use, which can be particularly useful for users with limited data plans.

- The rising use of mobile devices and the growing relevance of mobile apps for organizations drive the need for mobile accelerators. As more businesses rely on mobile applications to interact with consumers, the demand for mobile accelerators to optimize app performance will increase.

- Mobile traffic has increased dramatically in recent years, which drives the mobile accelerator market. Mobile traffic has exceeded desktop traffic in several nations as more people use smartphones and tablets to access the internet. This development has emphasized mobile marketing strategies and approaches to target this expanding audience.

- The mobile accelerator market faces significant security challenges as data is shared with third-party vendors. These challenges can restrain the market's growth and hinder businesses' and individuals' adoption of mobile accelerators.

- During the COVID-19 pandemic, mobile accelerator programs adapted to the new normal by offering virtual support to startups. The pandemic also accelerated the adoption of digital technologies, creating new opportunities for mobile accelerator programs to support and guide startups in the mobile app space.

Mobile Accelerator Market Trends

Increasing Mobile Traffic and Mobile Marketing Trends is Expected to Drive the Market Growth

- The increasing mobile usage and marketing trend has led to a rise in demand for mobile accelerators. Mobile accelerators help optimize mobile application performance and improve user experience, which has become essential for businesses to stay ahead in the competitive market.

- The increasing mobile usage and marketing trend has led to a rise in demand for mobile accelerators. Mobile accelerators are software tools that help mobile applications perform faster and more efficiently on mobile devices. According to Ericsson, 5G subscriptions are expected to increase globally between 2019 and 2027, from over 12 million to over 4 billion. Subscriptions are expected to be higher in North East Asia, South East Asia, India, Nepal, and Bhutan.

- Mobile devices have become an integral part of our daily lives, and people are increasingly using them for various purposes, such as communication, entertainment, shopping, and social media. As a result, the demand for mobile applications has increased, and businesses are focusing more on developing mobile applications to reach out to their customers.

- Mobile marketing has also become an essential aspect of digital marketing strategies. It involves using mobile devices such as smartphones and tablets to promote products or services through various channels such as SMS, mobile applications, social media, and mobile websites.

- Mobile accelerators are being used to ensure that mobile applications perform optimally. These accelerators help reduce the load time of mobile applications, improve their performance, and provide a better user experience. They also optimize the use of mobile device resources such as CPU, memory, and battery, which results in increased battery life and reduced data usage.

Asia-Pacific Expected to be the Fastest Growing Region

- The Asia-Pacific Mobile Accelerator Market is a rapidly growing market that includes a range of mobile technologies, applications, and services. Mobile accelerators refer to technologies designed to enhance the performance of mobile applications and services. These technologies help to optimize the performance of mobile devices and networks, making it possible for mobile applications and services to run more smoothly and efficiently.

- The market for mobile accelerators in the Asia-Pacific region is expected to grow rapidly in the coming years, driven by the increasing adoption of mobile technologies and the growing demand for high-performance mobile applications and services. The market is expected to be driven by countries such as China, Japan, India, and South Korea, home to some of the world's largest and most advanced mobile markets.

- In addition, the Chinese government has been investing heavily in developing its mobile infrastructure, including deploying 5G networks, which is expected to further drive the growth of the mobile accelerator market in China in the coming years.

- According to the National Bureau of Statistics of China, In China, there were about 1.69 billion mobile phone subscribers as of February 2023. According to official government statistics, the country's mobile internet penetration rate was 99.7 percent. As a result, Chinese businesses and society have attained a high level of digitization.

- The market is expected to continue to grow in the coming future, driven by factors such as the increasing adoption of mobile technologies and the growing demand for high-performance mobile applications and services. As the market continues to evolve, new technologies and services emerge that will further enhance the performance of mobile applications and services in the region.

Mobile Accelerator Industry Overview

The Mobile Accelerator Market is highly fragmented with the presence of major players like Akamai Technologies Inc., Qualcomm Inc., Telefonaktiebolaget LM Ericsson, Huawei Technologies Co. Ltd, and F5 Networks Inc. Players in the market are adopting strategies such as partnerships, innovations, agreements, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In December 2022, Ericsson and Aeris Communications, a prominent Internet of Things (IoT) solutions provider headquartered in San Jose, California, agreed to transfer Ericsson's IoT Accelerator and Connected Vehicle Cloud businesses. Over 9,000 companies used Ericsson IoT Accelerator to handle over 95 million connected devices and 22 million eSIM connections globally.

In September 2022, Qualcomm Technologies, Inc. began sampling the Qualcomm X100 5G RAN Accelerator Card and Qualcomm QRU100 5G RAN Platform to global clients and partners for next-generation 5G mobile infrastructure integration and verification. This was a huge step forward in the evolution and eventual commercialization of full-scale open and virtualized 5G networks.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Mobile Traffic and Mobile Marketing Trends

- 5.2 Market Restraints

- 5.2.1 Security Challenges as the Data is shared with Third-party Vendors

6 MARKET SEGMENTATION

- 6.1 By Device

- 6.1.1 Smartphones

- 6.1.2 Tablets

- 6.1.3 Other Devices

- 6.2 By Type

- 6.2.1 Content/Web Applications

- 6.2.2 Content Delivery Network Acceleration

- 6.2.3 WAN Optimization

- 6.2.4 Mobile Application Accelerator

- 6.2.5 Device/User End Acceleration

- 6.2.6 Other Types

- 6.3 By Application

- 6.3.1 Gaming Applications

- 6.3.2 M-Commerce Applications

- 6.3.3 Location-based Service Applications

- 6.3.4 Social Networking Applications

- 6.3.5 Music and Messaging Applications

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Akamai Technologies Inc.

- 7.1.2 Qualcomm Inc.

- 7.1.3 Telefonaktiebolaget LM Ericsson

- 7.1.4 Huawei Technologies Co. Ltd.

- 7.1.5 F5 Networks Inc.

- 7.1.6 Juniper Networks Inc.

- 7.1.7 Riverbed Technologies Inc.

- 7.1.8 Ascom Holding AG

- 7.1.9 Rockstart Inc.

- 7.1.10 Flash Networks Inc.

- 7.1.11 Mobidia Technology Inc.