|

市场调查报告书

商品编码

1433527

全球企业协作市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Enterprise Collaboration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

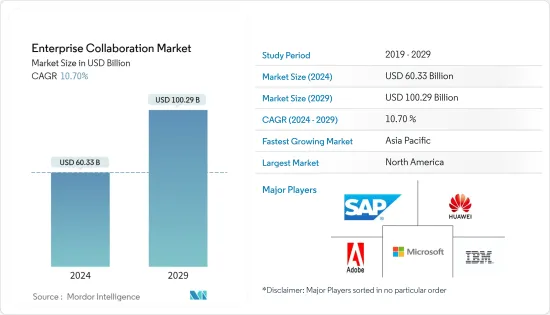

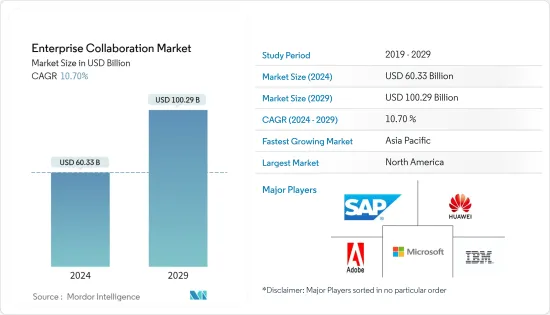

根据预测,2024年全球企业协作市场规模预估为603.3亿美元,2029年达到1,002.9亿美元,预测期间(2024-2029年)复合年增长率为10.70%。

该公司正在利用虚拟实境、机器人流程自动化和人工智慧机器人等先进工具来扩大内部生产力并改善与员工的沟通。据高盛称,到 2025 年,虚拟和扩增实境市场的企业和公共部门预计将占约 161 亿美元。 RealSense 和 DORA 等虚拟实境公司正在负责人中提供身临其境型的体验。

企业协作工具透过在员工之间提供无缝沟通并提高业务效率和生产力来帮助公司实现其业务目标。企业协作工具提供组织之间的资料同步和协作解决方案,包括检查官方电子邮件、日历和联络人等功能。此外,视讯会议可以帮助员工更积极地沟通并共用想法。

AI、IoT、ML等先进技术正在企业协作工具中落地,增强协作能力。基于人工智慧的企业协作工具可以追踪员工行为和共用内容,并提供消费行为、员工保留、办公室利用率、绩效优化等生产查核点,透过关联视觉化分析,为员工和员工提供前瞻性业务洞察。帮助他们更快完成业务。

云端基础的工作负载部署预计将主要由产生资料的持续成长所驱动。各种最终用途产业都会产生大量资料。资料中心适合必须运行多种用途和复杂工作负载以进行企业协作的组织。透过跨所有应用程式工具存取即时资料,您可以提高工作效率。

例如,2022 年 8 月,微软宣布在卡达推出新的资料中心区域,展示了微软作为该国提供企业级服务的最重要的超大规模云端供应商的巨大潜力。最新的云端资料中心区域随 Microsoft Azure 和 Microsoft 365 一起推出,使企业能够存取数百个可扩展、高度可用且有弹性的云端服务。

人们越来越多地使用行动装置来操作众多社交网路平台,这正在推动企业协作市场的成长。透过电脑造访社群网站的人越来越少,透过智慧型手机造访社群网站的人越来越多。例如,在美国,现在超过50%的网路流量来自行动设备,最新资料显示,到2026年,美国行动网路用户预计将达到3亿个。

此外,随着易于使用的智慧型手机的使用增加,中国和印度等新兴经济体也出现了类似的趋势。这些优势正在推动企业协作市场的成长。爱立信预计,2022年全球智慧型手机行动网路用户数量预计将达到约66亿,2028年将超过78亿人。印度、中国和美国的智慧型手机行动网路订阅数量最多。

资料隐私问题是企业协作市场成长的主要挑战之一。儘管许多公司专注于防止恶意资料骇客攻击和盗窃,但资料外洩最常见的原因是缺乏资料安全性或意外处理不当。此外,随着公司努力寻求更具协作性的环境,内部和与外部公司的资料交换将会增加。随着企业和员工之间的资料交换增加,越来越需要解决协作活动期间保护共用资料的挑战。这些挑战在一定程度上阻碍了市场的成长。

此外,COVID-19 的爆发对市场成长产生了积极影响。由于封锁,多个组织推广了协作工具,员工在危机期间能够在家工作。随着公司适应远距工作,微软的团队协作软体 Microsoft Teams 的需求增加了 40%。 Microsoft 宣布了 Teams 的新功能,主要旨在改进远端会议。公司减少了业务支出并专注于业务永续营运和永续性。未来中小型企业预计将加速采用企业协作解决方案。

企业协作市场趋势

云端基础的部署促进市场成长

部署到云端基础的工作负载预计将主要由生成的资料的持续成长驱动。多个行业处理大量资料。资料中心适合运行多种用途和复杂工作负载以进行企业协作的组织。资料中心透过跨所有应用程式工具存取即时资料来实现高生产力。

近年来,企业社交协作 (ESC) 解决方案正在将世界各地的人们连结起来。社交使用受到科技的限制,在一个部门有效的方法可能在另一个部门无效。随着云端的出现,整合社交协作解决方案变得更加容易。许多中小企业已经采用了云端。透过采用云端,小型企业可以降低硬体、软体、储存和技术人员的成本。它还有助于协作市场中的资料扩充性。

云端基础的平台提供更多功能和特性,使企业无需整合、实施和管理多个独立系统。基于云端基础的部署相对于本地部署的这些优势预计将促进市场成长。据 Flexera Software 称,到 2023 年,47% 的受访者将已经在 Amazon Web Services (AWS) 上运行大规模工作负载。

全球组织的扩张、生产力的提高以及自带设备 (BYOD) 和物联网趋势的成长是预计推动云端基础的企业协作市场成长的关键因素。开拓的云端基础协作解决方案,包括语音通信、音讯会议和社交协作软体,使企业能够高效、快速地协作,与客户保持积极的关係,并立即回应查询,从而实现市场成长。

根据印度企业事务部统计,截至2022年6月,印度、南亚地区约有148万家註册公司。此外,根据 BetterCloud 的数据,到 2022 年,世界各地的组织平均使用 130 个云端基础即服务 (SaaS)。自2015年以来,企业使用的SaaS应用程式数量持续增加,这可能会进一步推动市场成长。

公有云和私有云端应用程式的混合环境需要使用正确的工具进行同质云整合。例如,总部位于德国的 T-Systems 在高度安全的私有云端中运作动态协作服务,该云端完全符合该国严格的资料隐私和保护法律。

由此,新兴国家各领域的应用需求不断增加,云端安全解决方案的可行性也不断增强。由于每个地区的大多数公司都致力于这些技术服务,云端协作市场的使用量正在增加,从而推动了整体市场的成长。

北美市场实现显着成长

由于 Facebook Inc.、微软公司、Google有限责任公司和 Slack Technologies Inc. 等市场参与者的存在,北美在企业协作市场中占据了重要份额。这些公司为中小企业和大型企业提供技术先进的解决方案和产品,透过促进内部和外部沟通来提高生产力。该地区拥有先进的基础设施能力,是市场的重要收益来源。预计这些因素将在未来几年进一步促进该地区的市场成长。

该地区的企业正在超越公有云,进入混合IT 的新时代,即公有云、私有云端和传统 IT 结合。这些公司正在透过实施混合云策略来改善其协作业务的运作方式。

2022年6月,Google云端推出了自己的「Google公共部门」子公司,专注于美国。该部门向国家、州、地方政府和教育组织销售产品。这个最新部门将作为 Google LLC 的子公司,专注于向美国公共部门客户提供 Google Cloud 技术,包括 Google Cloud Platform 和 Google Workspace。

在当前场景下,透过行动电话、视讯会议、即时通讯工具等来共用资讯、在固定时间内传递讯息。协作通讯显着减少了拥塞并增加了联繫的便利性。为了更好的沟通,企业正在尽一切努力使云端和协作技术互通,这正在推动企业协作市场的成长。

Oberlo 表示,北美有 2,250 亿社群媒体用户和 3,730 亿行动用户。这使得企业能够处理笔记和培训资源,并共用与其行业相关的最新新闻。企业协作解决方案和服务已在该地区广泛采用,特别是因为美国是最早采用社交、行动、分析和云端 (SMAC) 技术的国家之一。

美国联合部队司令部、美国国防部以及许多地方和州机构等组织开始使用协作技术来建立内部和外部知识库。公司正在定制他们的产品以保持市场竞争力。 2022 年 8 月,美国Dropbox 发布了最新版本的企业软体入口网站。您可以使用快捷方式启动应用程式、在 Slack 上发送讯息以及在 Zoom 上进行视讯通话。

企业协作产业概况

企业协作市场非常分散。虽然主要企业都在瞄准较大份额,但一些较小的参与者也在关注相当大的市场份额。结果是竞争激烈的公司之间形成敌对关係。市场参与企业包括微软、华为技术有限公司和Adobe Systems。最新进展包括:

2022 年 7 月:微软宣布推出 Microsoft Cloud for Sovereignty,这是一个主要针对欧洲公共部门客户的独特解决方案。 Microsoft Cloud for Sovereignty 的加入使企业能够更好地控制资料,并扩大云端营运和管治程序的透明度。

2022 年 1 月:塔塔咨询服务公司 (TCS) 现已成为新推出的微软零售云端的合作伙伴,扩大了与 Hyperscale 的合作。 TCS 将与全球领先零售商合作中获得的深厚行业知识与多层面云转型框架相结合,帮助零售商利用 Microsoft Cloud for Retail 驾驭其增长和转型之旅。我们将提供支持,以加速Microsoft 零售云是一种特定于行业的安全云,它结合了透过标准资料模型连结的各种 Microsoft 技术,并将端到端购物者旅程中的体验与特定产业的智慧功能连接起来。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- API 整合提高效率

- 更多地使用行动装置进行时间管理

- 市场挑战

- 资料联动安全担忧

第六章市场区隔

- 依部署类型

- 本地

- 云端基础

- 按用途

- 通讯工具

- 会议工具

- 调整工具

- 按最终用途行业

- 通讯/IT

- 旅游/酒店业

- BFSI

- 零售/消费品

- 教育

- 运输/物流

- 卫生保健

- 其他最终用途产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Microsoft Corporation

- Huawei Technologies Co. Ltd.

- Adobe Systems Inc.

- SAP SE

- IBM Corporation

- Atlassian Corporation PLC

- Slack Technologies Inc.

- TIBCO Software Inc.

- Polycom Inc.

- Salesforce.Com Inc.

- Mitel LLC

- Cisco System Inc.

- Zoho Corporation Pvt. Ltd.

- Jive Software

- Axero Solutions LLC

第八章投资分析

第9章市场的未来

The Enterprise Collaboration Market size is estimated at USD 60.33 billion in 2024, and is expected to reach USD 100.29 billion by 2029, growing at a CAGR of 10.70% during the forecast period (2024-2029).

Enterprises utilize advanced tools like virtual reality, robotic process automation, and artificial intelligence bots to augment internal productivity and promote better employee communication. According to Goldman Sachs, the virtual and augmented reality market's enterprise and public sector segments are expected to account for around USD 16.1 billion by 2025. Virtual reality companies, such as RealSense and DORA, offer immersive experiences for the boardroom.

Enterprise collaboration tools help firms by providing seamless communication between employees and improving their operational efficiency and productivity, helping them meet their business goals. Enterprise collaboration tools provide data synchronization and collaboration solutions across organizations and include features such as checking official emails, calendars, and contacts. Furthermore, video conferencing helps to give the employees more engaging communication and sharing of ideas.

Advanced technologies such as AI, IoT, and ML are being implemented into enterprise collaboration tools to enhance collaborative capabilities. AI-based enterprise collaboration tools can track the activities of employees and the contents being shared and are used to deliver anticipated business insights to the employees and help get the work done quicker by correlating visual analytics with production checkpoints such as consumer behavior, employee retention, office utilization, and performance optimization.

The cloud-based deployment of workloads is anticipated to be primarily driven by the consistent growth in the generated data. Various end-user industries are dealing with a massive volume of data being generated. The data centers are more suited for an organization that has to run many applications and complex workloads for enterprise collaboration. It also enables high productivity, with access to real-time data with all application tools.

For instance, in August 2022, Microsoft announced the launch of its new data center region in Qatar, marking a significant possibility for Microsoft as the most significant hyperscale cloud provider to offer enterprise-grade services in the country. The latest cloud data center region launches with Microsoft Azure and Microsoft 365, giving organizations access to hundreds of scalable, highly available, and resilient cloud services.

The growing usage of mobile devices to operate numerous social networking platforms boosts the enterprise collaboration market growth. It is observed that few people access social networking sites via computers, while most people use smartphones to access these websites. For instance, recently, more than 50% of web traffic in the United States originated from mobile devices, and according to the latest data, mobile internet users in the United States are forecast to reach 300 million by 2026.

Furthermore, emerging economizing, such as China and India, are also experiencing a similar trend, owing to the increasing usage of smartphones due to their easy accessibility. These advantages are propelling the growth of the enterprise collaboration market. According to Ericsson, smartphone mobile network subscriptions worldwide reached almost 6.6 billion in 2022 and are forecast to exceed 7.8 billion by 2028. India, China, and the U.S. have the highest smartphone mobile network subscriptions.

Data privacy concern is one of the significant challenges for the growth of the enterprise collaboration market. While many enterprises focus on preventing malicious data hacking and theft, data breaches are most commonly caused due to lack of data security or accidental mishandling. Furthermore, as enterprises step toward a more collaborative environment, the exchange of data increases, both within the company and with external enterprises. With the increasing data exchange among enterprises and employees, there is a growing need to address the challenges of safeguarding shared data during collaboration activities. Such challenges are hampering the market growth at a certain level.

Furthermore, the outbreak of COVID-19 positively impacted the market growth. Due to the lockdown, multiple organizations promoted collaboration tools as employees managed to work from home during the crisis. Microsoft Teams, a team collaboration software from Microsoft, witnessed a 40% increase in demand due to the adjustment of businesses to remote work. Microsoft launched new Teams features, primarily designed to improve remote meetings. Enterprises reduced operational spending and focused more on business continuity and sustainability. SMEs anticipated to accelerate the deployment of enterprise collaboration solutions in the future period.

Enterprise Collaboration Market Trends

Cloud-based Deployment to Increase the Market Growth

Cloud-based deployment to workload is expected to be primarily driven by the consistent growth in the data generated. Several industry verticals are dealing with a massive volume of data. A data center is better suited for an organization that runs many kinds of applications and complex workloads for enterprise collaboration. It enables high productivity, with access to real-time data with all application tools.

Enterprise social collaboration (ESC) solutions have connected people worldwide in recent years. Social applications have been limited by technology and may work fine for one department but not for another. The advent of the cloud makes integrating social collaboration solutions more effortless. Most SMEs (small and medium enterprises) are adopting cloud deployment, as these solutions help SMEs avoid hardware, software, storage, and technical staff costs. It also helps in the scalability of data in the collaboration market.

The market players deliver cloud-based platforms with more features and functionality, avoiding organizations needing to integrate, implement, and manage several standalone systems. Such advantages of cloud-based deployment over on-premises are expected to boost the market growth. According to Flexera Software, in 2023, 47% of respondents are already running significant workloads on Amazon Web Services (AWS).

The expansion of organizations globally, increased productivity, and growth in the trend of bringing devices (BYOD) and the IoT are some significant factors expected to boost the growth of the cloud-based enterprise collaboration market. With the development of cloud-based Enterprise collaboration solutions, including telephony, teleconferences, and social collaboration software, enterprises collaborate efficiently and rapidly, maintain good relationships with clients, and immediately respond to queries, allowing market growth.

According to the Ministry of Corporate Affairs (India), as of June 2022, there were around 1.48 million registered companies in the South Asian country of India. In addition, According to BetterCloud, In 2022, organizations worldwide were using an average amount of 130 cloud-based software as a service (SaaS) applications. Since 2015, the number of SaaS apps enterprises use has constantly increased, which may further drive market growth.

Hybrid landscapes of public and private cloud applications require integration in a homogeneous cloud coordinated with the right tools. For instance, a German-based company, T-Systems, operates dynamic services for collaboration in the high-security private cloud, fully compliant with the country's strict data privacy and protection laws.

Therefore, the growing demand for applications across various sectors in emerging economies also boosts viability, providing relevant cloud security solutions. As most enterprises across regions engage in these technology services, the usage of the cloud collaboration market expands and drives the growth of the overall market.

North America to Experience Significant Market Growth

North America significantly holds the market share in the enterprise collaboration market due to the presence of market players such as Facebook Inc., Microsoft Corporation, Google LLC, and Slack Technologies Inc. These organizations provide technologically advanced solutions and products to small- and large-scale companies to boost their productivity by facilitating enhanced internal and external communications. This region has an advanced infrastructure capability, which has led it to become a significant revenue generator for the market. Such factors would further augment regional market growth in the coming years.

Companies in the region are moving beyond the public cloud and stepping into a new era of hybrid IT, which combines public cloud, private cloud, and traditional IT. These organizations have implemented a hybrid cloud strategy as it helps improve how they run their collaboration business.

In June 2022, Google Cloud launched a unique 'Google Public Sector' subsidiary focusing on the United States. The division will sell to national, state, and local governments and educational associations. This latest division will serve as a subsidiary of Google LLC and will specialize in bringing Google Cloud technologies, including Google Cloud Platform and Google Workspace, to US public sector customers.

In the current scenario, information is shared using mobile phones, video conferencing, instant messenger, and others that deliver information within a stipulated time. With collaborative communication, the congestion overload is reduced significantly, thus providing ease of contact. For better communication, firms are making every effort to have cloud and collaboration technology mutually available, which drives the growth of the Enterprise Collaboration Market.

According to Oberlo, North America has 225 billion social media users and 373 billion mobile subscriptions. This will enable enterprises to process memos and training resources and share industry-relevant news updates. Enterprise collaboration solutions and services have gained wide adoption in the region, particularly in the US, as the nation has been one of the earliest adopters of Social, Mobile, Analytics, and Cloud (SMAC) technologies.

Organizations such as the US Joint Forces Command, the US Department of Defense, and many local and state agencies have started to use collaborative technologies to build internal and external knowledge repositories. Companies are customizing their offerings to stay competitive in the market. US-based Dropbox announced its more recent version in August 2022, an enterprise software portal. It allows users to launch apps with shortcuts and use built-in Slack message-sending and Zoom video calls.

Enterprise Collaboration Industry Overview

The enterprise collaboration market is favorably fragmented. The top players aim for a large share of the market, while the numerous smaller players aim for a substantial pie of the market. This results in intense rivalry and competition. Key participants in the market are Microsoft Corporation, Huawei Technologies Co. Ltd, Adobe Systems Inc., etc. Some of the recent developments in the market are -

July 2022: Microsoft introduced the launch of the Microsoft Cloud for Sovereignty, a unique solution for public sector customers, mainly in Europe. With the addition of Microsoft Cloud for Sovereignty, companies will have greater control over their data and expanded transparency to the operational and governance procedures of the cloud.

January 2022: Tata Consultancy Services (TCS) is currently a partner for the newly-launched Microsoft Cloud for Retail, expanding its collaboration with the hyper-scale. TCS will combine its deep industry knowledge from working with significant retailers worldwide and its multi-horizon cloud transformation framework to assist retail clients in accelerating their growth and transformation journeys using Microsoft Cloud for Retail. Microsoft Cloud for Retail is a secure industry-specific cloud that combines various Microsoft technologies linked by a standard data model to connect experiences across the end-to-end shopper journey with integrated and intelligent capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 impact on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 API Integration for Greater Efficiency

- 5.1.2 Increase in Usage of Mobile Devices for Time Management

- 5.2 Market Challenges

- 5.2.1 Security Concerns in Data Collaboration

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud-based

- 6.2 By Application

- 6.2.1 Communication Tools

- 6.2.2 Conferencing Tools

- 6.2.3 Coordination Tools

- 6.3 By End-user Industry

- 6.3.1 Telecommunications and IT

- 6.3.2 Travel and Hospitality

- 6.3.3 BFSI

- 6.3.4 Retail and Consumer Goods

- 6.3.5 Education

- 6.3.6 Transportation and Logistics

- 6.3.7 Healthcare

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.3 Asia Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 South Korea

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Microsoft Corporation

- 7.1.2 Huawei Technologies Co. Ltd.

- 7.1.3 Adobe Systems Inc.

- 7.1.4 SAP SE

- 7.1.5 IBM Corporation

- 7.1.6 Atlassian Corporation PLC

- 7.1.7 Slack Technologies Inc.

- 7.1.8 TIBCO Software Inc.

- 7.1.9 Polycom Inc.

- 7.1.10 Salesforce.Com Inc.

- 7.1.11 Mitel LLC

- 7.1.12 Cisco System Inc.

- 7.1.13 Zoho Corporation Pvt. Ltd.

- 7.1.14 Jive Software

- 7.1.15 Axero Solutions LLC