|

市场调查报告书

商品编码

1433752

计程车:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Taxi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

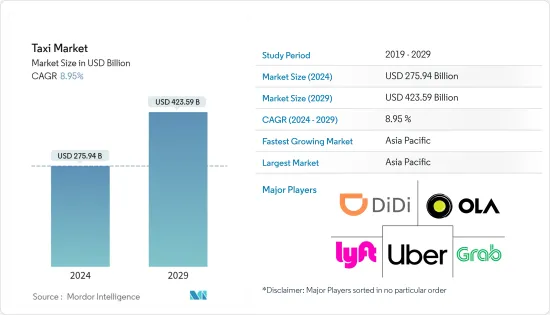

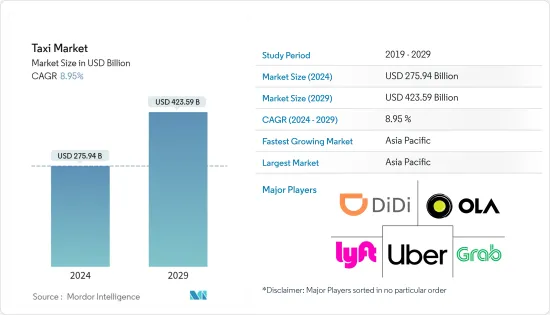

计程车市场规模预计到 2024 年为 2,759.4 亿美元,预计到 2029 年将达到 4,235.9 亿美元,在预测期内(2024-2029 年)复合年增长率为 8.95%。

整个计程车行业都受到了 COVID-19 的不利影响,导致计程车被封锁,需求受到限制。随着客户偏好转向私家车,拥挤场所风险的增加和社交距离措施阻碍了该行业的扩张。然而,随着封锁措施的放鬆和 COVID-19 疫苗的推出,需求逐渐回归市场。 Uber 和 Ola 等市场领导提供的计程车服务的扩展,以及选择方便的上下车地点的能力,正在鼓励消费者的选择,并将在一段时间内推动目标市场的成长。它对

从长远来看,由于叫车和共乘服务需求的增加、线上计程车预订管道的需求增加以及车辆拥有成本的增加,计程车行业预计将增长。与其他交通途径相比,交通拥堵加剧和计程车费用降低也是推动计程车市场的主要因素。

然而,大众交通工具的改善以及世界各地有关计程车服务的不同政府法律正在阻碍该行业的发展。环保电动计程车服务的兴起可能会在整个预测期内为市场扩张提供有吸引力的可能性。

预计亚太地区的目标市场将呈现显着的成长率。这是因为该地区拥有世界60%的人口,对印度和中国成为世界上劳动人口最多的地区做出了巨大贡献。

计程车市场趋势

线上预订推动市场

推动市场成长的主要因素之一是线上计程车预订平台的使用量不断增加。我们还提供便利的线上付款选项和灵活的接送地点。

由于网路和智慧型手机在世界各地的普及不断提高,透过应用程式预订的便利性极大地吸引了相比线下预订更喜欢线上预订的顾客。此外,应用程式上还提供司机位置跟踪、提前打车报价、司机联繫方式、车辆详细信息等信息,进一步增加了客户对在线预订的偏好。

许多主要营运商,例如 Grab、Uber 和 Ola,都在某些地区提供乘车共享选项(在乘客之间分摊车费),让客户能够利用对低成本计程车服务不断增长的需求。营运商正在采取相同的策略,并将乘车共享选项纳入其应用程式开发中,以保持乘车共享服务的成长趋势。

- 例如,越南领先的计程车业者之一 Mai Linh 专注于提供共乘服务,以克服该国的交通拥堵和人口等流动性挑战。该公司计划未来与 Kyyti Group 合作在越南推出共乘服务。

然而,随着线上计程车需求的飙升,政府对计程车聚合商推出了严格的指导方针来监管价格。例如

- 2020 年 11 月,印度政府对计程车聚合商的计程车票价设定了上限。根据新的指导方针,政府将允许 Uber Technologies 和 Ola 等基于应用程式的计程车聚合商申请高达 20% 的乘车费用佣金。

亚太地区计程车市场预计将显着成长

亚太地区在计程车业占据主导地位,约占计程车市场总量的一半。推动亚太地区摩托车/摩托车叫车服务兴起的主要因素是日益严重的交通拥堵以及与其他交通途径相比便宜的计程车费用。该地区人口占全球60%,叫车产业规模庞大且发展迅速。

计程车业在亚太地区正在迅速扩张。滴滴出行、Ola 和昂达等公司正在利用亚太地区智慧型手机的高普及。我们正在利用尖端技术和创新来增加市场占有率。南亚领先的计程车服务供应商在国际上不断发展,同时在区域市场上的竞争力也日益增强。中国计程车公司滴滴出行已在墨西哥、澳洲、哥斯大黎加、日本和其他几个国家开始营运。 Ola 是印度市场的领导者,在澳洲、纽西兰和英国都有业务。

中国是世界上人口最多的国家,拥有世界上最大的计程车市场。计程车因其弹性、舒适性、高可用性和终英里连接而逐渐成为必要的服务。

印度也拥有仅次于中国的庞大计程车市场。由于该国发生的各种社会经济和政治局势,计程车业不断变化(甚至每季)。在印度,计程车共乘/共享正在创造巨大的需求。自行车出租车在印度市场也越来越受欢迎。

2020 年 11 月,印度政府宣布了新的指导方针,将 Ola 和 Uber 等计程车聚合服务纳入法律规范。根据《2020年机动车聚合指南》,新标准要求叫车公司限制突波价格,防止其申请超过基本价格1.5倍的费用。新规定也允许私人公司使用私家车提供共乘服务,但每日限制在一个城市内行驶四次,每週限制两次城市之间行驶。

由于计程车需求旺盛,尤其是在一线层级和大城市,随着摩托车计程车的进入市场,线上计程车市场正在发生变化,摩托车计程车比计程车更便宜,并且在交通繁忙时更容易操纵。因此,摩托车出租车市场预计在未来几年将快速成长。

计程车业概况

计程车市场的主要企业包括 Uber、Grab、Lyft 和 Ola。 Uber 的主要扩张策略是专注于自动驾驶汽车等即将推出的技术。

- 2021年3月,中国叫车公司滴滴出行宣布计画在南非开展业务,并在英国、法国和德国推出叫车服务。

行业主要企业正在技术方面进行巨额投资。优步和滴滴出行正在致力于开发自动驾驶汽车,以改善客户体验。在印度,选择上门服务的客户数量正在迅速增加。因此,Ola、Meru 和 Prydo 以极具竞争力的价格为其客户提供付加服务。 Ola 与 Apple Music 及其他音乐和影片串流服务合作推出 Prime Play 服务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 预订类型

- 网上预约

- 线下预订

- 服务类型

- 计程车

- 共乘

- 车辆类型

- 摩托车

- 车

- 其他车辆类型(厢型车)

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 越南

- 韩国

- 其他亚太地区

- 世界其他地区

- 墨西哥

- 巴西

- 南非

- 阿根廷

- 其他国家

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- ANI Technologies Pvt. Ltd(Ola)

- BlaBlaCar

- Bolt Technologies OU

- Curb Mobility LLC

- (Didi Chuxing)Beijing Xiaoju Technology Co. Ltd

- Flywheel Software Inc.

- Gojek Tech

- Grab Holdings Inc.

- FREE NOW

- Kabbee Exchange Limited

- Lyft Inc.

- Uber Technologies Inc.

第七章 市场机会及未来趋势

The Taxi Market size is estimated at USD 275.94 billion in 2024, and is expected to reach USD 423.59 billion by 2029, growing at a CAGR of 8.95% during the forecast period (2024-2029).

The overall taxi sector was negatively affected by COVID-19, which resulted in lockdowns and limited demand for taxis. The increased risk of crowded places and the social distancing measures have hampered industry expansion as customers' preferences have switched toward personal vehicles. However, demand is progressively returning to the market with the easing of lockdown measures and the availability of COVID-19 vaccinations. The expansion of taxi services provided by market leaders such as Uber and Ola, as well as the ability to select convenient pick-up and drop-off locations, is encouraging consumers to choose them and positively impacts the target market growth in the upcoming period.

Over the long term, taxi industry is expected to grow due to increasing demand for ride-hailing and ride-sharing services, increasing demand from online taxi booking channels, and an increase in the cost of vehicle ownership. Compared to other modes of transportation, increasing traffic congestion and low taxi fare are the other major factors driving the taxi market.

However, industry development is hampered by improvements in public transit and differing government laws on taxi services in different nations worldwide. The rise of eco-friendly electric cab services will likely provide an attractive potential for market expansion throughout the forecast period.

Asia Pacific is expected to witness the considerable growth rate in the target market. This is due to the fact that the region is home to 60% of the world's population, with India and China contributing significantly to the region having the highest working population in the world.

Taxi Market Trends

Online Bookings Driving the Market

One of the primary factors fueling the market's growth is the increased usage of online cab booking platforms, mostly because of the convenience they provide to clients. They also offer simple online payment options and the flexibility of choosing the pick-up and drop-off locations.

The ease of booking through the app has significantly attracted customers to prefer online booking over offline booking, owing to the increasing penetration of the internet and smartphones worldwide. Additionally, the availability of information on the app like tracking the driver position, pre-estimated ride fare, driver contact, and vehicle details has further increased the customer preference for online booking.

Many major operators, such as Grab, Uber, and Ola, provide ride-sharing options (which offer a fare-splitting option among co-passengers) in certain regions, capturing the increasing demand for low taxi fare services among customers. Operators are adopting the same strategy and incorporating the ride-sharing option in their app development to sustain the growing trend of ride-sharing services.

- For instance, in Vietnam, Mai Linh, one of the country's major taxi operators, focuses on providing ride-sharing services to overcome the country's mobility challenges, like traffic congestion and population. The company partnered with Kyyti Group to launch a ride-sharing service in Vietnam in the future.

However, with the surge in demand for online taxis, the governments are implementing strict guidelines for taxi aggregators to regulate their prices. For instance,

- In November 2020, the Indian government capped cab aggregators' cab fares. According to new guidelines, the government will allow app-based taxi aggregators, such as Uber Technologies and Ola, to charge up to 20% commission on ride fares.

Asia-Pacific is expected to grow with a significant pace in the Taxi Market

Asia-Pacific has been dominating the taxi industry, accounting for about half of the overall taxi market. The key elements fueling the rise of the motorcycle/bike ride-hailing services in Asia-Pacific are increasing traffic congestion and inexpensive taxi fares compared to other means of transportation. As the region is home to 60% of the world's population, its ride-hailing industry is substantial and developing rapidly.

In Asia-Pacific, the taxi industry is expanding rapidly. Players like DiDi Chuxing, Ola, and Onda are capitalizing on Asia-Pacific's high smartphone penetration rate. They are gaining market share by utilizing cutting-edge technology and innovation. The major South Asian cab service providers are increasing the competition in regional marketplaces while growing internationally. Didi Chuxing, a Chinese taxi company, launched operations in Mexico, Australia, Costa Rica, Japan, and several other countries. Ola, the Indian market leader, operates in Australia, New Zealand, and the United Kingdom.

China has the world's largest taxi market as it is the most populous country. Taxis gradually became a necessary service due to their flexibility, comfort, high availability, and end-mile connection.

India also has a huge taxi market after China. The taxi industry is changing continuously (even every quarter) due to the different socio-economic and political situations arising in the country. Pooling/sharing of taxis in the country saw huge demand. Bike taxi is also gaining popularity in the Indian market.

In November 2020, the Government of India issued new guidelines for cab aggregators, like Ola and Uber, to bring them under a regulatory framework. As per the Motor Vehicle Aggregator Guidelines 2020, the new norms mandated a cap on surge prices, preventing ride-hailing companies from charging more than 1.5 times the base fare. The new rules also allow companies to offer pooling services on private vehicles, but with a daily limit of four intra-city rides and two inter-city rides per week.

With a high demand for cabs, especially in tier one and metro cities, the online cab market is changing with the entry of bike taxis into the market, which is much more affordable than cabs and provides easy maneuvering in traffic congestion. Thus, the bike taxi market is expected to grow rapidly in the coming years.

Taxi Industry Overview

Some of the major players in the taxi market include Uber, Grab, Lyft, and Ola. Uber's main strategy to expand its business is to focus on upcoming technologies like automated driving vehicles.

- In March 2021, Chinese ride-hailing company DiDi Chuxing started operations in South Africa and announced its plans to launch its ride-hailing services in the United Kingdom, France, and Germany.

The key players in the industry are investing hugely in technology. Uber and DiDi Chuxing are working on self-driving cars to enhance the customer experience. In India, there has been a surge in the number of customers opting for outstation services. Thus, Ola, Meru, and Prydo are offering value-added services to their customers at very competitive prices. Ola partnered with Apple Music and other music and video streaming services for its prime play service.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Booking Type

- 5.1.1 Online Booking

- 5.1.2 Offline Booking

- 5.2 Service Type

- 5.2.1 Ride-hailing

- 5.2.2 Ride-sharing

- 5.3 Vehicle Type

- 5.3.1 Motorcycle

- 5.3.2 Cars

- 5.3.3 Other Vehicle Types (Vans)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Vietnam

- 5.4.3.6 South Korea

- 5.4.3.7 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 South Africa

- 5.4.4.4 Argentina

- 5.4.4.5 Other Countries

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 ANI Technologies Pvt. Ltd (Ola)

- 6.2.2 BlaBlaCar

- 6.2.3 Bolt Technologies OU

- 6.2.4 Curb Mobility LLC

- 6.2.5 (Didi Chuxing) Beijing Xiaoju Technology Co. Ltd

- 6.2.6 Flywheel Software Inc.

- 6.2.7 Gojek Tech

- 6.2.8 Grab Holdings Inc.

- 6.2.9 FREE NOW

- 6.2.10 Kabbee Exchange Limited

- 6.2.11 Lyft Inc.

- 6.2.12 Uber Technologies Inc.