|

市场调查报告书

商品编码

1433757

类比积体电路(IC):市场占有率分析、产业趋势/统计、成长预测(2024-2029)Analog Integrated Circuit (IC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

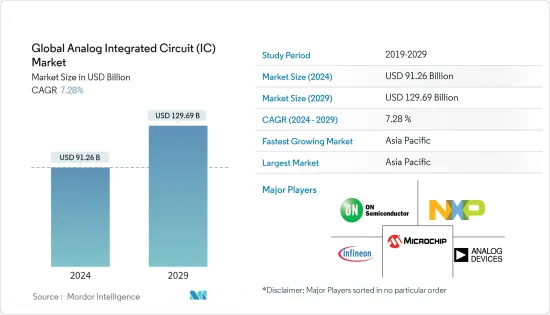

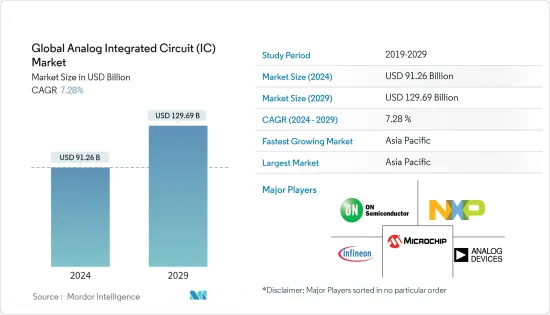

全球类比积体电路(IC)市场规模将在2024年达到912.6亿美元,并在2024-2029年预测期内以7.28%的复合年增长率增长,到2029年将达到1296.9亿美元。预计这一目标将会实现。

主要亮点

- 类比积体电路 (IC) 是在单一半导体材料晶圆上製造的互连组件网路。这些组件在连续的输入讯号范围内运行,而数位组件则仅使用两个输入和输出电压位准。这些电路在设备运作期间处理、接收和产生多个能量输出等级。使用振盪器、直流放大器、多谐振盪器和音讯放大器等组件的电子设备利用类比电路来保持相同的输出和输入电平。

- 由于类比 IC 在相当多的即时连接设备和应用中具有明显的优势,因此物联网 (IoT) 等新兴技术的引入和采用预计将推动市场成长。由于高速连接的可用性不断提高、云端的采用率不断提高以及资料处理和分析的使用不断增加,物联网 (IoT) 的采用率正在稳步增长。例如,爱立信预计,2022 年全球蜂巢式物联网连接数将达到 19 亿,预计到 2027 年将增至 55 亿,期间复合年增长率为 19%。

- 此外,由于智慧型手机、消费性电器产品、电脑和储存设备的普及,近年来类比IC的采用激增。智慧型手机中使用的各种IC包括充电IC、显示PMIC、SoC PMIC、相机PMIC等。苹果、高通、英特尔和三星S.LSI等主要企业主导了这个市场。因此,由于配备先进技术的智慧型手机的产量和销售增加,以及 5G 和 6G 的整合度不断提高,类比IC市场预计将在全球范围内获得巨大的吸引力。

- 然而,由于通膨上升、消费者支出下降以及消费者前景疲软,预计 2023 年全球智慧型手机需求将较 2022 年下降。这种下降预计将暂时阻碍类比IC市场。儘管如此,由于对 5G 智慧型手机的需求不断增长以及全球 5G 网路连接的扩大,特别是由于 5G 和折迭式智慧型手机的普及不断提高,预计市场将在 2024 财年略有復苏。例如,根据 GSMA 的数据,到 2025 年,5G 网路将覆盖全球三分之一的人口。

- 在很大程度上取决于业内熟练的类比晶片设计工程师的可用性。然而,半导体产业需要这样的技能。英特尔人力资源、人才规划和收购总监 Cindi Harper 表示,业界人才供不应求。同样,西门子 EDA 区域经理 Ruchir Dixit 表示,他预计未来五年美国将短缺 25 万名半导体工程师。中国大陆和台湾预计分别短缺30万名和5万名工程师。这种趋势阻碍了市场的成长。

- 此外,俄罗斯和乌克兰之间的衝突预计将对电子产业等多个产业产生重大影响。这场衝突已经影响该行业一段时间,加剧了半导体供应链问题和晶片短缺。此次中断导致镍、钯、铜、硅、锗、砷化镓磷化物、钛、铝和铁矿石等关键原料价格波动和材料短缺。此外,根据SEMI的数据,俄罗斯是全球45-50%钯金的供应国。它用于形成半导体接合线、引线框架、电极、电镀、涂层等。因此,随着各国关闭与俄罗斯的贸易,半导体製造商越来越注重供应替代原料,进一步推迟了市场所需半导体的生产。

类比积体电路(IC)市场趋势

行动电话在通讯领域占有很大份额

- 该部分包括为行动电话和多功能(语音/网路/电子邮件)手持设备设计和使用的专用类比 IC,其中语音通讯仍然是主要功能。这些手机专为2G、3G和Wimax等广域蜂巢式网路而设计,并采用CDMA、GSM及其升级版本等全面的传输格式。

- 智慧型手机普及的上升,尤其是在开发中国家,是由这些地区的人口成长和都市化加快推动的。例如,爱立信预测,到2022年,全球行动用户数将达到约84亿,呈现持续上升趋势。

- 随着5G技术的出现,5G智慧型手机的普及正在加速。根据2022年11月爱立信移动报告,预计年终5G行动用户数将达50亿。特别是,5G网路预计将覆盖85%的人口并处理约70%的行动流量。

- 许多产业参与者推出专为 5G 智慧型手机客製化的晶片组,为市场成长做出了重大贡献。例如,Google在 2022 年宣布推出 Pixel 6a、Pixel 7 和 Pixel 7 Pro,以支援印度的 5G 网路。 Pixel 6a支援19个5G频段,而Pixel 7和7 Pro则支援22个5G频段。

- 美国消费者科技协会 (CTA) 和美国人口普查局的一份报告预测,美国智慧型手机销售额将从 2021 年的 730 亿美元增至 2022 年的 747 亿美元。此外,GSMA 预测北美智慧型手机用户数量将会增加。到2025年,这一数字将增加至3.28亿人,行动电话用户(86%)和网路用户(80%)的普及也将增加。

- 爱立信行动报告显示,到 2024 年,中东和非洲 (MEA) 地区可能将有 6,000 万 5G 服务用户,约占所有行动用户的 3%。 GSMA 估计,中东和北非地区约有 5,000 万个 5G 连接,到 2025 年,光是阿拉伯国家就有可能达到 2,000 万个连接。这些统计数据证实了行动应用的快速发展推动了所研究的市场。

中国预计将成为亚太地区成长最快的市场

- 由于领先的半导体製造商的存在、快速的工业化和庞大的消费性电器产品市场,中国预计将成为模拟IC市场的主导者。该地区以其半导体的大规模生产以及类比 IC 在消费性电器产品、汽车和通讯等多个行业的采用而闻名。这些因素预计将推动所研究的国内市场的成长,从而为市场相关人员创造利润丰厚的机会。

- 此外,该国的 IT 和资料中心产业蓬勃发展,这可归因于每年产生的资料量不断增加。中国作为世界科技领域主导力量的惊人崛起主要得益于其蓬勃发展的资料中心生态系统。中国的互联网资料中心市场是全球技术最先进的市场之一,有许多组织透过数位平台运作。

- 此外,资料中心投资的增加和互联网普及的提高将要求许多此类设备整合与物理世界互动的感测器,从而需要模拟处理来进行类比数位转换。这些功能与数位技术相结合,形成了经济高效、低功耗且高度可靠的解决方案。因此,预计这些因素将在预测期内推动全球类比IC市场的成长。

- 此外,5G网路能力的增强预计将为模拟IC模组创造巨大需求。由于5G基地台的广泛部署,中国已成为5G领域的重要参与者。工信部公布的资料显示,截至年终,我国5G基地台已达231万个。中国对基础设施的巨额投资和雄心勃勃的部署策略使得实现5G广泛覆盖成为可能。专家预测,到2024年,中国5G基地台将超过600万个。

- 此外,根据中国资讯通讯研究院(CAICT)的数据,2022年7月中国5G智慧型手机出货量达1,470万部,占智慧型手机总出货的73%以上。此外,5G智慧型手机占当月中国行动电话总出货的74%。年初至今,2022年5G智慧型手机累计出货已达1.24亿支。此外,中国在同年推出了121款新的5G行动电话型号。随着5G智慧型手机的日益普及,对类比IC的需求预计将增加。

- 据ITA称,中国在年销量和产量方面继续领先全球汽车市场。预计2025年国内产量将达3,500万台。此外,今年中国汽车工业加大了对全球市场的拓展力度,出口量大幅成长,达到176万辆,与前一年同期比较成长81%。根据中国工业协会(CAAM)揭露的资料,2023年前5个月。汽车製造中的这一重要特征预计将在所研究的工业市场中对现代汽车的广泛应用产生巨大的需求。

类比积体电路(IC)产业概览

类比积体电路 (IC) 市场预测显示半整合形势。製造商透过产品创新和技术差异化展开激烈竞争。许多公司正在策略性投资模拟 IC 开发,以确保先发优势并保持竞争优势。该领域的知名厂商包括 Analog Devices Inc.、Infineon Technologies AG、Microchip Technology Inc.、NXP Semiconductors NV 和 ON Semiconductor。

2023 年 2 月,Analog Devices Inc. 和 Marvell Technology Inc. 宣布推出一款具有整合开放式 RAN 支援的最先进的 5G 大规模 MIMO (mMIMO) 参考设计平台。这个开创性平台将 ADI 的尖端 RadioVerse 收发器 SoC 与 Marvell 的 OCTEON 10 Fusion 5G基频相结合,为 5G 提供业界领先的 5 nm 数位波束成形解决方案。透过利用这项先进技术,该平台显着缩短了先进 mMIMO 无线电单元和 O-RAN 支援的上市时间,从而实现能耗降低高达 40%、尺寸更小、重量更轻。

2023 年 1 月,Microchip Technology 宣布推出其抗辐射产品组合的最新产品:MIC69303RT 3A 低压差 (LDO) 稳压器。这款商用现货 (COTS) 功率元件代表了 Microchip 在扩展其辐射硬化技术范围方面的重大进步。此次推出 COTS 抗辐射电源管理解决方案旨在为 Microchip 类比电源和介面业务部门的空间开拓新的设计机会。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 供应链分析

- 宏观经济因素和 COVID-19 的影响

第五章市场动态

- 市场驱动因素

- 智慧型手机、功能手机和平板电脑的普及不断提高

- 市场挑战

- 类比积体电路 (IC) 设计的复杂度不断增加

第六章市场区隔

- 按类型

- 通用IC

- 介面

- 能源管理

- 讯号转换

- 放大器/比较器(讯号调节)

- 应用 - 特定IC

- 消费者

- 音讯视讯

- 数位相机/摄影机

- 其他消费者

- 车

- 资讯娱乐

- 其他资讯娱乐

- 通讯设备

- 行动电话

- 基础设施

- 有线通讯

- 近场通讯

- 其他无线通讯

- 电脑

- 电脑系统显示

- 电脑周边设备

- 贮存

- 其他电脑

- 工业/其他

- 通用IC

- 按地区

- 美洲

- 欧洲

- 日本

- 中国

- 其他地区

第七章供应商市场占有率分析

第八章 竞争形势

- 公司简介

- Analog Devices Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors NV

- ON Semiconductor

- Richtek Technology Corporation(MediaTek Inc.)

- Skyworks Solutions Inc.

- STMicroelectronics NV

- Renesas Electronics Corporation

- Texas Instruments Inc.

- Qorvo Inc.

第九章 类比积体电路(IC)市场价格分析

第十章投资分析

第十一章市场的未来

The Global Analog Integrated Circuit Market size is estimated at USD 91.26 billion in 2024, and is expected to reach USD 129.69 billion by 2029, growing at a CAGR of 7.28% during the forecast period (2024-2029).

Key Highlights

- An analog integrated circuit (IC) is a network of interconnected components manufactured on a single wafer of semiconducting material. These components operate across a continuous range of input signals, contrasting with their digital counterparts, which utilize only two input and output voltage levels. These circuits process, receive, and generate multiple energy output levels during device operation. Electronic devices employing components such as oscillators, DC amplifiers, multi-vibrators, and audio amplifiers utilize analog circuits, which maintain equal output and input levels.

- The introduction and adoption of emerging technologies such as the Internet of Things (IoT) are expected to propel the market growth owing to the evident benefits of analog ICs across a considerable range of real-time connected devices and applications. Owing to the increasing availability of high-speed connectivity, rising cloud adoption, and increasing use of data processing and analytics, the adoption of the Internet of Things (IoT) is growing steadily. For instance, as per Ericsson, there were 1.9 billion cellular IoT connections in the world in 2022, which is expected to grow to 5.5 billion in 2027, registering a CAGR of 19% over the period.

- Furthermore, the adoption of analog ICs has surged in recent years due to the proliferation of smartphones, consumer electronics, computers, and storage devices, as well as the increased sales of electric vehicles. Various ICs used in smartphones include charge ICs, display PMICs, SoC PMICs, and Camera PMICs. Key players such as Apple, Qualcomm, Intel, and Samsung S.LSI dominate this market. Consequently, with the growing production and sales of smartphones featuring advanced technologies and the increasing integration of 5G and 6G, the analog IC market is anticipated to gain substantial traction globally.

- However, global smartphone demand is projected to decline in 2023 compared to 2022 due to ongoing inflation, reduced consumer spending, and a weaker consumer outlook. This decline is expected to temporarily hamper the Analog IC market. Nevertheless, the market is predicted to recover slightly in FY 2024 owing to heightened demand for 5G smartphones and the expanding 5G network connectivity worldwide, particularly driven by the increased proliferation of 5G and foldable smartphones. For instance, as per GSMA, by 2025, 5G networks will likely cover one-third of the world's population.

- There is a significant dependency on the availability of skilled analog chip design engineers in the industry. However, there is a need for such skills within the semiconductor industry. According to Cindi Harper, Human Resources, Talent Planning, and Acquisition at Intel, the demand for talent in the industry surpasses the supply. Similarly, Ruchir Dixit, country manager at Siemens EDA, has stated that the US expects a shortage of 250,000 semiconductor engineers over the next five years. China and Taiwan anticipate shortages of 300,000 and 50,000 engineers, respectively. Such trends hinder the market's growth.

- Moreover, the conflict between Russia and Ukraine is expected to significantly impact several industries like the electronics industry. The conflict has already exacerbated the semiconductor supply chain issues and the chip shortage that have impacted the industry for some time. The disruption caused volatile pricing for critical raw materials like nickel, palladium, copper, silicon, Germanium, Indium Gallium Arsenide Phosphide, titanium, aluminum, and iron ore, resulting in material shortages. Further, according to SEMI, Russia is a global supplier of 45-50% of palladium. The material is used to form bonding wires, lead frames, electrodes, plating, and coating for semiconductor packaging. Therefore, with every country shutting doors for trading with Russia, the semiconductor manufacturers' focus is increasing on alternative raw material supplies, further delaying the production of semiconductors required in the market.

Analog Integrated Circuit (IC) Market Trends

Cell Phone within Communication Segment to Hold Major Share

- This segment encompasses application-specific analog ICs designed for and used in cellular phones and multifunction (voice/web/email) handheld devices, where voice communication remains a primary function. These phones are intended for wide-area cellular networks such as 2G, 3G, and Wimax, employing comprehensive transmission formats like CDMA, GSM, and their upgraded versions.

- The escalating rates of smartphone adoption, particularly in developing nations, are fueled by increasing population growth and urbanization in these regions. For instance, Ericsson forecasts predict that global mobile subscriptions are expected to reach approximately 8.4 billion by 2022, indicating a continuous upward trend.

- The advent of 5G technology is fostering a surge in 5G smartphone penetration. As per the November 2022 Ericsson Mobility Report, it's anticipated that 5G mobile subscriptions will reach 5 billion by the end of 2028. Notably, 5G networks are expected to cover 85% of the population and handle around 70% of mobile traffic.

- The introduction of chipsets tailored for 5G smartphones by numerous industry players is contributing significantly to the market's growth. For example, Google unveiled the Pixel 6a, Pixel 7, and Pixel 7 Pro in 2022 to support India's 5G network. The Pixel 6a supports 19 5G bands, while Pixel 7 and 7 Pro support 22.

- Reports from the Consumer Technology Association (CTA) and the US Census Bureau project an increase in smartphone sales value in the United States from USD 73 billion in 2021 to USD 74.7 billion in 2022. Additionally, GSMA estimates a rise in smartphone subscribers in North America to 328 million by 2025, along with increased penetration rates for mobile subscribers (86%) and Internet users (80%).

- The Ericsson Mobility Report suggests that the Middle East & Africa (MEA) region may have 60 million 5G service subscribers by 2024, accounting for approximately 3% of all mobile subscriptions. GSMA estimates around 50 million 5G connections across MENA, with potentially 20 million connections in the Arab States alone by 2025. These statistics underscore the swift pace of mobile adoption driving the studied market

China is Expected to be the Fastest Growing Market in the Asia Pacific Region

- China is anticipated to emerge as a dominant player in the analog IC market, owing to the presence of major semiconductor manufacturers, rapid industrialization, and a vast consumer electronics market. The region is renowned for its high-volume production of semiconductors and the adoption of analog IC across diverse industries, such as consumer electronics, automotive, and telecommunications. These factors are expected to fuel the growth of the studied market in the country, thereby presenting lucrative opportunities for market players.

- In addition, the country is experiencing a thriving IT and data center industry, which is attributed to the increasing volume of data generated annually. China's remarkable ascent as a dominant force in the global technology sector is primarily bolstered by its flourishing data center ecosystem. The Chinese market for Internet data centers stands out as one of the most technologically advanced markets worldwide, with numerous organizations operating through digital platforms.

- Furthermore, it is expected that the rising investments in data centers and the increasing internet penetration is expected to create the demand for many of these devices to incorporate sensors that interact with the physical world, requiring analog processing for analog to digital conversion. By combining these functions with digital technology, a cost-effective, low-power, and reliable solution is achieved. As a result, these factors are expected to drive the growth of the global analog IC market during the forecast period.

- Moreover, the increasing 5G networking capabilities are expected to create a massive demand for analog IC modules. China has emerged as a prominent player in the 5G arena with a substantial deployment of 5G base stations. As per the data released by MIIT, China had 2.31 million 5G base stations by the end of 2022. The country's massive investment in infrastructure and ambitious rollout strategies have enabled it to achieve extensive 5G coverage. Experts predict that the 5G base stations in China will surpass six million by 2024.

- Furthermore, according to China Academy of Information and Communications Technology (CAICT), In July 2022, the shipment volume of 5G smartphones in China amounted to 14.7 million units, representing over 73 % of the total smartphone shipments. Additionally, 5G smartphones accounted for 74 % of all mobile phone shipments in China during that month. The year-to-date total for 5G smartphone shipments in 2022 reached 124 million units. Furthermore, China released 121 new 5G mobile phone models in the same year. The rising 5G smartphone penetration will likely drive the demand for analog IC.

- China remains the leading global vehicle market in annual sales and manufacturing output, per ITA. The domestic production is projected to touch 35 million vehicles by 2025. Additionally, the automotive industry in China has intensified its global outreach in the current year, with exports witnessing a remarkable surge of 81% year-on-year to 1.76 million vehicles in the first five months of 2023, as per the data disclosed by the China Association of Automobile Manufacturers (CAAM). Such significant capabilities in manufacturing automobiles are expected to create a significant demand for the studied market in the industry for their wide range of applications in modern cars.

Analog Integrated Circuit (IC) Industry Overview

The forecast for the Analog Integrated Circuit (IC) Market indicates a semi-consolidated landscape. Manufacturers are engaged in fierce competition, leveraging product innovation and technological differentiation. Many companies are strategically investing in the development of analog ICs to secure a first-mover advantage and maintain competitiveness. Notable players in this arena include Analog Devices Inc., Infineon Technologies AG, Microchip Technology Inc., NXP Semiconductors NV, and ON Semiconductor.

In February 2023, Analog Devices Inc. and Marvell Technology Inc. introduced their cutting-edge 5G massive MIMO (mMIMO) reference design platform, integrating Open RAN support. This pioneering platform combines ADI's state-of-the-art RadioVerse Transceiver SoC with Marvell's OCTEON 10 Fusion 5G baseband processor, delivering an industry-leading 5 nm digital beamforming solution for 5G. By harnessing this advanced technology, the platform significantly accelerates the time-to-market for advanced mMIMO radio units and O-RAN support, achieving up to 40% lower energy consumption, reduced size, and lighter weight.

In January 2023, Microchip Technology unveiled its latest addition to the radiation-tolerant portfolio, the MIC69303RT 3A Low-Dropout (LDO) Voltage Regulator. This commercial-off-the-shelf (COTS) power device represents a significant stride for Microchip as it expands its range in radiation-tolerant technology. The introduction of this COTS rad-tolerant power management solution aims to unlock new design opportunities in space applications within Microchip's analog power and interface business unit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Supply Chain Analysis

- 4.4 Impact of Macroeconomic Factors and COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of Smartphones, Feature Phones, and Tablets

- 5.2 Market Challenges

- 5.2.1 Increasing Design Complexity of Analog IC

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 General-Purpose IC

- 6.1.1.1 Interface

- 6.1.1.2 Power Management

- 6.1.1.3 Signal Conversion

- 6.1.1.4 Amplifiers/Comparators (Signal Conditioning)

- 6.1.2 Application-Specific IC

- 6.1.2.1 Consumer

- 6.1.2.1.1 Audio/Video

- 6.1.2.1.2 Digital Still Camera and Camcorder

- 6.1.2.1.3 Other Consumers

- 6.1.2.2 Automotive

- 6.1.2.2.1 Infotainment

- 6.1.2.2.2 Other Infotainment

- 6.1.2.3 Communication

- 6.1.2.3.1 Cell Phone

- 6.1.2.3.2 Infrastructure

- 6.1.2.3.3 Wired Communication

- 6.1.2.3.4 Short Range

- 6.1.2.3.5 Other Wireless

- 6.1.2.4 Computer

- 6.1.2.4.1 Computer System and Display

- 6.1.2.4.2 Computer Periphery

- 6.1.2.4.3 Storage

- 6.1.2.4.4 Other Computers

- 6.1.2.5 Industrial and Others

- 6.1.1 General-Purpose IC

- 6.2 By Geography

- 6.2.1 Americas

- 6.2.2 Europe

- 6.2.3 Japan

- 6.2.4 China

- 6.2.5 Rest of the World

7 VENDOR MARKET SHARE ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles*

- 8.1.1 Analog Devices Inc.

- 8.1.2 Infineon Technologies AG

- 8.1.3 Microchip Technology Inc.

- 8.1.4 NXP Semiconductors NV

- 8.1.5 ON Semiconductor

- 8.1.6 Richtek Technology Corporation (MediaTek Inc.)

- 8.1.7 Skyworks Solutions Inc.

- 8.1.8 STMicroelectronics NV

- 8.1.9 Renesas Electronics Corporation

- 8.1.10 Texas Instruments Inc.

- 8.1.11 Qorvo Inc.