|

市场调查报告书

商品编码

1641969

物联网感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)IoT Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

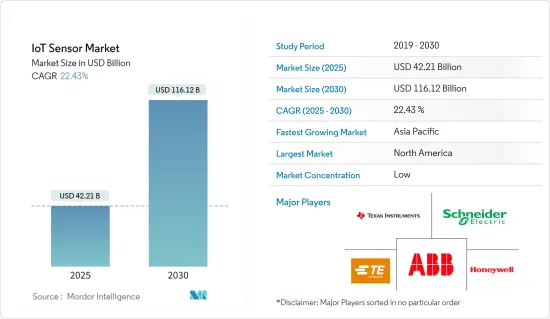

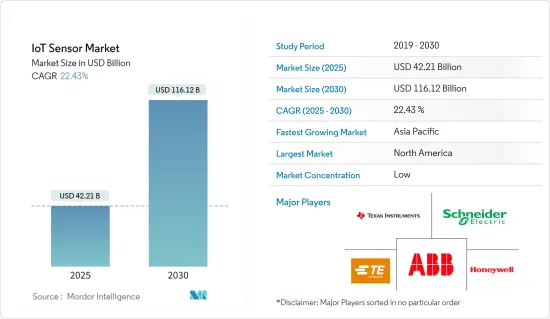

物联网感测器市场规模预计在 2025 年为 422.1 亿美元,预计到 2030 年将达到 1,161.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 22.43%。

新兴应用和经营模式,加上设备成本的下降,正在推动物联网的采用。因此,我们看到许多连网型设备的出现,包括联网汽车、机器、仪表、穿戴式装置和家用电器。根据爱立信的研究,到2021年,在总计280亿台连网设备中,近160亿台将是物联网设备。预计这一强劲成长将受到对开发互联生态系统和 3GPP蜂巢式物联网技术标准化的更多关注的推动。

主要亮点

- 欧洲、中国和其他地区的工业 4.0 计画是物联网部署的主要驱动力,因此也是物联网感测器的主要驱动力。据Accenture称,60% 的製造公司已开始进行物联网计划,其中超过 30% 处于早期采用阶段。此外,物联网感测器成本的下降是预测期内推动此技术采用的主要因素之一。

- 此外,智慧城市计画也有助于推动对物联网感测器的需求。新加坡已经推出了基于感测器的老年人监测系统,如果家中的年迈父母或家属开始出现健康状况恶化或行为异常的迹象,办公室工作的家庭成员就会收到警报。

- 此外,现场设备、感测器和机器人技术的进步预计将扩大市场范围。物联网技术正在解决製造业的劳动力短缺问题。对于越来越多的组织来说,机器人等工业 4.0 技术的使用已成为日常业务的一部分。

- 例如,在较小的晶片/晶圆和先进的製造设备上开发的新一代物联网感测器提供了更大的灵活性、连接性和效率。未来的联网工厂基础设施将需要低功耗的愿景,帮助升级基础设施以适应IIoT环境的创建,并鼓励业界采用满足需求的解决方案。

- 同时,最近的 COVID-19 疫情扰乱了全球供应链和多种产品的需求。预计到 2020年终物联网感测器部署将受到影响。此外,中国和其他国家的生产停顿导致2月和3月多个产业的各种产品短缺。然而,随着「社交距离」在较长时间内成为常态,我们预计各行各业对自动化解决方案的依赖将会增加。例如,智慧零售有可能成为一个巨大的趋势。

物联网感测器市场趋势

汽车和运输业推动市场成长

- 汽车巨头、网路安全供应商、晶片製造商和系统整合之间最近建立的业务伙伴关係和合资企业正在稳步推动全球汽车产业进入自动驾驶时代。

- 这使得高度(4 级)和完全(5 级)自动驾驶汽车的出现不可避免,可能在 2020 年实现。预计车辆之间为「决策」而进行的正确通讯需要车辆连通性,以便正确吸收和理解视觉、地理、音讯和其他资料。

- 随着智慧城市的兴起,车对车连接和先进的车辆管理将变得更加普遍,从而扩大物联网感测器的应用范围。这刺激了智慧感测器技术的快速创新和采用,从而增加了对物联网感测器的需求。

- 梅赛德斯-奔驰、大众、沃尔沃、丰田和谷歌等公司正增加对功能丰富的智慧汽车的投资,以提供更安全、更便捷、更舒适的驾驶体验。据纳斯达克称,无人驾驶汽车很可能在 2030 年占领市场主导地位。此外,DHL SmarTrucking 计划在 2028 年建立一支由 10,000 辆物联网卡车组成的车队。预计这将在预测期内推动物联网感测器的采用。

- 物联网也为汽车、运输和物流产业带来了巨大的革命。预防性维护、互联行动性和即时资料存取是推动研究领域采用物联网的关键因素。近年来,全球物联网运输和物流支出呈指数级增长。

- 物联网使运输机构能够绘製最有效的路线并最大限度地利用燃料,使物流公司能够追踪和追踪货物,使停车新兴企业能够即时监控可用的停车位。物联网设备正在部署于汽车的远端资讯处理系统、运输业者使用的预订和预约系统、安全性和监控系统、远端车辆监控系统和其他交通拥堵控制系统中。

北美占据主要市场占有率

- 北美是最大的市场之一,因为该地区拥有多家知名供应商,且各行业最早采用物联网技术。该地区的许多企业正在采用物联网来了解其产品的性能,并避免代价高昂的故障和低效率的定期维护停工。

- 该地区物联网的使用也是市场的主要驱动力。例如,史丹佛大学和 Avast 的一项研究发现,北美家庭的物联网设备密度比世界上任何其他地区都高。值得注意的是,该地区 66% 的家庭至少安装了一个物联网设备。此外,25%的北美家庭拥有两台或两台以上的设备。

- 此外,支援物联网的医疗穿戴式温度感测器等设备也已投入部署,这些设备可将资料远端传输到中央监控系统。根据趋势和阈值,医务人员可以识别和警告患者和房间并采取相应的措施。

- 此外,加拿大终端用户也正在投资这个市场。例如,加拿大能源部门正在采购网路连接感测器来监控各种活动,包括发电厂、电网和智慧家庭电錶。然而,根据2020年北美中小企业先进製造业调查显示,与美国相比,加拿大企业在采用先进技术方面落后。

- 此外,由于对 ADAS 系统的需求不断增加,该地区对物联网感测器的需求预计也会增加。德意志银行预计,到2021年美国ADAS产量将达1,845万台。

物联网感测器产业概况

物联网感测器市场分散,多家感测器製造商努力保持竞争力。这加剧了市场竞争。市场参与者正在采取伙伴关係、产品开发、合併和收购等策略活动来获得市场占有率。

- 2020 年 7 月:德克萨斯推出业界首款零漂移霍尔效应电流感测器 TMCS1100 和 TMCS110。据该公司介绍,新型感测器随时间和温度的变化具有最低的漂移和最高的精度。它还为工业马达驱动器、太阳能逆变器、能源储存设备和电源等交流电或直流高压系统提供可靠的 3 kVrms 隔离。

- 2020年6月,TE Connectivity推出了LVDT位置感测器。这些感测器根据 ICT 非公路设备和工业工具机的液压应用要求提供标准和自订解决方案。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 对物联网感测器市场的影响评估

- 市场驱动因素

- 由于成本和尺寸的降低,物联网感测器的使用不断增加

- 工业 4.0 和连网型设备日益广泛的应用

- 市场限制

- 对资料安全的担忧日益加剧

第五章 市场区隔

- 按类型

- 压力

- 温度

- 化学

- 运动/接近

- 其他类型

- 按最终用户

- 卫生保健

- 汽车与运输

- 製造/工业

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 法国

- 德国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- ABB Ltd

- Schneider Electric SE

- TE Connectivity

- Robert Bosch GmbH

- OMRON Corporation

- Sensata Technologies

- Honeywell International Inc.

- TDK Corporation

- STMicroelectronics NV

- Texas Instruments Inc.

第七章投资分析

第 8 章:市场的未来

The IoT Sensor Market size is estimated at USD 42.21 billion in 2025, and is expected to reach USD 116.12 billion by 2030, at a CAGR of 22.43% during the forecast period (2025-2030).

The new emerging applications and business models, coupled with the falling device costs, have been significantly driving the adoption of IoT. Consequently, many connected devices - connected cars, machines, meters, wearables, and consumer electronics. According to the Ericsson study, of the 28 billion total devices connected by 2021, close to 16 billion will be IoT devices. This robust growth is expected to be driven by the increased focus on deploying a connected ecosystem and the standardization of 3GPP cellular IoT technologies.

Key Highlights

- Industry 4.0 initiatives across regions like Europe, China, etc., are the major drivers of the IoT deployments, and therefore, the IoT sensors. According to Accenture, 60% of the manufacturing companies are already engaged in IoT projects, and more than 30% are at an early deployment stage. Moreover, the decreasing cost of IoT sensors is one of the prominent factors that would fuel the technology's adoption over the forecast period.

- Besides, smart city initiatives are also instrumental in driving the demand for IoT sensors. Singapore has already implemented a sensor-based Elderly Monitoring System that helps office working family members to receive alerts when the health condition of their home living elderly parents or dependents deteriorates or exhibits abnormal behaviors.

- Further, the advancements in field devices, sensors, and robots are expected to expand the market's scope. IoT technologies are overcoming the labor shortage in the manufacturing sector. For more and more organizations, using Industry 4.0 technologies, like robotization, is part of day-to-day operations.

- For instance, the new-gen IoT sensors, developed on smaller chips/wafers and evolved fabrication units, offer better flexibility, connectivity, and efficiency. It is deemed necessary for upcoming connected factory infrastructure to be visioned, with less power consumption, and are expected to prompt industry to adopt solutions that help them upgrade their infrastructure suited for creating an IIoT environment and complement the demand.

- On the other hand, owing to the recent outbreak of COVID-19, the global supply chain and demand for multiple products have been disrupted. The IoT sensor adoption is expected to be influenced by the end of 2020. Moreover, due to the production shutdown in countries like China, multiple industries have observed a shortage of various products during February and March. However, with the prolonged period of "social distancing," becoming a norm is expected to drive the reliance on automated solutions in various industries. Smart retail, for instance, could see a tremendous boost.

IoT Sensor Market Trends

Automotive and Transportation Industry to Drive the Market Growth

- The automotive sector across the globe is steadily transitioning toward an autonomous era, owing to the recent business collaborations and joint ventures among automotive giants, cybersecurity providers, chip makers, and system integrators.

- This indicates the inevitable advent of highly (Level 4) and fully (Level 5) autonomous vehicles, at the earliest, by 2020. Vehicle connectivity is expected to become necessary for proper communication among vehicles for 'decision-making' proper assimilation and comprehension of visual, geographical, audio, and other data.

- As smart cities emerge, Car2Car connectivity and advanced fleet management are expected to emerge, thus, providing scope for IoT sensors. This has fuelled rapid innovation and the adoption of intelligent sensor technology, driving the demand for IoT sensors.

- Companies such as Mercedes-Benz, Volkswagen, Volvo, Toyota, and Google Inc. are increasingly investing in developing smart cars with rich features that deliver safer, convenient, and comfortable driving experiences. According to a NASDAQ, driverless cars are likely to dominate the market by 2030. Moreover, DHL SmarTrucking aims to build a fleet of 10,000 IoT- enabled trucks by 2028. This is expected to boost the adoption of IoT sensors over the forecast period.

- IoT is also bringing a massive revolution in the automotive, transportation, and logistics industries. Access to preventative maintenance, connected mobility, and real-time data access are significant factors driving IoT adoption in the studied segment. The global IoT transportation and logistics spending almost increased by an exponential rate in the recent times.

- The IoT has enabled many transportation organizations to map the most efficient routes, maximize fuel usage, logistics companies track-and-trace their shipments, and parking start-ups to monitor their available spots in real-time. IoT devices are deployed in traffic congestion control systems in telematics systems within motor vehicles, reservation and booking systems used by transport operators, security and surveillance systems, and remote vehicle monitoring systems.

North America to Account for a Significant Market Share

- North America is one of the largest markets due to several established vendors in the region and the earliest adoption of IoT technology in various industries. Most of the companies in this region are increasingly adopting IoT to keep track of their offering's performance, thus, avoiding costly breakdowns or inefficient routine maintenance shutdowns.

- The usage of IoT in the region is also significantly driving the studied market. For instance, according to a study by Stanford University and Avast, North American homes have the highest density of IoT devices in any region in the world. Notably, 66% of homes in the region have at least one IoT device. Additionally, 25% of North American homes boast more than two devices.

- Further, devices like IoT-enabled medical wearable temperature sensors that transmit data remotely to a central monitoring system are already implemented. Medical staff is alerted based on trends and thresholds, identifying the patient and room, and can respond accordingly.

- Additionally, end-users in Canada have also been investing in the market. For instance, the Canadian energy sector has been procuring internet-connected sensors toward monitoring a range of activities across generating plants, distribution networks, and smart home meters. However, compared to the United States, Canadian companies have been slower to adopt advanced technologies, as per the 2020 Advanced Manufacturing survey of SMEs in North America.

- Further, the demand for IoT sensors in the region is anticipated to grow with the increasing demand for ADAS systems. According to Deutsche Bank, the US ADAS unit production volume will reach 18.45 million by 2021.

IoT Sensor Industry Overview

The IoT sensor market is fragmented, with several sensor manufacturers striving to maintain a competitive edge. This factor is, thereby, intensifying the competition in the market. Players in the market adopt strategic activities such as partnerships, product development, mergers, and acquisitions to capture the market share.

- July 2020: Texas Instruments Incorporated launched the industry's first zero-drift Hall-effect current sensors, TMCS1100 and TMCS110. The new sensors can enable the lowest drift and highest accuracy over time temperature, according to the company. In contrast, they provide reliable 3-kVrms isolation, especially for AC or DC high-voltage systems such as industrial motor drives, solar inverters, energy storage equipment, and power supplies.

- June 2020: TE Connectivity launched the LVDT position sensor. These sensors provide standard and custom solutions based on the hydraulic application requirements of ICT off-highway equipment and industrial machine tools.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Assessment of COVID-19 Impact on IoT Sensor Market

- 4.5 Market Drivers

- 4.5.1 Rising use of IoT sensors due to reduced cost and size

- 4.5.2 Increasing applications of Industry 4.0 and connected devices

- 4.6 Market Restraints

- 4.6.1 Rising concerns related to data security

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Pressure

- 5.1.2 Temperature

- 5.1.3 Chemical

- 5.1.4 Motion/Proximity

- 5.1.5 Other Types

- 5.2 By End User

- 5.2.1 Healthcare

- 5.2.2 Automotive and Transportation

- 5.2.3 Manufacturing / Industrial

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 France

- 5.3.2.3 Germany

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 South Korea

- 5.3.3.4 India

- 5.3.3.5 Rest of the Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 Latin America

- 5.3.4.2 Middle-East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd

- 6.1.2 Schneider Electric SE

- 6.1.3 TE Connectivity

- 6.1.4 Robert Bosch GmbH

- 6.1.5 OMRON Corporation

- 6.1.6 Sensata Technologies

- 6.1.7 Honeywell International Inc.

- 6.1.8 TDK Corporation

- 6.1.9 STMicroelectronics NV

- 6.1.10 Texas Instruments Inc.