|

市场调查报告书

商品编码

1433767

LED 驱动器:市场占有率分析、产业趋势/统计、成长预测 (2024-2029)LED Driver - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

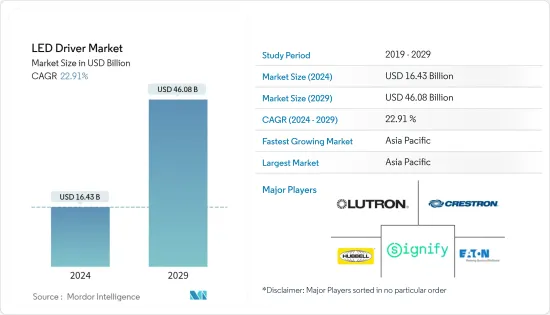

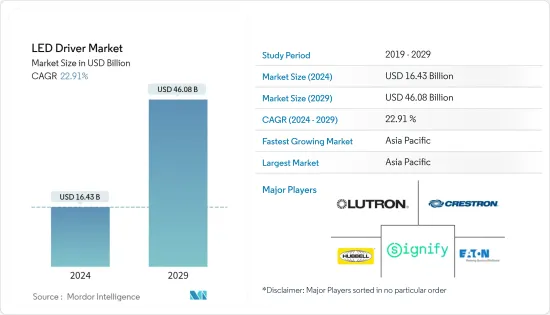

2024年全球LED驱动器市场规模将达到164.3亿美元,预计2029年将达到460.8亿美元,2024-2029年预测期内复合年增长率为22.91%。

LED 作为传统照明替代品的使用日益广泛,全球 LED 驱动器市场也不断扩大。 LED 与传统照明产品相比具有价值优势。这些优点包括 LED 寿命更长、比传统产品更节能、尺寸更小以及热量排放更少。同样,智慧家庭的兴起增加了对基于物联网 (IoT) 的连网型照明解决方案的需求,推动了全球 LED 驱动器市场的成长。

由于世界各国采取各种措施加强节能,全球LED驱动器市场正不断扩大。然而,一些限制因素正在阻碍全球 LED 驱动器市场的成长。由于人们错误地认为实施 LED 驱动器成本高昂,因此该行业也出现了负面趋势。此外,製造商之间在标准上缺乏共识也可能阻碍全球LED驱动器市场的成长。

照明技术的快速进步提高了电源效率和有效性,增加了产品需求并推动了全球 LED 驱动器市场的扩张。由于目前对照明解析度的要求不断提高,LED 照明在园艺、汽车、室内和工业等各种应用中的使用越来越多,这也推动了 LED 驱动器业务的扩张。由于计算器等小工具越来越多地使用 LED 驱动器,LED 驱动器业务预计将继续成长。

此外,近年来,由于工业发展和人口成长,世界对能源的需求迅速增加,资源减少和电力需求增加正在引发全球能源危机。为了克服这场危机,各国纷纷制定有关能源消耗的法规,并提倡普及节能家电。

儘管全球越来越多地采用更节能的照明解决方案,预计到 2022 年全球 90% 的室内照明将被 LED 和紧凑型萤光取代,但 LED 照明的使用和接受程度仍受到个人意识的影响、决策、生活方式和相关环境问题。儘管由于严格的法规,LED 解决方案的采用不断增加,但消费者对 LED 优势的认识明显较低,但已显着提高。另一方面,消费者应根据新的照明解决方案的好处避免花钱购买新的照明解决方案。

此外,由于世界各国政府旨在减少能源消耗和成本的各种创新城市倡议,预计世界各地对外部驱动力的需求将大幅增加。预计这将增加街道照明和户外照明解决方案对外部 LED 驱动器的需求。

LED驱动器市场趋势

无线控制能力显着成长

无线部分包括 BLE、EnOcean、Li-Fi 和 Zigbee。随着无线控制的加入,LED 驱动器变得更加智能,允许透过远端、行动应用程式甚至语音进行操作。支援的通讯协定包括 Zigbee、6LowPAN、ZWave 和 Wi-Fi。

2022年3月,长江国际会议中心的照明设计采用了DALI调光LF-ADxxx系列LED驱动器,符合能源效率需求。同时,DALI照明控制系统对照明能量的精确控制,结合建筑的高性能帷幕墙和环保景观,帮助长江国际会议中心荣获中国绿色建筑评估认证系统最高等级标誌。

Zigbee 是无线技术的开放标准,它使用数位无线电讯号进行照明和其他建筑自动化。 Zigbee 是蓝牙的替代方案,使用无线个域网路 (WPAN) 的 IEEE 802.15.4 无线标准,工作频率为 2.4GHz、900MHz 和 868MHz。然而,这些频率可能非常拥挤,讯号可能会受到干扰或丢失。

ZigBee 是网路照明中最常见的无线通讯通讯协定。这项技术已经发展了很长一段时间,也比较成熟。除了其卓越的网路架构之外,ZigBee 还提供卓越的电源效率。 Zigbee LED驱动器是一款专业设计的符合Zigbee 3.0通讯协定的LED照明灯具电源。连接Zigbee LED驱动器后,可透过闸道或遥控器控制LED照明灯具的开/关、亮度调光、色温调整、RGB颜色变化。

据通讯部(DoT)称,2022年6月,对促进通讯设备设计主导製造的PLI(生产连结奖励计画)计划进行了修订,以发展印度的5G生态系统。随着功率波动,LED 驱动器的效率越来越高,并且正在采购新的和改进的组件。

亚太地区预计成长最快

中国也是全球领先的LED解决方案出口国。该国有许多满足当地需求的当地供应商。除此之外,在中国营运的供应商也向北美和亚太地区其他国家出口LED解决方案。 LED 解决方案在该国的普及和订单不断增加预计将对该地区的市场成长产生重大影响。

此外,各国政府鼓励在道路和高速公路应用中采用照明技术,以节省能源和维护成本。这些政府和组织倡议预计将显着增加该国 LED 照明的采用,为 LED 驱动器创造成长机会。

根据Unnat Jyoti by Affordable Light Emitting Diode (LED)统计,截至2022年3月,分布3679亿个LED灯泡每年节省电力477.84亿度,减少峰值需求9566兆瓦,每年减少二氧化碳排放3870万亿吨。

在印度,快速的都市化正在推动 LED 照明在普通照明应用中的采用,对节能照明系统的需求不断增加,物联网与照明的整合以及标准照明控制通讯协定的接受正在推动市场增长。我是。儘管基于物联网的智慧照明系统日益普及和普及,但国内对支援物联网的 LED 驱动器的需求仍在增长。

东南亚是发光二极体(LED) 日益重要的市场。大部分成长将来自全国各地的市政、商业和住宅消费者,特别是印尼。越南LED照明成长最高,2013年至2015与前一年同期比较增超过60%,而印尼交通照明市场庞大。

LED驱动器产业概况

全球LED驱动器市场竞争激烈。由于存在各种规模的参与者,市场高度集中。市场主要参与者包括Signify Holding、Lutron Electronics Co.Inc.、Hubbell Incorporated、Eaton Corporation Plc、Acuity Brands Lighting Inc.、Crestron Electronics Inc.、ERP Power LLC、MEAN WELL Enterprises、Cree Inc.、AC Electronics (ACE) )、欧司朗有限公司等公司正在透过建立多个合作伙伴关係和投资新产品发布来扩大市场占有率,以在预测期内获得竞争优势。

2022 年 3 月,Signify Holdings 和 Perfect Plants 将扩大大麻生长灯的合作。 LED 驱动器是 LED 照明系统的大脑,因此 Signify 提供灵活的 GreenPower LED 系统。两个新的气候单元配备可调光飞利浦 GreenPower LED 顶光紧凑型生长灯和飞利浦 GrowWise 控制系统,提供可在所有生长阶段有效且高效使用的照明系统。

2022年2月,Hubbell Incorporated的商业和工业(C&I)照明部门被Daintree公司GE Current完全收购,打造出世界一流的端到端照明解决方案公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对 LED 驱动器市场的影响

第五章市场动态

- 市场驱动因素

- 对节能照明系统的需求增加和政府法规的增加

- LED产品价格更低

- 市场挑战

- 缺乏先进系统意识,加大资金投入

- 初始投资高

第六章市场区隔

- 副产品

- 恆定电流/AC LED

- 恆压

- 按控制功能

- 有线

- 0-10V

- DALI (Digital Addressable Lighting Interface)

- DMX (Digital Multiplex)

- 后缘

- 其他有线功能

- 无线(Wi-Fi、BLE、EnOcean、Li-Fi、Zigbee 等)

- 有线

- 频道数

- 单身的

- 双重的

- 3个或更多

- 按最终用户产业

- 住宅

- 办公室

- 零售/酒店业

- 户外的

- 医疗保健/教育机构

- 产业

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 其他地区

- 北美洲

第七章 竞争形势

- 公司简介

- Signify Holding

- Lutron Electronics Co. Inc

- Hubbell Incorporated

- Eaton Corporation Plc

- Acuity Brands Lighting Inc.

- Crestron Electronics Inc.

- ERP Power LLC

- MEAN WELL Enterprises Co. Ltd

- Cree Inc

- AC Electronics(ACE)

- Osram GmbH

- Autec Power Systems

- Enedo Plc

- Hatch Lighting

- Allanson International

第八章投资分析

第9章 市场的未来

The LED Driver Market size is estimated at USD 16.43 billion in 2024, and is expected to reach USD 46.08 billion by 2029, growing at a CAGR of 22.91% during the forecast period (2024-2029).

The use of LEDs as a replacement for conventional light is becoming more widespread, causing the worldwide LED driver market to increase. LEDs outperform traditional lighting products in terms of value. These advantages include an extended LED lifespan, more energy savings than conventional goods, miniaturization, and reduced heat emission. Similarly, since there are more smart homes, there is a greater need for Internet of Things (IoT) based connected lighting solutions, driving the growth of the worldwide LED driver market.

The global LED driver market is expanding due to various measures being taken by nations worldwide to increase energy conservation. Nevertheless, a few limitations are preventing the growth of the worldwide LED driver market. There is a misconception that installing LED drivers is expensive, so that the industry may experience some negative trends. Additionally, manufacturers' lack of agreed-upon standards might impede the growth of the worldwide LED driver market.

The quick technological advancements in lighting have enabled power efficiency and effectiveness, boosting the need for the product and fostering the expansion of the worldwide LED driver market. Due to the escalating demands for current lighting resolutions, the growing use of LED lighting in various applications, including horticulture, automotive, indoor, and industrial, has also boosted the expansion of the LED driver business. The business of LED drivers is anticipated to continue to grow due to the increasing utilization of LED drivers in gadgets like calculators.

Additionally, in recent years, the increasing industrial development and population growth led to a surge in global demand for energy-the decreasing amount of resources and increasing demand for power led to the energy crisis in the world. Various countries have passed regulations on energy consumption to overcome this crisis, which state the use of energy-saving consumer electronics.

Even though there is a robust global movement toward the use of more energy-efficient lighting solutions, with predictions mentioning that LED and compact florescent lamps replacing 90% of global indoor lighting by 2022, the usage and acceptance of LED light depends on the individual, their awareness, decision-making and lifestyle, and related environmental issues. The adoption of LED solutions is increasing due to stringent regulations, but consumer awareness about LEDs' benefits is significantly lower but rising significantly. Meanwhile, consumers should avoid spending on new lighting solutions based on benefits.

Further, the demand for external drivers is also expected to increase significantly across the globe owing to various innovative city initiatives under which governments worldwide are looking to reduce energy consumption and gain cost benefits. According to this, the demand for external LED drivers for street lights and outdoor lighting solutions is expected to increase.

LED Driver Market Trends

Wireless Control Feature to show Significant Growth

The wireless segment includes BLE, EnOcean, Li-Fi, and Zigbee. LED drivers are becoming smart with wireless controls added, operated by remote, mobile applications, and even through the voice. Protocols supported are Zigbee, 6LowPAN, ZWave, and Wi-Fi.

In March 2022, the Yangtze River International Conference Center lighting design relied on DALI dimmable LF-AADxxx series LED drivers to meet energy efficiency demands. Meanwhile, due to the precise control of the lighting energy of the DALI lighting control system and its combination with the building's high-performance curtain walls and environmental protection landscapes, the Yangtze River International Conference Center has been awarded the highest grade mark of China Green Building Evaluation and Certification System.

Zigbee is an open standard for wireless technology that uses digital radio signals for lighting and other building automation. An alternative to Bluetooth, Zigbee uses the IEEE 802.15.4 wireless standard for wireless personal area networks (WPANs) and operates on 2.4 GHz, 900 MHz, and 868 MHz frequencies. However, these frequencies can be very congested, which can interfere with signals or cause them to drop.

ZigBee is the most common protocol for wireless communication in networked lighting. This technology is relatively mature after a long time of development. Besides advantages in network architecture, ZigBee is also more power-saving. Zigbee LED driver is a professionally designed power supply for LED luminaires, compliant with the Zigbee 3.0 protocol. LED luminaires can be controlled by a gateway or remote controller to turn on/off, brightness dimming, color temperature tunable, and RGB color changing after connecting with the Zigbee LED driver.

According to the Department of Telecommunications (DoT), in June 2022, the PLI (Production Linked Incentive) scheme was amended to facilitate Design-Led Manufacturing of telecom equipment to develop the 5G ecosystem in India. LED drivers increasingly become efficient at power fluctuations and getting new and improved components.

Asia Pacific Region is Expected to Witness the Fastest Growth Rate

China is also among the significant exporter of LED solutions worldwide; the country is home to numerous local vendors that cater to local demand. Apart from this, vendors operating in the country export LED solutions to North America and other countries in the Asia-Pacific region. The increasing penetration and order in the country for LED solutions are expected to significantly impact the region's market growth.

Additionally, the government encourages the adoption of lighting technology for roadway and highway applications to save energy and maintenance costs. Such government and organizational initiatives are expected to significantly increase the country's adoption of LED lighting, thereby creating growth opportunities for the LED driver in the country.

According to Unnat Jyoti by Affordable Light Emitting Diode (LED), as of March 2022, the Distribution of 36.79 Crore LED bulbs resulted in energy savings of 47,784 million units of electricity per annum, peak demand reduction of 9,566 MW and 38.70 million tonnes of CO2 emission reduction annually.

In India, due to rapid urbanization, the growing adoption of LED lighting in general lighting applications, increasing demand for energy-efficient lighting systems, integration of IoT and lighting, and acceptance of standard lighting control protocols are driving the market growth. IoT-compatible LED drivers are growing in demand in the country against rising popularity and increasing penetration of IoT-based intelligent lighting systems.

Southeast Asia is an increasingly important market for light-emitting diodes (LED). Most of the growth comes from nationwide municipal, commercial, and home consumers, particularly in Indonesia. While Vietnam has seen the highest growth in LED lighting, with a year-on-year increase of more than 60 percent between 2013 to 2015, the transportation lighting market in Indonesia is enormous.

LED Driver Industry Overview

The Global LED Driver Market is very competitive. The market is highly concentrated due to various small and large players. Some of the significant players in the market are Signify Holding, Lutron Electronics Co. Inc, Hubbell Incorporated, Eaton Corporation Plc, Acuity Brands Lighting Inc., Crestron Electronics Inc., ERP Power LLC, MEAN WELL Enterprises Co. Ltd, Cree Inc, AC Electronics (ACE), Osram GmbH, and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

In March 2022, Signify Holdings and Perfect Plants will expand their collaboration on cannabis on grow lights. As an LED driver is the brain of an LED lighting system, Signify supplies flexible GreenPower LED systems. Two new climate cells are equipped with dimmable Philips GreenPower LED toplighting compact grow lights and the Philips GrowWise Control System, providing a light system that can be used effectively and efficiently in every growth phase.

In February 2022, the commercial and industrial (C&I) lighting division of Hubbell Incorporated was fully acquired by GE Current, a Daintree company, resulting in the development of a world-class end-to-end lighting solutions firm.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the LED Driver Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing demand for Energy-efficient Lighting Systems and Government Regulations

- 5.1.2 Declining Prices of LED Products

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness and Higher Capital Investment for Advanced Systems

- 5.2.2 High Initial Investment

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Constant Current and AC LED

- 6.1.2 Constant Voltage

- 6.2 By Control Feature

- 6.2.1 Wired

- 6.2.1.1 0-10V

- 6.2.1.2 DALI (Digital Addressable Lighting Interface)

- 6.2.1.3 DMX (Digital Multiplex)

- 6.2.1.4 Trailing Edge

- 6.2.1.5 Other Wired Features

- 6.2.2 Wireless (Wi-Fi, BLE, EnOcean, Li-Fi, Zigbee, etc.)

- 6.2.1 Wired

- 6.3 By Channel Count

- 6.3.1 Single

- 6.3.2 Dual

- 6.3.3 Three and Above

- 6.4 By End-User Industry

- 6.4.1 Residential

- 6.4.2 Office

- 6.4.3 Retail and Hospitality

- 6.4.4 Outdoor

- 6.4.5 Healthcare and Educational Institutions

- 6.4.6 Industrial

- 6.4.7 Other End Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.2.4 Rest of Europe

- 6.5.3 Asia Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 South Korea

- 6.5.3.5 Rest of Asia Pacific

- 6.5.4 Rest of the World

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Signify Holding

- 7.1.2 Lutron Electronics Co. Inc

- 7.1.3 Hubbell Incorporated

- 7.1.4 Eaton Corporation Plc

- 7.1.5 Acuity Brands Lighting Inc.

- 7.1.6 Crestron Electronics Inc.

- 7.1.7 ERP Power LLC

- 7.1.8 MEAN WELL Enterprises Co. Ltd

- 7.1.9 Cree Inc

- 7.1.10 AC Electronics (ACE)

- 7.1.11 Osram GmbH

- 7.1.12 Autec Power Systems

- 7.1.13 Enedo Plc

- 7.1.14 Hatch Lighting

- 7.1.15 Allanson International