|

市场调查报告书

商品编码

1433771

照明控制系统:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Lighting Control System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

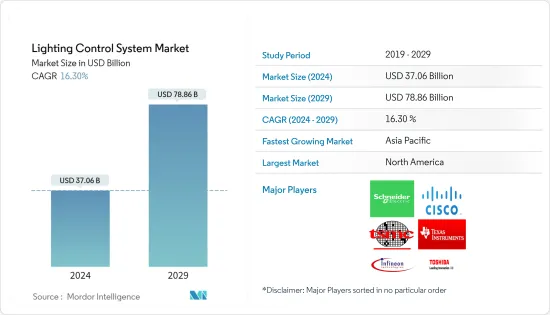

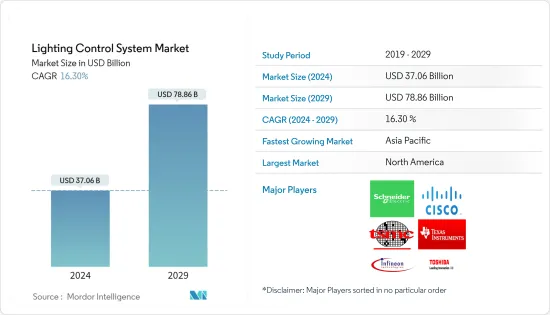

照明控制系统市场规模预计到2024年为370.6亿美元,预计到2029年将达到788.6亿美元,在预测期内(2024-2029年)增长16.30%,预计复合年增长率为

随着智慧型手机和平板电脑等智慧型装置的使用增加,市场正朝着采用物联网 (IoT) 的方向发展。随着照明控制市场在物联网连接设备中的应用,其采用正在影响市场的正面成长。

主要亮点

- 连接性的增强和技术解决方案的进步正在增加全球智慧照明控制系统的采用。 ZigBee 和蓝牙等无线技术使得在各种空间无缝安装智慧照明控制系统成为可能。

- 此外,智慧城市的概念也在各个地区不断兴起,这项运动得到了许多政府措施的支持。由于智慧城市由互联繫统组成,因此智慧城市中的常见照明应用需要自动化照明系统。这些自动照明系统使用基于感测器的控制系统。

- 例如,2018年4月,澳洲政府能源部长理事会宣布将以LED灯取代卤素灯,以提高能源效率。

- 然而,另一方面,无线连接可能不可靠,持续的维护是阻碍整体市场成长的因素。初始安装成本也很高,这是大规模实施照明控制系统时的一个主要问题。

照明控制系统市场趋势

智慧城市发展措施将推动智慧照明市场

- 根据联合国人类居住规划署的数据,城市消耗了全球78%的能源,飞利浦也预测,由于都市化,到2050年,66%的人口将居住在城市。这些都使得智慧城市依赖物联网,一切都相互依存的智慧城市。从路灯到交通灯等等。智慧照明可以成为智慧城市网路的支柱。

- 如今,大多数城市安装新的智慧照明或维修现有设施都选择已经配备感测器技术或可以轻鬆升级以利用物联网应用的系统。Masu。

- 例如,2018 年 2 月,伦敦致力于实施创新照明策略,利用智慧照明来减少能源和光污染,管理一天中不同时间的光照水平和颜色。

亚太地区复合年增长率最快

- 亚太地区的成长得益于该地区(主要是中国)快速的基础设施建设活动,其中照明控制系统正在为基础设施现代化铺平道路。不断增长的能源需求,尤其是来自中国和印度等新兴国家的能源需求,长期来看预计将消耗更多的能源。照明部分通常消耗商业建筑中的大部分电力以及私人住宅中的大量能源。

- 另外,中国、印度和台湾等新兴国家也越来越意识到连网型照明系统的效率,透过优化能源消耗来大幅节省成本。

- 印度正积极从使用传统照明转向LED和节能智慧灯。随着这项变化,印度被国内外製造商视为一个具有巨大潜力的市场。

- 根据ELCOMA报告,照明产业将透过引入更多节能产品以及与政府更紧密地合作开展各种规划和宣传电力消耗量,预计将减少18%到2020 年,这一比例将达到 13%。

照明控制系统产业概况

照明控制系统市场高度分散,各大公司林立。市场的主要企业包括德州仪器 (TI)、施耐德电机 (Schneider Electric SE)、飞利浦 (Philips NV) 和英飞凌 (Infineon Technologies)。产品推出、高额研发投入、合作与收购等是这些公司维持智慧照明控制市场激烈竞争的主要成长策略。

- 2018 年 6 月 - 霍尼韦尔推出一套下一代能源管理软体、智慧照明、语音控制和安全通讯系统。这些技术使酒店业能够完全整合能源管理、安全和安保系统、资产管理和品牌网路运营,以实现世界一流的客房和楼宇自动化。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进因素与市场约束因素介绍

- 市场驱动因素

- 对节能照明系统的需求不断增长

- 现代化和基础设施发展取得进展

- 市场限制因素

- 安装成本高

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按类型

- LED驱动器

- 开关和调光器

- 继电器单元

- 闸道

- 按通讯协定

- 有线

- 无线的

- 按用途

- 室内的

- 户外的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 公司简介

- General Electric Company

- Philips Lighting NV

- Eaton Corporation PL

- Honeywell International Inc.

- Acuity Brands Inc.

- Cree Inc.

- Lutron Electronics Co. Inc.

- Leviton Manufacturing Company Inc.

- Digital Lumens Inc.

- WAGO Corporation

- Infineon Technologies

- Schneider Electric

- Cisco Systems Inc.

- Taiwan Semiconductor

- Toshiba

第七章 投资展望

第八章 市场机会及未来趋势

The Lighting Control System Market size is estimated at USD 37.06 billion in 2024, and is expected to reach USD 78.86 billion by 2029, growing at a CAGR of 16.30% during the forecast period (2024-2029).

The market is moving toward the adoption of the Internet of Things (IoT), with the increasing usage of smart devices, such as smartphones, tablets, etc. As the lighting control market is finding its applications in IoT-connected devices, the increase in adoption is influencing a positive growth of the market.

Key Highlights

- The improved connectivity and advancements in technologies solutions have increased the adoption of smart lighting controlling system, globally. Wireless technologies, such as ZigBee and bluetooth, have made installations of smart lighting controlling system seamless across various spaces.

- Moreover, the concept of smart cities is also increasing in different regions and this movement is supported by many government initiatives. As a smart city consists of a connected system, the general lighting application in the smart city requires automated lighting systems. These automated lighting systems use sensor-based control systems.

- For instance, in April 2018, the Council of Australian Governments Energy Ministers have announced to replace halogen lamps with LED lamps to improve energy efficiency.

- However, on the flip side, wireless connections can be unreliable at times and ongoing maintenance are the factors hampering the overall growth of the market. The initial set up cost is also high, which is a major challenge in the large-scale adoption of lighting control systems.

Lighting Control System Market Trends

Smart City Development Initiatives to Drive the market for Smart Lighting

- According to the United Nations Human Settlements Program, cities consume 78% of the world's energy and Philips also predicted that by 2050, 66% of the population may live in cities, due to urbanization. These have resulted in smart cities, where smart cities rely on IoT, where everything is dependent on each other. From streets lights to traffic signals and beyond. Smart lighting can be a backbone for a smart city network.

- Nowadays, most cities that install new smart lighting or retrofit existing fixtures choose systems that already are equipped with sensor technology or that can be upgraded easily to utilize the advantages of IoT applications.

- For instance, in February 2018, London worked on an innovative lighting strategy that would use smart lighting to cut energy and light pollution, and manage light levels and color at different times of the day.

Asia-Pacific to Witness the Fastest CAGR

- The growth in Asia-Pacific is attributed to the rapid infrastructure building activities being undertaken in the region, mainly in China where lighting control systems pave the way for the modernization of infrastructure. It is anticipated to consume more energy resources in the longer run, especially with the growing energy demand from the developing countries, such as China and India. The lighting segment usually consumes the majority of the electricity in a commercial building and draws substantial energy levels for a private residence.

- Apart from this the increasing awareness regarding the efficiency of the connected lighting system in the emerging countries, like China, India, and Taiwan, is enabling significant cost savings through optimal energy consumption.

- India is making an affirmative shift from using conventional lighting to LED and energy efficient smart lights. Due to this change, India is perceived as a market with great potential for international and domestic manufacturers alike.

- According to a report by ELCOMA, the lighting industry is expected to reduce energy consumption for lighting from the present 18% of total power consumption to 13% by 2020, by introducing more energy efficient products and working more closely with the government to execute various schemes and awareness programs.

Lighting Control System Industry Overview

The lighting control system market is highly fragmented because of the presence of major players. Some of the key players in the market areTexas Instruments Incorporated,Schneider Electric SE,Philips NV,and Infineon Technologies, among others. Product launches, high expense on research and development, partnerships and acquisitions, etc. are the prime growth strategies adopted by these companies to sustain the intense competition in the intelligent lighting controls market.

- June 2018 -Honeywelllaunched a suite of next-generation energy management software, smart lighting, voice controls, and secure cloud communication systems. With these technologies, the hospitality industry can fully integrate energy management, safety and security systems, property management, and brand network operations for world-class guestroom and building automation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Growing Demand For Energy-efficient Lighting Systems

- 4.3.2 Growing Modernization And Infrastructural Development

- 4.4 Market Restraints

- 4.4.1 High Cost of Installation

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Hardware

- 5.1.1.1 LED Drivers

- 5.1.1.2 Sensors

- 5.1.1.3 Switches and Dimmers

- 5.1.1.4 Relay Units

- 5.1.1.5 Gateways

- 5.1.2 Software

- 5.1.1 Hardware

- 5.2 By Communication Protocol

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.3 By Application

- 5.3.1 Indoor

- 5.3.2 Outdoor

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 Latin America

- 5.4.4.2 Middle-East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 General Electric Company

- 6.1.2 Philips Lighting NV

- 6.1.3 Eaton Corporation PL

- 6.1.4 Honeywell International Inc.

- 6.1.5 Acuity Brands Inc.

- 6.1.6 Cree Inc.

- 6.1.7 Lutron Electronics Co. Inc.

- 6.1.8 Leviton Manufacturing Company Inc.

- 6.1.9 Digital Lumens Inc.

- 6.1.10 WAGO Corporation

- 6.1.11 Infineon Technologies

- 6.1.12 Schneider Electric

- 6.1.13 Cisco Systems Inc.

- 6.1.14 Taiwan Semiconductor

- 6.1.15 Toshiba