|

市场调查报告书

商品编码

1433775

汽车垫片与密封:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Automotive Gaskets and Seals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

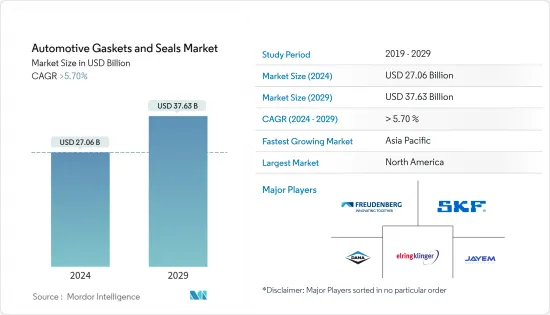

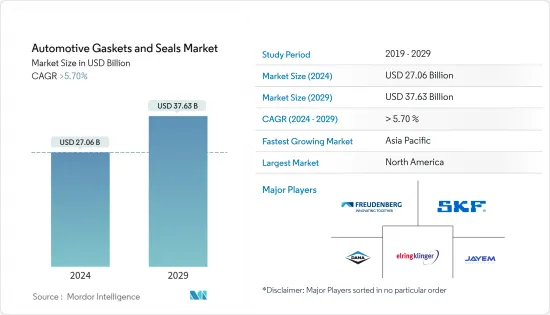

2024年,全球汽车垫片和密封件市场规模将达到270.6亿美元,2024-2029年预测期间复合年增长率超过5.70%,预计到2029年将达到376.3亿美元。

研究市场的成长取决于多种因素,包括新兴市场的电动车普及、已开发国家电动车基础设施的成长趋势以及原材料价格的波动。此外,美国、欧洲和中国汽车零件关税的影响也可能增加对垫圈和密封件的需求。

垫圈和密封件製造商正在进行研发活动,开发特殊类型的垫圈和密封件,以应对内燃机汽车和电池式电动车需求的预期成长。

日本电动持有数量的增加预计将进一步提振市场。印度汽车经销商联合会(FADA)最新数据显示,2022年10月印度电动车零售较去年同月成长约185%。印度政府已经提供了各种生产激励措施以及对电动车基础设施的大量投资。

参与该市场的製造商包括 Freudenberg、Dana Incorporated、Federal-Mogul、SKF GmbH 和 ElringKlinger AG。随着中国在电动车销售中占据主导地位,昆山三和引擎零件工业有限公司等当地製造商供应大多数汽车所需的缸头和排气歧管垫片。

汽车垫片和密封件市场趋势

汽车产量的增加推动市场成长

多年来,全球汽车工业的汽车产量大幅成长。这种成长归因于多种因素,包括人口成长、新兴市场收入水准提高、基础设施改善和技术进步。根据欧洲汽车工业协会(法国)预测,2022年全球汽车产量将达8,540万辆,较2021年成长5.7%。

开发中国家,特别是亚洲国家的汽车产量正在迅速成长。中国和印度等国家经济快速成长,导致可支配收入增加和汽车需求增加。因此,许多全球汽车製造商在这些市场设立了生产设施,以满足不断增长的需求。

汽车产业见证了显着的技术进步,包括电动车 (EV) 和自动驾驶汽车 (AV)。环境问题和政府措施增加了电动车的普及,导致电动和混合动力汽车产量的增加。此外,自动驾驶汽车的发展也促使製造商投资研发,从而催生了自动驾驶汽车的生产。

汽车製造商不断开拓新市场并在全球扩大业务。我们在不同地区建立了生产设施,以满足当地需求并降低生产成本。这种扩大策略使公司能够开拓新的基本客群并挖掘新兴市场的潜力。

因此,随着汽车数量的增加,汽车垫圈和密封件市场的参与者赚取收益的机会也增加,促进了整体市场的扩张。

亚太地区和欧洲主导市场

- 过去十年,亚太汽车产业经历了史上最大的变化。该市场在全球汽车销售中所占的份额越来越大。推动汽车垫圈和密封件市场成长的另一个主要因素是该地区电动车产量和销量的增加。

- 亚太地区拥有中国、印度和泰国等主要汽车市场。中国是全球最大的汽车市场,2020年将超越欧洲成为继欧洲之后的第二大汽车市场。由于垫片密封件同时用于电动车和传统内燃机火车头(ICE),因此中国存在巨大的市场机会。印度拥有庞大的小客车和商用车市场,是垫片和密封件市场另一个具有成长潜力的关键地区。

- 到 2026 年,印度汽车产业收入预计将达到 3,000 亿美元,复合年增长率从目前的 740 亿美元增长 15%,为汽车垫圈和密封件市场的参与者创造机会。

- 此外,预计欧洲也将在全球汽车垫圈和密封件市场中占据很大份额。该地区商用车的需求不断增长,汽车产业的火车头和电动车领域都在快速发展。儘管汽车销售整体呈下降趋势,但二手车和其他二手车的销售量却在增加,尤其是在亚太地区,这是垫圈和密封件售后市场销售的主要成长要素。

汽车垫片和密封件产业概述

汽车垫圈和密封件市场是一个分散的市场。市场主要企业包括科德宝集团、斯凯孚集团、德纳公司、Elringklinger AG、Jayem Auto Industries、昆山三、引擎零件工业、住友理工等。世界各地的各种製造商正在开发和发布越来越受欢迎的新产品。例如

- 2023 年 8 月,科德宝 SE 宣布科德宝密封技术公司已开发出 3D热感障。

- 2022年8月,特瑞堡AB宣布特瑞堡密封系统推出HMF Flat Seal,这是一系列新的平垫片材料,用于低温和高温应用中的静态密封。该系列包括用于各种行业(包括汽车行业)的刺激性化学品和介质的专用材料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场驱动因素

- 全球汽车销售增加导致需求增加

- 市场限制因素

- 原物料价格波动

- 工业吸引力 - 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 垫片

- 贴纸

- 垫片应用类型

- 缸头

- 排气歧管

- 其他垫片应用类型

- 密封应用类型

- 引擎

- 传播

- 方向盘

- 电池

- 车辆类型

- 小客车

- 商用车

- 销售管道

- OEM

- 售后市场

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他地区

- 南美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 供应商市场占有率

- 公司简介

- SKF Group

- Dana Incorporated

- Elringklinger AG

- Jayem Auto Industries Pvt Ltd

- Kunshan Sanwa Engine Parts Industry Co. Ltd

- Sumitomo Riko

第七章 市场机会及未来趋势

The Automotive Gaskets and Seals Market size is estimated at USD 27.06 billion in 2024, and is expected to reach USD 37.63 billion by 2029, growing at a CAGR of greater than 5.70% during the forecast period (2024-2029).

The growth of the market studied depends on various factors, such as the adoption rate of electric vehicles in developing nations, increasing electric vehicle infrastructure trends in developed nations, variations in raw material prices, etc. Additionally, the impact of tariff rates among the United States, Europe, and China for automotive components may also contribute to the demand for gaskets and seals.

Manufacturers of gaskets and seals have been conducting R&D activities to develop special types of gaskets and seals for the expected rise in demand for IC engine vehicles and battery electric vehicles.

The growing electric vehicle fleet in the country will propel the market further. According to the newest figures from the Federation of Automobile Dealers Association of India (FADA), retail electric car sales in India increased by around 185% in October 2022, over the same month last year. The Indian government has already offered various production incentives along with heavy investments in electric vehicle infrastructure.

Some of the manufacturers in the market include Freudenberg, Dana Incorporated, Federal-Mogul, SKF GmbH, ElringKlinger AG, etc. As China dominates electric vehicle sales, local manufacturers, such as Kunshan Sanwa Engine Parts Industry Co. Ltd, have been supplying the necessary cylinder heads and exhaust manifold gaskets to the majority of the vehicles.

Automotive Gaskets & Seals Market Trends

Increasing Vehicle Production to Propel the Market Growth

The global automotive industry has been experiencing significant growth in vehicle production over the years. This growth can be attributed to various factors, including increasing population, rising income levels in emerging markets, improved infrastructure, and technological advancements. According to the European Automobile Manufacturers' Association (French: L'Association des Constructeurs Europeens d'Automobiles (ACEA)), in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021.

Developing countries, particularly in Asia, have witnessed a surge in vehicle production. Countries like China and India have experienced rapid economic growth, leading to a rise in disposable income and increased demand for automobiles. As a result, many global automakers have set up production facilities in these markets to cater to the growing demand.

The automotive industry has witnessed remarkable technological advancements, including electric vehicles (EVs) and autonomous vehicles (AVs). The growing popularity of EVs, driven by environmental concerns and government initiatives, has led to increased production of electric cars and hybrids. Additionally, the development of AVs has prompted manufacturers to invest in research and development, leading to the production of self-driving cars.

Vehicle manufacturers are continually exploring new markets and expanding their operations globally. They establish manufacturing facilities in different regions to meet local demand and reduce production costs. This expansion strategy enables companies to tap into new customer bases and leverage the potential of emerging markets.

Thus, as the number of vehicles increases, so will the opportunity for players operating in the automotive gaskets & seals market to generate revenue, facilitating overall market expansion.

Asia-Pacific and Europe to dominate the Market

- Over the last decade, the Asia-Pacific automotive industry has undergone the most significant transformation in its history. The market is recording an increasing share of global vehicle sales. Another major factor driving the growth of the automotive gaskets and seals market is increased production and sales of electric vehicles in the region.

- The Asia-Pacific region is home to major automotive markets like China, India, and Thailand. China is the world's biggest automotive market and the second-largest market for electric vehicles after Europe recently surpassed it in 2020. Since gaskets and seals find applications in both electric vehicles and conventional internal combustion engine (ICE) vehicles, China presents huge market opportunities. With a large market for passenger and commercial vehicles, India is another major area for potential growth for the gaskets and seals market.

- The Indian vehicle sector is predicted to reach USD 300 billion in revenue by 2026, growing at a CAGR of 15% from its present value of USD 74 billion creating opportunities for players operating in the vehicle gaskets and seals market.

- In addition, Europe is also expected to hold a significant share of the global automotive gaskets and seals market. The commercial vehicle demand is growing in the region, with high developments in both the ICE and electric vehicle segments of the automobile industry. Although a decreasing trend is being observed in terms of vehicle sales in its entirety, the increase in sales for used cars and other used vehicles, especially in the Asia-Pacific region, is a major growth factor in the aftermarket sales for gaskets and seals.

Automotive Gaskets & Seals Industry Overview

The automotive gaskets and seals market is a fragmented market. Some of the major players in the market are Freudenberg Group, SKF Group, Dana Incorporated, Elringklinger AG, Jayem Auto Industries, Kunshan Sanwa Engine Parts Industry, and Sumitomo Riko, among others. Different manufacturers are gaining traction by developing and launching new products across the world. For instance,

- In August 2023, Freudenberg SE announced that Freudenberg Sealing Technologies has developed the 3D thermal barriers, acting as protective layers that help slow down or even stop thermal runaway by increasing resistance to propagation, hence the better safety for electric cars.

- In August 2022, Trelleborg AB announced that Trelleborg Sealing Solutions has launched HMF FlatSeal, a new range of flat gasket materials for static sealing in low and high-temperature applications. The range includes specialist materials for use with harsh chemicals and mediums in various industries including the automotive industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Automobile Sales Across the Globe is Likely to Bolster Demand

- 4.2 Market Restraints

- 4.2.1 Volatility in Raw Material Prices

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Gaskets

- 5.1.2 Seals

- 5.2 Gasket Application Type

- 5.2.1 Cylinder Head

- 5.2.2 Exhaust Manifold

- 5.2.3 Other Gasket Application Types

- 5.3 Seal Application Type

- 5.3.1 Engine

- 5.3.2 Transmission

- 5.3.3 Steering

- 5.3.4 Battery

- 5.4 Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Commercial Vehicles

- 5.5 Sales Channel Type

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 China

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Rest of the World

- 5.6.4.1 South America

- 5.6.4.2 Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 SKF Group

- 6.2.2 Dana Incorporated

- 6.2.3 Elringklinger AG

- 6.2.4 Jayem Auto Industries Pvt Ltd

- 6.2.5 Kunshan Sanwa Engine Parts Industry Co. Ltd

- 6.2.6 Sumitomo Riko