|

市场调查报告书

商品编码

1433795

特种二氧化硅:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Specialty Silica - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

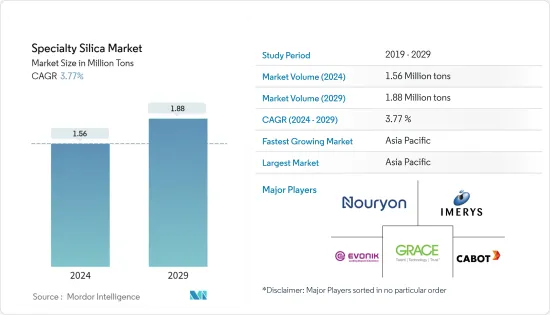

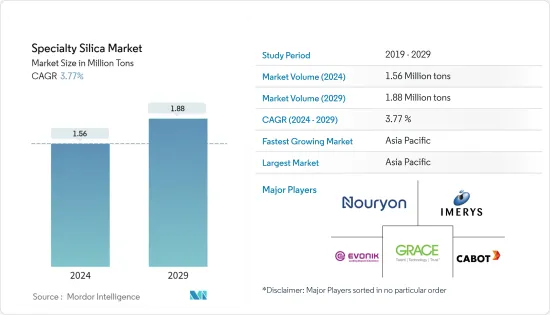

预计2024年全球特种二氧化硅市场规模将达156万吨,2029年将达188万吨,2024-2029年预测期间内复合年增长率为3.77%。

COVID-19 对市场产生了负面影响。受疫情影响,世界各国政府纷纷采取封锁措施,防止病毒传播。许多企业和工厂关闭,扰乱了全球供应链。然而,市场已经从 COVID-19 疫情中恢復过来,并且正在迅速成长。

主要亮点

- 橡胶行业需求的增加正在推动市场成长。此外,特种二氧化硅在个人保健产品中的使用不断增加也推动了市场的发展。

- 然而,特种二氧化硅的昂贵性质和替代产品的可用性预计将阻碍市场成长。

- 儘管如此,绿色轮胎的日益崛起预计将成为未来几年市场的机会。

- 在预测期内,亚太地区预计将成为特种二氧化硅最大且成长最快的市场。

特种二氧化硅市场趋势

橡胶工业需求增加

- 特种二氧化硅通常用于需要高机械强度和良好电绝缘性的液体硅胶橡胶(LSR)和高温硫化橡胶(HTV)。

- 在工业橡胶产品中,特种二氧化硅用于减少输送机中的滞后损失,并作为彩色橡胶颗粒和具有良好接触性能的产品中的活性填料。

- 根据美国经济分析局统计,2022年各国橡胶製品(含塑胶製品)付加价值超过3,820亿美元,较上年付加约11%。

- 特种二氧化硅因其极高的纯度和低吸湿性而主要用于轮胎製造橡胶。具有比橡胶製品更好的电气性能。

- 在北美,根据OICA(国际汽车构造组织)的数据,2022年汽车产量为1,480万辆,比2021年的1,340万辆成长9.88%。

- 此外,根据OICA的数据,2022年德国汽车产量为370万辆,比2021年同期的330万辆成长11%。

- 据Modern Tire Dealer称,2022年美国轮胎总出货量量约3.35亿条。 2022 年出货的大部分轮胎是替换小客车轮胎,约 2.22 亿条。轮胎产业的成长预计最终将提振橡胶产业的需求,从而有利于特种二氧化硅市场。

- 因此,所有上述因素预计将在预测期内推动全球市场。

亚太地区主导市场

- 预计亚太地区将在预测期内主导特种二氧化硅市场。这是由于中国、印度和日本等国家的轮胎製造、工业橡胶製造、油漆和涂料以及个人护理行业等应用的需求增加。

- 根据世界油漆和涂料工业协会估计,2022年亚太地区油漆和涂料行业的价值预计将达到630亿美元。中国在该地区市场占据主导地位,复合年增长率为 5.8%。 2022年,中国市场预计成长5.7%。依照目前趋势,2022年中国油漆涂料总销售额将超过450亿美元。在东亚,该国拥有最大的市场占有率,占 78%。

- 到2022年,印度将成为世界第四大橡胶消费国。目前印度人均橡胶使用量为 1.2 公斤,而全球整体橡胶使用量为 3.2 公斤。印度橡胶工业的收益约为 1,200 亿卢比(约 14 亿美元)。轮胎产业消耗了印度橡胶产量的大部分,占全国总产量的一半以上。

- 为因应该国橡胶工业的成长,日本横滨橡胶公司Yokohama将于2023年投资8,200万美元(约679亿印度卢比)扩大其在印度的小客车轮胎产品组合,以满足印度日益增长的需求。宣布将扩大产能。维沙卡帕特南的生产设施预计将于年终竣工并投入营运。

- 此外,中国也是最大的汽车生产国和消费国。中国汽车工业协会的报告显示,2022年中国汽车产量与前一年同期比较成长约3.4%。 2021年汽车产量为2,608万辆,而2022年汽车产量约2,702万辆。这一增长将导致轮胎需求增加并影响特种二氧化硅市场。

- 在印度,大约 12% 的橡胶用于鞋类生产。印度製鞋业预计未来几年将成长 4.5%。运动鞋类别中,跑鞋的消费量最大,与前一年同期比较增加1.5倍。马来西亚领先鞋履品牌Bata计划在年终开设500家专利权店。

- 根据马来西亚橡胶局的数据,2022 年上半年,马来西亚轮胎产品出口将从 8.328 亿令吉(约 1.889 亿美元)增长 6% 至 8.832 亿令吉(约 2.3039 亿美元)。并且还有成长的空间。该委员会正在寻求加强对新投资、技术进步和更环保产品的关注,以促进该国的出口。

- 因此,所有这些市场趋势预计将在预测期内推动该地区特种二氧化硅市场的需求。

特种二氧化硅产业概况

特种二氧化硅市场较为分散。从市场占有率来看,目前该市场由几家大型企业占据主导地位。特种二氧化硅市场的主要企业包括 WR Grace &Co.、Cabot Corporation、Imerys、Evonik Industries AG 和 Nouryon。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 橡胶工业需求增加

- 增加特殊二氧化硅在个人保健产品中的使用

- 其他司机

- 抑制因素

- 特种二氧化硅价格昂贵

- 市场上替代产品的可用性

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔:市场规模(基于数量)

- 类型

- 沉淀二氧化硅

- 硅胶

- 气相二氧化硅

- 胶质氧化硅

- 熔融石英

- 目的

- 橡皮

- 个人护理

- 食品/饲料

- 化学品

- 塑胶

- 油漆、被覆剂、油墨

- 金属/耐火材料

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M(Ceradyne Inc.)

- Cabot Corporation

- Clariant

- Denka Company Limited

- Evonik Industries AG

- Fuji Silysia Chemical

- Fuso Chemical Co. Ltd

- Glassven CA

- Imerys

- Merck KGaA

- Nouryon

- Orisil

- Tata Chemicals

- WR Grace & Co.

- Wacker Chemie AG

第七章 市场机会及未来趋势

- 绿色轮胎的兴起

- 其他机会

The Specialty Silica Market size is estimated at 1.56 Million tons in 2024, and is expected to reach 1.88 Million tons by 2029, growing at a CAGR of 3.77% during the forecast period (2024-2029).

COVID-19 had a negative influence on the market. Because of the pandemic scenario, various governments around the world established lockdowns to prevent the virus from spreading. Numerous companies and factory closures had disrupted global supply networks. However, the market has recovered from the COVID-19 outbreak and is growing rapidly.

Key Highlights

- The growing demand from the rubber industry is notably driving market growth. Moreover, the increasing utilization of specialty silica in personal care products is also pushing the market forward.

- However, the expensive nature of specialized silica and the availability of substitute products is expected to hinder market growth.

- Nevertheless, the growing emergence of green tires is projected to act as an opportunity for the market in the future.

- The Asia-Pacific region is expected to be the largest and fastest-growing market for specialty silica during the forecast period.

Specialty Silica Market Trends

Increasing Demand from the Rubber Industry

- Specialty silica is commonly used in Liquid Silicone Rubber (LSR) and High-Temperature Vulcanized (HTV) rubber, which requires high mechanical strength and good electrical insulation.

- In industrial rubber goods, specialty silica is used for reducing hysteresis loss in conveyor belts or as an active filler in colored rubber particles or in products with good contact.

- According to the United States Bureau of Economic Analysis, the value added by rubber products (plastic products included) in the country during 2022 was more than USD 382 billion, approximately 11% more than the value added during the previous year.

- Specialty Silica is mainly used in rubber for tire production due to its extremely high purity and low moisture absorption. It has superior electrical properties to rubber products.

- In North America, according to the Organisation Internationale des Constructeurs d'Automobiles (OICA), automotive production in 2022 accounted for 14.8 million units, an increase of 9.88% compared to the production in 2021, which was reported to be 13.4 million units.

- Further, OICA also stated that, in 2022, Germany produced 3.7 million vehicles which increased by 11% compared to 3.3 million vehicles in the same period in 2021, thereby indicating an increased demand for tires from the automotive industry.

- According to the Modern Tire Dealer, in 2022, overall shipments of United States tires amounted to around 335 million units. The majority of tire units shipped in 2022 were replacement passenger tires, with some 222 million units. The increasing tire industry would eventually enhance the demand from the rubber industry, thereby benefiting the specialty silica market.

- Therefore, all the aforementioned factors are expected to drive the global market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for specialty silica during the forecast period. In countries like China, India, and Japan, owing to the increasing demand from applications such as tire manufacturing, industrial rubber manufacturing, paints and coatings, and the personal care industry.

- In 2022, according to the World Paint & Coatings Industry Association, the Asia-Pacific paints and coatings industry was estimated to be worth USD 63 billion. China dominated the region's market, which is growing at a CAGR of 5.8%. In 2022, the Chinese market is expected to have grown by 5.7%. According to current trends, China's total sales of paints and coatings exceeded USD 45 billion in 2022. In East Asia, the country had the largest market share of 78%.

- India is the fourth-largest consumer of rubber in the world as of 2022. Rubber usage per capita in India is currently 1.2 kilograms, compared to 3.2 kilograms globally. The rubber industry in India generates revenue of approximately INR 12 thousand crores (~USD 1.4 billion). The tire sector consumes the majority of India's rubber production, accounting for over half of the country's total output.

- Owing to the growing rubber industry in the country, in 2023, Yokohama, the Indian arm of the Japanese Yokohama Rubber Company, announced that it would invest USD 82 million (~INR 679 crore) to expand its passenger car tire production capacity in India to meet the rising demands from the local market. The production facility at Visakhapatnam will be completed and start operations by the end of 2024.

- Moreover, China is the largest producer and consumer of automotive vehicles. The China Association of Automobile Manufacturers (CAAM) reported that, compared to the prior year, China's automobile production increased by about 3.4% in 2022. In comparison to the 26.08 million automobiles produced in the year 2021, around 27.02 million were produced in 2022. This increase would lead to growth in the demand for tires in the industry thereby impacting the specialty silica market.

- In India, about 12% of rubber is used to produce footwear. The Indian footwear industry is estimated to grow at 4.5% in the coming years. Under the sports footwear category, running shoes are the most consumed category, with a 1.5X spike compared to the previous year. Bata, one of the leading footwear brands in the country, has set out a plan to open 500 new franchise stores by the end of the year 2023.

- According to the Malaysian Rubber Board, Malaysia's exports have room for growth in terms of tire products as they registered a 6% increase from MYR 832.8 million (~USD 188.9 million) to MYR 883.2 million (~USD 200.39 million) during the first half of 2022. The council is trying to focus more on new investments, technological advances, and greener products to boost the country's exports.

- Hence, all such market trends are expected to drive the demand for the specialty silica market in the region during the forecast period.

Specialty Silica Industry Overview

The specialty silica market is fragmented in nature. In terms of market share, few of the major players currently dominate the market. Some of the key players in the specialty silica market include W. R. Grace & Co., Cabot Corporation, Imerys, Evonik Industries AG, and Nouryon, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Rubber Industry

- 4.1.2 Increasing Utilization of Specialty Silica in Personal Care Products

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Expensive Nature of Specialized Silica

- 4.2.2 Availability of Substitute Products in the Market

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Precipitated Silica

- 5.1.2 Silica Gel

- 5.1.3 Fumed Silica

- 5.1.4 Colloidal Silica

- 5.1.5 Fused Silica

- 5.2 Application

- 5.2.1 Rubber

- 5.2.2 Personal Care

- 5.2.3 Food and Feed

- 5.2.4 Chemicals

- 5.2.5 Plastics

- 5.2.6 Paints, Coatings and Inks

- 5.2.7 Metal and Refractories

- 5.2.8 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M (Ceradyne Inc.)

- 6.4.2 Cabot Corporation

- 6.4.3 Clariant

- 6.4.4 Denka Company Limited

- 6.4.5 Evonik Industries AG

- 6.4.6 Fuji Silysia Chemical

- 6.4.7 Fuso Chemical Co. Ltd

- 6.4.8 Glassven C.A.

- 6.4.9 Imerys

- 6.4.10 Merck KGaA

- 6.4.11 Nouryon

- 6.4.12 Orisil

- 6.4.13 Tata Chemicals

- 6.4.14 W. R. Grace & Co.

- 6.4.15 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Emergence of Green Tires

- 7.2 Other Opportunities