|

市场调查报告书

商品编码

1433820

地板:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Wood Flooring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

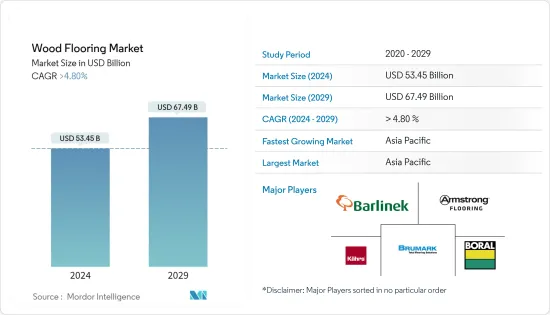

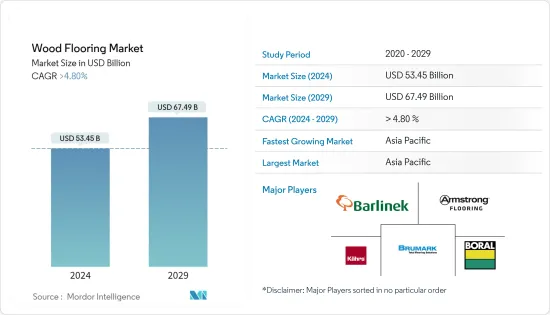

地板市场规模预计2024年为534.5亿美元,预计到2029年将达到674.9亿美元,在预测期内(2024-2029年)增长超过4.80%,预计将以复合年增长率增长。

由于建筑和非建设活动的快速增长,可支配收入的增加和住宅维修的增加,特别是在新兴国家,正在推动地板行业的发展。木材等环保材料的重要性日益增加以及外汇波动等因素影响了报酬率,预计地板市场的利润率将出现波动。原材料价格的波动、严格的监管以及地板成本的上涨正在阻碍该行业的成长。依产品划分,市场分为实木和工程木材。由于与其他地板材料相比,工程木製品的製造需要更少的能源,预计工程木製品领域在预测期内将以显着的速度成长。供应商公司采取了多种策略,例如合作、併购和合资企业,以建立永续的业务并在全球行业中建立强大的地位。

COVID-19感染疾病全球地板市场的当前情况显示出復苏和成长的迹象。随着限制的放鬆和建设活动的恢復,人们待在家里的时间越来越多,并投资于住宅装修计划,对地板的需求不断增加。此外,室内设计中对永续和天然材料的偏好正在增加对地板的需求。

地板市场趋势

工程木材对地板的需求激增

工程木材预计在预测期内仍将保持高需求,因为它是混凝土和硬木的合适替代品。建筑师、建筑商、规范负责人和建筑设计师都使用工程木製品,他们认识到节能农业实践可以节省能源、加快施工速度、降低人事费用和减少废弃物,并被人们广泛使用。可支配收入的增加和公众对工程木材好处的认识不断提高,预计将加速北美和欧洲该行业的发展。实木地板业务占全年总收益的大部分。工程木製品的优点之一是它们的设计可以满足最终用户的要求和自订规格。易于维护和色彩设计的独特性是推动这一领域成长的其他特征。

线上销售的成长推动市场

该线上平台扩大了地板製造商和零售商的客户群。在线销售产品使企业能够接触到当地市场以外的客户,并进入国内和国际市场。这种更广泛的覆盖范围会增加您的整体销售。线上销售为客户提供了便利性和可近性。潜在买家可以随时在舒适的家中浏览各种地板选择。无需前往实体店即可比较产品、阅读评论并做出明智的决定。这种便利因素促使更多客户在线上购买地板。

线上平台允许地板销售商提供详细的产品信息,例如规格、功能和安装指南。这些全面资讯的可用性有助于潜在买家更好地了解产品并做出明智的选择。此外,您还可以在线上提供部落格、影片和教学等教育资源,以引导客户完成选择和安装过程。这增加了客户的信任并鼓励在线购买。在线销售通常会带来更具竞争力的价格。透过降低与实体店相关的管理成本,线上零售商可以以具有竞争力的价格提供地板产品。客户可以轻鬆比较不同线上平台的价格,从而促进线上购买并促进整体市场成长。

地板产业概况

该报告涵盖了地板市场上的主要国际参与者。从市场占有率来看,目前很少大公司占据市场主导地位。然而,随着技术进步和产品创新,中小企业正在透过赢得新合约和开拓新市场来增加其市场份额。市场上营运的主要企业包括 Armstrong Flooring Inc.、Barlinek SA、Boral Limited、Brumark Corporation 和 Kahrs Holding AB。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场考量与动态

- 市场概况

- 市场驱动因素

- 都市化和人口成长

- 市场限制因素

- 经济不确定性

- 市场机会

- 加大地板材料产业技术创新(智慧地板)

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 影响地板市场的趋势

- 电子商务对市场的影响

- 产业创新

- COVID-19 对市场的影响

第五章市场区隔

- 副产品

- 实木

- 加工木材

- 按分销管道

- 家居中心

- 旗舰店

- 专卖店

- 在线的

- 其他分销管道

- 按最终用户

- 住宅

- 商业的

- 按地区

- 北美洲

- 南美洲

- 欧洲

- 亚太地区

- 中东/北非

第六章 竞争形势

- 公司简介

- Armstrong Flooring, Inc.

- Beaulieu International Group

- Barlinek SA

- Boral Limited

- Brumark Corporation

- Kahrs Holding AB

- Mannington Mills, Inc.

- Mohawk Industries, Inc.

- Nature Home Holding Co Ltd

- Tarkett SA

第七章 市场的未来

第 8 章 免责声明与出版商讯息

The Wood Flooring Market size is estimated at USD 53.45 billion in 2024, and is expected to reach USD 67.49 billion by 2029, growing at a CAGR of greater than 4.80% during the forecast period (2024-2029).

Increasing home renovation owing to increased disposable income and faster growth in construction and non-construction activities, especially in developing countries, fuels the development of the wooden flooring industry. Factors like increased importance on eco-friendly materials, such as wood, and fluctuation in foreign currencies affect profit margins, which are estimated to fluctuate in the wooden flooring market. Fluctuating prices of raw materials coupled with stringent regulations and the increasing cost of wooden floorings are restraints for industry growth. By product, the market is segmented into solid wood and engineered wood. The engineered wood segment is expected to grow at a significant growth rate during the forecast period due to the manufacturing of engineered wood products that require less energy in comparison to that of other flooring materials. The vendor companies adopted various strategies, including collaborations, mergers and acquisitions, partnerships, and joint ventures, to build a sustainable business and gain a strong position in the global industry.

The present scenario of the wood flooring market globally post-COVID is showing signs of recovery and growth. With the easing of restrictions and resumption of construction activities, there is an increasing demand for wood flooring as people spend more time at home and invest in home improvement projects. Additionally, the preference for sustainable and natural materials in interior design drives the demand for wood flooring.

Wood Flooring Market Trends

Engineered Wood is Surging the Demand for Wooden Flooring

Engineered wood demand is expected to remain high during the forecast period, as it is an apt alternative to concrete and hardwood. Engineered wood products are widely used by architects, builders, code officials, and building designers aware of energy-efficient farming practices that conserve energy, speed up construction, cut labor costs, and reduce waste. The segment is expected to move at a higher pace in North America and Europe, owing to increased disposable income and widespread awareness of the benefits of engineered wood among the populace. The engineered wooden floor segment contributed a large share of total revenue in the current year. One of the advantages of engineered wood products is that they can be designed per the demand and custom specifications of the end-user. Easy maintenance and uniqueness of colorful design are among other features pushing the segment's growth.

Increasing Online Sales is Driving the Market

Online platforms provide wood flooring manufacturers and retailers with an expanded customer base. By selling products online, companies can reach customers beyond their local markets and tap into national and international markets. This broader reach helps increase overall sales volume. Online sales offer convenience and accessibility to customers. Potential buyers can browse through a wide range of wood flooring options from the comfort of their homes at any time of day. They can compare products, read reviews, and make informed decisions without visiting physical stores. This convenience factor has attracted more customers to purchase wood flooring online.

Online platforms allow wood flooring sellers to provide detailed product information, including specifications, features, and installation guidelines. This availability of comprehensive information helps potential buyers understand the product better and make informed choices. Additionally, educational resources, such as blogs, videos, and tutorials, can be provided online to guide customers through the selection and installation process. This enhances customer confidence and encourages online purchases. Online sales often lead to increased price competitiveness. With fewer overhead costs associated with physical stores, online retailers can offer competitive prices for wood flooring products. Customers can compare prices easily across different online platforms, encouraging them to purchase online and driving the overall market growth.

Wood Flooring Industry Overview

The report covers major international players operating in the wood flooring market. In terms of market share, few of the major players currently dominate the market. However, with technological advancement and product innovation, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. Some leading players operating in the market are Armstrong Flooring Inc., Barlinek SA, Boral Limited, Brumark Corporation, and Kahrs Holding AB, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Urbanization and Population Growth

- 4.3 Market Restraints

- 4.3.1 Economic Uncertainty

- 4.4 Market Opportunities

- 4.4.1 Rising Technological Innovations (Smart Flooring) in the Floor Covering Industry

- 4.5 Value Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Trends Influencing the Wood Flooring Market

- 4.8 E-Commerce Impact on the Market

- 4.9 Technological Innovations in the Industry

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Solid Wood

- 5.1.2 Engineered Wood

- 5.2 By Distribution Channel

- 5.2.1 Home Centers

- 5.2.2 Flagship Stores

- 5.2.3 Specialty Stores

- 5.2.4 Online

- 5.2.5 Other Distribution Channels

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 South America

- 5.4.3 Europe

- 5.4.4 Asia-Pacific

- 5.4.5 Middle East and North Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Armstrong Flooring, Inc.

- 6.1.2 Beaulieu International Group

- 6.1.3 Barlinek SA

- 6.1.4 Boral Limited

- 6.1.5 Brumark Corporation

- 6.1.6 Kahrs Holding AB

- 6.1.7 Mannington Mills, Inc.

- 6.1.8 Mohawk Industries, Inc.

- 6.1.9 Nature Home Holding Co Ltd

- 6.1.10 Tarkett S.A.*