|

市场调查报告书

商品编码

1642042

数位保险库:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Digital Vault - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

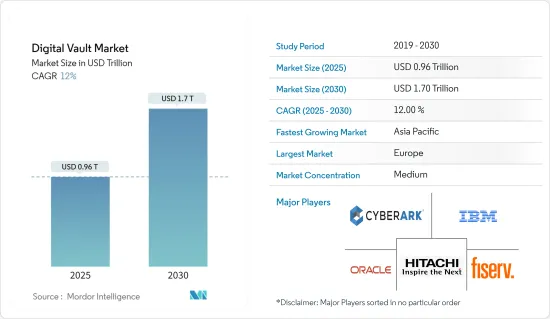

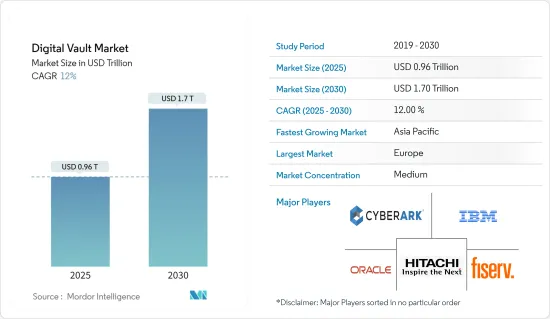

预计 2025 年数位保险库市场规模为 9,600 亿美元,到 2030 年将达到 1.7 兆美元,预测期内(2025-2030 年)的复合年增长率为 12%。

COVID-19 疫情对全球数位保险库市场的成长产生了有益的影响。线上业务趋势对数位保险库的市场份额和市场规模产生了积极影响。随着网路攻击风险的不断上升,危及企业的安全,数位保险库解决方案的采用正在增加,从而推动了市场的成长。

关键亮点

- 蒙大拿州历史学会 (MHS) 采用的数位储存库就是一个例子,它为 MHS 提供了一个平台来组织照片、地图、信件、报纸、报导和其他类型资源并提供背景资讯。

- 这些公司透过技术改进以及收购、合作、合併等竞争手段不断扩大其全球影响力。公司也在投资研发以应对日益激烈的市场竞争。例如,2022 年 2 月,Digital Vault Services GmbH (DVS) 和 Trinity Management Systems GmbH (Trinity) 宣布合作。 Trinity 和 DVS 合作将 Trinity 财政管理系统 (TMS) 连接至 Guarantee Vault,后者是一个数位担保和担保的中央註册中心。 Trinity 客户将能够透过 Guarantee Vault 直接从他们的 TMS 请求和管理数位保固。

- 为了吸引更多的客户,银行正在透过其网路银行系统提供超越标准金融服务的新服务和产品。其中一项服务允许消费者使用一项线上银行服务(例如银行网站或行动应用程式)查看银行帐户信息,包括各家银行的交易和帐户余额。一些银行还提供收集和储存其他客户文件的选项,例如通讯和电子商务发票、付款通知和医疗文件。一些银行允许您将文件直接上传到您的网路银行帐户。透过将所有资讯整合到一个地方,客户可以更好地了解他们的财务状况和业务。

- 政府采取各种倡议,将公民数位化,最大限度地减少实体文件的处理,创建真实文件以最大限度地减少诈骗和伪造,降低政府的行政成本,随时随地访问资料等因素是数位保险库市场的基本驱动力。

- 然而,数位保险库业务发展的主要障碍是成本高昂以及存在多种相互竞争的网路安全解决方案。开发中国家缺乏相容性和知识是可能阻碍全球数位保险库业务发展的一些问题。

数位储存市场趋势

云端基础的数位保险库呈现巨大成长

- 云端基础的数位保险库允许最终用户将他们需要的资讯储存在供应商的伺服器上,并随时随地远端存取它,从而降低了内部维护的成本。

- 云端基础的数位保险库可协助最终用户将所需资讯储存在供应商的伺服器上。与内部部署模型相比,云端基础的数位保险库正成为一种流行的选择,因为它们显着减少了前期投资和 IT 开销。推动业务成长的另一个方面是公司越来越依赖云端解决方案来进行资料储存、处理和资料连接。

- 数位储物柜是印度政府通讯和资讯技术部下属电子和资讯技术部 (DEITY) 的倡议,为公民提供10MB 的免费线上储存空间,用于将重要文件和证书以软拷贝形式储存在各种共用。

- 日益增多的资料外洩事件促使企业选择数位保险库,预计将在预测期内提振市场需求。例如,根据《HIPAA日誌》发布的资料,2022年1月,美国医疗保健组织遭遇了2021年迄今最严重的资料外洩事件。近年来,此类案件数量有所增加,从 2016 年的 329 起增至 2021 年的 712 起。

由于《通用资料保护条例》的实施,欧洲预计将大幅成长

- 数位化的兴起和资料隐私的需求促使人们将所有重要文件和密码储存在安全的数位格式中,例如数位保险库和储物柜。

- 欧盟委员会的线上平台「数位单一市场」是一种数位储存库,为公民和文化创新产业(CCI) 提供访问欧洲3,700 多个图书馆、檔案馆、博物馆、画廊和视听设施的权限。存取权限我们的藏品超过 5300 万件,包括图像、文字、音讯、视讯和 3D 材料。

- 预计预测期内,多家欧洲银行和新兴企业的众多发展将为该地区的数位保险库市场创造机会。例如,2022年2月,Magyar Bankholding与Thought Machine签署协议,建立新的数位银行。 Magyar Bankholding 成立了一家名为 Foundation 的新子公司,其委託是开发一家现代化的数位银行,为私人客户提供贷款、储蓄和付款解决方案。 Vault 将成为该新兴企业的主要金融基础设施。

- 此外,2022 年 5 月,一家比利时新兴企业为企业推出了数位保险库。 Hypervault 系统则是针对企业、服务供应商以及任何寻求安全、符合 GDPR 要求的方式储存敏感资料的人。该公司表示,建造金库时会考虑到欧洲的法律结构。

数位保险库产业概况

数位保险库市场竞争较弱,该领域有几家大公司。该市场的主要参与者包括 CyberArk Software Ltd.、IBM、Oracle、Hitachi 和 Fiserv, Inc.这些参与企业不断对其产品进行创新,这使他们比市场上的其他参与企业更具竞争优势。对数位保险库市场的研发活动、策略伙伴关係和併购的大量投资帮助公司提高了盈利和市场占有率。

- 2022 年 3 月——总部位于密苏里州的金融咨询和资产管理公司 SRG Financial Advisors 与业界领先的安全文件交换和数位保管解决方案提供商 FutureVault 合作,推出 Mile Marker Vault。

- 2021 年 6 月—CyberArk 宣布推出 CyberArk 身分安全平台。这些进步扩大了云端和混合环境中的保护范围,并有助于确保高风险存取的安全。 CyberArk 提供的这项云端服务用于确保机器与人的身份验证的安全。

- 2021 年 5 月-江森自控宣布与 DigiCert 合作,利用其物联网设备管理器来改善智慧建筑的网路安全、数位身分验证管理和公开金钥基础建设(PKI)。该设备管理器建立在 DigiCert ONE 数位证书平台上,为智慧建筑解决方案带来先进、安全的连接。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场概况

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- COVID-19 对产业的影响

第五章 市场动态

- 市场驱动因素

- 资料隐私和安全文件共用问题

- 处理透过连网设备产生的资料

- 市场限制

- 使用实体保险库

第六章 市场细分

- 按部署

- 本地

- 云

- 按类型

- 解决方案

- 按服务

- 按最终用户

- BFSI

- 资讯科技/通讯

- 政府

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- IBM

- CyberArk Software Ltd.

- Hitachi Limited

- Fiserv, Inc.

- Oracle Corporation

- Keeper Security

- Multicert

- Accruit LLC

第八章投资分析

第九章:市场的未来

The Digital Vault Market size is estimated at USD 0.96 trillion in 2025, and is expected to reach USD 1.70 trillion by 2030, at a CAGR of 12% during the forecast period (2025-2030).

The COVID-19 outbreak had a beneficial impact on worldwide digital vault market growth. The growing trend of conducting online businesses positively impacted the digital vault market's share and size. As the risk of cyber-attacks increased, putting businesses' security at risk, organizations increasingly use digital vault solutions, thus boosting market growth.

Key Highlights

- The adoption of the digital vault by the Montana Historical Society (MHS) is one such instance that provides MHS with a platform that organizes and provides context for photographs, maps, letters, newspapers, articles, and other types of resources.

- These companies are continuously expanding their worldwide reach through technological improvements as well as competitive techniques such as acquisitions, collaborations, and mergers. Companies also invest in R&D to keep up with the rising market rivalry. For instance, in February 2022, Digital Vault Services GmbH (DVS) and Trinity Management Systems GmbH (Trinity) announced cooperation. Trinity and DVS partnered to connect Trinity Treasury Management System (TMS) with Guarantee Vault, a central register for digital guarantees and sureties. Trinity customers will be able to request and manage their digital guarantees directly from their TMS via Guarantee Vault.

- To attract more clients, banks offer new services and products through online banking systems that go beyond standard financial services. One of these services is providing consumers with the opportunity to view all bank account information, including transactions and account balances from various banks, using a single online banking service (e.g., a bank website or a mobile application). Some banks also give the option of collecting and storing other customer documents, such as telecommunication or e-commerce invoices, payment notices, medical care documentation, and so on. Some banks even allow users to upload documents directly to their online banking accounts. By aggregating all information in one place, customers can benefit from a better overview of their financial assets and operations.

- Various government initiatives to digitally empower the citizens, minimizing the handling of physical documents, authentic documentation to minimize fraud and forgery, reducing government administrative overheads, and access to data at any time and anywhere are the other factors which are fundamental in driving the digital vault market.

- However, some of the primary factors impeding the development of the digital vault business in the foreseeable years are the significant cost involved and the existence of various competing cybersecurity solutions. Compatibility and absence of knowledge in developing nations are some problems that may function as a stumbling obstacle for the global digital vault business.

Digital Vault Market Trends

Cloud-Based Digital Vaults to Register a Significant Growth

- Cloud-based digital vaults enable the end-users to store the required information on the vendor's servers, which can be accessed remotely anywhere and at any time, thus, reducing their cost factor for on-premise maintenance.

- Cloud-based digital vault help ends users store the necessary information on the vendor's servers. These are widely chosen above on-premise versions since they save significantly on upfront expenditures and IT overhead. Another encouraging aspect of business growth is enterprises' growing reliance on cloud solutions for data storage, processing, and data connectivity.

- Digital locker is an initiative of the Department of Electronics and Information Technology (DEITY) under the Ministry of Communications and IT, Government of India, which provides its citizens 10MB of free online storage space to store important documents and certificates as soft copies in different formats, which can be shared through e-mails, if needed.

- The growing number of data breaches is expected to influence businesses to opt for a digital vault, thereby boosting the market demand over the forecast period. For instance, as per the data published by HIPAA Journal, in January 2022, healthcare organizations in the United States saw the highest number of large-scale data breaches to date in 2021. The number of such cases has increased in recent years, going from 329 cases in 2016 to 712 cases in 2021.

Europe is Expected to Share Significant Growth Owing to GDPR Adoption

- The increase in digitization and the need for data privacy have given rise to storing all the important documents and passwords in a secure digital format, as in digital vaults or lockers.

- European commission's online platform, Digital Single Market, is a kind of digital vault that has given access to citizens and the Cultural and Creative Industries (CCIs) to over 53 million items, including images, texts, sounds, videos, and 3D materials from the collections of over 3700 libraries, archives, museums, galleries, and audio-visual collections, across Europe.

- Numerous developments by several banks and startups in the European region are expected to create opportunities for the digital vault market in the region over the forecast period. For instance, in February 2022, Magyar Bankholding signed an agreement with Thought Machine to build a new digital bank. Magyar Bankholding established a new subsidiary named Foundation, which is entrusted with developing a modern digital bank that would provide retail customers with loan, savings, and payment solutions. Vault will serve as the key financial infrastructure for the startup.

- Furthermore, In May 2022, a Belgian startup created a digital vault for businesses. The Hypervault system is intended for enterprises, service providers, and anyone that want a GDPR-compliant method of securely storing sensitive data. According to the company, the company is constructing the vault while considering the European legal structure.

Digital Vault Industry Overview

The Digital Vault Market is moderately competitive, owing to the presence of several major players. Some of the major players operating in the market include CyberArk Software Ltd., IBM, Oracle, Hitachi, Ltd., and Fiserv, Inc., among others. The continuous innovations brought out by these players in their products have allowed them to gain a competitive advantage over other players in the market. Significant investments in R&D activities, strategic partnerships, and mergers and acquisitions in the digital vault market have enabled the companies to increase profitability and market share.

- March 2022 - SRG Financial Advisors, a financial advisory and wealth management firm headquartered in Missouri, announced the launch of the Mile Marker Vault through its partnership with FutureVault, an industry-leading provider of secure document exchange and digital vault solutions.

- June 2021 - CyberArk announced the advancements to its CyberArk Identity Security Platform. These advancements help to broaden protection, and secure high-risk access across cloud and hybrid environments. This cloud-delivered service from CyberArk is used to protect the machine and human identities.

- May 2021 - Johnson Controls announced a partnership with DigiCert to take advantage of IoT Device Manager for improving smart building cybersecurity, management of digital identities, and Public Key Infrastructure (PKI). This device manager is built on DigiCert ONE digital certificate platform, which provides advanced secure connectivity in smart building solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGTHS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Data Privacy and Secured File Sharing Concerns

- 5.1.2 Handling of Data Generated through Connected Devices

- 5.2 Market Restraints

- 5.2.1 Use of Physical Vault

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Type

- 6.2.1 Solutions

- 6.2.2 Services

- 6.3 By End-User

- 6.3.1 BFSI

- 6.3.2 IT and Telecommunication

- 6.3.3 Government

- 6.3.4 Other End-Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM

- 7.1.2 CyberArk Software Ltd.

- 7.1.3 Hitachi Limited

- 7.1.4 Fiserv, Inc.

- 7.1.5 Oracle Corporation

- 7.1.6 Keeper Security

- 7.1.7 Multicert

- 7.1.8 Accruit LLC