|

市场调查报告书

商品编码

1851026

虚拟路由器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Virtual Router - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

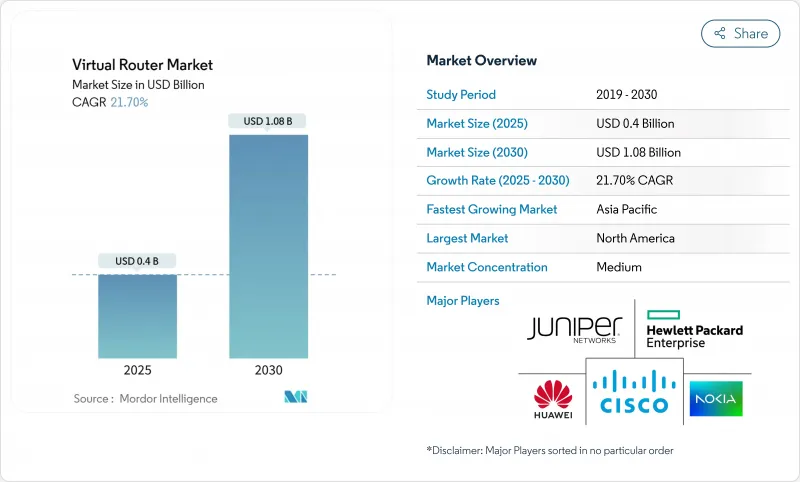

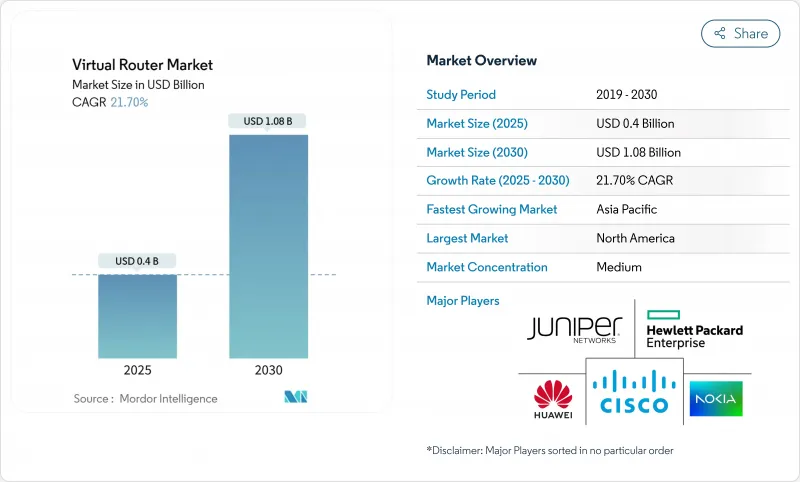

预计到 2025 年,虚拟路由器市场规模将达到 4 亿美元,到 2030 年将达到 10.8 亿美元,在预测期(2025-2030 年)内,复合年增长率为 21.70%。

这种成长反映了云端原生应用的激增、私有5G的商业化部署以及在提高网路敏捷性的同时降低资本支出的需求。企业青睐基于软体的路由,因为它能够快速扩展、与编配工具整合并支援服务速度,从而加快产品部署速度并降低营运成本。虽然许多超大规模资料中心都在使用开放原始码路由协定栈,但云端供应商正在将虚拟路由功能直接整合到其基础设施即服务(IaaS)中,从而降低了准入门槛。围绕HPE-Juniper等大型併购案的监管审查表明,市场格局正在日趋成熟,规模和产品组合深度正日益决定着企业的成败。

全球虚拟路由器市场趋势与洞察

SDN 和 NFV 架构的日益普及

服务供应商和企业正在整合基础设施,并将路由工作负载迁移到软体,以降低营运成本。交换器加速了服务部署,使网路功能能够在几分钟内而非几週内启动。像义大利 EOLO 这样的营运商已经利用 MANO 部署的虚拟路由器扩展了数千个基地台链路,证明了这种模式在全国范围内的可行性。 SDN 控制器还使提供者能够为需要按延迟或频宽设定檔进行隔离的 5G 服务引入网路切片。因此,企业正在投资编配平台,增加软体工程团队的人员,并将网路营运转型为敏捷的软体管线。

对网路敏捷性和可扩展容量的需求日益增长

混合办公、视讯会议和云端工作负载给传统的广域网路架构带来了巨大压力,这些架构将流量路由到资料中心,导致延迟和成本上升。由中央策略引擎控制的虚拟路由器可以将流量直接导向云端应用,为远端办公人员提供一致的使用者体验。在亚太地区,製造商正在部署可在生产轮班期间重新配置的软体定义路由,因为智慧工厂依赖低延迟链路来运行机器人和物联网感测器。这些部署凸显了虚拟路由器市场如何支援无需现场部署的动态重配置,从而与数位转型专案的速度相符。

多租户虚拟网路功能中的安全漏洞

多租户託管增加了攻击面,因为虚拟路由器共用计算层和虚拟机器管理程式。康考迪亚大学的调查团队发现了可以绕过租户隔离的跨层攻击。为此,ETSI 更新了其 NFV 安全框架,纳入了更强大的能力断言和加密的管理通道。金融服务和政府机构已要求进行额外的渗透测试和审核日誌记录,这将延缓部署速度,但最终将增强平台的安全性。

细分市场分析

到2024年,解决方案产品将占虚拟路由器市场收入的60.3%,证实了软体授权和虚拟设备仍然是企业寻求SD-WAN和NFV功能的主要购买驱动因素。这种主导地位源于路由代码的高价值、对运营商级规模的需求以及这些许可在网路现代化计划中发挥的关键作用。然而,服务才是成长引擎,到2030年将以24.5%的复合年增长率成长,因为企业需要购买设计、迁移和营运方面的专业知识。许多强制执行TIC 3.0的联邦机构都依赖整合商来确保在向软体定义路由过渡期间的合规性。

企业缺乏内部NFV(网路功能虚拟化)人才,因此服务供应商正在将咨询和维运服务打包出售,以确保成功。託管服务越来越多地纳入执行时间和效能的服务等级协议,从而将维运风险从客户转移出去。这种趋势表明,供应商的策略正在转变,他们不再仅仅依靠技术清单,而是开始注重生命週期服务,这强化了虚拟路由器市场的咨询式销售模式。

到2024年,云端基础的部署将占虚拟路由器市场规模的68.7%,复合年增长率将达到25.01%,成为成长最快的模式。企业青睐超大规模云端提供的即时可用性、计量收费的经济模式以及内建的高可用性。微软的虚拟广域网路中心路由策略表明,软体路由将成为云端的原生功能,而非外部设备。虽然在需要本地资料处理的高度监管行业中,本地部署仍然很常见,但随着安全框架的日趋成熟,其成长速度已落后于云端模式。

混合模式应运而生,出于延迟方面的考虑,控制平面部署在云端,而资料平面则保留在本地。供应商透过提供允许实例跨站点免费迁移的授权协议来应对这一趋势,从而推动了混合模式的普及。随着频宽密集型工作负载的激增,云端爆发仍然是关键驱动因素,云端託管路由也逐渐成为新站点的预设选择。

虚拟路由器市场按元件(解决方案和服务)、部署类型(云端基础和本地部署)、最终用户(服务供应商、企业及其他)、应用程式(SD-WAN 和 WAN 边缘、VCPE/边缘路由、VPN 和网路安全及其他)以及地区进行细分。市场预测以美元计价。

区域分析

受云端运算普及和SD-WAN早期部署的推动,北美地区将在2024年占据虚拟路由器市场38.1%的份额。 AT&T等通讯业者正在将核心流量迁移到白盒路由,这清楚地表明软体路由已达到营运商层级。美国各地的企业正在将虚拟路由器整合到零信任架构中,而加拿大服务供应商正在部署虚拟路由器以扩展农村宽频覆盖范围。联邦机构正在推动TIC 3.0合规性,并保持持续的支出动能。

亚太地区将以23.8%的复合年增长率(CAGR)实现最快成长,到2030年,这主要得益于日本、韩国和印度等国政府大力推进的5G网路建设。製造业和采矿业的专用5G网路需要在局部路由来控制自主机器,这为边缘虚拟路由器的发展创造了有利条件。 GSMA预计该地区的专用5G投资将大幅成长,并强调数位转型将推动这一成长。

欧洲持续保持稳定成长,资料主权法律推动了国内云端区域的发展,而这些区域需要软体定义互连。通讯业者正在采用NFV技术以在价格监管下降低成本,欧盟的Gaia-X倡议正在推广开放式数位基础设施和虚拟路由。中东和非洲正在投资智慧城市计划,并鼓励全球供应商试行用于公共网路的边缘路由。拉丁美洲也取得了一些进展,尤其是在寻求可靠云端连接以支持金融科技应用的金融中心。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- SDN 和 NFV 架构的日益普及

- 对网路敏捷性和可扩展容量的需求日益增长

- 与硬体路由器相比,整体拥有成本更低

- 云端运算和边缘运算工作负载的爆炸性成长

- 超大规模资料中心业者所使用的开放原始码虚拟路由协定栈

- 虚拟路由器支援私有的 5G 企业网络

- 市场限制

- 多租户虚拟网路功能中的安全漏洞

- 与传统路由设备整合的挑战

- 虚拟化中不可预测的效能

- 专有许可和供应商锁定

- 产业价值链分析

- 监管环境

- 技术展望

- 产业吸引力:波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测数据

- 按组件

- 解决方案

- 服务

- 依部署类型

- 云端基础的

- 本地部署

- 最终用户

- 服务供应商

- 公司

- 资料中心/云端供应商

- 政府/公共部门

- 透过使用

- SD-WAN 和 WAN 边缘

- vCPE/边缘路由

- VPN和网路安全

- 资料中心互连

- 其他(物联网闸道器、智慧家庭)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 新加坡

- 马来西亚

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Hewlett Packard Enterprise Company

- Broadcom Inc.

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- Arista Networks, Inc.

- VMware, Inc.

- 6WIND SAS

- VyOS(Sentrium SL)

- Netgate(Rubicon Communications)

- Arrcus, Inc.

- netElastic Systems, Inc.

- F5, Inc.

- Fortinet, Inc.

- Versa Networks, Inc.

- Ciena Corporation

- Telco Systems(BATM)

- Kaloom, Inc.

- Radisys Corporation

- Altiostar(Rakuten Symphony)

- Pluribus Networks, Inc.

- Mavenir Systems, Inc.

第七章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The Virtual Router Market size is estimated at USD 0.4 billion in 2025, and is expected to reach USD 1.08 billion by 2030, at a CAGR of 21.70% during the forecast period (2025-2030).

Growth reflects the surge of cloud-native applications, the commercial rollout of private 5G, and the drive to trim capital outlays while boosting network agility. Enterprises prefer software-based routing because it scales rapidly, integrates with orchestration tools, and supports service velocity, enabling faster product rollouts and lower operating expenses. Competitive dynamics also favor the technology: open-source routing stacks now power many hyperscale data centers, while cloud providers embed virtual routing functions directly into infrastructure-as-a-service offerings, flattening barriers to entry. Regulatory scrutiny of large mergers, such as the contested HPE-Juniper deal, signals a maturing landscape where scale and portfolio depth increasingly decide winners.

Global Virtual Router Market Trends and Insights

Rising adoption of SDN and NFV architectures

Service providers and enterprises are shifting routing workloads onto software to consolidate infrastructure and cut operating expenses, achieving up to 60% savings when NFV replaces fixed hardware. The switch accelerates service rollouts because network functions spin up in minutes rather than weeks. Operators such as EOLO in Italy scaled thousands of base-station links with MANO-deployed virtual routers, proving the model works at a nationwide scale. SDN controllers also let providers introduce network slicing for 5G services that need isolation by latency or bandwidth profiles. As a result, companies pour investment into orchestration platforms and staff up software engineering teams, transforming network operations into agile software pipelines.

Growing need for network agility and scalable capacity

Hybrid work, video meetings, and cloud workloads stress legacy WAN architectures that route traffic back to a data center, adding latency and cost. Virtual routers, controlled by central policy engines, steer traffic directly to cloud applications, delivering a consistent user experience for remote staff. In Asia-Pacific, smart factories depend on low-latency links for robotics and IoT sensors, prompting manufacturers to deploy software-defined routing that can be re-provisioned during production shifts. These deployments highlight how the virtual router market supports dynamic reconfiguration without physical truck rolls, matching the speed of digital transformation programs.

Security vulnerabilities in multi-tenant VNFs

Multi-tenant hosting increases attack surfaces because virtual routers share compute layers and hypervisors. Researchers at Concordia University identified cross-layer attacks that can bypass tenant isolation. In response, ETSI updated its NFV security framework to include stronger capability assertions and encrypted management channels. Financial services and government agencies demand additional penetration testing and audit logging, which slows rollouts but ultimately strengthens platform security.

Other drivers and restraints analyzed in the detailed report include:

- Lower total cost of ownership vs. hardware routers

- Proliferation of cloud and edge-computing workloads

- Integration pain-points with legacy routing gear

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solution offerings generated 60.3% of virtual router market revenue in 2024, confirming that software licenses and virtual appliances remain the core purchase for enterprises seeking SD-WAN and NFV capabilities. This dominance is underpinned by the high value of routing code, the need for carrier-grade scale, and the critical role these licenses play in network modernization projects. Services, however, are the growth engine, rising at 24.5% CAGR through 2030 as organizations purchase design, migration, and managed operations expertise. Many federal agencies pursuing TIC 3.0 mandates rely on integrators to ensure compliance while migrating to software-defined routing.

Enterprises lack in-house NFV talent, so service providers package advisory and run-operate services to guarantee success. Managed offerings increasingly embed service-level agreements for uptime and performance, transferring operational risk away from customers. The pattern indicates a strategic pivot, in which vendors differentiate on lifecycle services instead of technical checklists, reinforcing the virtual router market's consultative sales motion.

Cloud-based deployment captured 68.7% of the virtual router market size in 2024 and also posted the fastest 25.01% CAGR. Enterprises value instant availability, pay-as-you-grow economics, and built-in high availability offered by hyperscale clouds. Microsoft's Virtual WAN Hub routing policies illustrate how software routing becomes a native cloud function rather than an external appliance. On-premise deployments remain common in highly regulated sectors requiring local data processing, but their growth lags cloud models as security frameworks mature.

Hybrid patterns emerge in which control planes reside in the cloud while data planes stay on-premises for latency reasons. Vendors respond with licensing that moves instances across sites without additional fees, reinforcing adoption. As bandwidth-intensive AI workloads proliferate, cloud bursting remains a major driver, positioning cloud-hosted routing as the default for new sites.

Virtual Router Market is Segmented by Component (Solution and Service), Deployment Type (Cloud-Based and On-Premise), End-User (Service Provider, Enterprise, and More), Application (SD-WAN and WAN Edge, VCPE/Edge Routing, VPN and Network Security, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest slice of the virtual router market revenue at 38.1% in 2024, boosted by cloud adoption and early SD-WAN rollouts. Telecom operators such as AT&T migrate core traffic to white-box routing, sending a clear signal that software routing is carrier-grade. Enterprises across the United States integrate virtual routers into zero-trust architectures, while Canadian service providers deploy virtual routers to extend broadband in rural regions. Federal agencies' push for TIC 3.0 compliance maintains spending momentum.

Asia-Pacific is the fastest mover at a 23.8% CAGR to 2030, supported by state-backed 5G build-outs in Japan, South Korea, and India. Private 5G networks in manufacturing and mining require localized routing to control autonomous machines, creating fertile ground for edge-ready virtual routers. The GSMA expects private 5G investment in the region to rise sharply, highlighting how digital transformation fuels this expansion.

Europe maintains steady growth as data-sovereignty laws encourage in-country cloud regions that need software-defined interconnects. Telecom operators deploy NFV to cut costs amid price regulation, and the EU's Gaia-X initiative promotes open digital infrastructure aligned with virtual routing. The Middle East and Africa invest in smart-city projects, inviting global vendors to pilot edge routing for public safety nets. Latin America experiences moderate progress, with adoption centered on financial hubs that demand reliable cloud connectivity for fintech applications.

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Hewlett Packard Enterprise Company

- Broadcom Inc.

- Telefonaktiebolaget LM Ericsson

- ZTE Corporation

- Arista Networks, Inc.

- VMware, Inc.

- 6WIND S.A.S.

- VyOS (Sentrium S.L.)

- Netgate (Rubicon Communications)

- Arrcus, Inc.

- netElastic Systems, Inc.

- F5, Inc.

- Fortinet, Inc.

- Versa Networks, Inc.

- Ciena Corporation

- Telco Systems (BATM)

- Kaloom, Inc.

- Radisys Corporation

- Altiostar (Rakuten Symphony)

- Pluribus Networks, Inc.

- Mavenir Systems, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of SDN and NFV architectures

- 4.2.2 Growing need for network agility and scalable capacity

- 4.2.3 Lower total cost of ownership vs. hardware routers

- 4.2.4 Proliferation of cloud and edge-computing workloads

- 4.2.5 Open-source virtual routing stacks used by hyperscalers

- 4.2.6 Virtual routers enabling private 5G enterprise networks

- 4.3 Market Restraints

- 4.3.1 Security vulnerabilities in multi-tenant VNFs

- 4.3.2 Integration pain-points with legacy routing gear

- 4.3.3 Performance unpredictability under virtualization

- 4.3.4 Proprietary licensing and vendor lock-in

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 By Deployment Type

- 5.2.1 Cloud-based

- 5.2.2 On-Premise

- 5.3 By End-user

- 5.3.1 Service Provider

- 5.3.2 Enterprise

- 5.3.3 Data Center/Cloud Provider

- 5.3.4 Government and Public Sector

- 5.4 By Application

- 5.4.1 SD-WAN and WAN Edge

- 5.4.2 vCPE/Edge Routing

- 5.4.3 VPN and Network Security

- 5.4.4 Data Center Interconnect

- 5.4.5 Others (IoT Gateways, Residential)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Singapore

- 5.5.4.6 Malaysia

- 5.5.4.7 Australia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems, Inc.

- 6.4.2 Juniper Networks, Inc.

- 6.4.3 Huawei Technologies Co., Ltd.

- 6.4.4 Nokia Corporation

- 6.4.5 Hewlett Packard Enterprise Company

- 6.4.6 Broadcom Inc.

- 6.4.7 Telefonaktiebolaget LM Ericsson

- 6.4.8 ZTE Corporation

- 6.4.9 Arista Networks, Inc.

- 6.4.10 VMware, Inc.

- 6.4.11 6WIND S.A.S.

- 6.4.12 VyOS (Sentrium S.L.)

- 6.4.13 Netgate (Rubicon Communications)

- 6.4.14 Arrcus, Inc.

- 6.4.15 netElastic Systems, Inc.

- 6.4.16 F5, Inc.

- 6.4.17 Fortinet, Inc.

- 6.4.18 Versa Networks, Inc.

- 6.4.19 Ciena Corporation

- 6.4.20 Telco Systems (BATM)

- 6.4.21 Kaloom, Inc.

- 6.4.22 Radisys Corporation

- 6.4.23 Altiostar (Rakuten Symphony)

- 6.4.24 Pluribus Networks, Inc.

- 6.4.25 Mavenir Systems, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment