|

市场调查报告书

商品编码

1433834

工业自动化软体:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Industrial Automation Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

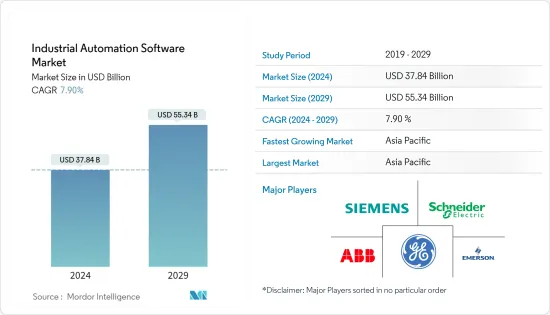

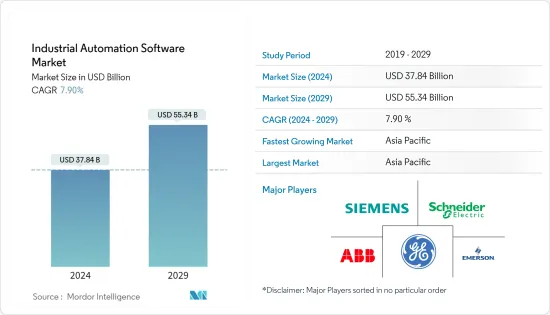

工业自动化软体市场规模预计到 2024 年为 378.4 亿美元,预计到 2029 年将达到 553.4 亿美元,在预测期内(2024-2029 年)复合年增长率为 7.90%。

工业自动化软体是控制整个工业过程的支撑系统。各行业不断增长的动态需求以及复杂的操作和流程正在推动对工业自动化软体的需求。工业自动化有助于减少操作所需的机器时间,而这只有透过强大的软体才能实现。

主要亮点

- 各种类型的工业自动化具有多种优势,包括更轻鬆的监控、减少废弃物和提高生产速度。自动化透过标准化来提高质量,并以更低的成本按时为客户提供可靠的产品。

- 连接工业机械和设备并获取即时资料在采用SCADA、HMI、PLC系统、MES、APM、APC、PLM、OTS等软体、提供可视化的控制系统软体等时发挥重要作用。这些系统有助于减少产品故障、减少停机时间、安排维护、从反应状态过渡到预测状态,并为决策建立规格阶段。

- 工业IoT(IIoT) 和工业 4.0 是物流链开发、生产和管理的新技术方法(称为智慧工厂自动化)的核心。这些是工业领域的主要趋势,机器和设备透过网路连接。

- 然而,实施工业自动化解决方案的初始成本很高。此外,僱用和培训员工来支持解决方案的成本可能会增加总成本并阻碍市场成长。

- 新冠疫情之前製造业出现的趋势包括全球范围内越来越多地采用工业 4.0、随着政府支持和法规的增加,越来越重视製造过程中的工业自动化。此外,MES与ERP层、SCADA与MES层的整合已经崩坏。儘管COVID-19大流行并没有引发工业5.0,但它导致了工业4.0的引入,工业4.0利用了多种智慧製造技术。数位化工作流程和自动化不再是一个目标,而是正在成为一项要求。物联网设备为製造商提供了在这场大流行期间维持收益流的途径。

工业自动化软体市场趋势

SCADA 对市场成长有重大影响

- 监控和资料采集 (SCADA) 软体在过去十年中经历了快速成长。 SCADA 系统可协助最终用户产业的员工分析资料并从远端位置做出关键决策。此外,它还可以在人机介面 (HMI) 上处理、分发和显示资料,有助于透过快速回应来缓解问题。

- SCADA 系统通常具有紧密配合的硬体和软体组件。硬体收集资料并将其输入电脑的处理单元,该单元以不同的时间间隔处理资料。 SCADA 系统记录事件并将它们记录在硬碟上的资料夹或将它们传送到印表机。

- SCADA 系统在许多工业应用中发挥重要作用。在日常业务中使用 SCADA 的行业包括用水和污水系统、发电、输电和配电系统以及石油和天然气系统。例如,在石油和天然气行业,SCADA 用于监控油井和泵站以及水泵压力和管道流量。

- 2022年2月,通用电气(GE)Digital宣布推出最新版本的CIMPLICITY 2022 HMI/SCADA软体。该软体可为各种规模的应用程式提供更快的回应、降低成本、提高安全性并盈利。 CIMPLICITY 还提供本地、云端或混合架构的部署选项,从而降低基础架构和维护成本。

- 人工工资是任何企业最大的支出之一。美国劳工统计局的数据显示,2021年第三季美国工人的人事费用上涨1.3%,创20年来最大涨幅。 SCADA 等工业自动化解决方案可以减少任务所需的劳动时间,从而降低相关的人事费用。

欧洲市场成长显着

- 机器人和自动化产业是德国机械工程领域最具创新性的产业之一。这家德国OEM是世界领先的 R&A 公司之一。人机协作 (HRC) 和机器视觉 (MV) 技术被认为是该全球中心的关键优势,该中心容纳了来自各个细分市场的机器人公司。包括机器学习和深度学习在内的人工智慧领域的技术发展,很可能会带动传统工业机器人和协作机器人的进一步应用。

- SECO 是一家创新嵌入式系统、物联网 (IoT) 和人工智慧 (AI) 解决方案的全球供应商,最近在德国纽伦堡举行的 2022 年嵌入式世界博览会上宣布扩大其人机介面产品系列。除了该公司广泛的 FLEXY VISION 系列之外,HMI产品系列还扩展到包括 Garz & Fricke 的模组化 Proven Concept (PCT) HMI 系列,具有齐平安装、后部安装和麵板安装安装选项、显示智慧和介面。新增了单板计算机,它提供:

- 德国和欧洲的机器视觉产业在过去十年中发展迅速。机器视觉技术的应用不仅在汽车和电子电气行业(包括半导体),还包括金属、食品、包装、非製造业(智慧交通技术、医疗诊断设备、外科技术等)等其他领域。 )正在取得进展。

- 製造技术中心(MTC)和拉夫堡大学产业政策研究中心(IPRC)最近发布的一份报告发现,加速英国工业自动化和机器人技术的采用可以显着提高该国製造业的生产力。还将成立一个新的国家机器人研究中心,透过消除障碍并加速智慧协作机器人技术的普及来推进智慧製造。

- 许多欧盟研究与创新 (R&I) 计画始终支持解决方案和技术的开发,使欧洲製造业能够充分利用数位机会。许多计划均由未来工厂官民合作关係关係资助,涵盖数位自动化、製造资产流程优化、模拟和分析技术以及製造业中小企业的资讯通信技术创新等领域。

工业自动化软体产业概况

工业自动化软体市场竞争适度,由有影响力的参与者组成。在这个市场上占有重要份额的主要企业正致力于扩大海外基本客群。这些公司正在利用策略合作来增加市场占有率并提高收益。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 对品质和可靠製造的自动化需求不断增加

- 对大规模生产的需求不断增加,同时降低了营运成本

- 工业 4.0 和支援技术的快速采用

- 市场限制因素

- 缺乏专家,安全意识下降

- 实施工厂自动化解决方案的成本高昂

第六章市场区隔

- 副产品

- 监控/资料采集 (SCADA)

- 集散控制系统(DCS)

- 製造执行系统(MES)

- 人机介面 (HMI)

- 可程式逻辑控制器(PLC)

- 按最终用户产业

- 电力业

- 汽车产业

- 石油和天然气工业

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Emerson Electric Company

- ABB Ltd

- Siemens AG

- General Electric Company

- Schneider Electric SE

- Honeywell International Inc.

- Rockwell Automation Inc.

- HCL Technologies Limited

- Parsec Automation Corporation

- SAP SE

- Tata Consultancy Services Limited

- Hitachi Ltd

第八章投资分析

第9章市场的未来

The Industrial Automation Software Market size is estimated at USD 37.84 billion in 2024, and is expected to reach USD 55.34 billion by 2029, growing at a CAGR of 7.90% during the forecast period (2024-2029).

Industrial automation software is the support system in controlling the overall industrial process. The increasing dynamic needs of various industries and complex operations and processes are driving the demand for industrial automation software. Industrial automation helps in reducing the machine hours required for operations, which can be made possible only through robust software.

Key Highlights

- The automation of various industries has offered various benefits, such as effortless monitoring, waste reduction, and increased production speed. Automation offers customers improved quality with standardization and dependable products on time and at a much lower cost.

- Connecting industrial machinery and equipment and obtaining real-time data have played a key role in the adoption of SCADA, HMI, and PLC systems, software such as MES, APM, APC, PLM, and OTS, and control system software that offers visualization. These systems help in reducing the faults in the product, reducing downtime, scheduling maintenance, switching from a reactive state to a predictive state, and creating prescriptive stages for decision-making.

- The Industrial Internet of Things (IIoT) and Industry 4.0 are at the center of new technological approaches for the development, production, and management of the logistics chain, otherwise known as smart factory automation. These are dominating trends in the industrial sector, with machinery and devices being connected via the internet.

- However, the initial costs associated with the implementation of industrial automation solutions are high. Additionally, the costs involved in hiring and training employees who are capable of handling the solution add to the total cost, which can hinder market growth.

- The trends that existed in the pre-COVID manufacturing industry include growing adoption of Industry 4.0 throughout the world, increasing emphasis on industrial automation in manufacturing processes with increasing government support, the growing emphasis on regulatory compliance, increasing complexity and integration of supply chains, surging demand for software systems that reduce time and cost and improve overall equipment effectiveness (OEE) and the collapse of the convergence of MES and ERP layers and SCADA and MES layers. While the COVID-19 pandemic has not triggered Industry 5.0, it has brought about the adoption of Industry 4.0, which utilizes several smart manufacturing technologies. Digital workflows and automation are no longer goals; they are becoming necessary requirements. IoT devices have offered manufacturers a path toward preserving revenue streams during this pandemic.

Industrial Automation Software Market Trends

SCADA has a Significant Impact on the Market Growth

- The supervisory control and data acquisition (SCADA) software experienced rapid growth over the past decade. SCADA system helps the end-user industry employees to analyze the data and make crucial decisions from a remote location. It further assists in mitigating the issues with a quick response as it processes, distributes, and displays the data on the human-machine interface (HMI).

- SCADA systems usually function in close coordination with hardware and software components. The hardware collects and feeds data into the processing unit of a computer, which then processes it at varying time intervals. SCADA systems either record and log events into a folder on a hard disk or send them to a printer.

- SCADA systems play an important role in a number of industrial applications. Some of the industries that use SCADA in their daily operations include water and wastewater systems, electric generation, transmission and distribution systems and oil and gas systems. For instance, in the Oil and Gas industry, SCADA is used to monitor well and pumping sites along with distribution pumping pressure and pipeline flow.

- In February 2022, General Electric (GE) Digital announced the launch of its latest version of CIMPLICITY 2022 HMI/SCADA software. For applications of all sizes, the software can deliver fast response, reduced costs, improved security, and increased profitability. CIMPLICITY also provides options to deploy on-prem, in the cloud, or in a hybrid architecture to reduce infrastructure and maintenance costs.

- The labor wage is one of the largest expenses for any business. As per the US Bureau of Labor Statistics, labor costs for workers in the US rose by 1.3% for the third quarter of 2021, which was the largest hike in 20 years. Industrial automation solutions, such as SCADA, enables the reduction in required labor hours for the tasks, thereby reducing the associated labour costs.

Europe Market to Witness Significant Growth

- The robotics and automation industry is one of the most innovative in the German mechanical engineering sectors. German OEMs rank among the world's leading R&A companies. Human-robot collaboration (HRC) and machine vision (MV) technologies are considered the major strengths in a global hub that hosts robotics players from all market segments. Technological developments in the field of artificial intelligence, including machine learning and deep learning, will lead to further applications of conventional industrial robots and collaborative robots.

- Recently, SECO, a global provider of innovative embedded systems, Internet of Things (IoT), and Artificial Intelligence (AI) solutions, presented its expanded Human Machine Interface product portfolio at embedded world 2022 in Nuremberg, Germany. In addition to the company's wide-ranging FLEXY VISION family, the HMI product portfolio was expanded to include the modular Proven Concept (PCT) HMI series by Garz & Fricke with flush mount, rear mount, and panel mount installation options and an accompanying single board computer providing display intelligence and interfaces.

- The machine vision industry in Germany and Europe has been growing at a fast rate over the past decade. Beyond the automotive industry and the electrical and electronics industries (including semiconductors), other sectors - including the metal, food, and packaging, as well as non-manufacturing industries (e.g., intelligent traffic technology, medical diagnostic equipment, and surgical technologies) - are increasingly making use of machine vision technology.

- As per a recent report produced by the Manufacturing Technology Centre (MTC) and Loughborough University's Industrial Policy Research Centre (IPRC), speeding up the adoption of industrial automation and robotics in the United Kingdom could lead to significant improvements in the country's manufacturing productivity. A new national robotics research center is also being set up in the country to advance smart manufacturing by eliminating barriers and accelerating the widespread use of smart collaborative robotics technologies.

- Much EU-based research & innovation (R&I) programs have constantly supported the development of solutions and technologies that enable the European manufacturing sector to fully utilize digital opportunities. Many of the projects are financed by the Factories of the Future Public-Private Partnership as they cover areas such as digital automation, process optimization of manufacturing assets, simulation and analytics technologies, and ICT innovation for manufacturing SMEs.

Industrial Automation Software Industry Overview

The Industrial Automation Software Market is moderately competitive and consists of some influential players. The key players with a noticeable share in the market are concentrating on expanding their customer base across foreign countries. These businesses are leveraging strategic collaborative actions to improve their market percentage and enhance their profitability.

- February 2022 - Emerson announced the opening of a new integrated manufacturing facility at Mahindra World City, in Chennai, Tamil Nadu. The 145,000-square-foot facility will manufacture major products of the company's Automation Solutions business which provides industrial customers in India and across Asia with technologies to improve productivity, safety, and environmental sustainability.

- July 2021 - Rockwell Automation announced the acquisition of Plex Systems for USD 2.22 billion to expand its industrial cloud software offering. Plex Systems is a pure software-as-a-service, cloud-native smart manufacturing platform operating at scale.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Automation for Qualitative and Reliable Manufacturing

- 5.1.2 Growing Need for Mass Production with Reduced Operation Cost

- 5.1.3 Surge in Adoption of Industry 4.0 and Enabling Technologies

- 5.2 Market Restraints

- 5.2.1 Limited Availability of Professionals and Awareness of Security

- 5.2.2 High Implementation Costs for Factory Automation Solutions

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Supervisory Control and Data Acquisition (SCADA)

- 6.1.2 Distributed Control System (DCS)

- 6.1.3 Manufacturing Execution Systems (MES)

- 6.1.4 Human Machine Interface (HMI)

- 6.1.5 Programmable Logic Controller (PLC)

- 6.2 By End-user Industry

- 6.2.1 Power Industry

- 6.2.2 Automotive Industry

- 6.2.3 Oil and Gas Industry

- 6.2.4 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Emerson Electric Company

- 7.1.2 ABB Ltd

- 7.1.3 Siemens AG

- 7.1.4 General Electric Company

- 7.1.5 Schneider Electric SE

- 7.1.6 Honeywell International Inc.

- 7.1.7 Rockwell Automation Inc.

- 7.1.8 HCL Technologies Limited

- 7.1.9 Parsec Automation Corporation

- 7.1.10 SAP SE

- 7.1.11 Tata Consultancy Services Limited

- 7.1.12 Hitachi Ltd