|

市场调查报告书

商品编码

1433853

汽车物流:全球市场占有率分析、产业趋势/统计、成长趋势预测(2024-2029)Global Automotive Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

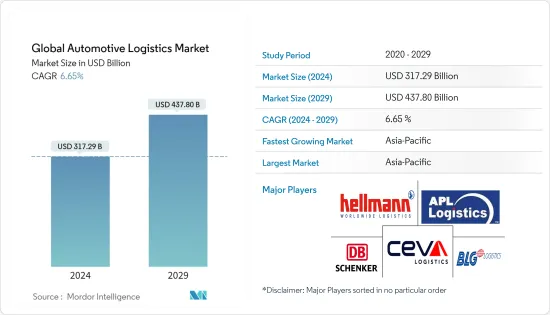

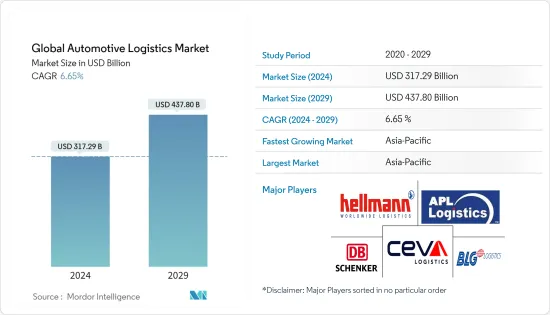

预计2024年全球汽车物流市场规模为3,172.9亿美元,预估2029年将达4,378亿美元,预测期(2024-2029年)复合年增长率为6.65%。

COVID-19 问题对许多行业产生了重大影响,包括旅游业、医疗保健和零售业。汽车产业也因疫情造成的供应链大规模中断而受到严重影响。儘管政府限制逐渐取消,健康问题仍对汽车产业产生重大影响。随着汽车产业的不断发展,物流变得更加复杂。汽车公司正在转向供应链策略来开发新的市场机会、降低成本并保持竞争优势。

主要亮点

- 此外,电动车的引入预计将为全球汽车物流市场带来显着的成长。物流业的公司也为OEM製造商以及层级和层级零件製造商提供仓储和库存管理服务。对这些服务的需求取决于汽车的生产数量。

- 因此,汽车产量高的地区很可能在汽车仓储领域占有较大份额。除了仓储和配送之外,物流服务供应商(LSP)也为OEM提供组装服务。

- 世界各地的汽车製造商正在透过创新的运输解决方案颠覆传统的供应链。例如,2019 年 1 月,雷诺宣布计划为俄罗斯透过线上展示室销售的车辆推出宅配服务。线上展示室的推广是雷诺在俄罗斯销售发展策略的一部分。雷诺已透过该网站销售了 27,000 辆整车,主要是雷诺 Captur 和雷诺 Duster。

- 运输整车的传统方法是滚装/滚装(RORO),但随着汽车行业的分散化和电动车的不断引入,货柜运输变得越来越可行。中国和东南亚的成长为运输和物流公司带来了机会。

- 此外,从中国出发的开发航线也正在采用货柜,特别是在中国和欧洲之间的铁路上。东南亚对汽车销售和物流服务的需求不断增长,被认为是实施容器化的有利地区之一。

- 菲律宾、马来西亚、泰国、越南、柬埔寨等东协市场自贸协定签署后,整车以旧换新不断增加。汽车运输服务提供商 CFR Rinkens 已获得一份合同,透过货柜将宝马汽车从欧洲运输到越南。

汽车物流市场趋势

汽车产销前景广阔,需要高效率的物流服务

儘管存在一些阻力,全球汽车产业的前景仍然乐观。据业内人士透露,全球轻型汽车产量令人印象深刻,并且仍在持续成长。预计亚太地区的产量成长率最高,其次是北美。此外,电动车的生产和销售正以创纪录的速度成长,需要专业的物流。

COVID-19大流行和汽车半导体短缺导致2020年起全球汽车产业需求下降和生产停顿。由于晶片短缺,2021 年全球将有约 1,130 万辆汽车停产,由于汽车产业供应链中断,预计 2022 年还将有 7 辆汽车停产。因疫情而下降的全球汽车销售开始復苏,2021年达到6,670万辆。这一销量预计将在 2022 年下降,2023 年的销量预计仍将低于 2019 年的水平。

在经历了多年的两位数成长之后,中国经济开始放缓。从销量来看,2020年中国拥有最大的汽车市场,约1,980万辆。然而,由于国内冠状病毒的爆发以及对即将到来的景气衰退的担忧,2021年中国的月度汽车销量大幅下降。在有效的遏制措施下,4月市场开始出现復苏迹象,为各大厂商提供了救命稻草。

亚太地区主导市场

根据行业分析,亚太地区预计将占据主要市场份额。这主要归功于中国和印度等新兴经济体。预计有许多因素将推动该地区的汽车物流市场,包括原材料的容易取得、该地区汽车需求的增加、人口的成长以及低工资劳动力的供应。

亚太地区是丰田、马鲁蒂铃木、现代汽车和上汽汽车等主要汽车OEM商的所在地。随着生产和贸易活动的增加,对物流公司管理采购、运输和储存活动以更有效地优化OEM供应链的需求越来越大。

全球物流公司越来越多地进入亚太地区,以利用市场相关的成长。例如,2019年6月,法国物流供应商捷富凯在中国重庆设立了一家专门子公司,专门从事欧洲、俄罗斯和中国之间的铁路车辆进出口业务。此外,本集团的其他物流活动均位于华中地区。

捷富凯计划透过整车行业的活动以及目前在中国汽车行业的入境和售后服务来加强其在中国的OEM供应链。这包括整车的上门服务、预运输、车辆运输、储存、复合设计、营运管理以及国内经销商交付。此外,集团预计中国基础设施驱动的「一带一路」主导将带来对新一代汽车物流的需求增加以及其他发展机会。

「一带一路」影响到该地区大多数国家并制定了重大发展计划。由于多个国家的环境和永续性目标,该地区的电动车销量将显着成长。有能力处理电动车及其零件的物流公司可以从这种情况中受益。

汽车物流行业概况

汽车物流市场较为分散,有大型的全球参与者、较小的本地参与者以及少数拥有市场占有率的参与者。大多数全球物流公司都设有汽车物流部门来满足市场需求和需求。此外,本地企业在库存处理、服务提供、处理产品和技术方面的能力也越来越强。

市场上的第三方物流(3PL)服务供应商在可靠性和供应链能力的基础上展开激烈竞争。公司正试图透过提供高付加服务来使他们的服务脱颖而出。电子商务销售的成长为物流公司在速度、交付等方面带来了机会和挑战。

拥有高资产和资本的全球企业可以投资先进的技术和物流中心,并从上述场景中受益。同时,区域和当地企业正在提出更好的行业解决方案来支援製造商、零售商和经销商的需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 产业价值链分析

- 政府法规和倡议

- 全球物流行业(概述、LPI 分数、主要货运统计数据等)

- 关注全球汽车产业(概况、发展与趋势、统计等)

- 聚焦-电子商务对传统汽车物流供应链的影响

- 逆向物流的回顾与说明(概述、与正向物流相比的挑战等)

- 深入了解汽车售后市场及其物流活动

- 合约物流与综合物流需求聚焦

- COVID-19 对汽车物流市场的影响

第五章市场动态

- 市场驱动因素

- 市场限制因素

- 市场机会

- 产业吸引力-波特五力分析

- 买家/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章市场区隔

- 按服务

- 运输

- 仓储、配送、库存管理

- 其他的

- 按类型

- 成品车

- 汽车零件

- 其他的

- 按地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 义大利

- 俄罗斯

- 法国

- 其他欧洲国家

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中东/非洲

- 南非

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东/非洲

- 亚太地区

第七章 竞争形势

- 公司简介

- Hellmann Worldwide Logistics SE & Co. KG

- APL Logistics Ltd

- BLG Logistics Group AG & Co. KG

- CEVA Logistics

- DB Schenker

- DHL Group

- GEFCO SA

- Kerry Logistics Network Ltd

- Kuehne+Nagel International AG

- Penske Logistics Inc.

- Ryder System Inc.

- DSV Panalpina AS

- Expeditors

- Panalpina

- XPO Logistics Inc.

- Tiba Group

- Bollore Logistics

- CFR Rinkens*

第八章市场的未来

第九章 附录

The Global Automotive Logistics Market size is estimated at USD 317.29 billion in 2024, and is expected to reach USD 437.80 billion by 2029, growing at a CAGR of 6.65% during the forecast period (2024-2029).

The COVID-19 problem has significantly impacted numerous industries, including tourism, healthcare, and retail. Due to the pandemic's extensive disruption of its supply chain, the automotive industry has also been severely impacted. The health issue continues to significantly influence the automotive industry despite a gradual lifting of government restrictions. With the automotive industry continually evolving, logistics are getting complex. Automotive companies are looking toward supply chain strategies to exploit new market opportunities, reduce costs, and maintain competitive advantage.

Key Highlights

- Additionally, the introduction of electric vehicles is projected to offer a key uplift to the global automotive logistics market. The players operating in the logistics industry also offer warehousing and inventory management services to OEMs and Tier I and Tier II component manufacturers. The demand for these services depends on vehicle production.

- Hence, the regions with more vehicle production are likely to have a significant share in the automotive warehousing sector. In addition to warehousing and distribution, logistics service providers (LSPs) also offer assembly services for OEMs.

- Global car makers are disrupting the traditional supply chain with innovative transport solutions. For instance, in January 2019, Renault announced plans to start a home delivery service in Russia for vehicles sold via its online showroom. Promoting the online showroom is part of Renault's sales development strategy in Russia. It has already sold 27,000 finished vehicles via the site, primarily Renault Kaptur and Renault Duster units.

- While roll-on/roll-off (ro-ro) is the traditional method of shipping finished vehicles, containerization is becoming increasingly viable as the automotive industry decentralizes and introduces more EVs. Growth in China and Southeast Asia offers shipping and logistics companies good opportunities.

- Furthermore, the use of containers on developing routes out of China is also being adopted, especially by rail between China and Europe. Southeast Asia is considered one of the favorable regions to make containerization feasible, as the region witnesses growth in vehicle sales and demand for logistics services.

- Following the free trade agreement signed in the ASEAN markets, including the Philippines, Malaysia, Thailand, Vietnam, and Cambodia, trade-in finished vehicles has grown. CFR Rinkens, a vehicle transportation service provider, won a contract to ship BMWs from Europe to Vietnam in containers.

Automotive Logistics Market Trends

Positive Outlook for the Automotive Sales and Production Demands Efficient Logistics Services

Despite some headwinds, the automotive industry looks bright globally. According to industry sources, global light vehicle production unit sales have been remarkable and continue to grow. APAC is expected to register the highest growth rate in terms of production volumes, followed by North America. Furthermore, electric vehicle production and sales are increasing at a record pace, which needs specialized logistics.

The COVID-19 pandemic and automotive semiconductor shortages have resulted in lower demand and production halts for the worldwide automobile sector since 2020. Around 11.3 million vehicles were removed from production globally in 2021 due to the chip shortage, and predictions predict that seven more vehicles will be removed from production in 2022 due to supply chain disruptions in the automotive industry. After experiencing a decline during the pandemic, global auto sales began to rebound, reaching 66.7 million units sold in 2021. It was anticipated that this sales volume would drop in 2022, and the 2023 sales volume is expected to still be below the 2019 levels.

China's economy started to slow down after years of double-digit growth. Based on sales, China had the largest vehicle market, with about 19.8 million units in 2020. However, the coronavirus outbreak in the nation and worries about an impending recession caused monthly auto sales in China to plunge in 2021. Because of effective containment measures, the market began to show indications of recovery in April, giving key manufacturers a lifeline.

Asia-Pacific dominates the Market

As per the industry analysis, the Asia-pacific region is estimated to hold the major market share in the market. This is primarily because of emerging economies such as China and India. Numerous factors, like easy availability of raw materials, increased demand for vehicles in the region, rising population, and availability of low-wage workers, are anticipated to drive the automotive logistics market in the region.

APAC is home to some of the major automotive OEM companies, like Toyota, Maruti Suzuki, Hyundai, and SAIC Motor Corporation Limited, among others. With the increasing production and trading activities, there is a demand for logistics companies to manage the procurement, transport, and storage activities of the OEMs to optimize the latter's supply chain more efficiently.

Global logistics companies are increasingly entering the APAC region to tap the growth associated with the market. For instance, in June 2019, French logistics provider GEFCO set up a dedicated subsidiary in Chongqing (China) to specialize in importing and exporting vehicles by rail between Europe, Russia, and China. Additionally, it is developing the group's other logistics activities in Central China.

Beyond current inbound and aftermarket services in the Chinese automotive sector, GEFCO plans to boost OEM supply chains in China with activity in the finished vehicle sector. These include door-to-door services for complete built-up units, pre-carriage, car transport, storage, compound design, operation management, and domestic distribution to dealers. Furthermore, the group anticipates increasing demand for new-generation automotive logistics and other development opportunities resulting from China's Belt and Road infrastructure-led initiative.

OBOR extends to most of the countries in the region with major development plans. Electric Vehicle sales will witness significant growth in the region, owing to several nation's environmental and sustainability goals. Logistics companies with capabilities to handle EVs and their parts can benefit from this scenario.

Automotive Logistics Industry Overview

The automotive logistics market is fragmented in nature, with large global players, small- and medium-sized local players, and few players who occupy the market share. Most global logistics players have an automotive logistics division to meet the market needs and demand. Additionally, local players are increasingly enhancing their capabilities in terms of inventory handling, service offerings, products handled, and technology.

The third-party logistics (3PL) service providers in the market compete intensely based on reliability and supply chain capacity. By offering value-added services, companies would differentiate their service offerings. The growing e-commerce sales are creating opportunities and challenges for logistics firms in terms of speed, delivery, etc.

Global companies with high assets and capital can invest in advanced technology and distribution centers and benefit from the scenario mentioned above. On the other hand, regional and local players are coming up with better sector solutions to support the needs of manufacturers, retailers, as well as dealers. This industry's major players include Hellmann Worldwide Logistics, APL Logistics, BLG Logistics Group, CEVA Logistics, and DB Schenker.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Industry Value Chain Analysis

- 4.3 Government Regulations and Initiatives

- 4.4 Global Logistics Sector (Overview, LPI Scores, Key Freight Statistics, etc.)

- 4.5 Focus on the Global Automotive Industry (Overview, Development and Trends, Statistics, etc.)

- 4.6 Spotlight - Effect of E-commerce on Traditional Automotive Logistics Supply Chain

- 4.7 Review and Commentary on Reverse Logistics (Overview, Challenges in Comparison with Forwards Logistics, etc.)

- 4.8 Insights on Automotive Aftermarket and its Logistics Activities

- 4.9 Spotlight on the Demand for Contract Logistics and Integrated Logistics

- 4.10 Impact of COVID 19 on Automotive Logistics Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Restraints

- 5.3 Market Opportunities

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Powers of Buyers/Consumers

- 5.4.2 Bargaining Power of Suppliers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing, Distribution, and Inventory Management

- 6.1.3 Other Services

- 6.2 By Type

- 6.2.1 Finished Vehicle

- 6.2.2 Auto Components

- 6.2.3 Other Types

- 6.3 Geography

- 6.3.1 Asia-Pacific

- 6.3.1.1 China

- 6.3.1.2 Japan

- 6.3.1.3 India

- 6.3.1.4 South Korea

- 6.3.1.5 Rest of Asia-Pacific

- 6.3.2 North America

- 6.3.2.1 United States

- 6.3.2.2 Canada

- 6.3.2.3 Mexico

- 6.3.3 Europe

- 6.3.3.1 United Kingdom

- 6.3.3.2 Germany

- 6.3.3.3 Italy

- 6.3.3.4 Russia

- 6.3.3.5 France

- 6.3.3.6 Rest of Europe

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 South Africa

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 Saudi Arabia

- 6.3.5.4 Rest of Middle East & Africa

- 6.3.1 Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 Hellmann Worldwide Logistics SE & Co. KG

- 7.2.2 APL Logistics Ltd

- 7.2.3 BLG Logistics Group AG & Co. KG

- 7.2.4 CEVA Logistics

- 7.2.5 DB Schenker

- 7.2.6 DHL Group

- 7.2.7 GEFCO SA

- 7.2.8 Kerry Logistics Network Ltd

- 7.2.9 Kuehne + Nagel International AG

- 7.2.10 Penske Logistics Inc.

- 7.2.11 Ryder System Inc.

- 7.2.12 DSV Panalpina AS

- 7.2.13 Expeditors

- 7.2.14 Panalpina

- 7.2.15 XPO Logistics Inc.

- 7.2.16 Tiba Group

- 7.2.17 Bollore Logistics

- 7.2.18 CFR Rinkens*

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 GDP Distribution (by Activity - Key Countries)

- 9.2 Insights on Capital Flows - Key Countries

- 9.3 Economic Statistics - Transport and Storage Sector, Contribution to Economy (Key Countries)

- 9.4 Global Automotive Industry Statistics