|

市场调查报告书

商品编码

1433856

纺织品:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Textile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

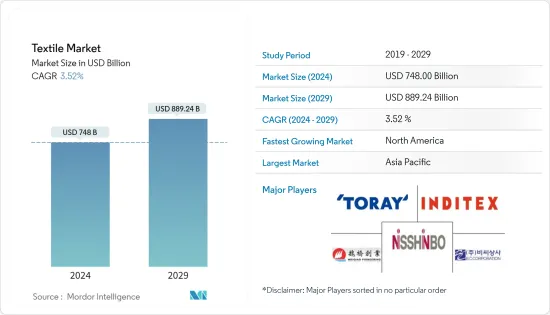

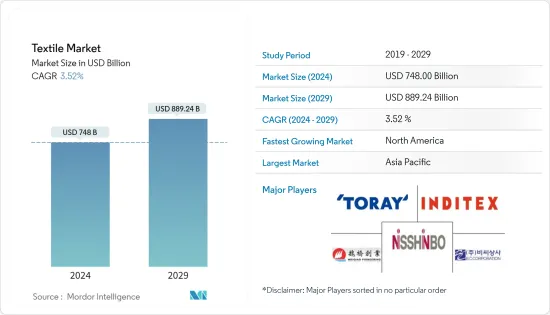

预计2024年纺织品市场规模将达7,480亿美元,预计2029年将达8,892.4亿美元,预测期内(2024-2029年)复合年增长率为3.52%。

COVID-19大流行为2020年的纺织业带来了巨大的挑战。亚洲是全球最大的纺织业市场之一,受到长期封锁和限制的影响,大多数亚洲国家对产品的国际需求急剧下降。在纺织业占出口比重较大的国家,损失尤其严重。国际劳工组织 (ILO) 的一项研究显示,2020 年上半年全球纺织品贸易崩坏。此外,对欧盟、美国、日本等主要采购地区的出口下降了约70%。由于棉花和其他原材料短缺,该行业也遭受了多次供应链中断。

纺织业是一个不断成长的市场,主要竞争对手是中国、欧盟、美国和印度。中国在纺织品和服饰的生产和出口方面均处于世界领先地位。美国是主要的原棉生产国和出口国,也是主要的纺织品和服饰进口国。欧盟(EU)纺织业占世界纺织业的五分之一以上,以德国、西班牙、法国、义大利和葡萄牙为首。印度是第三大纺织品製造国,占全球整体纺织品产量的6%以上。已开发国家和开发中国家的快速工业化和技术进步帮助纺织业拥有了能够高效生产织物的现代化设备。这些因素帮助纺织业在研究期间录得更高的收益,预计也将有助于纺织业在预测期间的进一步发展。

纺织市场趋势

对天然纤维的需求增加

天然纤维复合材料由于比传统纤维相对更轻、强度更高,因此广泛应用于汽车产业的内部和外部应用。从植物和动物中获得的天然纤维包括棉、丝、亚麻、羊毛、亚麻、黄麻和羊绒。这些纤维广泛应用于服饰、服饰、建筑材料、医用敷料、汽车内装等。中国、印度和美国拥有丰富的天然纤维,尤其是棉花,为全球纺织品市场的成长做出了巨大贡献。丝绸有细丝和粗丝之分,可用于室内装饰和服饰。羊毛和黄麻因其弹性、拉伸性和柔软性而被用作纤维材料。棉花、丝绸、羊毛和黄麻等天然纤维消费的增加可能会在预测期内推动全球纺织品市场。

转向不织布

出生率上升和人口老化正在增加对婴儿尿布、卫生棉和成人失禁用品等卫生用品的需求,预计这将推动对不织布的需求。不织布以地工织物的形式用于道路建设,以提高道路的耐用性。与不织布相关的低维护成本预计将推动建筑应用的需求。全球汽车和运输业的积极前景预计将在未来几年进一步推动不织布市场的成长。由于非织造布的耐用性,汽车行业使用不织布来製造许多外部和内部零件。快速工业化和纺织技术领域的最新创新是推动全球不织布需求的其他因素。

纺织业概况

本报告重点介绍了纺织业的主要企业。由于市场竞争激烈且分散,每家公司在全球纺织业的市场占有率都很有限。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察与动态

- 市场概况

- 市场驱动因素

- 市场限制因素/问题

- 市场机会

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 产业创新

- COVID-19 对纺织业的影响

第五章市场区隔

- 目的

- 服饰

- 产业/职能

- 家

- 材料

- 棉布

- 黄麻

- 丝绸

- 合成纤维

- 羊毛

- 过程

- 机织品

- 不织布

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 市场竞争概况

- 公司简介

- Toray Industries Inc.

- BC Corporation

- Industria de Diseno Textil SA(Inditex SA)

- Shandong Weiqiao Pioneering Group Company Limited

- Nisshinbo Holdings Inc.

- Chori Co. Ltd

- Texhong Textile Group Ltd.

- Aditya Birla Nuvo Ltd

- Hyosung TNC Corp.

- PVH Corp.

- Far Eastern New Century Corp

- Arvind Ltd*

第七章 市场的未来

第八章 免责声明

The Textile Market size is estimated at USD 748 billion in 2024, and is expected to reach USD 889.24 billion by 2029, growing at a CAGR of 3.52% during the forecast period (2024-2029).

The COVID-19 pandemic has challenged the textile industry drastically in 2020. Asia, which is one of the largest markets for the textile industry in the world, has suffered from the prolonged lockdowns and restrictions in the majority of Asian countries along with the sudden drop in international demand for their products. The loss was particularly high in countries where the textile industry accounted for a larger share of the exports. According to the study by the International Labour Organization (ILO) the global textile trade collapsed during the first half of 2020. Also, exports to the major buying regions in the European Union, the United States, and Japan fell by around 70%. The industry also suffered several supply chain disruptions due to the shortages of cotton and other raw materials.

The textile industry is an ever-growing market, with key competitors being China, the European Union, the United States, and India. China is the world's leading producer and exporter of both raw textiles and garments. The United States is the leading producer and exporter of raw cotton, while also being the top importer of raw textiles and garments. The textile industry of the European Union comprises Germany, Spain, France, Italy, and Portugal at the forefront with a value of more than 1/5th of the global textile industry. India is the third-largest textile manufacturing industry and is responsible for more than 6% of the total textile production, globally. The rapid industrialization in the developed and developing countries and the evolving technology are helping the textile industry to have modern installations which are capable of high-efficient fabric production. These factors are helping the textile industry to record more revenues during the study period and are expected to help the industry further in the forecast period.

Textile Market Trends

Increasing Demand for Natural Fibers

Natural fiber composites are relatively lighter and have more strength than conventional fibers, and therefore, find extensive application in the automotive industry for interior and exterior applications. Natural fibers obtained from plants and animals include cotton, silk, linen, wool, hemp, jute, and cashmere. These fibers are widely used to manufacture garments, apparel, construction materials, medical dressings, and interiors of automobiles, among others. The abundance of natural fibers, especially cotton, in China, India, and the United States, is contributing significantly to the growth of the global textile market. Silk is used in upholstery and apparel, as it is available in both variations fine as well as coarse. Wool and jute are used as textile materials for their resilience, elasticity, and softness. The increasing consumption of natural fibers, such as cotton, silk, wool, and jute, will drive the global textile market during the forecast period.

Shifting Focus Toward Non-woven Fabrics

The increasing birth rate and aging population has contributed to the growing demand for hygiene products, such as baby diapers, sanitary napkins, and adult incontinence products, which, in turn, is expected to fuel the demand for non-woven fabrics. Nonwovens are used in road construction in the form of geotextiles to increase the durability of roads. Low maintenance costs associated with nonwovens are expected to fuel its demand in construction applications. The positive outlook of the automobile and transportation industry, globally, is further expected to propel growth for the non-woven fabric market over the next years. The automobile industry manufactures a large number of exterior and interior parts using non-woven fabrics owing to their durability. Rapid industrialization and recent innovations in the field of textile technology are other factors fueling demand for non-woven fabrics, globally.

Textile Industry Overview

The report covers the major players operating in the textile industry. In terms of market share, the companies in the global textile industry do not have a considerable amount of market share, as the market is highly competitive and fragmented.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints/Challenges

- 4.4 Market Opportunities

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7 Technological Innovation in the Industry

- 4.8 Impact of COVID-19 on the Textile Industry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Clothing Application

- 5.1.2 Industrial/Technical Application

- 5.1.3 Household Application

- 5.2 Material

- 5.2.1 Cotton

- 5.2.2 Jute

- 5.2.3 Silk

- 5.2.4 Synthetics

- 5.2.5 Wool

- 5.3 Process

- 5.3.1 Woven

- 5.3.2 Non-woven

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Competition Overview

- 6.2 Company Profiles

- 6.2.1 Toray Industries Inc.

- 6.2.2 B.C. Corporation

- 6.2.3 Industria de Diseno Textil SA (Inditex SA)

- 6.2.4 Shandong Weiqiao Pioneering Group Company Limited

- 6.2.5 Nisshinbo Holdings Inc.

- 6.2.6 Chori Co. Ltd

- 6.2.7 Texhong Textile Group Ltd.

- 6.2.8 Aditya Birla Nuvo Ltd

- 6.2.9 Hyosung TNC Corp.

- 6.2.10 PVH Corp.

- 6.2.11 Far Eastern New Century Corp

- 6.2.12 Arvind Ltd*