|

市场调查报告书

商品编码

1433864

eGRC(企业管治、风险与合规)-市场占有率分析、产业趋势与统计、成长预测(2024-2029)Enterprise Governance, Risk And Compliance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

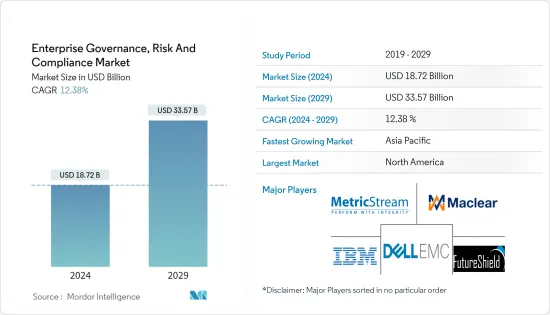

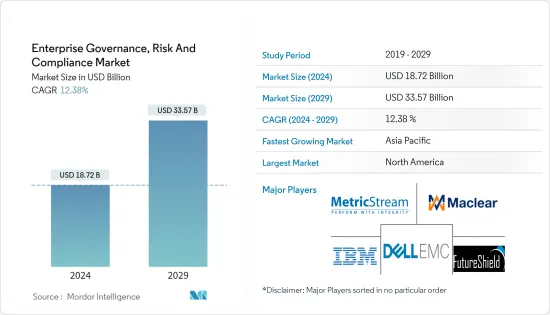

eGRC(企业管治、风险与合规)市场规模预计到 2024 年为 187.2 亿美元,在预测期内(2024-2029 年)预计到 2029 年将达到 335.7 亿美元,复合年增长率为 12.38%年内) 。

组织在复杂且高度动态的全球环境中运作。因此,管理因周围变化的影响而产生的风险和合规性是组织面临的最大挑战之一。

主要亮点

- eGRC 帮助组织预测、理解和全面管理风险。因此,组织能够平衡风险和机会,做出有效的策略决策,并有效地应对公司内部和外部发生的变化。

- 各个最终用户部门引入严格的政府法规和指令,增加了实施满足合规性、审核、风险管理和其他需求的 eGRC 解决方案的需求。大约 57% 的高阶主管将其列为「风险与合规」。作为两大风险类别之一,我们觉得最没有准备好面对它。

- 此外,数位化和大量资料的共用增加了组织之间的威胁,引发了各种形式的网路威胁和攻击。因此,网路安全威胁是 eGRC 软体采用的关键驱动因素之一。对财务估值效率和节省成本解决方案的需求不断增加预计将推动市场成长。

- 然而,对 eGRC 的各种好处缺乏认识,尤其是中小型企业,这阻碍了市场的成长。此外,企业行为准则和组织结构的持续变化可能会抑制市场成长。例如,只有 36% 的组织制定了正式的企业风险管理 (ERM) 计画。

eGRC(企业管治、风险与合规)(eGRC)市场趋势

BFSI 领域的需求预计将大幅成长

- 确保合规性和管理风险已成为业务目标的重要组成部分和企业策略中不可协商的要素。在当今高度法规环境中,新的义务和标准开始生效,遵守监管变化以确保安全已成为任何银行的首要任务。

- 疫情爆发后,全球最大的银行发现网路钓鱼和其他相关攻击激增。有些银行放宽了安全标准,例如允许透过电子邮件转账,以保持业务永续营运。

- 在没有银行内部防火墙保护或监控的情况下存取公司资讯的远端员工是最大的安全威胁之一。

- 网路犯罪分子正在利用 ATM 机诈骗银行客户,并采用银行业务木马、发动勒索软体攻击、部署销售点恶意软体等策略,展现能力。技术进步为全球大多数金融服务供应商提供了支援。对安全性和可靠性的基本需求正在增加。

预计北美将主导市场

- 随着超扩张企业的界限正在消失,北美在全球对公司管治、风险和合规解决方案的需求中占据了很大一部分。

- 随着企业规模的不断扩大,安全风险也随之增加。这一因素导致人们更加关注身分和存取管理,而该国政府制定了更严格的法规。因此,企业必须遵守与身分管理相关的联邦法律、法规、标准和管治。

- 此外,巨量资料、物联网和云端软体等技术的出现预计将推动预测期内GRC软体的成长。因此,近年来网路攻击显着增加。因此,这个因素推动了市场的成长。

- 公司管治、风险和合规策略期望 IT、财务、营运和法律纪律根据要求进行协作,并在不同的法规中应用相同的控制措施。例如,该地区的医院可以使用相同的控制来实现 PCI 合规性,因为企业管治、风险和合规性提供了减少冗余和重复并提高效率和一致性的流程。我们已经确保了这一点。

- 预计北美在预测期内将保持其在收益方面的主导地位。这主要是由于该地区较早采用了公司管治、风险和合规管理解决方案。由于严格的企业管治法规,美国对 EGRC 解决方案的需求最高。

eGRC(企业管治、风险与合规)(eGRC) 产业概述

公司管治、风险与合规市场是一个竞争相对激烈、集中度中等的市场。领先公司采取了新产品开发、收购和合作策略来增强市场占有率。随着最终用户的企业管治和合规政策的发展,功能创新和更新将变得司空见惯。

- 2023 年 6 月 - 综合风险管理 (IRM) 和管治、风险与合规 (GRC) 解决方案供应商 MetricStream 推出了 AiSPIRE,这是业界首款由人工智慧驱动、以知识为中心的 GRC 产品。 AiSPIRE 利用大规模语言模型、基于 GRC 本体的知识图和生成式 AI 功能来释放资料的全部潜力。 AiSPIRE 提供涵盖企业 GRC 各个方面的认知见解,从而提高效率和预测性、资料主导的决策。

- 2023 年 6 月:Copyleaks,一个基于人工智慧的文本分析、抄袭识别和人工智慧内容检测平台,推出了生成式人工智慧管治、风险和合规性(GRC),这是一套完整的保护措施,以确保生成式人工智慧公司的合规性。)降低风险并保护整个组织的敏感资料。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 严格的政府法规和义务

- 与数位化相关的网路安全威胁

- 市场限制因素

- 缺乏意识

- 价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 类型

- 软体

- 服务

- 公司规模

- 中小企业

- 大公司

- 最终用户产业

- BFSI

- 卫生保健

- 製造业

- 资讯科技和电讯

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 公司简介

- Dell EMC

- IBM Corporation

- Maclear LLC

- MetricStream, Inc.

- Future Shield, Inc.

- Oracle Corporation

- SAP SE

- SAS Institute, Inc.

- Wolters Kluwer

- Software AG

第七章 投资分析

第八章市场的未来

The Enterprise Governance, Risk And Compliance Market size is estimated at USD 18.72 billion in 2024, and is expected to reach USD 33.57 billion by 2029, growing at a CAGR of 12.38% during the forecast period (2024-2029).

Organizations operate in a complex and highly dynamic global environment. Hence, managing risk and compliance due to the impact of the changes around is one of the biggest challenges an organization faces.

Key Highlights

- Enterprise GRC helps organizations anticipate, understand, and holistically manage their risks. As a result, organizations can balance risks and opportunities, make strategic decisions effectively, and respond efficiently to the changes occurring within and outside the enterprise.

- Implementing stringent regulations and mandates by the government across various end-user verticals has increased the need to adopt eGRC solutions that fulfill the need for compliance, audit, risk management, etc. Around 57% of senior-level executives rank 'risk and compliance' as one of the top two risk categories they feel least prepared to address.

- Moreover, the rising threats amongst organizations due to digitalization and the sharing of vast data have led to different forms of cyber threats and attacks. Hence, the cybersecurity threat is one of the critical drivers for eGRC software adoption. The increasing need for efficiency in financial assessment and cost-saving solutions is expected to fuel market growth.

- However, a lack of awareness about the various benefits of eGRC, especially in small and medium businesses, has hindered market growth. Furthermore, continuous changes in the company's code of conduct and organizational structures are likely to curb market growth. For instance, only 36% of organizations have a formal enterprise risk management (ERM) program.

Enterprise Governance, Risk and Compliance (eGRC) Market Trends

Demand from BFSI segment is expected to Witness Significant Growth

- Ensuring compliance and managing risks have become vital parts of the business goals and the non-negotiated components of corporate strategy. In the present strict regulatory environment, with new mandates and standards coming into effect, the need to conform to the regulatory changes to ensure safety has emerged to be the priority for any bank.

- Major banks globally saw a sharp increase in phishing and other related attacks after the pandemic. Multiple banks relaxed security standards to maintain business continuity, including authorizing money transfers via e-mail.

- Remote employees with access to company information without banks' internal firewall protections and monitoring are among the biggest security threats.

- Cybercriminals have demonstrated their capabilities against the Mexican financial sector by exploiting ATMs and defrauding bank customers while also employing such tactics as banking Trojans, launching ransomware attacks, and deploying point-of-sale malware.As technological advancements have supported most financial services vendors globally, there is a push toward the fundamental need for security and reliability.

North America Expected to Dominate the Market

- North America accounts for a significant portion of the global demand for enterprise governance, risk, and compliance solutions, owing to the disappearing boundaries in the hyper-extended enterprises.

- With the hyper-extended enterprises, the security risks also grow. This factor has resulted in an increased focus on identity and access management, for which the government in the country is framing stricter regulations. Therefore, enterprises must comply with federal laws, regulations, standards, and governance relevant to identity management.

- Moreover, the emergence of technologies, such as Big Data, IoT, and cloud software, is anticipated to propel the growth of GRC software over the forecast period. Due to this, there has been a significant rise in cyber-attacks in the last few years. Hence, the factor drives the growth of the market.

- With the enterprise governance, risk, and compliance strategy, the IT, finance, operations, and legal domains are expected to collaborate on their requirements to apply the same control to different regulations. For instance, the hospitals in the region use the same control to ensure compliance with PCI, as enterprise governance, risk, and compliance offer a process that reduces redundancy and repetition and improves efficiency and consistency.

- North America is projected to continue its dominance in terms of revenue in the forecast period. This is majorly due to the early adoption of enterprise governance, risk, and compliance management solutions in the region. Demand for EGRC solutions is highest in the US due to stringent corporate governance regulations.

Enterprise Governance, Risk and Compliance (eGRC) Industry Overview

The enterprise governance, risk, and compliance market is relatively a high competitive and moderately concentrated market. The major companies have been using new product development, acquisition, and collaboration strategies to strengthen their market share. Innovation and updating the features are common as corporate governance and compliance policies evolve for the end-users.

- June 2023 - MetricStream, a provider of integrated risk management (IRM) and governance, risk, and compliance (GRC) solutions, launched AiSPIRE, the industry's first AI-powered, knowledge-centric GRC product. AiSPIRE would be leveraging large language models, GRC ontology-based knowledge graphs, and generative AI capabilities to unlock the full potential of an organization's existing GRC and transactional data. By providing cognitive insights across all aspects of enterprise GRC, AiSPIRE enables greater efficiency and predictive and data-driven decision-making.

- June 2023: Copyleaks, an AI-based text analysis, plagiarism identification, and AI-content detection platform, launched its Generative AI Governance, Risk, and Compliance (GRC) solution, a full suite of protection to ensure generative AI enterprise compliance, reduce organization-wide risk, and safeguard proprietary data.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Government Regulations and Mandates

- 4.2.2 Cyber Security Threat Owing to Digitalization

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Software

- 5.1.2 Services

- 5.2 Size of the Enterprise

- 5.2.1 Small and Medium Enterprise

- 5.2.2 Large Enterprise

- 5.3 End-User Industry

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 Manufacturing

- 5.3.4 IT and Telecom

- 5.3.5 Other End-User Vertical

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Dell EMC

- 6.1.2 IBM Corporation

- 6.1.3 Maclear LLC

- 6.1.4 MetricStream, Inc.

- 6.1.5 Future Shield, Inc.

- 6.1.6 Oracle Corporation

- 6.1.7 SAP SE

- 6.1.8 SAS Institute, Inc.

- 6.1.9 Wolters Kluwer

- 6.1.10 Software AG