|

市场调查报告书

商品编码

1433872

防火墙即服务:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Firewall-as-a-Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

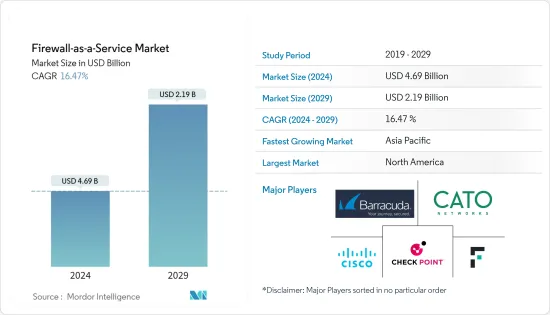

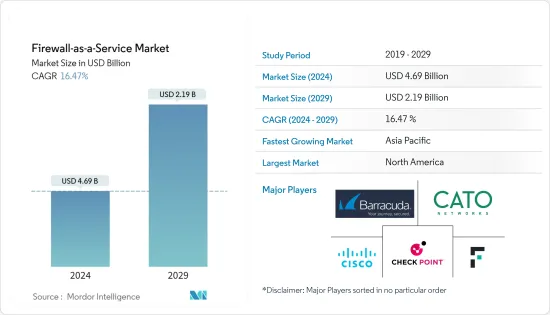

2024年全球防火墙即服务市场规模将达到46.9亿美元,2024-2029年预测期间复合年增长率为16.47%,到2029年将达到21.9亿美元。预计这一数字将达到。

云端基础的防火墙服务为组织提供了多种优势,包括灵活的扩充性、安全存取奇偶校验、迁移安全性、身分保护和安全性效能管理。因此,许多组织实施防火墙即服务来管理云端网路中的资料封包。

主要亮点

- 基于硬体的安全选项变得越来越不常见,普及的扩散导致使用服务交付范例的基于软体的解决方案的实施增加。在过去五年中,这些变更加速了 FWaaS 解决方案以及其他网路和保全服务的普及,从而产生了更具可扩展性和用户友好性的安全解决方案。

- 基于云端基础的应用程式的显着增长、公共云端环境中资料外洩的激增以及企业组织不断变化的防火墙通讯协定是影响防火墙即服务在全球市场中成长的主要因素。然而,整合託管和本地防火墙的复杂性以及低度开发国家缺乏IT基础设施基础设施正在阻碍市场成长。

- 防火墙即服务在 BFSI、政府、IT 和电讯、医疗保健、零售、製造、航太和国防、能源和公共产业各个行业中得到广泛应用,并提供先进的云端基础的网路安全解决方案。随着云端网路上的流量呈指数级增长,组织正在采用防火墙和端点安全等安全解决方案来保护各自云端网路上的资料。

- COVID-19 的影响增加了在家工作和云端的采用。提供远端存取可能会成为 IT 员工待办事项清单的很大一部分。根据 Global Workplace Analytics 的数据,到年终,多达 30% 的员工可能每週在家工作几天。网路安全内部人士调查中超过一半 (54%) 的受访者表示,COVID-19 增加了工作流程和应用程式的云端采用率。此外,约 66% 的受访者预计远距工作者面临的安全威胁将会增加。无论您的使用者在哪里工作,防火墙都应该保护您组织的网路。

防火墙即服务市场趋势

公共云端部署模式预计将占据重要市场占有率

- 随着组织不断将业务转移到云端环境,资料保护和安全漏洞正成为各行业的主要问题,包括金融服务、政府、医疗保健、零售、国防、IT 和通讯等。

- 根据 RedLock Inc. 的报告,全球近一半 (49%) 的资料库未加密,因此很容易受到潜在的网路攻击。此外,超过一半 (51%) 的组织会使用云端储存服务,这增加了在託管环境中运行的应用程式遭受攻击的风险。

- 此外,从传统IT基础设施基础设施转变为云端环境的转变导致端点数量快速增加,需要针对云端平台的高阶防火墙保护服务。

- 市场上的供应商正在回应这项需求,提供增强版的防火墙即服务 (FWaaS) 解决方案,具有 SSL 卸载、内容快取和负载平衡功能,以确保应用程式的顺利处理。世界各地的已开发国家正在采用 FWaaS 作为保护其云端环境并改善整体业务功能的必要服务。

- 2023 年 4 月,Akamai Technologies, Inc. 推出了 Prolexic 网路云端防火墙。 Akamai Prolexic 的这项功能可让客户管理和定义自己的存取控制清单 (ACL),同时为他们提供更大的灵活性来保护自己的网路边缘。 Prolexic 是 Akamai云端基础的DDoS 防护平台,可在攻击到达应用程式、资料中心和网路连线基础架构之前阻止攻击。

预计亚太地区市场将显着成长

- 目前,亚太地区的防火墙即服务采用率最快,大型和小型企业都采用此技术。中国网路攻击日益增多,国防能力亟待提高。然而,该国也有可能成为世界其他地区网路攻击的重要中心。此外,中国的技术进步正在增加连网设备的数量。支援 5G 的设备还将显着提高设备互连性。因此,将有更多的设备连接,从而立即增加市场对安全产品的需求。

- 由于组织日益趋于数位化以及在业务中使用相关技术,中国的网路安全事件正在急剧增加。由于技术进步,连网设备在中国正在兴起。此外,随着支援5G的设备的使用不断增加,设备的互连性也将显着增加,导致对安全产品的需求直接增加,这将显着推动该地区的市场。

- 日本企业和政府对网路安全的兴趣正在迅速增加。针对日本组织的网路攻击的增加促使政府制定新的策略、法律和设施。此外,虽然智慧型手机的普及和各种电器产品的网路连接使生活变得更加方便,但人们每天都面临着资讯被盗的风险。

- 日本寻求与各国进行双边合作,落实网路安全优先事项,包括与美国国土安全部达成协议,以改善和合作遏制各国政府面临的网路威胁。美国国土安全部宣布,2023年1月,美国和日本签署了更新的网路安全合作备忘录,主要旨在加强业务合作。

- 澳洲政府致力于实现到 2030 年成为网路最安全国家的目标,以应对日益增长的网路威胁和对网路安全解决方案不断增长的需求,并致力于确保国家保持持久性和适应性。我们正在投资我们的能力。为了实现这一目标,政府希望使该国成为网路安全产品和服务的公认品牌,并促进国内市场的成长。

防火墙即服务业概述

防火墙即服务市场按 Barracuda Networks, Inc.、Cato Networks、Check Point Software Technologies, Inc.、Cisco Systems, Inc. 和 Forcepoint 等大公司的存在进行细分。市场参与者正在采取合作伙伴关係和收购等策略来增强其产品供应并获得永续的竞争优势。

- 2023 年 2 月 - Fortinet 推出了一款新的 ASIC,预计将更有效、更强大地融合 FortiGate 防火墙核心系列的安全性和网路功能。这款自订晶片采用 7 奈米封装,称为第五代安全处理系统 (FortiSP5),预计将为 FortiGate 系统带来多项性能改进。

- 2022 年 10 月 - 线上安全领导者 McAfee Corp. 在英国推出 McAfee+。这条新产品线包括全新的隐私和身分保护,使用户能够充满信心且安全地过着线上生活。新的 McAfee+ 产品系列首先在美国首次亮相,现在也可在英国使用,为用户提供广泛的个人资料清理服务、ID 恢復帮助、丢失钱包帮助以及针对所有设备的世界级保护免受威胁。获得防御能力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进与约束因素介绍

- 市场驱动因素

- 云端基础的应用程式快速成长

- 公共云端环境中的资料外洩事件迅速增加

- 企业组织中防火墙通讯协定的变化

- 市场限制因素

- 整合託管和本地防火墙的复杂性

- 产业价值链分析

- 工业吸引力 - 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按服务模式

- SaaS

- IaaS

- PaaS

- 按部署模型

- 私人的

- 民众

- 混合

- 依使用者类型

- 大公司

- 中小企业

- 按行业分类

- BFSI

- 资讯科技/通讯

- 卫生保健

- 零售

- 航太/国防

- 由其他行业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中东/非洲

- 北美洲

第六章 竞争形势

- 公司简介

- Barracuda Networks, Inc.

- Cato Networks

- Check Point Software Technologies, Inc.

- Cisco Systems, Inc.

- Forcepoint

- Fortinet, Inc.

- IntraSystems

- Juniper Networks, Inc.

- Microsoft Corporation

- Sprout Technologies Ltd

- Vocus Communications

- Zscaler, Inc.

第七章 投资分析

第八章 市场机会及未来趋势

The Firewall-as-a-Service Market size is estimated at USD 4.69 billion in 2024, and is expected to reach USD 2.19 billion by 2029, growing at a CAGR of 16.47% during the forecast period (2024-2029).

Cloud-based firewall services offer several benefits to organizations, including flexible scalability, secure access parity, security over migration, identity protection, and secure performance management. As a result, many organizations are implementing firewall-as-a-service to manage their data packets in the cloud network.

Key Highlights

- Hardware-based security options are becoming less common, and the implementation of more software-based solutions that use a service delivery paradigm has increased due to widespread cloud adoption. Over the past five years, these changes have accelerated the uptake of FWaaS solutions and other network and security services, bringing about more scalable and user-friendly security solutions.

- The enormous growth in cloud-based applications, the surge in data breaches in the public cloud environment, and ever-changing firewall protocols for business organizations are major factors influencing growth for the firewall-as-a-service in the global market. However, the complexity of integrating hosted firewalls with on-premise firewalls and inadequate IT infrastructures in underdeveloped nations are obstructing market growth.

- Firewall-as-a-service has found a place in various industries such as BFSI, government, IT & telecom, healthcare, retail, manufacturing, aerospace & defense, energy & utilities, and others, offering an advanced cloud-based network security solution for enterprises. As traffic increases exponentially over the cloud network, organizations have adopted security solutions like firewalls and endpoint security to protect their data on their respective cloud network.

- The impact of Covid-19 led to a rise in work-from-home and cloud adoption. The majority of IT employees' to-do lists will be dominated by providing remote access. According to Global Workplace Analytics, up to 30% of the workforce could be working from home multiple days per week by the end of the year. More than half (54%) of a Cybersecurity Insiders survey respondents said Covid-19 increased their cloud adoption for workflows and apps. Furthermore, about 66% of respondents anticipate increased security threats to remote workers. No matter where the users are located while working, firewalls must safeguard the organization's networks.

Firewall-as-a-Service Market Trends

Public Cloud Deployment Model is Expected to Hold Significant Market Share

- As organizations continue to move their operations to cloud environments, data protection, and security breaches have become major concerns across various industries, including financial services, government organizations, healthcare institutions, retail, defense, IT & telecom, and others.

- A report by RedLock Inc. reveals that nearly half (49%) of all databases worldwide are not encrypted, leaving them vulnerable to potential cyber-attacks. Additionally, over half (51%) of organizations are exposed to cloud storage services, increasing the risk of attacks on applications running in hosted environments.

- Furthermore, the shift from traditional IT infrastructure to cloud environments has resulted in a rapid increase in endpoints, necessitating advanced firewall protection services that are specific to cloud platforms.

- Vendors in the market are responding to this demand by offering enhanced versions of firewall-as-a-service (FWaaS) solutions with SSL offloading, content caching, and load balancing to ensure the smooth processing of applications. Developed countries worldwide are adopting FWaaS as a necessary service to protect their cloud environments and improve overall business functions.

- In April 2023, Akamai Technologies, Inc. launched the Prolexic Network Cloud Firewall. This capability of Akamai Prolexic allows customers to manage and define their own access control lists (ACLs) while enabling greater flexibility to secure their own network edge. Prolexic is Akamai's cloud-based DDoS protection platform that stops attacks before they reach applications, data centers, and internet-facing infrastructure.

Asia Pacific Expected to Witness Significant Growth in the Market

- The Asia Pacific region is currently experiencing the fastest adoption of firewall-as-a-service, with both large and small enterprises adopting this technology. China has witnessed an increase in cyberattacks, which has prompted the country to improve its defense capabilities. However, the country also has a good chance of serving as a significant point of origin for cyberattacks in other parts of the globe. Moreover, the number of connected devices has increased in China due to technological advancements. The interconnectivity of the devices will also grow exponentially with 5G-enabled devices. Consequently, there are more connected devices, which immediately increases the market's need for security products.

- Cybersecurity incidents have sharply increased in China as a result of the growing organizational propensity toward digitization and the usage of related technology as part of their operations. Due to technological advancements, there are more connected gadgets in China. Moreover, with the rise in the usage of 5G-enabled gadgets, the interconnectedness of the devices will also significantly increase, which in turn directly increases the need for security products, driving the market significantly within the region.

- Cybersecurity is gaining interest from Japanese enterprises and the government rapidly. The rise in cyberattacks on Japanese organizations prompts the government to establish new strategies, legislation, and facilities. Moreover, the widespread utilization of smartphones and the increasing connection of various electrical appliances to the Internet have made life more convenient but however, had exposed people to the daily risk of information theft.

- Japan is seeking bilateral cooperation with countries to operationalize its cybersecurity priorities, such as the agreement with the U.S. Department of Homeland Security, to improve and collaborate on curbing cyber threats faced by the governments. In January 2023, The United States and Japan signed an updated memorandum of cooperation on cybersecurity mainly to strengthen operational collaboration, as stated by the U.S. Department of Homeland Security.

- The government of Australia is focusing on the goal of becoming the most cyber-secure nation by 2030 as a result of growing cyber threats and demand for cyber security solutions for which the country is investing in enduring and adaptive capabilities. With this aim, the government wants the country to be a recognized brand for cybersecurity products and services, boosting domestic market growth.

Firewall-as-a-Service Industry Overview

The Firewall-as-a-Service market is fragmented with the presence of major players like Barracuda Networks, Inc., Cato Networks, Check Point Software Technologies, Inc., Cisco Systems, Inc., and Forcepoint. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2023 - Fortinet introduced a new ASIC that promises to meld the security and network functions of its core family of FortiGate firewalls more efficiently and powerfully. The custom chip is a 7-nanometer package, called a fifth-generation security processing system or FortiSP5, that promises several performance improvements for the FortiGate system.

- October 2022 - McAfee Corp., a leader in online security, introduced McAfee+ in the UK. This new product line includes all-new privacy and identity protections that let users live their lives online with confidence and security. The new McAfee+ product suite, which first debuted in the US, is now accessible in the UK and gives users access to extensive Personal Data Cleanup services, identity recovery assistance, lost wallet assistance, and the ability to secure all of their devices with world-class defense against threats.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Enormous Growth in Cloud Based Applications

- 4.3.2 Surge in Data Breaches on Public Cloud Environment

- 4.3.3 Everchanging Firewall Protocols for Business Organisations

- 4.4 Market Restraints

- 4.4.1 Complexity in Integrating Hosted Firewalls with On-premise Firewalls

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service Model

- 5.1.1 SaaS

- 5.1.2 IaaS

- 5.1.3 PaaS

- 5.2 By Deployment Model

- 5.2.1 Private

- 5.2.2 Public

- 5.2.3 Hybrid

- 5.3 By User Type

- 5.3.1 Large Enterprises

- 5.3.2 SMEs

- 5.4 By Industry Vertical

- 5.4.1 BFSI

- 5.4.2 IT & Telecom

- 5.4.3 Healthcare

- 5.4.4 Retail

- 5.4.5 Aerospace & Defence

- 5.4.6 Other Industry Verticals

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 Australia

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Rest of Latin America

- 5.5.5 Middle-East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Barracuda Networks, Inc.

- 6.1.2 Cato Networks

- 6.1.3 Check Point Software Technologies, Inc.

- 6.1.4 Cisco Systems, Inc.

- 6.1.5 Forcepoint

- 6.1.6 Fortinet, Inc.

- 6.1.7 IntraSystems

- 6.1.8 Juniper Networks, Inc.

- 6.1.9 Microsoft Corporation

- 6.1.10 Sprout Technologies Ltd

- 6.1.11 Vocus Communications

- 6.1.12 Zscaler, Inc.