|

市场调查报告书

商品编码

1433886

工业电脑断层扫描 - 市场占有率分析、产业趋势与统计、成长预测(2024 年 - 2029 年)Industrial Computed Tomography - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

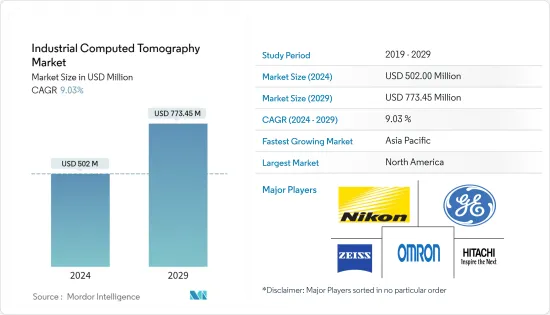

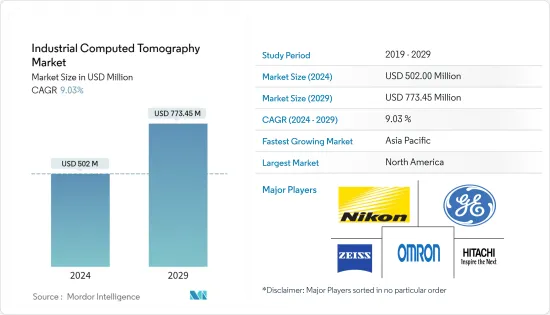

工业电脑断层扫描市场规模预计到 2024 年为 5.02 亿美元,预计到 2029 年将达到 7.7345 亿美元,在预测期内(2024-2029 年)CAGR为 9.03%。

大流行病毒透过自动侦测和监控系统取代了生产线的员工,限制了他们的工作。这增加了工业领域对电脑断层扫描的需求。 For instance, the South Korean government is offering an impetus up to KRW 20 billion (USD 16.8 million) to cover relocation and facility costs for firms relocating to regions outside the capital and up to KRW 15 billion to tech firms relocating to the capital region of首尔.预计这将增加对工业测试、检测和监控系统的需求,从而扩大电脑断层扫描的市场。

主要亮点

- 人们越来越有兴趣将 CT 扫描技术应用于食品生产设施中进行异物检测。主要驱动因素包括零售商要求更高的品质检验制度,而仅靠金属检测技术无法提供这种制度,以及提高产品品质、开拓新客户群或透过提供高品质产品来维持现有客户利润的愿望。

- 航空航太与国防 (A&D) 产业预计将实现全球强劲成长,其中亚太地区处于领先地位,交付量达 16,930 架,约占需求的 40%。这使得 A&D 服务市场达到 33.65 亿美元(资料来源:Cyient,2019 年)。新兴地区对商用飞机的需求不断增长(过去两年空中巴士等主要供应商的交付订单增加就证明了这一点)预计将为航空航太业带来新的机会。

- 此外,柯林斯航太系统公司于 2019 年 6 月在新加坡进行了战略投资,开发了增材製造和 MRO 流程的航空航天创新中心。此类投资为航空航太和国防领域的工业 CT 带来了市场机会。

- 因此,随着航空航太和国防工业的不断发展,用于无损检测的工业X 射线(DR) 和电脑断层扫描(CT) 系统可以满足最关键的航空航天/国防标准,并确保对飞机零件和设备进行安全可靠的检查。材料,从而在检查过程中为操作员提供支持,并促进原型的生产以及抽查样品检查,为该领域工业 CT 市场的增长铺平道路。

工业电脑断层扫描市场趋势

航太将推动工业电脑断层扫描市场

- 航太产业整合了一些对品质最关键的产品,从小型电子感测器到整个复合材料直升机旋翼桨叶,大多数公司都拥有专为提高效率和可重复性而设计的X 光和CT 系统,以确保设备每次都能安全、正确地运作。

- 飞机製造商选择可用于一次性检查涡轮机和活塞发动机等大型零件的 CT 设备,以节省时间和金钱。这些高温合金成分的密度和一致性可以透过工业CT设备进行测试和检查。这些企业或行业的这些机器的高销售量可以推动市场成长。

- Trending 介绍了用于航空航天领域尺寸计量的 X 射线电脑断层扫描,用于对工业零件进行尺寸测量,具有多种优势并可执行任何其他测量技术通常无法完成的无损测量任务。

- 例如,以高资讯密度检查复杂和高价值的积层製造产品,而无需切割或破坏组件。在飞机製造过程中,各种材料和设计概念都要经过 CT 测试程序。此外,由于 CT 可以定量测量材料密度和尺寸,因此可以建立正确的零件模型。透过定量地了解零件在零件座标系中的特征,可以判断是否适合使用。

欧洲将占据主要市场份额

- 由于多个政府严格的安全法规和工业设备的预防性维护,汽车和航空航太产业不断增长的需求鼓励了欧洲工业CT市场的发展。英国、德国、法国和俄罗斯被认为是欧洲工业CT市场最重要的市场之一。英国是欧洲主要的航空航太业,其航空航太收入几乎占全球的17%,仅次于美国。

- 英国航空航太和国防工业规模庞大,拥有世界着名国防承包商之一的BAE系统公司、麦克拉伦、劳斯莱斯等公司。政府对健康和环境的担忧正在导致实施和实施执行旨在提高该部门在管理辐射防护方面的绩效的倡议,导致政府制定了严格的法规。德国在离岸风电计画上投入了大量资金。工业4.0起源于德国,投资数位化的企业需要高水准的测试实验室。

- 法国政府在2019年国防预算中拨出7.58亿欧元用于研发研究,42亿欧元用于服务支持,主要用于飞机维修。该项目的成长带动了该地区对 CT 系统的需求。

- 航空航太和汽车产业对具有详细 3D 视图的大体积扫描需求预计将推动该领域电脑断层扫描的销售。法国是核电的巨大投资者,也是核能的全球领导者。该国拥有许多全球能源产业巨头,例如法国燃气苏伊士集团、法国电力集团和阿海珐集团。不过,减少对非再生能源依赖的努力可能会改变未来几年的市场动态。

工业电脑断层扫描产业概述

工业电脑断层扫描市场竞争相当激烈,由多家参与者组成。就市场份额而言,目前很少有主要参与者占据市场领先地位。这些在市场上占有相当份额的主要参与者的目标是扩大其在其他国家的客户群。这些公司正在利用策略合作计划来扩大市场份额并提高获利能力。随着行业绩效的日益重要和竞争水平的不断提高,市场有望在预测期内实现强劲增长。

- 2020 年 12 月 - 蔡司宣布吸收义大利工业 X 射线系统解决方案供应商 BOSELLO HIGH TECHNOLOGY (BOSELLO),并以 Carl Zeiss X-ray Technologies Srl 的名义运作。凭藉 BOSELLO 的客户客製化解决方案,蔡司朝着成为工业和研究无损测量和测试技术整合解决方案提供者的目标迈出了重要一步。

- 2020 年 12 月 - 尼康推出了一款新的监控套件,该套件将根据全球公认的标准 ASTM E2737 提供功能性和简单性。 ASTM E2737 侦测器评估套件适用于该公司的整个 X 光 CT 侦测、计量和大型 CT 系统。除了全系列领先业界的探测器之外,还支援製造商的所有 X 射线源,包括旋转靶技术和 450kV 微焦点源。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设和市场定义

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 市场概况

- 市场驱动因素与限制简介

- 市场驱动因素

- 解析度和影像处理方面的技术改进

- 对便携式放射成像设备的需求不断增加

- 市场限制

- 工业 CT 系统的购买和维护成本高昂

- 产业吸引力 - 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代产品的威胁

- 竞争激烈程度

- COVID-19 工业电脑断层扫描市场影响的评估

第 5 章:市场细分

- 应用

- 缺陷检测与检验

- 故障分析

- 装配分析

- 其他应用

- 最终用户产业

- 航太

- 汽车

- 电子产品

- 油和气

- 其他最终用户产业

- 地理

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第 6 章:竞争格局

- 公司简介

- Waygate Technologies

- Nikon Corporation

- Omron Corporation

- Zeiss International

- Hitachi Ltd.

- Bruker Corporation

- Thermo Fisher Scientific Inc.

- Shimadzu Corporation

- Comet Group Limited

- 3DX-Ray Limited

第 7 章:投资分析

第 8 章:未来的市场机会

The Industrial Computed Tomography Market size is estimated at USD 502 million in 2024, and is expected to reach USD 773.45 million by 2029, growing at a CAGR of 9.03% during the forecast period (2024-2029).

The pandemic virus has limited employees working on the production lines by replacing them with automated detection and monitoring systems. This has been increasing the demand for the computed tomography in the industrial sector. For instance, the South Korean government is offering an impetus up to KRW 20 billion (USD 16.8 million) to cover relocation and facility costs for firms relocating to regions outside the capital and up to KRW 15 billion to tech firms relocating to the capital region of Seoul. This is expected to boost the demand for industrial testing, detection, and monitoring systems, thereby augmenting the market for the computed tomography.

Key Highlights

- There is an increasing interest in applying CT scanning technology into food production facilities for foreign body detection. The primary drivers include retailers demanding higher quality inspection regimes that cannot be provided by metal detection technology alone and a desire for improved product quality, opening up new customer bases, or maintaining margins with existing customers by delivering high-quality products.

- The aerospace and defense (A&D) industry is positioned for strong global growth, with Asia-Pacific leading the way, with around 40% of the demand accounting for 16,930 deliveries. This makes for an A&D service market of USD 3.365 billion (source: Cyient, 2019). The growing demand for commercial jets from emerging regions (as witnessed in the increase in the delivery orders by key vendors such as Airbus over the last two years) is expected to open up new opportunities in the aerospace industry.

- Also, Collins Aerospace Systems, in June 2019, made a strategic investment in Singapore by developing an aerospace innovation hub for additive manufacturing and MRO processes. Such investments prompt the market opportunity for industrial CT in the aerospace and defense sector.

- Consequently, with the intensification of growth of the A&D industry, industrial X-ray (DR) and computed tomography (CT) systems for non-destructive testing can meet the most critical aerospace/defense standards and ensure safe and reliable inspection of aircraft parts and materials, thereby supporting the operator at the inspection process, and also boosting the production of prototypes, as well as for spot-check sample inspection, paving the way for the growth of industrial CT market in the domain.

Industrial Computed Tomography Market Trends

Aerospace Industry to Drive the Industrial Computed Tomography Market

- The Aerospace industry integrates some of the most quality critical products ranging from a small electronic sensor or an entire composite helicopter rotor blade, most of the companies have X-ray and CT Systems designed for efficiency and repeatability to ensure equipment functions safely and correctly each time.

- Aircraft manufacturers opt for CT equipment that can be used for the inspection of large components such as turbines and piston engines in a single run in order to save time and money. The density and consistency of these superalloys components can be tested and inspected by means of industrial CT equipment. The high sales volume of these machines from such businesses or industries can drive market growth.

- Trending is an introduction to x-ray computed tomography for dimensional metrology in aerospace for performing dimensional measurements on industrial parts, providing several advantages and performing non-destructive measurement tasks that are often impossible with any other measurement technologies.

- For instance, the inspection of complex and high-value additive manufacturing products with a high density of information and without any need to cut or destroy the components. During the manufacturing of an aircraft, various materials and design concepts undergo the testing procedure through CT. Also, because CT allows for quantitative measures of material density and dimensions, it is possible to build a correct model of the part. By knowing quantitatively the features of a component in the part coordinate system, its suitability for service can be judged.

Europe to Hold a Major Market Share

- The development of the industrial CT market in Europe is encouraged by the intensifying demand from the automotive and aerospace industry, because of the strict safety regulations by several governments and preventive maintenance of industrial equipment. The United Kingdom, Germany, France, and Russia have been identified as one of the foremost markets for Industrial CT market in Europe. The United Kingdom is the chief aerospace industry in Europe, with almost 17% of the worldwide revenues in aerospace, second only to the United States.

- The British aerospace and defense industry is vast, with the presence of firms, like BAE Systems, which is one of the world's prominent defense contractors, and McLaren, Rolls Royce, etc. Health and environmental worries by the government is leading to the implementation and execution of initiatives meant at improving the sector's performance at managing radiation protection, leading to stern regulations set by the government. Germany is spending substantially on offshore wind power projects. Industry 4.0 has its roots in Germany, and the businesses investing in digitalization will need a high level of testing labs.

- The French government set EUR 758 million for R&D studies from the defense budget 2019, and EUR 4.2 billion is allocated for service support, majorly dedicated to aircraft maintenance. This project's growth in the region's demand for CT systems.

- Big volume scan requirements in the aerospace and automotive industry with a detailed 3D view are anticipated to drive the sale of computed tomography in the area. France is a massive investor in nuclear power and the global leader in nuclear energy. The country houses numerous global giants in the energy business, such as GDF Suez, EDF, and Areva. Though, attempts are made to decrease dependence on non-renewable sources of energy might amend the dynamics of the market in the future years.

Industrial Computed Tomography Industry Overview

The industrial computed tomography market is reasonably competitive and consists of several players. In terms of market share, few of the key players presently lead the market. These chief players with a substantial share in the market are aiming to expand their customer base across other countries. These companies are leveraging on strategic collaborative initiatives to augment their market share and increase their profitability. With the increasing importance on performance and rising levels of competition in the industry, the market is poised to witness strong growth over and beyond the forecast period.

- December 2020 - ZEISS announced the absorption of BOSELLO HIGH TECHNOLOGY (BOSELLO), an Italian supplier of solutions for industrial X-ray systems to operate under the name of Carl Zeiss X-ray Technologies Srl. With BOSELLO's customer-specific solutions, ZEISS took a significant step towards its goal of becoming an integrated solution provider in non-destructive measurement and testing technology for industry and research.

- December 2020 - Nikon launched a new monitoring kit that will provide functionality and simplicity in accordance with the globally accepted standard, ASTM E2737. The ASTM E2737 Detector Evaluation Package was made available to suit the entire range of the company's X-ray CT inspection, metrology, and large CT systems. All of the manufacturer's X-ray sources are also supported including the rotating target technology and the 450kV microfocus source, in addition to a full range of industry-leading detectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Technology Improvements in Resolution and Image Processing

- 4.3.2 Intensifying Demand for Portable Radiography Equipment

- 4.4 Market Restraints

- 4.4.1 High Acquisition and Maintenace Cost of Industrial CT systems

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the COVID-19 Impact on the Industrial Computed Tomography Market

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Flaw Detection and Inspection

- 5.1.2 Failure Analysis

- 5.1.3 Assembly Analysis

- 5.1.4 Other Applications

- 5.2 End User Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Electronics

- 5.2.4 Oil and Gas

- 5.2.5 Other End User Industries

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Waygate Technologies

- 6.1.2 Nikon Corporation

- 6.1.3 Omron Corporation

- 6.1.4 Zeiss International

- 6.1.5 Hitachi Ltd.

- 6.1.6 Bruker Corporation

- 6.1.7 Thermo Fisher Scientific Inc.

- 6.1.8 Shimadzu Corporation

- 6.1.9 Comet Group Limited

- 6.1.10 3DX-Ray Limited