|

市场调查报告书

商品编码

1433889

示波器:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Oscilloscope - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

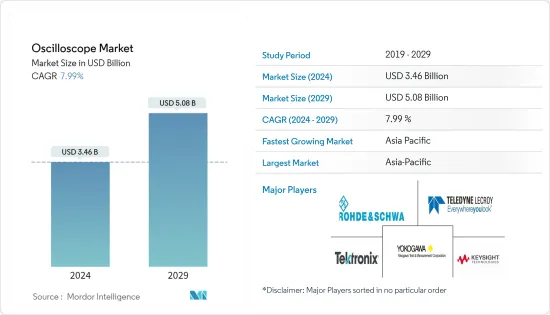

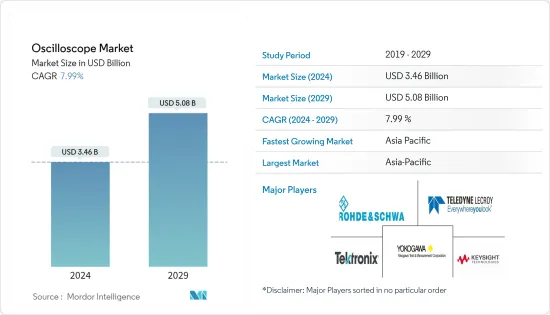

示波器市场规模预计到 2024 年为 34.6 亿美元,预计到 2029 年将达到 50.8 亿美元,预测期内(2024-2029 年)复合年增长率为 7.99%。

对更高准确度的需求,加上安全应用日益增长的要求以及对高速资料传输的需求,正在推动示波器的采用率。此外,所研究的市场的最新趋势包括客户要求的规格不断增加,例如频宽、取样率和储存深度。

工程师需要执行的波形测试范围不断扩大也推动了市场的发展。工程师需要更高的频宽和采样率、更多的通道(类比和数位)以及更深的捕获内存,以在较长的测试週期内保持最大的采样性能。

此外,对高能源效率和高性能电子设备的需求不断增长,以及对模组化仪器的需求不断增长,预计将推动示波器市场的需求。工程师使用示波器来收集资料并理解它。现代示波器具有许多用于分析资料的内建工具,包括追踪和趋势,它可以绘製测量结果以识别异常情况。

示波器市场上的几家主要公司都致力于开发新产品,以在竞争中保持领先。例如,2023年3月,Acute Technology, Inc.宣布推出新款4通道数位储存示波器。新型 TravelScope 3000 (TS3000) 提供 1 GS/s 取样率和 200 MHz频宽。超过 20 种波形测量,具有使用者定义的阈值设置,以及即时更新垂直、时间和通道间定时测量的统计资料。

示波器价格昂贵,因为真空管、电晶体、电容器等元件非常昂贵,维护成本也很高。在规划示波器维修预算时,您需要考虑零件成本和技术人员时间。技术人员每小时申请75 至 100 美元。如果示波器需要重大升级,其成本可能高达 500 美元,这是市场上的一个主要限制。

在 2020 年至 2021 年早期阶段,全球爆发的 COVID-19 对所研究市场的供应链和生产产生了重大影响。自2020年新型冠状病毒感染疾病(COVID-19)爆发以来,製造业面临COVID-19的感染疾病。由于政府强制封锁、严格的安全规程以及由此造成的劳动力短缺,工厂难以管理生产,因此发生了疫情。这促使人们转向工业自动化并扩大了研究市场。此外,由于过度依赖中国(也是疫情的中心)而导致供应链中断,迫使供应链重组并转移到其他国家。

示波器市场趋势

IT和通讯领域成长显着

根据认证威胁情报分析师 (CTIA) 的 2021 年无线产业年度调查,由于电讯业正在蓬勃发展。行动无线资料流量达42兆MB,较2016年成长207%。

示波器可用于分析所有类型的通讯讯号。有一些特殊的示波器可以在 GHz 范围内运作。工程师可以快速分析广播、电视、行动电话和微波讯号。也可以使用特殊探头直接分析电磁讯号。

通讯讯号仅出现在某些电讯应用。这些现在普遍出现在大多数消费者和商业产品中。几乎所有主要的电子设备如传真机、电话和电脑都连接到网络,似乎每个人都拥有行动电话等无线通讯设备。

随着通讯电路在消费性产品中变得越来越普遍,设计和测试工程师除了数位和类比讯号之外还需要表示和检验通讯讯号。这些产品需要快速设计,示波器等测试解决方案至关重要,因为检验通讯讯号对于许多工程师来说是一项相对较新的任务。

即将到来的 5G 技术预计将成为通讯行业标准,开创连接性、速度和可能性的新时代。行动网路的速度将比现在快 100 倍,规模也将比现在大 1,000 倍。随着5G技术的兴起,很少有供应商寻求在城镇推出5G服务。示波器在通讯业中用于测试通讯讯号,因此添加这些通讯服务将推动示波器市场的发展。例如,2023年4月,Gogo商务航空宣布将其Gogo 5G网路扩展到加拿大,为北美商务航空公司提供额外服务。 Gogo 5G预计平均速度达到25Mbps左右,峰值速度在75-80Mbps范围内,让乘客在低吞吐量或高速的情况下享受视讯会议、电视直播、游戏等资料密集型互动服务。可以享受吞吐量。

2022年8月,Bharti Airtel将于本月稍后推出5G服务,并计划在2024年3月覆盖5,000个城镇。这将推动示波器市场的发展。

例如,2022年4月,通讯部表示,通讯服务供应商/基础设施供应商将安装行动铁塔,以提高网路覆盖范围和容量,但须遵守技术商业可行性和部署义务。政府设立了普遍服务义务基金(USOF),以规划和实施各种计划,建造行动塔并为该国农村和偏远地区的人们提供电讯服务。示波器在通讯业中用于提高网路覆盖范围和容量。

预计亚太地区将在预测期内实现最快的成长

随着市场上示波器的应用和需求不断增加,两家公司一直在亚太地区的示波器製造领域进行合作。

例如,2022年8月,Advantest与罗德与施瓦茨RTP高性能示波器合作,对高速SoC测试仪进行大批量评估。根据这种伙伴关係,该公司的目标是根据现代要求提高品质。

它具有每秒 33 次的快速上升时间以及采用分解演算法的强大而稳定的抖动分析,使精确的系统测量变得更加准确和轻鬆。此外,Advantest 还与 R&S RTP 高性能示波器配合,以实现高采集速度和讯号完整性。区域公司之间的这种合作将推动亚太地区示波器市场的成长。

COVID-19感染疾病大大增加了对行动电话网路的需求。根据爱立信移动报告,印度、尼泊尔和不丹估计,2021年至2027年间,印度地区的行动资料总流量将增加四倍。这是因为智慧型手机的使用量正在增加,每部智慧型手机的平均资料流量也在增加。印度地区的海拔高度位居世界第二。

此外,随着印度服务供应商准备今年推出 5G,行动网路将继续在推动经济和社会包容性方面发挥关键作用。随着亚太地区网路服务的日益普及,市场对抖动分析的需求也稳定成长。

此外,亚太地区的资料中心市场成长最快,吸引了许多外国公司越来越多的投资。例如,2022 年 4 月,Digital Edge (Singapore) Holdings Pte. Ltd. 宣布计划透过与 SK Ecoplant 合作在韩国仁川开发资料中心。两家公司将在仁川市富平区国家工业园区内共同兴建120MW超大型资料中心开发计划。

示波器产业概述

示波器市场竞争非常激烈。该市场的参与者竞相生产更快、更小、更具成本效益的设备。随着技术的变化,市场也在变化。这种现象保持了竞争力,因为每个竞争者都可以寻找机会先于其他竞争者创造出更先进的东西。

2023 年 5 月,Pico Technology 宣布对其基于 PC 的 Picscope 9000 系列示波器进行了补充和更新。 PicoScope 9000 系列由两种不同的产品架构组成,以实惠的价格提供高效能。 PicoScope 9000 可轻鬆适应Gigabit资料流品质、射频和微波调变包络以及波形保真度。

2022 年 4 月,全球科技公司是德科技发布了业界首款基于示波器的汽车通讯协定触发和解码解决方案(D9010AUTP)。此解决方案涵盖CAN XL(控制器区域网路eXtraLong),并允许工程师测试低速汽车序列汇流排通讯协定。检验和调试功能简化了 CAN/CAN FD(灵活资料速率)和 CAN XL 等系统的开发和故障排除。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19大流行对市场的影响

第五章市场动态

- 市场驱动因素

- 设计、製造和维修行业对精度和速度的需求日益增长

- 市场限制因素

- 维护成本高、可用性差

第六章市场区隔

- 成分

- 硬体

- 软体

- 类型

- 模拟

- 数位的

- 基于PC

- 最终用户

- 医学/生命科学

- 工程

- 车

- 资讯科技/通讯

- 消费性电子产品

- 航太/国防

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争形势

- 公司简介

- Tektronix, Inc.

- Keysight Technologies Inc.

- Rohde & Schwarz GmbH & CoKG

- Teledyne LeCroy Inc.

- Yokogawa Test & Measurement Corporation

- National Instruments Corporation

- Rigol Technologies, Inc.

- Fluke Corporation

- Siglent Technologies Co. Ltd

- Pico Technology

- B&K Precision Corporation

- Scientech Technologies Pvt. Ltd.

第八章投资分析

第九章 市场机会及未来趋势

The Oscilloscope Market size is estimated at USD 3.46 billion in 2024, and is expected to reach USD 5.08 billion by 2029, growing at a CAGR of 7.99% during the forecast period (2024-2029).

The demand for higher accuracy, coupled with the increasing requirements for safety applications and the necessity for fast data transmission, are driving the adoption rate of oscilloscopes. Moreover, some of the recent trends in the market studied include specification increases demanded by customers, such as bandwidth, sample rate, and memory depth.

The range of waveform testing that engineers need to perform is expanding, which is another driving force for the market. Engineers are demanding higher bandwidths and sampling speeds, more channels (both analog and digital), and deeper capture memories to sustain maximum sampling performance for longer test durations.

Furthermore, the growing demand for power-efficient and high-performance electronic devices and increasing demand for modular instrumentation will drive the demand for the oscilloscope market. Engineers use oscilloscopes to collect data and make sense of it. Modern oscilloscopes have many built-in tools for analyzing data, such as Track and Trend, which graphs measurements to identify anomalies.

Several leading players operating in the oscilloscope market are focusing on developing new products to stay ahead of the competition. For instance, in March 2023, Acute Technology, Inc. announced to launch a new 4-channel digital storage oscilloscope. The new TravelScope 3000 (TS3000) offers a sample rate of 1 GS/s and a bandwidth of 200 MHz. It has over 20 waveform measurements with user-defined threshold settings and real-time updates of vertical, time, and inter-channel timing measurements with statistics.

Oscilloscopes are costly because their components, such as tubes, transistors, and capacitors, are quite expensive, leading to high maintenance costs. When planning a budget for scope maintenance, the cost of the parts and the technician's time must be considered. A technician might bill USD 75 to USD 100 an hour. A scope could cost USD 500 or more if it needs a significant upgrade which has been a considerable market restriction.

The outbreak of COVID-19 across the globe had significantly affected the supply chain and production of the studied market during the initial phase of 2020 and 2021. Since the outbreak of COVID-19 in 2020, the manufacturing sectors have been facing the consequences of the pandemic as factories struggled to manage production due to forced lockdowns by the government, strict safety protocols, and the resultant lack of workforce. This prompted them to switch to industrial automation, which augmented the studied market. Moreover, the disruption of supply chains due to overdependence on China, which was also the pandemic's epicenter, has forced the reorganization and shift of supply chains to other countries.

Oscilloscope Market Trends

IT and Telecommunication Segment to Have a Significant Growth Rate

The telecommunications industry is flourishing owing to increased R&D activity in the sector, as per the 2021 annual wireless industry survey of Certified Threat Intelligence Analysts (CTIA). Mobile wireless data traffic reached 42 trillion MBs, a 207% increase from 2016.

Oscilloscopes can be used to analyze all kinds of communication signals. There are special oscilloscopes that can operate in the GHz range. Engineers can quickly analyze radio, TV, mobile phone, and microwave signals. Special probes can also be used to analyze EM signals directly.

Communications signals were found only in specific telecommunications applications. Now they are common occurrences in most consumer and business products. Almost every major electronic equipment, like faxes, telephones, and computers, is networked, and it seems as if everyone owns a wireless communications device like a cellular phone.

As communications circuitry becomes more common in consumer products, design and test engineers must represent and verify communications signals in addition to digital and analog signals. Because these products must be designed quickly, and verifying communications signals is a relatively new task for many engineers, a test solution, such as an oscilloscope, is essential.

The upcoming 5G technology is expected to become the industry standard for telecommunications, heralding a new era of connectivity, speed, and possibility. Mobile networks will be 100 times faster and 1,000 times larger than they are now. With the increase of 5G technology, few vendors are trying to launch their 5G services in towns and cities. Adding these communication services will drive the market for oscilloscopes because oscilloscopes are used for testing communication signals in the telecom industry. For instance, in April 2023, Gogo Business Aviation announced the expansion of its Gogo 5G network into Canada, providing additional coverage to business aviation operators in North America. Gogo 5G is expected to reach average speeds of around 25Mbps and peak speeds in the 75-80Mbps range, allowing passengers to enjoy data-intensive interactive services such as video conferencing, live TV, and gaming at lower and higher throughput.

In August 2022, Bharti Airtel will launch 5G services later this month to cover 5,000 towns and cities by March 2024. This will drive the market for oscilloscopes.

For instance, in April 2022, the Ministry of Communications stated that Telecom Service Providers/Infrastructure Providers install mobile towers to improve network coverage and capacity, subject to techno-commercial feasibility and the rollout obligation. The government has established the Universal Service Obligation Fund (USOF) to plan and implement various schemes to build mobile towers and provide telecommunications services to people in the country's rural and remote areas. Oscilloscopes are used in the telecommunication industry to improve network coverage and capacity.

Asia Pacific is Expected to Register the Fastest Growth During the Forecast Period

With the increasing applications and demand for oscilloscopes in the market, the companies have been collaborating on manufacturing oscilloscopes in the Asia-Pacific region.

For instance, in August 2022, Advantest Corp. collaborated with the Rohde & Schwarz RTP high-performance oscilloscope for mass production evaluation of high-speed SoC testers. In line with this collaboration, the company aims to improve the quality per the latest requirements.

The unit is expected to have a high-speed rise time of 33 per second and a powerful, highly stable jitter analysis function with the decomposition algorithm, which enables accurate and simpler accurate system measurements. Further, Advantest also collaborated with R&S RTP high-performance oscilloscope for its high acquisition rate and signal integrity. Such collaborations among the regional companies will fuel the market growth of oscilloscopes in the Asia-Pacific region.

The COVID-19 pandemic has dramatically increased the need for cellular networks. According to the Ericsson Mobility Report, India, Nepal, and Bhutan estimated that the total mobile data traffic in the Indian region will grow fourfold between 2021 and 2027. This is due to the increasing use of smartphones, and the average data traffic per smartphone in the India region is the second highest in the world.

Further, mobile networks continue to play a pivotal role in driving economic and social inclusion as service providers in India prepare to launch 5G this year. In line with such an increase in the adoption of network services in the Asia-Pacific region, the need for jitter analysis is bound to increase in the market.

Moreover, the data center market in the Asia Pacific is among the fastest growing and attracting increasing investments from many foreign players. For instance, in April 2022, Digital Edge (Singapore) Holdings Pte. Ltd. announced plans to develop a data center in Incheon, South Korea, through a partnership with SK ecoplant. The companies will jointly build and promote a 120MW hyper-scale data center development project in the National Industrial Complex in Bupyeong-gu, Incheon.

Oscilloscope Industry Overview

The Oscilloscope Market is profoundly competitive. The players within this market compete in manufacturing faster, smaller, and more cost-effective devices. The market changes with the changes in technology. This phenomenon keeps it competitive as each competitor can seek an opportunity to create something more advanced before the others do.

In May 2023, Pico Technology announced additions and updates to its Picoscope PC-based 9000 series oscilloscopes. The PicoScope 9000 series comprises two distinct product architectures, delivering high performance at reasonable prices. The PicoScope 9000s readily address Gigabit data stream quality and RF and microwave modulated envelope and waveshape fidelities.

In April 2022, Keysight Technologies, Inc., a global technology company, released the industry's first oscilloscope-based automotive protocol trigger/decode solution (D9010AUTP). This solution covers CAN XL (Controller Area Network eXtraLong) and enables engineers to test low-speed automotive serial bus protocols. Verification and debug capabilities simplify the development and troubleshooting of systems such as CAN/CAN FD (Flexible Data Rate) and CAN XL.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 The Impact of COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Need For Accuracy And Speed In Designing, Manufacturing, or Repairing Industries

- 5.2 Market Restraints

- 5.2.1 High Maintenance Cost And Lacking Ease of Use

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 Type

- 6.2.1 Analog

- 6.2.2 Digital

- 6.2.3 PC-Based

- 6.3 End-User

- 6.3.1 Medical and Life Sciences

- 6.3.2 Engineering

- 6.3.3 Automotive

- 6.3.4 IT and Telecommunications

- 6.3.5 Consumer Electronics

- 6.3.6 Aerospace and Defense

- 6.3.7 Other End User Industries

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Tektronix, Inc.

- 7.1.2 Keysight Technologies Inc.

- 7.1.3 Rohde & Schwarz GmbH & CoKG

- 7.1.4 Teledyne LeCroy Inc.

- 7.1.5 Yokogawa Test & Measurement Corporation

- 7.1.6 National Instruments Corporation

- 7.1.7 Rigol Technologies, Inc.

- 7.1.8 Fluke Corporation

- 7.1.9 Siglent Technologies Co. Ltd

- 7.1.10 Pico Technology

- 7.1.11 B&K Precision Corporation

- 7.1.12 Scientech Technologies Pvt. Ltd.