|

市场调查报告书

商品编码

1433895

低温运输包装:市场占有率分析、产业趋势、成长预测(2024-2029)Cold Chain Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

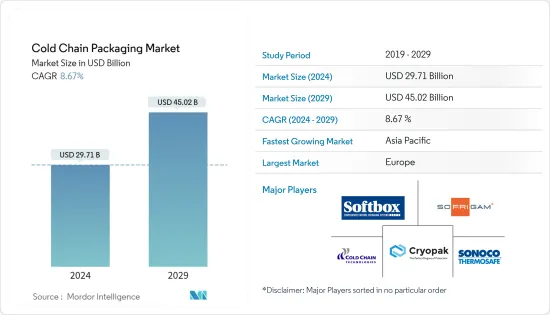

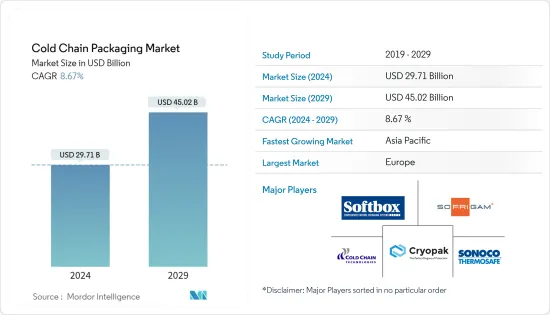

预计2024年低温运输包装市场规模为297.1亿美元,预计到2029年将达到450.2亿美元,在预测期内(2024-2029年)增长8.67%,复合年增长率为

联合国粮食及农业组织估计,考虑到每个国家、每个社会群体以及供应链每个环节的贡献,全球每年有 13 亿吨粮食被浪费。 COVID-19感染疾病带来的粮食系统不稳定使本已可怕的损失变得更加痛苦。

主要亮点

- 各国政府采用低温运输包装,不仅反映了包装的重要性,也有助于扩大市场。例如,2022年6月,主要由印度政府资助的「低温运输、付加和保护基础设施计画」计画报告称,政府将资助低温运输投资,包括加工。

- 低温运输、付加和保鲜基础设施方案旨在提供从农场入口到消费者的无缝整合的低温运输和保鲜基础设施。此策略重点在于发展农场级低温运输基础设施,并提供计划规划的弹性。此外,根据印度政府先前製定的成本参数,有兴趣的投资者可以根据印度政府宣布的综合低温运输和付加基础设施计划获得计划成本35%至50%的补贴。 。

- 此外,鑑于电子商务的激增,预计绝缘包装将在小型电子商务和食品配送形式(包括餐套件和其他生鲜食品和饮料)中实现强劲销售。由于多个装有生鲜产品和冷冻商品的包裹需要良好的隔热性,大流行导致的行为变化意味着包裹将被放置在外面一段时间。因此,疫情预计将进一步增加对低温运输包装解决方案的需求。

- 低温运输包装解决方案对于全球生鲜食品贸易的成长以及食品和保健品的全球供应至关重要。消费者对生鲜食品的需求不断增长、贸易自由化带来的国际贸易成长、有组织的食品零售业的扩张是推动市场成长的一些因素。

- 日益严格的法规,例如《食品安全现代化法案》(要求冷藏保存食品)的有效实施,正在推动市场成长。此外,医疗设备和製药业等各种工业应用不断增长的需求对全球低温运输包装市场做出了重大贡献。

- 然而,最近,由于供需差距扩大,聚苯乙烯价格不稳定,导致价格上涨,并可能在预测期内持续上涨。此外,原材料成本的上涨也增加了最终产品的整体成本。

- 在 COVID-19 之前,使用低温运输解决方案的效率并不是重中之重。大流行期间世界面临的最严峻挑战之一是生产足够的疫苗来为全体人口提供免疫。这是一项艰鉅的任务,目的是确保疫苗在不损坏的情况下分发给公众。疫情带来的封锁和其他限制迫使一些企业改变产业计画或引入宅配选项。此外,这需要高效率的低温运输物流解决方案。消费者意识的增强以及维持重要品质标准的需求进一步增加了需求。

低温运输包装市场趋势

医药产业的成长扩大了低温运输包装市场

- 据 Almac Pharma Services 称,正在开发的生物药物管道变得对温度更加敏感,导致原料药在冷冻温度(-40 至 -70°C)下的储存增加。该公司指出,细胞和基因治疗产品的标籤、包装和分销通常需要在超低温(-20至-80°C)下储存和加工产品,并且产品必须在使用前立即解冻。补充说有。

- 高价值药品大多透过世界各地分销网络的低温运输运输。因此,药品的成长预计将推动低温运输包装市场。根据国际贸易中心统计,同年,根据英国向英国出口的药品价值,比利时是英国产品出口额最大的欧盟成员国,金额约为24.3亿英镑。 。高出口价值表明低温运输包装可以根据包装条件选择,因为它适应温度和运输方式等动态条件。

- 此外,低温运输包装市场直接受到医疗保健产业冷藏药品需求持续成长的影响。从地区来看,低温运输包装市场以欧洲和北美为主。这是因为欧洲和北美国家进出口大量的生物製药。这些地区也是改善药品运输和仓储的创新者。

- 此外,市场也受到政府有关低温运输包装材料使用法规的影响。人们也强烈需要更永续的设计,包括再利用计划,以减少碳排放。对温控包装的兴趣也受到法规和标准变化的影响。例如,ISTA(国际安全运输协会)温度分布在过去五年中发生了变化。预计此类变化将对市场产生影响。

欧洲占最大市场占有率

- 欧洲占据低温运输包装市场的主要份额。由于医疗保健行业对冷藏药品的需求不断增加,预计该市场在预测期内将大幅增长。

- 许多公司将投资和研发工作集中在开发创新的低温运输包装技术上,以在竞争中保持领先地位。例如,2022年5月,益昇华包装与AMD合作创建了新一代时间温度指示器(TTI),这是一种针对製药业的智慧包装技术。英国公司之间的合作旨在结合 AMD 和 Essentra Packaging 的优势,提供相关的未来包装解决方案并提高病患安全。

- 此外,欧洲公司正在透过实施低温运输解决方案在增强药品包装和储存方面取得进展。例如,2022 年 7 月,位于海伦芬的Sharp Corporation工厂扩大了其医疗保健服务范围。Sharp Corporation是合约包装和临床供应服务的领先供应商。该网站增加了标籤和二次包装服务,并增强了现有的临床储存和分销能力,以适应开放和随机临床试验。最初的包装和标籤步骤已经完成。Sharp Corporation目前提供全方位的异地临床服务,包括-80°C至-80°C温度下的二次包装、2至8°C的储存以及作为临床试验材料的QP放行的干冰储存。现在可用。该网站的客户可以获得有关在欧洲发布和分销商品的监管问题的帮助。

- 此外,随着欧洲大陆製药和生命科学公司数量的不断增加,许多欧洲公司正在致力于企业发展,以扩大其国际影响力。例如,2022年2月,德国邮政DHL集团旗下物流公司DHL供应链生命科学与医疗保健(LSHC)部门宣布,今年将投资超过4亿美元,用于扩大药品和医疗设备的分销网络。 。占地面积将减少 27%,增加约 300 万平方英尺。新建筑将拥有完全许可的温控空间,以满足药品储存需求,以及可处理包装和受控运输的整合解决方案。

低温运输包装产业概况

低温运输包装市场适度分散,少数参与者占据了市场主要份额。主要参与者包括 Cold Chain Technologies、Sonoco Thermosafe、Sofrigram、Softbox Systems、Cryopak、Sealed Air Corporation、DGP Intelsius LLC.、Amcor Plc 等。

- 2022 年 3 月 - Cold Chain Technologies, LLC 宣布收购 Packaging Technology Group, LLC,这是一家为生命科学领域提供环保、路边可回收热感包装解决方案的知名供应商。该协议将使包装技术集团公司能够增加对关键永续技术的投资,并为世界各地的客户提供广泛的创新解决方案。

- 2021 年 12 月 - Recycold Cool Solutions BV 是一家环保冷却包製造商,被 Ranpak Holdings Corp 收购。与传统的冰袋不同,Recycold 冰袋由可安全排水的植物凝胶製成。添加以扩展 Ranpak 的低温运输包装解决方案范围。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 製药和医疗保健行业的成长带来市场復苏

- 消费者对生鲜食品的需求增加

- 市场限制因素

- 关于使用低碳材料的政府法规

- 原料成本上涨

- COVID-19 市场影响评估

第五章市场区隔

- 副产品

- 保温容器

- 冷媒

- 温度监测

- 按最终用户使用情况

- 食品

- 乳製品

- 药品

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争形势

- 公司简介

- Pelican BioThermal LLC

- Sonoco Thermosafe

- Cold Chain Technologies Inc.

- Cryopak Industries Inc.

- Sofrigam Company

- Intelsius(A DGP Company)

- Coolpac

- Softbox Systems Ltd.

- Clip-Lok SimPak

- Chill-Pak.com.

第七章 投资分析

第八章市场的未来

The Cold Chain Packaging Market size is estimated at USD 29.71 billion in 2024, and is expected to reach USD 45.02 billion by 2029, growing at a CAGR of 8.67% during the forecast period (2024-2029).

The Food and Agriculture Organization estimates that 1.3 billion metric tonnes of food are wasted worldwide each year, accounting for contributions from every country, every societal group, and every step in the supply chain. The instability in the food system brought on by the COVID-19 epidemic made an already terrible loss even more painful.

Key Highlights

- The adoption of cold chain packaging by various governments not only demonstrates the importance of the packaging but also aids in market expansion. For instance, in June 2022, the "Scheme of Cold Chain, Value Addition and Preservation Infrastructure" plan, which is largely funded by the Indian government, reported that the government provides funding for investments in the cold chain, including processing.

- The Scheme of Cold Chain, Value Addition, and Preservation Infrastructure aims to provide seamless, integrated cold chain and preservation infrastructure facilities from the farm gate to the consumer. With a focus on developing farm-level cold chain infrastructure, the strategy offers project planning flexibility. Additionally, an interested investor may receive a grant or subsidy of 35% to 50% of the project cost based on previously established cost parameters by the government under the scheme for integrated cold chain and value addition infrastructure released by the Government of India.

- Further, considering the spike in e-commerce, insulated packaging is expected to see strong sales with smaller e-commerce and food delivery formats across meal kits and other perishable food and beverage items. As multiple packages containing fresh and frozen items require good insulation, the pandemic-led behavioral change has led to packages being left outdoors for some time. Hence, the pandemic is further expected to witness a significant increase in the demand for cold chain packaging solutions.

- Cold chain packaging solutions are essential to the growth of the global trade in perishable products and the worldwide availability of food and health supplies. The rise in consumer demand for perishable food items, growth of international trade due to trade liberalization, and expansion of the organized food retail industry are some of the factors driving the growth of the market.

- Increasing stringent regulations, such as the effective implementation of the Food Safety Modernization Act (cold storage warehouse requirement to preserve food), drive the market's growth. Additionally, the rising demand from various industrial applications, such as the medical devices and pharmaceutical industries, are significant contributors to the global cold chain packaging market.

- However, in recent times, instability in polystyrene prices, due to the increased gap between demand and supply, has led to a price surge, which is likely to continue during the forecast period. Moreover, the escalated cost of raw materials is boosting the overall cost of the final product.

- Efficiency in using cold chain solutions was never a top priority before COVID-19. While during the pandemic, one of the most difficult challenges facing the globe was to produce enough vaccines to immunize every citizen, which was a huge undertaking to ensure that vaccines were distributed to citizens without spoiling them. Due to lockdowns and other limitations brought on by the outbreak, some businesses were forced to alter their business plans and implement home delivery options. Additionally, this called for efficient cold chain logistics solutions. Demand increased even more due to growing consumer awareness and the necessity of upholding essential quality standards.

Cold Chain Packaging Market Trends

Growth in Pharmaceutical Sector to Augment the Cold Chain Packaging Market

- According to Almac Pharma Services, the pipeline of biological drugs in development is becoming more temperature-sensitive, resulting in an increase in the storage of bulk drug substances at frozen temperatures (-40 to -70 °C). The company adds that labeling, packing, and distributing cell and gene therapy products often requires products to be stored and processed at ultra-low temperatures (-20 to -80 °C), with the products only being defrosted immediately before use.

- The high-value pharmaceutical products are mostly shipped via the cold chain across the entire distribution network worldwide. Thus, pharmaceutical growth is anticipated to propel the cold chain packaging market. According to International Trade Center, the value of exports of pharmaceutical products from the United Kingdom to the European Union show that in that year, Belgium was the EU member with the largest export value of such British goods, amounting to almost 2.43 billion British pounds. The significant export value represents that the packaging conditions may choose cold chain packaging to adapt to dynamic conditions such as temperature, mode of transportation,etc.

- Moreover, the cold chain packaging market is directly influenced by the continuous growth in demand for cold storage medicinal products used in the healthcare industry. Regionally, the cold chain packaging market is dominated by Europe and North America region. This is due to the high number of biopharmaceuticals imports & exports in the countries in Europe and North America. These regions are also the innovators for the improvement in shipping and warehousing of pharmaceutical products.

- Further, the market is witnessing an effect due to government regulations regarding the use of materials in cold chain packaging. There is also a strong demand for more sustainable designs, including re-use programs, to reduce the carbon footprint. The interest in temperature-controlled packaging is also impacted by changing regulations and standards. For instance, ISTA's (International Safe Transit Association) temperature profiles were altered within the past five years. Such changes are anticipated to affect the market.

Europe to Hold the Largest Market Share

- Europe occupies the major share in the cold chain packaging market. The market is expected to grow significantly in the forecast period owing to continuous growth in demand for cold storage medicinal products used in the healthcare industry.

- Many companies have focused on investments and research and development activities on creating innovative cold chain packaging technologies to stay ahead of the competition. For instance, in May 2022, Essentra Packaging collaborated with AMD to create a new generation of Time Temperature Indicators (TTIs), a smart packaging technology for the pharmaceutical industry. The collaboration by the United Kingdom-based companies aims to provide future packaging solutions that are relevant and improve patient safety by combining the strengths of AMD and Essentra Packaging.

- Additionally, European businesses are creating advancements in enhancing pharmaceutical packaging and storage by implementing cold chain solutions. For instance, in July 2022, the Netherlands' Sharp plant in Heerenveen increased the range of healthcare service offerings. Sharp is a prominent player in contract packaging and clinical supply services. Labeling and secondary packaging services have been added to the site to accommodate open and randomized clinical trials, enhancing the clinical storage and distribution capabilities already there. Already finished are the initial packaging and labeling procedures. Sharp can now provide a full range of clinical services out of the facility, including secondary packaging between temperatures of -80°C and -80°C, storage between 2 and 8°C, and on dry ice as QP release for clinical trial materials. The website's customers can get help with regulatory issues to release and distribute items in Europe.

- Furthermore, many European-based businesses are engaged in corporate growth to broaden their reach internationally due to the growing number of pharmaceutical and life sciences enterprises across the continent. For instance, in February 2022, the life sciences and healthcare (LSHC) sector of the Deutsche Post DHL Group's logistics company, DHL Supply Chain, announced that it would invest more than USD 400 million this year to expand its pharmaceutical and medical device distribution network footprint by 27 percent or nearly 3 million additional square feet. The new buildings will have complete licensing, temperature-controlled space that satisfies pharmaceutical storage needs, and integrated solutions that can handle the packing and managed transportation.

Cold Chain Packaging Industry Overview

The cold chain packaging market is moderately fragmented due to a few players having a significant share in the market. Some of the major players are Cold chain Technologies, Sonoco Thermosafe, Sofrigram, Softbox Systems, Cryopak, Sealed Air Corporation, DGP Intelsius LLC., Amcor Plc, among others.

- March 2022 - The acquisition of Packaging Technology Group, LLC, a prominent supplier of environmentally friendly, curbside-recyclable thermal packaging solutions for the life sciences sector, was announced by Cold Chain Technologies, LLC. Through this agreement, the Packaging Technology Group Company will be able to make more investments in vital sustainable technologies and provide its customers worldwide with a wider range of innovative solutions.

- December 2021 - Recycold Cool Solutions BV, a producer of eco-friendly cool packs, has been acquired by Ranpak Holdings Corp. Recycold Cool Packs, which are constructed from a drain-safe, plant-based gel, unlike conventional cool packs, have been added to increase the variety of Ranpak's Cold Chain packaging solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Growth in Pharmaceutical and Healthcare Sector to Boost the Market

- 4.4.2 Increasing Consumer Demand for Perishable Food

- 4.5 Market Restraints

- 4.5.1 Government Regulations Regarding the Use of Materials with Low Carbon

- 4.5.2 Rising Cost of Raw Material

- 4.6 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Insulated Containers

- 5.1.2 Refrigerants

- 5.1.3 Temperature Monitoring

- 5.2 By End User Applications

- 5.2.1 Food

- 5.2.2 Dairy

- 5.2.3 Pharmaceutical

- 5.2.4 Other End-user Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Pelican BioThermal LLC

- 6.1.2 Sonoco Thermosafe

- 6.1.3 Cold Chain Technologies Inc.

- 6.1.4 Cryopak Industries Inc.

- 6.1.5 Sofrigam Company

- 6.1.6 Intelsius (A DGP Company)

- 6.1.7 Coolpac

- 6.1.8 Softbox Systems Ltd.

- 6.1.9 Clip-Lok SimPak

- 6.1.10 Chill-Pak.com.