|

市场调查报告书

商品编码

1433897

光纤测试设备:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Fiber Optic Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

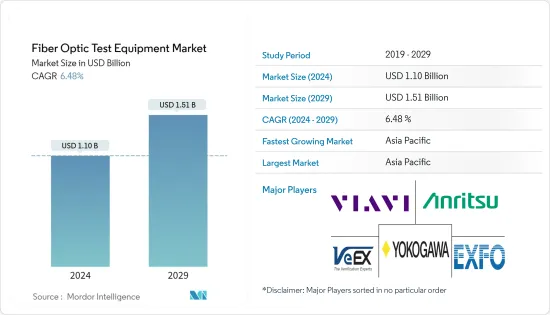

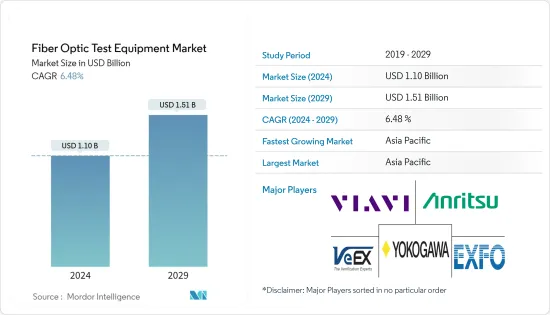

光纤测试设备市场规模预计到 2024 年为 11 亿美元,预计到 2029 年将达到 15.1 亿美元,预测期内(2024-2029 年)复合年增长率为 6.48%。

主要亮点

- 通讯业正在迅速采用光缆来实现高速资料传输,而光缆测试设备在网路系统的製造、检验、现场故障排除和研发阶段的重要性逐年增加。 .它正在增加。整个行业。

- 光纤电缆提高了附近建筑物电脑网路中一栋建筑物内多台电脑的连接速度。此电缆可协助您在网路之间快速移动大型檔案和其他资料。

- 光纤比大多数电力公司使用的传统铜线更可靠,并提供更快、更高频宽的资料传输模式。光纤网路透过脉衝光穿过人类头髮大小的玻璃纤维束来传输资料。当数位讯号通过光传输时,没有外界干扰,讯号损失减少。这使得资料传输网路更加可靠,即使是远距也是如此。

- 由于光纤电缆网路数量的增加,全球光纤测试设备市场预计将成长。随着即时操作需求的增加,成功的服务交付需要持续测试频宽和插入损耗。由于这种需求,全球光纤测试设备市场预计将大幅成长。此外,光纤测试行业属于集中行业,引发了人们对维持最低劳动力水准的担忧。人事费用约占安装成本的一半,其中大部分由重复性任务组成。

- 新的 COVID-19 爆发增加了资料的使用。根据中国领先的创新网路娱乐服务平台猫眼娱乐发布的关于新型冠状病毒肺炎(COVID-19 )感染疾病对中国娱乐业影响的报告显示,电影业受到了疫情的严重打击。我收到了。相较之下,包括电视和串流平台在内的线上娱乐市场正在蓬勃发展,而人们却被限制在家中。

光纤测试设备市场趋势

5G/LTE 网路和固定宽频用户的普及

- 增加的频宽、超低延迟和高速连接正在扩展文明、革新产业并从根本上改善日常体验。电子医疗、连网车辆和运输系统以及先进的行动云端游戏曾经被认为是未来主义。

- 5G 基础设施市场预计将透过实现众多最终用户领域的连接来改变各种宽频服务领域。据GSMA称,5G网路在早期部署试验中已实现约45%的城市覆盖率。中国、印度和其他国家希望在2020年之前部署5G网络,这将需要对支援5G的基础设施进行大量财政投资。

- 小型基地台预计将构成 5G 网路的大部分。它还有望透过消除昂贵的屋顶系统和安装成本来帮助提供者节省资金,并提高行动电话性能和电池寿命。

- 据爱立信称,2016年具有蜂窝连接功能的物联网设备数量预计将达到4亿台,预计将从2016年的4亿台增长到2022年的15亿台。这一强劲成长将得益于产业对建立互联生态系统和标准化 3GPP蜂巢式物联网技术的日益关注。

亚太地区将经历最快的成长

- 资料中心是光纤的最大消费者之一,这使得它们能够以更少的交换器机架和资料资料其他部分之间的连接来提供高速资料传输。资料中心电力消耗,因此研究人员投资增加了低功耗光纤的使用。该地区资料中心数量的增加预计将增加市场对光纤测试设备的需求。

- 根据我国资料中心消费量,目前我国中小型资料中心数量超过40万个,年用电总量达1,000亿度,即每个资料中心约25千万瓦时。每年。此外,国内资料在地化的成长趋势可能会推动资料中心的发展。

- 此外,区域电信业者正在努力加强该地区的 5G 基础设施。例如,全球通讯主导,在印度推出了开放测试和整合中心 (OTIC)。此次合作伙伴包括 Reliance Jio 和中国移动等公司。预计此类努力将持续下去,并可能加速光纤测试设备的市场采用。

- 目前,日本製造的光缆产品以其先进的创新和高端的品质享誉全球。近年来,日本已成为世界领先的光缆生产国和出口国之一。 2021 年 6 月,日本创造了网路速度记录,在 3,001 公里内传输速度达 319 Tb/s。

- 2021年11月,藤仓株式会社宣布,日本藤仓株式会社子公司AFL在威尔特郡斯温顿正式开设新的光缆设施,采用F藤仓的气吹缠绕管光缆(AB-宣布已开始商业化)世贸中心的生产。英国丝带(SWR)纤维技术。

- 印度是全球第二大电讯市场,拥有 11.6 亿用户,并在过去十年中实现了显着成长。 GSM 协会 (GSMA) 编写的一份报告显示,印度的行动经济正在快速成长,预计将对印度的国内生产总值(GDP) 做出重大贡献。

- 据IEEE comsoc.org称,截至2020年11月,印度拥有28万公里的光纤网络,并预计在2020年之前安装多达50万公里的光纤,以实现国家宽频任务设定的目标。 2024 年。

- 所有上述因素预计将在预测期内增加亚太地区对光纤测试设备的需求。

光纤测试设备产业概况

由于市场参与者之间的激烈竞争,光纤测试设备市场变得分散。这些公司也进行了大量投资,为客户提供广泛的特定应用现场测量、监控和维护技术。此外,这些公司不断投资于策略合作伙伴关係、收购和产品开发,以扩大市场占有率。以下是该公司最近的一些倡议:

- 2022 年 3 月 - VIAVI Solutions Inc. 推出适用于 OneAdvisor 800 的 400G 模组,为现场工作的业务服务和网路核心技术人员提供先进的 400G 传输测试和维护功能。透过将传输通讯协定和光纤网路的模组化相结合,OneAdvisor 800 为需要将设备带入现场的技术人员提供了前所未有的测试效能。

- 2022 年 3 月 - EXFO 透过将从 InOpticals Inc. 获得的技术整合到其测试和测量产品组合中,扩展了其电气和光学测试解决方案范围,提供全面的模组化测试解决方案。这为收发器和光学组件的整个端到端流程提供了一流的性能。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 5G/LTE 网路的普及和固定宽频用户的增加

- 扩大光纤网路在电力和公共事业管理、安全和通讯领域的采用

- 市场限制因素

- 测试仪和光纤测试设备高成本

- 缺乏意识和技术知识

第六章市场区隔

- 依设备类型

- 光学光源

- 光功率损耗计

- 光时域反射仪

- 频谱仪

- 远端光纤测试系统

- 其他设备

- 按最终用户使用情况

- 通讯

- 资料中心

- 产业

- 其他最终用户应用程式

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 北美洲

第七章 竞争形势

- 公司简介

- EXFO Inc.

- Anritsu Corporation

- VIAVI Solutions Inc.

- VeEX Inc.

- Yokogawa Corporation

- Kingfisher International

- AFL Global

- Fluke Corporation

- Pelorus Technologies Pvt. Ltd

- Deviser Instruments

- Terahertz Technologies Inc.

- AMS Technologies Ag

第八章投资分析

第9章市场的未来

The Fiber Optic Test Equipment Market size is estimated at USD 1.10 billion in 2024, and is expected to reach USD 1.51 billion by 2029, growing at a CAGR of 6.48% during the forecast period (2024-2029).

Key Highlights

- As the telecommunication industry is rapidly adopting fiber optic cables for attaining high-speed data transfer, the importance of testing equipment for these has increased over the years in manufacturing, inspection, on-field troubleshooting of network systems, as well as research and development phases across the industries.

- With the use of fiber optic cables, connecting several computers in a single building in computer networking nearby structures become faster. This cable aids in the rapid movement of large files and other data between networks.

- Fiber optics provide a more dependable, faster, and higher bandwidth mode of data transfer than traditional copper lines used by most utilities. Fiber optic networks send data by pulsing light via glass fiber strands approximately the size of human hair. When digital signals are sent via light, there is no external interference and reduced signal loss. This results in a more dependable data transmission network, even across vast distances.

- The global fiber optic test equipment market is expected to grow in response to the growing number of fiber cable networks. To deliver successful services, the increased need for real-time operations necessitates continual testing of bandwidth and insertion loss. As a result of this need, the global fiber optic test equipment market is expected to grow significantly. Also, the fiber optics testing sector is labor-intensive, and there are rising concerns about maintaining a minimal workforce. The labor cost is around half of the installation cost and largely consists of repeated labor.

- The outbreak of COVID-19 has increased the usage of data. According to a report on the impact of the COVID-19 pandemic on China's entertainment industry by MaoyanEntertainment, a leading platform providing innovative Internet-empowered entertainment services in China, the movie industry was severely hit by the pandemic. In contrast, the online entertainment market, including TV and streaming platforms, was booming as people were confined to their homes.

Fiber Optic Test Equipment Market Trends

Increasing Penetration Of 5G/LTE Networks And Fixed Broadband Subscription

- Increased bandwidth, ultra-low latency, and faster connectivity are expanding civilizations, revolutionizing industries, and radically improving day-to-day experiences. E-health, networked vehicles and traffic systems, and advanced mobile cloud gaming were formerly considered futuristic.

- The 5G infrastructure market is predicted to transform the realm of various broadband services by enabling connectivity across numerous end-user verticals. According to the GSMA, 5G networks have achieved roughly 45 percent urban coverage in early deployment trials. China, India, and other countries want to deploy a 5G network by 2020, which will necessitate significant financial investment in 5G-capable infrastructure.

- Small cells are projected to make up the majority of 5G networks. They also help providers save money by removing costly rooftop systems and installation expenses, and they are projected to improve mobile handset performance and battery life.

- According to Ericsson, the 400 million IoT devices with cellular connections in 2016 are expected to grow to 1.5 billion by 2022, up from 400 million in 2016. Increased industrial attention on building a connected ecosystem and the standardization of 3GPP cellular IoT technologies are likely to support this strong growth.

Asia Pacific Region to Witness the Fastest Growth

- Data centers are one of the largest consumers of fiber optics, which enables the data centers to provide high-speed data transmission with fewer connections between racks of switches and other parts of the data centers. Owing to the high-power consumption of data centers, researchers have been investing in increasing the use of low-power fiber optics. The rise in the number of data centers in the region is estimated to increase the demand for fiber optic test equipment in the market.

- According to the Energy Consumption of Data Centers in China, the current number of small and medium-sized data centers in China has exceeded 400,000, and the annual total power demand has reached 100 billion kWh, i.e., around 250,000 kWh, for each data center annually. Also, the rising trend of data localization in the country may promote the development of data centers.

- Additionally, the regional telecommunication companies are taking initiatives to strengthen the 5G infrastructure in the region. For instance, global telecommunication collaboratively took the initiative to launch an Open Test and Integration Center (OTIC) in India. This collaboration includes companies such as Reliance Jio and China Mobile. Such initiatives are expected to continue, which may fuel the market adoption of fiber optic test equipment.

- Presently, Japan-made optical fiber cable products are renowned worldwide for their advanced innovations and high-end qualities. Japan has been one of the leading global optical fiber cable producers and exports over the last few years. In June 2021, Japan set an internet speed record by transferring 319 Tb/s over 3,001 km.

- In November 2021, Fujikura Ltd announced that AFL, a subsidiary of Fujikura Ltd, Japan, officially opened its new fiber optic cable facility in Swindon, Wiltshire, starting commercial production of FFujikura'sAir Blown Wrapping Tube Cable (AB-WTC) using Spider Web Ribbon® (SWR®) fiber technology in the United Kingdom.

- India is the world's second-largest telecommunications market with a subscriber base of 1.16 billion and has registered strong growth in the last decade. The Indian mobile economy is growing rapidly, and it is projected to contribute substantially to IIndia'sGross Domestic Product (GDP), according to a report prepared by GSM Association (GSMA).

- According to IEEE comsoc.org, as of November 2020, India had an optical fiber-based network spanning 28 lakh (100,000) kilometers as against the target set up by the National Broadband Mission to deploy as much as 50 lakh kilometers of optical fiber by 2024.

- All of the above factors are expected to grow the demand for fiber optic test equipment in the Asia Pacific region over the forecast period.

Fiber Optic Test Equipment Industry Overview

The fiber optics test equipment market is fragmented due to the high competitive rivalry among the market players. Also, these companies are extensively investing in offering customers a wide range of technologies for application-specific field measurement, monitoring, and maintenance. Moreover, these companies continuously invest in strategic partnerships, acquisitions, and product development to gain more market share. Some of the recent actions by the companies are listed below.

- March 2022 - VIAVI Solutions Inc. introduced a 400G module for the OneAdvisor 800, providing advanced 400G transport test and maintenance functionality for business service and network core technicians working in the field. Combining its transmission protocol and fiber network modularity, the OneAdvisor 800 offers unprecedented testing performance for technicians who must carry their gear into the area.

- March 2022 - EXFO is expanding its range of electrical and optical test solutions by integrating technology acquired from InOpticals Inc. into its test & measurement portfolio to deliver comprehensive, modular test solutions. This brings best-in-class performance across the end-to-end process for transceivers and optical components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Penetration of 5G/LTE Networks and Fixed Broadband Subscription

- 5.1.2 Growing Adoption of fiber optic networks for power and utility management, Security, and Communication

- 5.2 Market Restraints

- 5.2.1 High Cost of Testers and Fiber Optic Test Equipment

- 5.2.2 Lack of Awareness and Technical Knowledge

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Optical Light Sources

- 6.1.2 Optical Power & Loss Meters

- 6.1.3 Optical Time Domain Reflectometer

- 6.1.4 Optical Spectrum Analyzers

- 6.1.5 Remote Fiber Test System

- 6.1.6 Other Equipment Types

- 6.2 By End-user Application

- 6.2.1 Telecommunications

- 6.2.2 Data Centers

- 6.2.3 Industries

- 6.2.4 Other End-user Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle-East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.5.4 Rest of Middle-East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 EXFO Inc.

- 7.1.2 Anritsu Corporation

- 7.1.3 VIAVI Solutions Inc.

- 7.1.4 VeEX Inc.

- 7.1.5 Yokogawa Corporation

- 7.1.6 Kingfisher International

- 7.1.7 AFL Global

- 7.1.8 Fluke Corporation

- 7.1.9 Pelorus Technologies Pvt. Ltd

- 7.1.10 Deviser Instruments

- 7.1.11 Terahertz Technologies Inc.

- 7.1.12 AMS Technologies Ag