|

市场调查报告书

商品编码

1433914

ZigBee:市场占有率分析、产业趋势与统计、成长预测(2024-2029)ZigBee - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

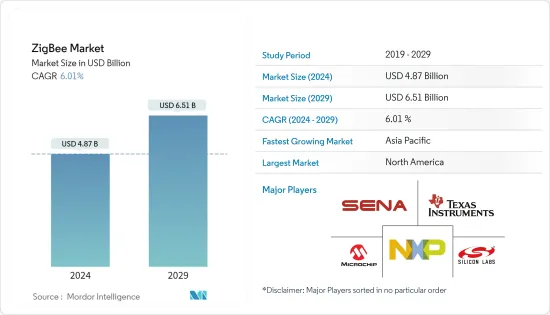

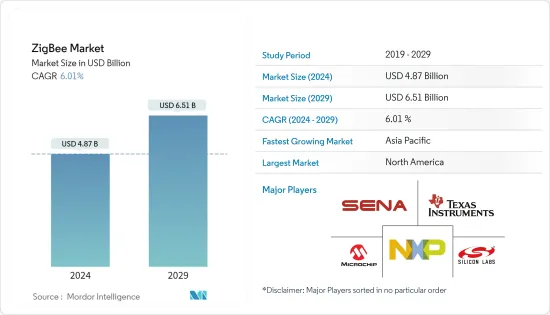

ZigBee市场规模预计到2024年为48.7亿美元,预计到2029年将达到65.1亿美元,在预测期内(2024-2029年)复合年增长率为6.01%。

低成本、低功耗的网膜网路广泛应用于控制和监控应用,覆盖范围从 10 公尺到 100 公尺。此通讯系统比其他专有的短距离无线感测器网路(例如蓝牙或 Wi-Fi 连线)更便宜、更容易。

主要亮点

- 随着智慧型装置的采用趋势不断增长,消费性电子产业的成长预计将推动基于 ZigBee 的通讯服务在新兴国家的应用,这些通讯服务用于基于 IEEE 802.15.4 的装置监控。

- 对具有低成本、低功耗解决方案的 Zigbee 无线网路的广泛部署的需求预计将推动不断增长的市场,这些解决方案可以使用廉价电池运作多年,用于智慧型能源/智慧电网和楼宇自动化系统中的众多监控与控制应用。

- 智慧感测器技术的引入、连接性的增强以及云端运算的进步正在推动工业物联网的采用和发展。这一趋势预计也将推动 ZigBee 在工厂设备需要短距离通讯的小型工业环境中的成长。

- 物联网在智慧家庭应用中不断发展。预计它可以进行定制,以便为用户提供更多控制并增强设备的操作能力。例如,根据投资虚拟实境、扩增实境、人工智慧和机器人技术的创业投资公司Loup Ventures的数据,到2025年,全球智慧音箱市场的收益预计将达到355亿美元。

- ZigBee 网路使用网膜拓扑,允许所有设备(「节点」)相互通讯以形成无线网膜网路。网膜网路可协助设备共用大量路径并定期优化其与其他设备的连接,从而使网膜能够自动从无线电干扰和断开的链路中恢復。

Zigbee市场趋势

自动化的兴起正在推动智慧家庭和建筑领域的发展

- ZigBee 网路主要针对运作时间低于 1% 的低占空比感测器。它是一个基于 IEEE 802.15.4 的套件,由于接近性、低资料速率和低功耗系统功能,可在整个智慧家庭生态系统中实现高水准的通讯。

- Zigbee 使用多种资讯传输机制,包括直接位址、群组位址和广播位址。建立这个互联网通讯协定网膜网路将实现整个楼宇自动化领域的远距资讯通讯。

- 对Hypervolt、HIXAA、SmartRent和其他中小企业等新兴企业的投资不断增加,可能会在预测期内产生对高性能、低功耗物联网MCU市场的需求。行业中基于物联网的新计划将帮助您获得。

- 例如,2022 年,瑞萨电气公司推出了 32 位元 RA 系列微控制器 (MCU)。这款新产品基于 Arm Cortex-M23 内核,提供专为工业自动化、医疗设备、智慧家电和穿戴式装置等物联网端点应用而设计的低功耗消费 MCU。

- 此外,随着对创新家居技术的投资和采用不断增加,消费者开始将声控助理、智慧安防系统等产品视为标准家居用品,而不是多余的奢侈品,因此,整合 Zigbee通讯产品在各个领域正在大力推广。最终用户行业。

北美占最大市场份额

- 智慧家庭在北美正在兴起,该地区的人们对家庭自动化越来越感兴趣。对智慧型手机和行动应用程式的依赖将继续增长,因为智慧型手机为控制智慧家居技术提供了一个有吸引力且直观的视窗。

- 例如,2021 年 10 月,美国能源局(DOE) 向 10 个采用新技术的先导计画拨款 6,100 万美元,这些计画将把数千个家庭和职场改造成最先进的节能结构。宣布。这些连网型社区可以与电网合作优化能源消耗,显着减少碳排放和能源成本。这将进一步推动市场成长。

- 预计约 3000 万美国家庭将添加智慧家居技术,消费者希望添加到家庭中的产品包括连网型摄影机、视讯门铃和连网灯泡,这些产品可以将 Zigbee 标准应用于其通讯连网型。扬声器等。

- 语音驱动的智慧扬声器的采用也在增加,预计大多数美国家庭将安装 Amazon Echo、Google Home 和 Sonos One 等智慧型设备,这将鼓励 Zigbee 连接媒体的采用。在预测期内。

- 根据史丹佛大学和 Avast 最近的一项研究,北美家庭的物联网设备密度是世界上所有地区中最高的。值得注意的是,该地区 66% 的家庭至少拥有一台物联网设备。此外,25% 的北美家庭拥有两台或更多设备。由于强大的云端基础设施、连接设备数量的增加以及该地区人工智慧和机器学习技术的进步,ZigBee 市场预计将成长。

- 到 2022 年,该地区的平均家庭将平均拥有 9 台设备,其中近一半 (48%) 的总合和连接将支援视讯。因此,随着物联网设备的日益普及,这些智慧家庭设备对 ZigBee 晶片的需求预计在预测期内将会增加。

Zigbee产业概述

ZigBee 市场竞争适中,由几个主要企业组成。目前,少数参与者在市场占有率方面占据主导地位。然而,随着互联媒体通讯技术的进步,新的参与者正在增加他们在市场上的影响力,从而扩大企业发展。

- 2021 年 12 月 - Silicon Labs 是安全智慧无线技术领域的先驱,致力于建立更互联的世界,推出了首款 3D虚拟智慧家庭平台。这次互动之旅引导用户了解创新的智慧家庭解决方案、适用的通讯协定和生态系统连结。使用者可以自助游览三个用例:家庭安全、家庭自动化和健康,以及协同工作的通讯协定和生态系统。

- 2021 年 11 月 - Microchip Technology 宣布在其智慧嵌入式视觉倡议中为使用 PolarFire RISC-V系统晶片(SoC) 现场可程式闸阵列(FPGA) 的设计人员推出第二款开发工具。 PolarFire 装置是业界同类产品中功耗最低的 SoC FPGA,具有双 4K 视讯处理功能和丰富的作业系统,包括即时作业系统 (RTOS) 和 Linux。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 工业自动化和智慧家庭中越来越多地采用连网型设备

- 整个物联网生态系统中高性能设备成本降低的趋势日益明显

- 市场挑战

- ZigBee 标准网路设备製造的复杂性

- 技术简介

- Zigbee网膜网络

- Zigbee 3.0

- ZigBee RF4CE

- ZigBee PRO

- ZigBee IP

第六章市场区隔

- 按最终用户产业

- 资讯科技/通讯

- 住宅自动化

- 工业自动化

- 卫生保健

- 零售(数位电子商务)

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东/非洲

- 北美洲

第七章 供应商市场占有率

第八章 竞争形势

- 公司简介

- Texas Instruments Incorporated

- NXP Semiconductors NV

- Microchip Technology Inc.

- Silicon Laboratories Inc

- Digi International Inc.

- Sena Technologies Inc.

- Nordic Semiconductor ASA

- Qualcomm Technologies Inc.

- Semiconductor Components Industries LLC(ON Semiconductor)

第九章投资分析

第10章市场的未来

The ZigBee Market size is estimated at USD 4.87 billion in 2024, and is expected to reach USD 6.51 billion by 2029, growing at a CAGR of 6.01% during the forecast period (2024-2029).

The low-cost and low-powered mesh network is widely deployed for controlling and monitoring applications, covering the range of 10-100 meters. This communication system is less expensive and more straightforward than the other proprietary short-range wireless sensor networks, such as Bluetooth and Wi-Fi connectivity.

Key Highlights

- Due to the rising trend toward adopting smart devices, the increasing consumer electronics industry is expected to drive the application of ZigBee-based communication services used for monitoring and controlling devices based on IEEE 802.15.4 across emerging economies.

- Growing demand for the Zigbee broad-based deployment of wireless networks with low-cost, low-power solutions that can run for years on inexpensive batteries for a host of monitoring and control applications across smart energy/smart grid & building automation systems with significant advancements is expected to drive the market.

- The adoption of smart sensor technology, connectivity improvements, and advancements in cloud computing have helped drive the adoption and evolution of Industrial IoT. This trend is also expected to drive the growth of ZigBee in small industrial environments where factory devices have to communicate over a short distance.

- The Internet of Things has been growing across smart home applications. It is expected to become more customizable to give more control to users and enhance the appliance operating functions. For instance, Loup Ventures, a venture capital firm that invests in virtual reality, augmented reality, artificial intelligence, and robotics, the global smart speaker market's revenue is expected to reach USD 35.5 billion by 2025.

- ZigBee networks use a mesh topology where all devices ('nodes') can communicate with each other to form a wireless mesh network. The mesh network helps the devices share over numerous paths and regularly optimize their connections to other devices, enabling the mesh to recover from wireless interference or broken links automatically.

Zigbee Market Trends

Smart Homes & Building Sector is Gaining Traction Due to Emergence of Automation

- ZigBee network is primarily intended for low-duty cycle sensors, those active for less than 1% of the time. It is an IEEE 802.15.4-based suite for high-level communication across the smart home ecosystem due to its proximity, low data rate, and low power system features.

- Zigbee uses a variety of information transfer mechanisms, such as direct, group, and broadcasting addresses. Mesh network in this internet protocol can be established, which enables the long-distance communication of information across the building automation sector.

- Increasing investments in start-ups such as Hypervolt, HIXAA, SmartRent, and other SMEs help to gain new IoT-based projects in industries that are likely to create a need for a high-performance, low-power IoT MCUs market over the forecast period.

- For instance, in 2022, Renesas Electric Corporation introduced the 32-bit RA Family of microcontrollers (MCUs). The new product is based on the Arm Cortex-M23 core, which provides shallow power consumer MCUs explicitly designed for IoT endpoint applications such as industrial automation, medical devices, intelligent home appliances, and wearables.

- Further, with the increasing investments and adoption of innovative home technologies, consumers start to perceive products, such as voice-activated assistants and smart security systems, as standard household items rather than redundant luxuries, thereby driving the application of the Zigbee communication product integrated across the end-user industry.

North America to Account for the Most Significant Share in the Market

- Smart homes are on the rise across North America, where people in the region are increasingly looking to automate their homes. Dependence on smartphones and mobile apps is set to increase as smartphones offer an attractive and intuitive window into controlling smart home technology.

- For instance, in October 2021, The United States Department of Energy (DOE) announced $61 million in funding for ten pilot projects using new technology to transform thousands of homes and workplaces into cutting-edge, energy-efficient structures. These Connected Communities can interact with the electrical grid to optimize their energy consumption, significantly reducing carbon emissions and energy costs. Which further increases market growth.

- With nearly 30 million U.S. households projected to add smart home technology, the products consumers want to add to their homes include connected cameras, video doorbells, connected light bulbs, smart locks, and smart speakers that find the application of Zigbee standards for their communication medium.

- Also, the adoption of voice-powered smart speakers is taking off, with an estimate of smart devices such as the Amazon Echo, Google Home, and Sonos One that will be installed in most U.S. households, thereby driving the application of the Zigbee connectivity medium during the forecast period.

- According to a recent Stanford University and Avast study, North American homes have the highest density of IoT devices of any region in the world. Notably, 66% of homes in the region have at least one IoT device. Additionally, 25% of North American homes boast more than two devices. Due to robust cloud infrastructure, an increasing number of connected devices, and advancements in artificial intelligence and machine learning technologies in the region, the market for ZigBee is expected to grow.

- The average household in the region would have an average of nine devices by 2022, and nearly half (48%) of total devices and connections will be video capable. Hence, with the growing adoption of IoT devices, the demand for ZigBee chips is expected to increase for these smart home devices over the forecast period.

Zigbee Industry Overview

The ZigBee Market is moderately competitive and consists of a few major players. Some of the players currently dominate the market in terms of market share. However, with the advancement in communication technology across the connectivity medium, new players are increasing their market presence, thereby expanding their business footprint across the emerging economies.

- December 2021- Silicon Labs, a pioneer in secure, intelligent wireless technology for a more connected world, has introduced a first-of-its-kind 3D virtual smart home platform. This interactive journey guides users through innovative smart home solutions, applicable protocols, and ecosystem connections. Users can explore three use cases: home security, home automation, and health, as well as the protocols and ecosystems they work with and connect to on a self-guided tour.

- November 2021- Microchip Technology has announced the release of the second development tool in its Smart Embedded Vision initiative for designers who use its PolarFire RISC-V System on Chip (SoC) Field Programmable Gate Array (FPGA). The PolarFire device, the industry's lowest-power SoC FPGA in its class, is the only mid-range device that supports dual 4K video processing and quad-core RISC-V application-class processors running both the Real Time Operating System (RTOS) and rich operating systems such as Linux.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Connected Devices Across Industrial Automation & Smart Homes

- 5.1.2 Rising Trend of Low Cost with High Performance Equipment Across IoT Ecosystem

- 5.2 Market Challenges

- 5.2.1 Complexity in the Manufacturing of Networking Equipment With ZigBee Standards

- 5.3 Technology Snapshot

- 5.3.1 Zigbee Mesh Network

- 5.3.2 Zigbee 3.0

- 5.3.3 ZigBee RF4CE

- 5.3.4 ZigBee PRO

- 5.3.5 ZigBee IP

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 IT & Telecommunication

- 6.1.2 Residential Automation

- 6.1.3 Industrial Automation

- 6.1.4 Healthcare

- 6.1.5 Retail (Digital Ecommerce)

- 6.1.6 Other End-user Industries

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 Italy

- 6.2.2.4 France

- 6.2.2.5 Russia

- 6.2.2.6 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 South Korea

- 6.2.3.5 Australia and New Zealand

- 6.2.3.6 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Mexico

- 6.2.4.3 Rest of Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Texas Instruments Incorporated

- 8.1.2 NXP Semiconductors NV

- 8.1.3 Microchip Technology Inc.

- 8.1.4 Silicon Laboratories Inc

- 8.1.5 Digi International Inc.

- 8.1.6 Sena Technologies Inc.

- 8.1.7 Nordic Semiconductor ASA

- 8.1.8 Qualcomm Technologies Inc.

- 8.1.9 Semiconductor Components Industries LLC (ON Semiconductor)