|

市场调查报告书

商品编码

1433940

防伪印刷:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Security Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

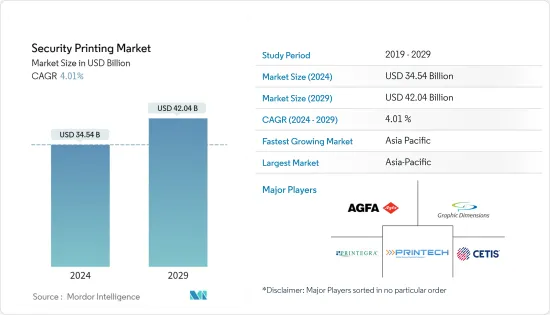

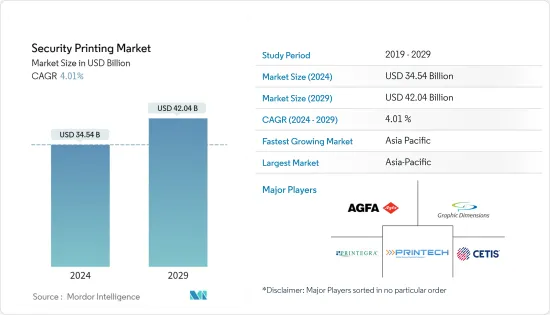

安全印刷市场规模预计到 2024 年为 345.4 亿美元,预计到 2029 年将达到 420.4 亿美元,预测期内(2024-2029 年)复合年增长率为 4.01%。

主要亮点

- 科技比以往任何时候都更先进、更容易获得、能力更强,这使得组织很难在仿冒品仿冒品面前保持领先。技术的进步使得复製不安全文件的高品质副本变得更加容易。造假者现在可以更轻鬆地找到具有高端彩色影印机、印刷厂品质解析度甚至更小型印刷机的扫描器。

- 据联准会称,美国流通价值2兆美元的联准会纸币,财政部表示流通价值约700亿美元的假钞。考虑到这些趋势,政府还建立了多个法律规范来防止货币伪造。

- 此外,执法和安全法规也是推动该市场的关键因素。在某些伪造案件中,高安全性材料和完整的钞票是从高安全性印刷业诈欺取得的。这清楚地强调了印钞公司和证券基板製造商需要采取必要措施,向相关发行机构核实其订单的性质。

- 聚碳酸酯广泛用于安全身分证件,具有出色的抗攻击性、广泛的安全功能和较长的使用寿命。各公司正在改进技术以增强安全功能。它可能反映了未来的趋势。例如,金雅拓彩色雷射防护罩是一种独特的解决方案,用于保护聚碳酸酯身分证件中的彩色照片。这种新的出版解决方案配备了四色激光,可以用特殊墨水照亮文件的内部结构,提供最高的分辨率和防伪水平。

- 然而,向无现金经济的转变、身分证件的数位化以及与防伪纸相关的严格认证可能会阻碍防伪印刷业在预测期内的成长。

- 由于冠状病毒感染疾病(COVID-19)的流行,安全列印市场受到了重大影响。从全球病例来看,欧洲和亚洲是疫情最严重的地区。此后,美国疫情影响加剧,病例急剧增加。此外,商业活动的增加和办公空间的重新开放预计也将推动支付卡的需求,这可能会进一步支持所研究市场的成长。

防伪印刷市场趋势

纸币占据很大的市场份额

- 大多数央行正在转向更稳健的选择,例如纯聚合物基材、纸聚合物复合材料以及优质清漆和涂料。儘管价格更高,但改用聚合物可以为签发机构节省大量成本,因为它们的使用寿命更长,并且耐折迭、耐污垢和耐微生物性更强。

- 国内外聚合物造假的增加在该银行做出现代化钞票的决定中发挥了重要作用。纸张通常由棉纤维製成,以提高强度和耐用性,并且是大多数纸币的基础材料。有些纸张添加了亚麻线、特殊颜色的线或法医学线,以增强其独特性并防止复製。

- 此外,打击假钞的需求日益增长,导致防伪纸在钞票和钞票印刷中的使用增加。安全线或纤维、全像图和水印通常被用作保护金钱的特征。水印主要用于纸币上,因为它们很容易被公众识别,并保护它们免受扫描器以及化学、机械和影印的影响。此外,还使用安全纤维和浮水印来保护彩色副本。

- 根据联准会的数据,美国发行的美元钞票的年度价值存在波动。儘管2021年美国量化宽鬆期间印製了价值3,197亿美元的纸币,但2022年流通中的现金数量达到了2,671亿美元。随着纸币需求的增加,对高阶安全功能的需求也增加。随着美国的量化宽鬆以及 2021 年印製更多纸币,采用先进的安全措施来打击假币将变得非常重要。这将增加对安全列印解决方案的需求,包括缩微印刷、全像图、特殊墨水和其他安全功能等技术。

亚太地区将带来显着的市场成长

- 日本、沙乌地阿拉伯和印度等主要国家货币生产的发展以及对假冒安全纸检测的改进预计将在预测期内推动安全印刷市场的成长。

- 此外,亚太地区造假和造假活动的增加,包括假币、腐败和恐怖主义融资,也导致了保护纸张印刷的区域要求的扩大。此外,护照、ID卡、银行帐户资讯等纸张的需求不断增加,加上人口的不断增加,为参与企业提供了多种发展前景。

- 基于 RFID 的解决方案的日益普及预计将形成一个非常有利于所研究市场成长的生态系统。例如,2022年7月,印度查谟和克什米尔联邦直辖区乌德汉普尔地区政府宣布将在火车站设立射频识别(RFID)发卡柜檯,为Amarnath Jishri提供便利。朝圣。

- 2022 年 7 月,印度钞票造纸厂私人有限公司 (BNPMIPL) 在巴拉索尔投资 250 亿印度卢比(3.1509 亿美元),为印度所有四种货币的印刷厂提供高品质的钞票纸张。生产并建立下游。从长远来看,它可以增强凝聚力、提高生产力并降低成本。因此,这些发展预计将在未来几年扩大亚太地区安全印刷市场。

防伪印刷业概况

由于安全印刷市场服务少数公司,因此安全印刷业内的竞争很小。这是因为有几个变数限制了参与者的数量,例如资金要求、法律和法规。市场上营运的主要企业包括 Agfa-gevaert Group、Graphic Dimensions、Cetis dd 和 Printech Global Secure Payment Solutions LLC。

- 2022 年 9 月 - 利比里亚总统乔治·M·维阿在利比里亚蒙罗维亚部长官邸举行的仪式上,介绍了劳工部和计划承包的参与公司之一 CETIS 的新工作许可证数位化。我们已正式启动计划。它在欧洲用于文件安全列印和身份管理。新的数位工作许可证透过安全、快速和透明地招募外籍劳工来保护员工和投资者的权利。

- 2022 年 1 月 - 根据现代化计划,印度安全印刷和造币公司有限公司 (SPMCIL) 在其纳西克的每台钞票印刷机和德瓦斯的钞票印刷机上安装了新的货币印刷生产线。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对安全列印市场的影响

第五章市场动态

- 市场驱动因素

- 仿冒案件增加

- 基于 RFID 的解决方案的出现

- 市场限制因素

- 向无现金数位化过渡

- 市场机会

第六章市场区隔

- 按应用程式类型

- 钞票

- 付款卡

- 查看

- 个人身分证件

- 票务

- 邮票

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东/非洲

- 拉丁美洲

第七章 竞争形势

- 公司简介

- Agfa-gevaert Group

- Graphic Dimensions Inc.

- Cetis DD

- Printegra(Ennis Inc)

- Printech Global Secure Payment Solutions LLC

- Graphic Security Systems Corporation

- Premier Packaging Solutions(DSS Inc.)

第八章投资分析

第九章 市场机会及未来趋势

The Security Printing Market size is estimated at USD 34.54 billion in 2024, and is expected to reach USD 42.04 billion by 2029, growing at a CAGR of 4.01% during the forecast period (2024-2029).

Key Highlights

- With technology becoming more advanced, accessible, and capable than ever, it is challenging for organizations to stay ahead of counterfeiters and forgers. Technological advancement also made replicating even high-quality duplicates of unsecured documents easier. Counterfeiters find it easier than ever to find scanners with high-end color copiers, print-shop quality resolutions, and even small printing presses.

- According to the Federal Reserve, there are more than USD 2 trillion worth of Federal Reserve notes in circulation in the United States, and about USD 70 billion counterfeit notes are in circulation, according to the Department of Treasury. Considering such trends, the government also framed several regulatory frameworks to prevent currency counterfeiting.

- Furthermore, Law enforcement and security regulations are significant factors driving this market. In some counterfeiting cases, high-security materials and complete banknotes are sourced under false deceit from the security printing industry. It underlined a clear need for banknote printing companies and security substrate producers to take the necessary steps to verify the nature of orders with the relevant issuing institutions.

- Polycarbonate is broadly used for secure ID documents, offering excellent resistance against attacks, a wide range of security features, and an extended lifetime. Various players are improving the technology to strengthen security features. It may reflect the trend in the future. For instance, Gemalto Color Laser Shield is a unique solution for securing a color photo within a polycarbonate ID document. Powered by four-color lasers striking a special ink in the document's inner structure, this new issuance solution achieves the highest resolution and counterfeit protection levels.

- However, the transition toward a cashless economy, digitization of identification cards, and strict certification related to security paper may hamper the growth of the security printing industry over the forecast period.

- A notable impact of the global outbreak of COVID-19 was observed on the security printing market. Regarding the number of patients globally, Europe and Asia were among the worst affected areas. Subsequently, the impact of the pandemic intensified in the United States as well, evident from the spike in the number of patients. Furthermore, the increasing commercial activity and resumption of office spaces are also expected to drive the demand for payment cards, which may further support the studied market's growth.

Security Printing Market Trends

Banknotes Holds the Significant Share in The Market

- Most central banks are switching to more robust options, such as pure polymer substrates, paper/polymer composites, and premium varnishes and coatings. Although more expensive, changing to the polymer can result in significant cost savings for issuing authorities because of their longer longevity and increased resistance to folding, soiling, and microbes.

- The rise in local and global polymer counterfeiting played a significant role in the bank's decision to modernize banknotes. Paper, often manufactured from cotton fibers for strength and durability, is the substrate for most banknotes. Some papers include linen, specialized colored, or forensic threads added to them to add to their uniqueness and guard against copying.

- Additionally, the greater use of security paper in printing money and banknotes results from the growing need to combat counterfeit banknotes. Security threads or fibers, holograms, and watermarks are frequently employed as features to protect money. The watermark is primarily used in banknotes as the public can easily recognize it, and it offers protection against scanners and chemical, mechanical, and reproduction attempts. Furthermore, security fibers and a watermark are used to protect color photocopying.

- According to Federal Reserve, US dollar banknotes issued in the US include a variable annual value. The value of cash in circulation reached USD 267.1 billion in 2022, despite USD 319.7 billion worth of banknotes being issued in 2021 during the quantitative easing in the US. As the demand for banknotes increases, the need for advanced security features also grows. With the quantitative easing in the US and the issuance of many banknotes in 2021, it becomes crucial to incorporate advanced security measures to combat counterfeiting. It drives the demand for security printing solutions, including technologies like microprinting, holograms, special inks, and other security features.

Asia-Pacific to Account for Significant Market Growth

- Increasing developments by major countries, including Japan, Saudi Arabia, and India, in currency production and improved detection of counterfeit security papers are expected to propel security printing market growth over the forecast period.

- Furthermore, increasing counterfeiting and forgery operations in the Asia-Pacific, such as false currency, corruption, and terrorist funding, contributed to expanding the region's requirement for protecting paper printing. Moreover, the increased demand for papers such as passports, ID cards, and bank credentials, coupled with the expanding population, provides several development prospects for market participants.

- The increasing adoption of RFID-based solutions is expected to develop an ecosystem highly favorable for the growth of the studied market. For instance, in July 2022, Udhampur District Administration, in the Union Territory of Jammu & Kashmir, India, announced the establishment of a desk at the Railway Station for the issuance of Radio Frequency Identification (RFID) cards for the convenience of Shri Amarnath Ji Pilgrims.

- In July 2022, Bank Note Paper Mill India Private Limited (BNPMIPL) would spend INR 2,500 crore (USD 315.09 million) in Balasore to build a facility that will produce high-quality bank note sheets for all four currencies printing plants in India and establish downstream cohesion in the long term to enhance productivity and cut costs. Thus, these developments are expected to increase the security printing market in Asia-Pacific Region over the coming years.

Security Printing Industry Overview

There is minimal competition within the security printing sector since the market serves a small number of businesses. It is because several variables, including capital needs, laws, and regulations, constrain the number of players. Some key players operating in the market include Agfa-gevaert Group, Graphic Dimensions, and Cetis d. d., and Printech Global Secure Payment Solutions LLC.

- September 2022- The Liberian president, at a ceremony held at the Ministerial Complex in Monrovia, Liberia, George M. Weah, formally launched the new Work Permit Digitalization Project of the Ministry of Labour and project contractor, the company CETIS, one of the player in Europe for security printing documents and identity management. The new digital work permit safeguards employees' and investors' rights by allowing for the secure, rapid, and transparent recruitment of foreign workers.

- January 2022- Under its modernization initiatives, the Security Printing and Minting Corporation of India Limited India (SPMCIL) set up new banknote printing lines at each Currency Note Press in Nashik and Bank Note Press, Dewas.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Security Printing Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Incidences of Forgery

- 5.1.2 Emergence of RFID-based Solutions

- 5.2 Market Restraints

- 5.2.1 Transition Towards Cashless Economy and Digitization

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Application Type

- 6.1.1 Banknotes

- 6.1.2 Payment Cards

- 6.1.3 Cheques

- 6.1.4 Personal ID

- 6.1.5 Ticketing

- 6.1.6 Stamps

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Middle-East and Africa

- 6.2.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Agfa-gevaert Group

- 7.1.2 Graphic Dimensions Inc.

- 7.1.3 Cetis D.D.

- 7.1.4 Printegra (Ennis Inc)

- 7.1.5 Printech Global Secure Payment Solutions LLC

- 7.1.6 Graphic Security Systems Corporation

- 7.1.7 Premier Packaging Solutions (DSS Inc.)