|

市场调查报告书

商品编码

1433941

分子育种-市场占有率分析、产业趋势/统计、成长预测(2024-2029)Molecular Breeding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

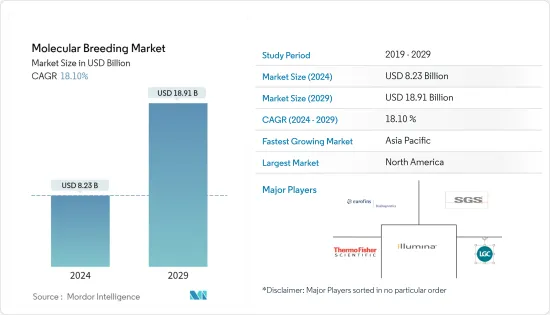

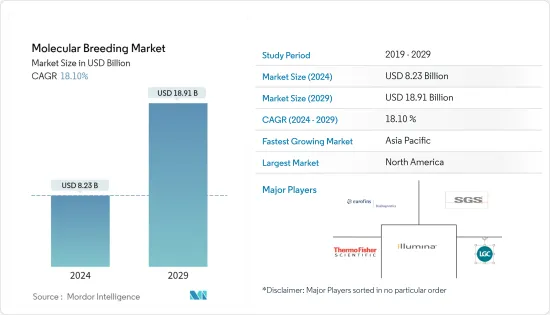

分子育种市场规模预计2024年为82.3亿美元,预计到2029年将达到189.1亿美元,在预测期内(2024-2029年)复合年增长率为18.10%增长。

开发作物新品种的过程几乎需要20-25年,但利用生物技术,这个时间可以缩短到几乎7-8年。标记辅助选择 (MAS) 等工具使科学家能够更轻鬆、更快速地选择能够产生更高产量结果的植物性状。分子育种技术仍处于起步阶段。在荷兰和英国,分子育种技术100%用于农作物新作物。主要企业正在采用这些技术来改进其种子品种。遗传学和研究领域的价格下降将改善市场。来自公共和私营部门的资金正流向植物育种和基因研究,包括基因组选择和 MAS 在大田和蔬菜作物中的应用,这将刺激未来的市场。预计在预测期内,亚太地区的分子育种市场将成长最快。

分子育种市场趋势

玉米产量大幅增加

全球对粮食生产和消费的需求正在迅速增长。美国玉米平均产量已从20世纪上半叶的1.6吨/公顷增加到约9.5吨/公顷。产量的显着提高归功于混合玉米的采用、合成肥料的使用以及推动分子育种市场的新农业方法。分子育种性状的介绍和使用基于 DNA 标记的新育种技术的开发为分子育种创造了一个新的创新市场。例如,在未来 20 年里,生物技术性状和标记辅助育种可能会使美国的玉米产量增加一倍。

北美地区占比最大

2017年,北美在分子育种市场中占据最大份额,农民对分子育种益处的认识不断增强,其次是欧洲,因为小麦和玉米产量较高,这将增加未来前景,市场预计将扩大。市场。美国和加拿大以及欧洲的领先公司的存在导致分子育种市场的采用率不断提高。由于印度、中国和泰国等主要企业的投资增加,亚太地区分子育种市场预计将以最高的速度成长。

分子育种产业概况

分子育种市场高度分散,领导企业采取了产品定价分析、新产品开发、收购合併、扩张、合作等多种策略来在市场上留下自己的足迹。像先正达这样的领先公司使用 Thermo Fisher Scientific 高度修改的基因型鉴定平台来提供其育种管道所需的资料,并识别具有更好产量潜力的新植物。快速选择品种。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场促进与市场约束因素介绍

- 市场驱动因素

- 市场限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按用途

- 植物

- 家畜

- 按标记

- 简单的数组迭代

- 单核苷酸多态性

- 表达序列标籤

- 其他的

- 分子育种过程

- 标记辅助选择

- QTL作图

- 标记辅助回交

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 世界其他地区

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Illumina

- LGC Limited

- Thermo Fisher Scientific

- SGS

- LemnaTec

- Charles River

- DanBred

- Intertek

- Eurofins

第七章 市场机会及未来趋势

The Molecular Breeding Market size is estimated at USD 8.23 billion in 2024, and is expected to reach USD 18.91 billion by 2029, growing at a CAGR of 18.10% during the forecast period (2024-2029).

The process of developing new crop varieties almost takes around 20- 25 years but this time limit can be shortened to almost 7-8 years by using biotechnology. Tools like marker-assisted selection (MAS) make it easier and faster for the scientist to select plant traits with more productive results. Molecular breeding technology is in the nascent stage. Netherland and UK witnessed 100% adoption of molecular breeding techniques for new crop variety. Major players in seed companies have been adopting these technologies for improvement in seed varieties. The decline of prices in the genetic and research departments leads to the improvement of the market. Funds flow from private as well as public sectors towards plant breeding and genetic research such as genomic selection in field and vegetable crops and application of MAS will gear up the market in the future. The molecular breeding market is projected to grow highest in the Asia-Pacific region during the forecast period.

Molecular Breeding Market Trends

Increase in production of Corn exponentially

Global demand for food production and consumption increasing at a rapid pace. U.S. average corn yield has increased from 1.6tonnes/hectare in the first half of the 20th century to approximately 9.5tonnes/ha. The dramatic yield improvement is due to the use of hybrid corn, synthetic fertilizers, and the adoption of new farm practices that drives the molecular breeding market. Introduction of molecular breeding traits and development of new breeding technology using DNA based markers created a new and innovative market for molecular breeding. For instance, Over the next two decades, biotechnology traits and marker-assisted breeding have the potential to double the corn yields in the U.S.

North America account for largest share

North America accounted for the largest share in the molecular breeding market in 2017, followed by Europe due to high yield in the production of wheat and maize as awareness among the farmers about the benefits of molecular breeding are increasing which will create a scope in the future market. The presence of major companies in US and Canada followed by Europe has resulted in increasing adoption of the molecular breeding market. The Molecular breeding market in the Asia-Pacific region is projected to grow with highest rate due to increasing investment from the key players in countries such as India, China, and Thailand.

Molecular Breeding Industry Overview

The molecular breeding market is highly fragmented and major players have used many strategies such as pricing analysis of the product, new product development, acquisition and mergers, expansion, the partnership to make a footprint in the market. Major players like Syngenta using advance modified genotyping platforms from "Thermo Fisher Scientific" to provide necessary data for the breeding pipeline to quickly select the new varieties with much better yield potential.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.4 Market Restraints

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 On basis of application

- 5.1.1 Plant

- 5.1.2 Livestock

- 5.2 On basis of marker

- 5.2.1 Simple sequence repeat

- 5.2.2 Single nucleotide polymorphism

- 5.2.3 Expressed sequence tags

- 5.2.4 Others

- 5.3 On basis of molecular breeding process

- 5.3.1 Marker assisted selection

- 5.3.2 QTL Mapping

- 5.3.3 Marker assisted back crossing

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of World

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Illumina

- 6.3.2 LGC Limited

- 6.3.3 Thermo Fisher Scientific

- 6.3.4 SGS

- 6.3.5 LemnaTec

- 6.3.6 Charles River

- 6.3.7 DanBred

- 6.3.8 Intertek

- 6.3.9 Eurofins