|

市场调查报告书

商品编码

1642213

网路摄影机:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Webcams - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

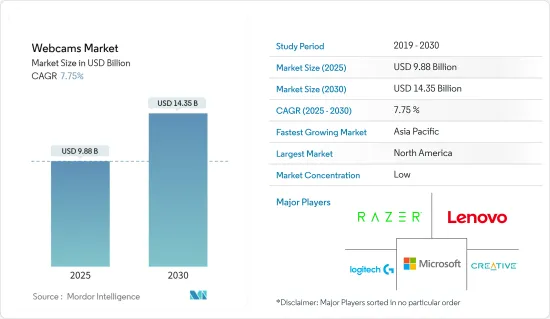

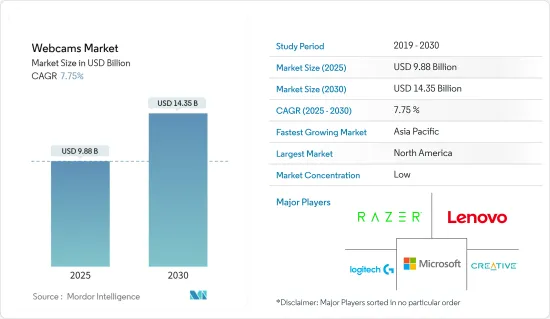

网路摄影机市场规模预计在 2025 年为 98.8 亿美元,预计到 2030 年将达到 143.5 亿美元,在市场估计和预测期(2025-2030 年)内复合年增长率为 7.75%。

由于网路摄影机在安全和监控、娱乐、视讯会议、视觉行销、实况活动等领域的应用日益广泛,网路摄影机产业越来越受到关注。

关键亮点

- 在商业领域,网路摄影机是最有价值的商业沟通工具。由于专业人士越来越倾向于使用虚拟办公室通信,预计预测期内对网路摄影机的需求将会增加。医疗保健行业越来越多地使用网路摄影机进行视讯会议和远端患者监护可能会推动市场扩张。

- 新冠疫情已迫使全球大多数企业转向混合办公或在家工作模式。这种居家办公模式将在疫情后形成一种混合工作文化,要求在日常会议和活动中使用网路摄影机。此外,自疫情以来,对远端和混合工作模式的重视程度不断提高,导致企业环境中对网路摄影机的需求激增。视讯会议已成为开展业务和客户会议的新常态。网路摄影机製造商正在开发具有尖端技术和功能的摄像头,以满足不断变化的客户期望和增强的网路存取。

- 此外,全球工业和私营部门对安全监控系统的需求不断增长,以及对自动导引运输车(AGV) 和无人机 (UAV) 的需求不断增长,是预计在预测期内推动网路摄影机市场成长的关键因素。由于网路摄影机具有视觉控制、命令方向处理和降低开销等多种特性,预计网路摄影机市场也将实现成长。

- 根据Guru99统计,美国和欧洲市场占全球数位学习服务用户的70%。 63%的美国学生每天都使用线上学习资源。 21%的大学实施了混合式学习模式。 50% 的 K-12 教师采用线上培训。未来网路摄影机的使用量可能会大幅成长。

- 您的网路速度直接影响您录製或传输的影像和影片的品质。需要最低网路速度以避免影像失真。由于网路速度的波动将成为市场成长的限制因素,因此网路摄影机在偏远地区和网路连线较弱地区的采用预计会比较缓慢。

- 一些知名製造商正在为他们的数位单眼相机和无反光镜相机添加 USB 串流媒体支持,这给网路摄影机公司带来了激烈的竞争。佳能和FUJIFILM提供的应用程式可让您透过 USB 将其相机用作网路摄影机。Canon的应用程式相容于 Mac 和 Windows,而FUJIFILM的应用程式仅适用于 Windows。Canon开发了新软体 EOS Webcam 公共产业,可以将CanonEOS 单眼相机、无反光镜相机和 PowerShot 小型相机转变为 USB 网路摄影机。

网路摄影机市场趋势

外部网路摄影机有望发挥重要作用

- 外置摄影机通常有更多空间来容纳镜头和其他组件,从而获得更高的解析度和更清晰的影像、影片和音讯。当声音和影像品质很重要时,高阶外部网路摄影机比基本的内建网路摄影机更能满足您的客户的需求。用户可以找到更昂贵的外部摄像头,这些摄像头具有一体式设备通常没有的额外功能,例如多个麦克风、广角镜头和复杂的自动对焦功能。

- 外部网路摄影机领域在视讯会议、电子学习、安全、交通管理和医疗系统等商业应用方面实现了强劲成长。家庭、办公室和物流安全环境中对即时监控设备以及视讯会议的需求不断增长是推动网路摄影机市场发展的主要因素之一。这些外部网路摄影机也可用作即时监控工具,记录破坏行为、反社会行为和乱丢垃圾的行为。

- 政府机构越来越多地使用监控技术也影响市场。这些设备正在作为我们数位化努力的一部分而被使用。许多政府已经实施了监控系统来保护关键基础设施和公共场所。网路摄影机市场也受到都市化进程加快、生活方式改变、投资增加和消费者支出增加的推动。

- 例如,2023 年 9 月,罗技宣布了两条新的产品线:1080p 网路摄影机 Brio 105 和 M240,这是一款紧凑、安静、具有企业级安全性的滑鼠。使用此网路摄影机,您可以轻鬆且经济地为所有员工配备用于会议的网路摄影机。此网路摄影机可与您的员工每天使用的主流视讯通话平台配合使用,并且经过认证可与 Google Meet 和 Chromebook 配合使用。

- 此外,外接网路摄影机的重大进步也引起了线上串流媒体供应商和视讯部落客(vlogger)等新类别消费者日益增长的需求。在当前的市场情况下,有几种外部网路摄影机专为部落格和串流媒体活动而设计,并在低照度可见性、解析度和自动对焦特性方面进行了几项优化。

北美占据主要市场占有率

- 由于线上学习和远端教育活动的扩展,北美是收益最高的地区之一。美国远距教育的一项研究发现,熟悉技术和学习管理系统线上介面的学生更有可能受到激励,对课程感到满意,并学到更多知识。

- 据We Are Social称,截至2023年1月,美国约有3.11亿人可以上网,美国是全球最大的线上市场之一。近年来,美国数位人口稳定成长。最常见的解释之一是宽频网路的普及率不断提高。因此,预计未来对网路摄影机的需求将会增加。

- 美国企业每天举行超过1,100万次视讯会议,54%的美国劳动力经常参加视讯会议。此外,美国企业每週举行约 5,500 万次视讯会议。由于每天都会发生如此多的虚拟会议,对网路摄影机的需求显着增加,公司正致力于创新,使解决方案和协作更加舒适和方便。预计网路摄影机的需求将会增加。

- 由于可以轻鬆采用新技术来改善安全和监控事件、职场视讯会议、K-12 教育和视觉行销,该地区对网路摄影机的需求持续增长。产品扩展到多个行业预计将反映网路摄影机市场的成长。

- 美国发生「9·11」恐怖攻击事件后,对即时运动追踪和监控的需求和要求日益增加。考虑到北美的银行和金融业,出于安全目的在场所部署网路摄影机来管理记录和文件已成为监控的重要组成部分。

网路摄影机产业概览

网路摄影机市场竞争激烈,由几家大公司组成。从市场占有率来看,目前少数几家大公司占据着市场主导地位。凭藉着压倒性的市场占有率,这些大公司正致力于扩大海外基本客群。这些公司正在利用策略合作措施来增加市场占有率和盈利。

- 2023 年 6 月:Sky 推出新镜头,以增强智慧型电视的社交、健康和游戏功能。 Sky Live 相机以磁力方式吸附在您的 Sky Glass智慧型电视顶部,并透过 USB-C 和 HDMI 连接。您可以与家人同时看电视、使用 Zoom 进行视讯聊天、记录您的家庭锻炼以及玩 Kinect 风格的动作控制游戏。

- 2022 年 9 月:Insta360 推出人工智慧驱动的 4K 网路摄影机 Insta360 Link。 Insta360 Link 为企业主管、教育工作者和直播主播提供了卓越影像品质和无缝用户体验的强大组合。 Link 的 4K 解析度和业界领先的 1/2 吋感应器可在任何光照场景中提供逼真的影像清晰度、细节和宽动态范围。透过三轴万向架和内建 AI 演算法,网路摄影机能够随时让您保持在画面中并回应您的手势指令。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 音讯会议和虚拟会议的兴起

- 网路摄影机的平均售价大幅下降

- 市场限制

- 新兴国家网路普及率低

- 网路摄影机骇客攻击案例不断增加(隐私问题)

第六章 市场细分

- 按下网路摄影机类型

- 外部网路摄影机

- 内建网路摄影机

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Logitech International SA

- Microsoft Corporation

- Lenovo Group Limited

- Razer Inc.

- Creative Technology Ltd.

- Ausdom Global

- Vivitar Corporation

- Shenzhen Teng Wei Video Technology Co. Ltd.

- A4Tech Co. Ltd.

- KYE Systems Corp.(Genius)

第八章投资分析

第九章:未来市场展望

The Webcams Market size is estimated at USD 9.88 billion in 2025, and is expected to reach USD 14.35 billion by 2030, at a CAGR of 7.75% during the forecast period (2025-2030).

The webcams industry is gaining prominence owing to the growing adoption of web cameras in security and surveillance, entertainment, video conferences, visual marketing, and live events.

Key Highlights

- In the business sector, webcams are the most valuable business communication tools. Demand for webcams will rise during the projected period due to increased tendencies toward virtual office communication among professionals. The increasing use of webcams in the health industry for video conferencing and remote patient monitoring will likely drive market expansion.

- COVID-19 pushed most companies across the globe towards the hybrid work and work-from-home models. This WFH is now leveraged into a hybrid work culture after the pandemic, mandating the use of a webcam for daily meetings and activities. Furthermore, with the increased emphasis on remote working and hybrid work models post-COVID, the corporate environment is seeing a surge in demand for webcams. Video conferencing became the new norm for conducting business and client meetings. Webcam manufacturers are developing cameras with cutting-edge technology and features in response to changing client expectations and enhanced internet access.

- Additionally, the growing demand for surveillance systems for security and safety purposes and rising demand for automated guided vehicles (AGVs) and unmanned aerial vehicles (UAVs) across industrial and private sectors worldwide are the principal factors expected to drive the growth of the webcams market over the forecast period. Also, owing to several characteristics offered by webcams, such as vision control, command direction process, and decreased overheads, the webcam market is anticipated to grow.

- According to Guru99, the US and European markets account for 70% of the world's e-learning services users. 63% of students in the United States use online learning resources daily. A blended learning model was implemented by 21% of colleges. Online training is used by 50% of K-12 instructors. The usage of webcams might observe significant growth over some time.

- Internet speed directly affects the quality of images and videos recorded and streamed. Minimum internet speed is needed to avoid video distortion. Deployment of webcams is expected to witness slow growth in remote or distant locations and regions with weak internet connectivity, as fluctuations in internet speed act as restraints to market growth.

- Some known manufacturers are adding USB streaming support to their DSLR and mirrorless cameras, giving tough competition to the webcam companies. Cannon and Fujifilm include apps that let users use their cameras as webcams over USB. Canon's app works for Mac and Windows, while Fujifilm's is Windows-only. Canon developed new software, the EOS Webcam Utility, which turns Canon EOS SLR, mirrorless camera, or PowerShot compact into a USB webcam.

Webcams Market Trends

External Webcam Expected to Gain Considerable Significance

- External cameras usually offer higher resolutions and sharper images, videos, and audio because they include more room for lenses and other components. A high-end external webcam will better meet customers' needs than a basic inside webcam if sound and image quality are important. The user can anticipate finding more expensive external cameras with extras like numerous microphones, wide-angle lenses, and sophisticated auto-focus features that aren't normally seen in integrated devices.

- The external webcams segment witnessed considerable growth in commercial applications for video-conferencing, e-learning, security, traffic management, and healthcare systems. The rise in demand for real-time monitoring devices in home, office, and logistical security settings, combined with video conferencing, is one of the major factors driving the webcams market. These external webcam cameras are additionally employed as momentary surveillance tools to record vandalism, antisocial conduct, and fly-tipping.

- The market is also impacted by government agencies' growing usage of surveillance technology. As part of their efforts to go digital, they use these devices. Many governments are implementing surveillance systems to safeguard important infrastructure and public areas. The webcam market is also aided by growing urbanization, changing lifestyles, increased investments, and rising consumer spending.

- For instance, in September 2023, Logitech introduced two new product lines, Brio 105, a 1080p webcam and M240 a compact silent mouse with enterprise-level security for business. This webcam makes easy and affordable to deploy a webcam for every employee for the meetings. It works with leading video calling platforms they use every day and is certified for Google Meet and Works with Chromebook.

- Further, considerable advances in external webcams are finding increasing demand from a new class of consumers, such as online streaming vendors and video bloggers (vloggers). In the current market scenario, several external webcams are purpose-built for vlogging and streaming activities, with several optimizations regarding low light visibility, resolution, and autofocus characteristics.

North America Holds a Substantial Market Share

- North America stands to be one of the highest revenue-generating regions due to the growing online learning and distance education activities. A US study by Distance for Education found that students who are more comfortable with technology and the online interface of the learning management system are more likely to be motivated, satisfied with the course, and learn more.

- According to We Are Social, around 311 million people in the United States accessed the Internet in January 2023, making it one of the largest online markets in the world. In recent years, the digital population in the United States steadily expanded. One of the most common explanations is the increasing availability of broadband internet. Therefore, in the coming future, the demand for webcams is expected to grow.

- The US businesses host more than 11 million video conferencing meetings daily, while 54% of the workforce in the United States take part in video conferences frequently. Furthermore, businesses in the United States hold approximately 55 million video conferences weekly. With such high usage of virtual meetings daily, the demand for webcams rises significantly, and the players are focused on innovating solutions and collaborations for more comfort and convenience. The demand for webcams is expected to rise.

- The demand for web cameras is continuously building in the region owing to an ease in selecting new technology that improves security and surveillance events, video conferencing at work, K-12 education, and visual marketing. Deployment of the product in multiple industries is supposed to witness the growth of the webcam market.

- After the 9/11 attack in the US, the demand for tracking real-time movements and surveillance grew and became compulsory. Considering North America's banking and finance sector, the induction of webcams on the premises for security objectives to control the records and documents became an essential part of surveillance.

Webcams Industry Overview

The Webcam market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent market share are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability.

- June 2023: Sky introduced a new camera to enhance its smart TVs' social, health, and gaming capabilities. Sky Live camera magnetically attaches to the top of Sky Glass smart TVs and connects through USB-C and HDMI. It allows you to watch TV with other families simultaneously, makes video chats using Zoom, tracks home exercises, and includes Kinect-style motion-controlled games.

- September 2022: Insta360 released the Insta360 Link, an AI-powered 4K webcam. Insta360 Link provides a potent combination of superior image quality and a seamless user experience for business executives, educators, and live streamers. Link's 4K resolution and an industry-leading 1/2" sensor give life-like image clarity, detail, and a wide dynamic range in every lighting scenario. The webcam can always keep the user in the frame and respond to gesture commands thanks to a 3-axis gimbal and built-in AI algorithms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Penetration of Teleconferencing and Virtual Meetings

- 5.1.2 Steep Decline in Average Selling Price of Webcams

- 5.2 Market Restraints

- 5.2.1 Poor Internet Penetration in Developing Countries

- 5.2.2 Increasing Cases of Webcam Hacking (Privacy Concerns)

6 MARKET SEGMENTATION

- 6.1 By Webcam Type

- 6.1.1 External Webcam

- 6.1.2 Embedded Webcam

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Logitech International S.A.

- 7.1.2 Microsoft Corporation

- 7.1.3 Lenovo Group Limited

- 7.1.4 Razer Inc.

- 7.1.5 Creative Technology Ltd.

- 7.1.6 Ausdom Global

- 7.1.7 Vivitar Corporation

- 7.1.8 Shenzhen Teng Wei Video Technology Co. Ltd.

- 7.1.9 A4Tech Co. Ltd.

- 7.1.10 KYE Systems Corp. (Genius)