|

市场调查报告书

商品编码

1434480

灌溉控制器:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Irrigation Controllers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

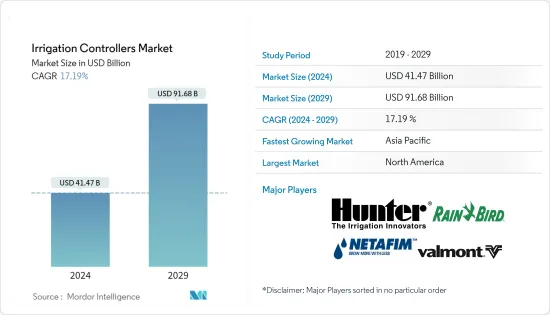

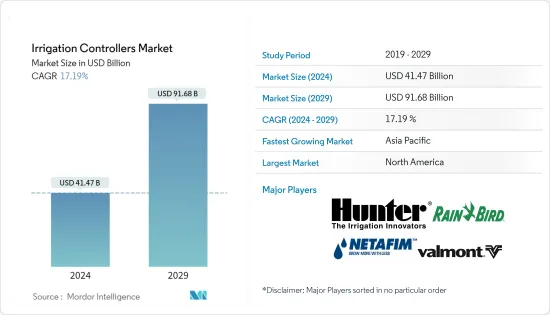

灌溉控制器市场规模预计2024年为414.7亿美元,预计到2029年将达到916.8亿美元,在预测期内(2024-2029年)复合年增长率为17.19%增长。

灌溉管理者对于在正确的时间提供大量水以最大限度地提高农业产量并实现水和化学品的高效率使用至关重要。有人认为,由于许多地区面临供水减少和干旱,灌溉管理人员面临供水减少和干旱的问题。智慧灌溉设备(例如控制器)可以在您需要时提供准确的水量,从而节省水和金钱。智慧灌溉系统与传统灌溉类型设备的不同之处在于,它们根据作物和草坪的个别需求调整浇水时间表并自动运作。智慧灌溉设备有两种类型:基于天气的控制器和基于感测器的控制器。基于天气的控制器使用当地的天气资料以及土壤表面的蒸发量和植物表面的蒸腾量,并相应地调整灌溉计划。基于感测器的灌溉控制器嵌入根部区域,控制器读取水分含量读数,然后自动浇水。

此外,政府提高永续性和减少环境破坏的政策也增加了对控制器的需求。通讯知识的改善和机械化灌溉需求的增加预计将增加预测期内的成长机会。

灌溉控制器市场趋势

透过智慧灌溉方法确保粮食安全

根据世界银行 2017 年的研究,人口成长将增加粮食需求。因此,到2050年,农业产量需要扩大70%才能满足粮食需求。因此,实现这一目标需要智慧灌溉方法来提高生产力和作物产量,因为许多地区缺乏足够的灌溉设施。 WaterSense 是一项由美国环保署 (EPA) 赞助的合作伙伴计划,旨在鼓励使用节水型产品和资源来帮助节约用水。这些经过认证的产品透过在灌溉过程中施用精确的水量来帮助提高作物产量。因此,这进一步增加了市场对灌溉控制器产品的需求。 2014年,欧盟宣布了先进灌溉用水和能源管理(WEAM4i)计划,旨在提高灌溉系统的用水效率、降低能源成本,改善全球粮食安全,为确保安全做出贡献。这项措施将影响智慧灌溉产品的成本,进而促进该地区的智慧灌溉方法。因此,世界各国政府对粮食安全的迫切需求正在推动整个灌溉控制器市场。

北美将主导全球市场

北美大量的草坪、花园、游乐场和高尔夫球场设有微灌溉活动,导致该地区这些设备的采用率很高。在北美,美国是灌溉管理者成长的主要贡献者,其次是欧洲。欧盟通用农业政策(CAP)鼓励欧洲农业和农村发展的创新。 CAP 的主要重点是透过改善灌溉基础设施并使农民能够使用先进的灌溉技术来节约用水。这将导致未来几年从传统灌溉系统转向机械化灌溉系统。北美在智慧灌溉控制器市场中占据主要份额。严重缺水增加了有效灌溉系统的使用,预计在预测期内将增加对灌溉控制器的需求。

预计亚太地区将成为未来五年成长最快的灌溉控制器市场。该地区成长的关键因素包括气候条件、政府的大力支持、生产力的提高以及减少水资源浪费的日益增长的需求。

灌溉控制器产业概况

灌溉管理者的形势是多种多样的并且不断发展。该领域的製造商拥有广泛的产品系列和广泛的地理覆盖范围。例如,雨鸟公司的高尔夫部门于 2019 年宣布,已指定 Living Turf 为雨鸟高尔夫灌溉产品在澳洲的主要分销合作伙伴。製造商可以透过如何更好和有效地满足买家的需求来在市场上发展。新进入者在多个行业拥有强大的影响力,因此必须与市场上的现有企业竞争。新产品开发和日益增长的自动化趋势正在该领域创造机会。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 按类型

- 基于天气的控制器

- 基于感测器的控制器

- 副产品

- 智慧型控制器

- 点击计时器

- 基本控制器

- 按灌溉类型

- 滴水/滴流

- 喷灌

- 按用途

- 农业

- 非农

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Valmont Industries, Inc.

- FlyBird Farm Innovations Pvt Ltd

- Hunter Industries

- Rain Bird Corporaion

- Netafim Ltd

- HydroPoint Data Systems, Inc.,

- Nelson Irrigation

- Galcon

- Smart Farm Systems, Inc.

- Tevatronic

第七章 市场机会及未来趋势

The Irrigation Controllers Market size is estimated at USD 41.47 billion in 2024, and is expected to reach USD 91.68 billion by 2029, growing at a CAGR of 17.19% during the forecast period (2024-2029).

Irrigation controllers are important in applying a large amount of water at the right time to obtain maximum agricultural production and to achieve a high level of efficiency in the use of water and chemicals.As many areas are facing dwindling water supplies anddrought conditions, it is suggested to use smart irrigation equipment such as controllers, because they apply the exact amount of water when it is needed, by this water and money are saved. Smart irrigation systems, unlike traditional irrigation types of equipment, tailor the watering schedules and runs automatically to meet independent crop or lawn needs. The smart irrigation equipment is available in two types, weather-based controllers and sensor-based controllers. Weather-based controllers use local weather data along with the evaporation from the soil surface and transpiration from the plant surfaceand adjust the irrigation schedules according to it. Sensor-based irrigation controllers are buries in the root zone,the moisture content level reading is read by the controllerand by this, the water is applied automatically.

Furthermore, the governmental policies to increase sustainability and reduce environmental damage are driving the demand for the controllers.Improvements in communication knowledge and increasing demand for mechanized irrigation are expected to increasegrowth opportunities over the forecast timeframe.

Irrigation Controllers Market Trends

Ensuring Food Security With Smart Irrigation Methods

According to a study by The World Bank in 2017, the demand for food will rise due to the increasing population. Hence, to meet the food requirement the agricultural production will need to expand 70% by 2050. Therefore, to achieve this target smart irrigation methods are needed to increase crop production by enhancing its productivity, as many areas don't have enough irrigational facilities. WaterSense is a partnership program sponsored by the U.S. Environmental Protection Agency (EPA) to encourage water-efficient products and resources helpful for saving water. These certified products help in increasing crop yield by applying an accurate amount of water during the irrigation process. Therefore, this has further induced the demand of irrigation controller products in the market. European Union announced a program "Water and Energy Advanced Management for Irrigation (WEAM4i)" in 2014 to improve water usage efficiency and reduce the energy costs in irrigation systems and also help in ensuring food security on a global basis. This initiative will impact the cost of smart irrigation products which as a result will drive the smart irrigation methods in the region. Hence, the pressing demand for food security from governments across the world is driving the overall market for irrigation controllers.

North America to dominate the global market

Owing to the presence of large numbers of lawns, gardens, playgrounds and golf courses and micro-irrigation activities in North America, this region has resulted in the high adoption of these devices. In North America, the United States is the main contributor to the growth of irrigation controllers, globally followed by Europe. The Common Agricultural Policy (CAP) of the European Union encourages innovation in European agriculture and rural development. CAP's primary focus is to conserve water by improving irrigation infrastructure and enabling farmers to use advanced irrigation technology. This would result in the next few years switching from conventional irrigation systems to mechanized irrigation systems. North America is responsible for a major stake in the smart irrigation controllers market.High water shortage has led to an increase in the use of effective irrigation systems, which is expected to drive demand for irrigation controllers during the forecast period.

The Asia Pacific is projected to be the fastest-growing irrigation controllers market over the next five years. The major drivers for the growth in this region include the climatic conditions, strong government support, increased productivity, and increased need for reducing wastage of water.

Irrigation Controllers Industry Overview

The irrigation controllers' landscape is diverse and continually evolving. The manufactures in this segment have a wide range of product portfolios and have great geographical reach. For instance Rain Bird Corporation - Golf Division announced the appointment of Living Turf as the primary distribution partner for Rain Bird Golf irrigation products across Australia in 2019. The manufactures can foster in the market by how well and efficiently the needs of the buyers are met. New entrants need to contend with the presence of market incumbents as they have a strong presence in several industries. New product developments and the rising trend of automation are creating opportunities in this sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Weather based controllers

- 5.1.2 Sensor based controllers

- 5.2 By Product

- 5.2.1 Smart controllers

- 5.2.2 Tap timers

- 5.2.3 Basic controllers

- 5.3 By Irrigation type

- 5.3.1 Drip/ Trickle

- 5.3.2 Sprinkler

- 5.4 By Application

- 5.4.1 Agricultural

- 5.4.2 Non- agricultural

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Rest of the Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East & Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of the Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mosted Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Valmont Industries, Inc.

- 6.3.2 FlyBird Farm Innovations Pvt Ltd

- 6.3.3 Hunter Industries

- 6.3.4 Rain Bird Corporaion

- 6.3.5 Netafim Ltd

- 6.3.6 HydroPoint Data Systems, Inc.,

- 6.3.7 Nelson Irrigation

- 6.3.8 Galcon

- 6.3.9 Smart Farm Systems, Inc.

- 6.3.10 Tevatronic