|

市场调查报告书

商品编码

1434483

硫肥:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Sulfur Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

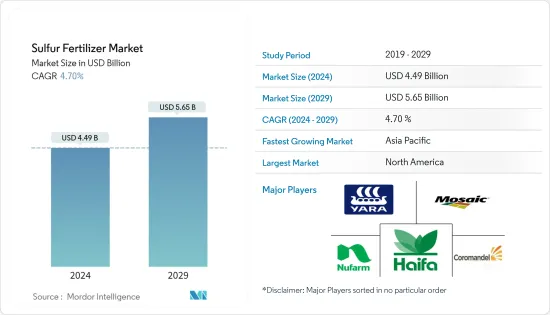

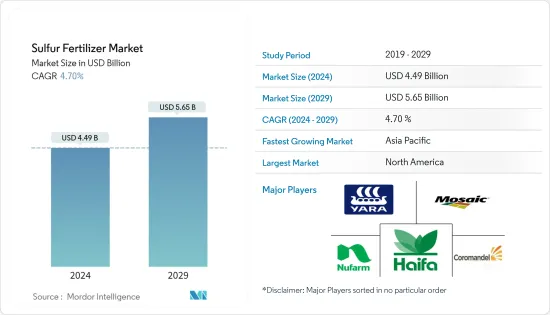

硫肥市场规模预计2024年为44.9亿美元,预计到2029年将达到56.5亿美元,在预测期内(2024-2029年)复合年增长率为4.70%增长。

推动硫肥市场成长的主要因素是化肥製造业需求的增加。化肥製造业的需求预计在预测期内将会成长。推动市场的主要因素是世界各地土壤缺硫以及易缺硫的特定作物。另一方面,严格的排放环境法规预计将阻碍市场成长。目前,欧洲和北美的硫磺消费量很大,而亚太地区预计将快速成长。

硫肥市场趋势

减少硫排放

过去几十年来,硫排放显着减少。例如,美国二氧化硫(SO2)排放从1970年的3,122万吨减少到2017年的282万吨。二氧化硫的减少主要归功于《清洁空气法》,其中包括引入酸性气体。雨计划。由于积极实施《清洁空气法》,硫排放正在减少,大气中只有25%的硫沉积在土壤上。目前,作物缺乏硫,并且由于《清洁空气法》在预测期内推动了硫常量营养素市场,未来硫缺乏将进一步增加。

亚太地区预计将主导市场

北美主导市场并拥有最高的市场占有率。广阔的农业面积和对硫磺使用的认识是特定市场成长的主要原因。由于农业实践的不断增加,对优质农产品的需求不断增加,预计亚太地区将成为成长最快的市场。

硫肥产业概况

全球硫肥市场有些分散,各个较小的公司所持股份较小。 Yara International、Nutrien Ltd 和 Coromandel International 等全球市场参与者是该领域的主要市场参与者,而 Rural Liquid Fertilizers 和 Nutri-Tech Solutions 等较小的公司也占据了该市场的重要份额。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 市场限制因素

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 类型

- 硫酸盐

- 单质硫

- 微量营养素硫酸盐

- 其他的

- 目的

- 固体的

- 液体

- 作物类型

- 粮食

- 油籽和豆类

- 水果和蔬菜

- 草坪和装饰

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 最采用的策略

- 市场占有率分析

- 公司简介

- Nufarm

- Haifa Chemicals

- K+S Aktiengesellschaft

- The Mosaic Company

- Coromandel International

- Yara International

- Nutrien

- Deepak Fertilisers and Petrochemicals

- Israel Chemicals Ltd.

- Koch Industries

第七章 市场机会及未来趋势

The Sulfur Fertilizer Market size is estimated at USD 4.49 billion in 2024, and is expected to reach USD 5.65 billion by 2029, growing at a CAGR of 4.70% during the forecast period (2024-2029).

Major factors driving the growth of the sulfur fertilizer market are the rising demand from the fertilizer manufacturing sector. Rising demand from the fertilizer manufacturing sector is expected to grow during the forecast period. The main factors which will drive the market are Sulphur deficiency in soil across the globe and specific crops prone to Sulphur deficiency. On the flip side, stringent environmental regulations regarding emissions are expected to hinder the market growth. Europe and North America have a significant consumption of sulfur currently,while rapidgrowth has been projected in the Asia-Pacific regions.

Sulfur Fertilizers Market Trends

Reduction in Sulfur Emission

Sulfur emission has decreased significantly over the last decades. For instance, In the United States, Sulfur dioxide emission (SO2) has fallen to 2.82 million tons in 2017 from 31.22 million tons in 1970. The reduction in sulfur dioxide is mainly due to the Clean Air Act, which includes the implementation of the Acid Rain Programme. As the Clean Air Act is progressing positively, there has been a reduction in sulfur emission, so the amount of atmospheric sulfur deposited in the soil is only 25%. Crops are now deficient with sulfur and in the future, more deficiency of sulfur will continue due to the "Clean Air Act" which will drive the sulfur macronutrients market during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

North America dominates the market and holds the highest market share. Large agriculture area and awareness about the use of sulphur is the main reason for the growth of the specific market. The Asia-Pacific is projected to be the fastest-growing market as the region is driven by the increasing demand for high-quality agriculture produce with the increase in agriculture practices.

Sulfur Fertilizers Industry Overview

The global sulfur fertilizer market is slightly fragmented, with various small and medium-sized companies coining smaller shares. Global market players, such as Yara International, Nutrien Ltd, and Coromandel International are the leading market players in the segment, while smaller companies, such as Rural Liquid Fertilizers and Nutri-Tech Solutions also account for a formidable share in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Sulfate

- 5.1.2 Elemental Sulfur

- 5.1.3 Sulfate of micronutrients

- 5.1.4 Others

- 5.2 Application

- 5.2.1 Solid

- 5.2.2 Liquid

- 5.3 Crop Type

- 5.3.1 Cereals and Grains

- 5.3.2 Oilseeds and pulses

- 5.3.3 Fruits and Vegetables

- 5.3.4 Turf and Ornamental

- 5.3.5 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategy

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Nufarm

- 6.3.2 Haifa Chemicals

- 6.3.3 K+S Aktiengesellschaft

- 6.3.4 The Mosaic Company

- 6.3.5 Coromandel International

- 6.3.6 Yara International

- 6.3.7 Nutrien

- 6.3.8 Deepak Fertilisers and Petrochemicals

- 6.3.9 Israel Chemicals Ltd.

- 6.3.10 Koch Industries