|

市场调查报告书

商品编码

1434492

醇聚氧乙烯醚:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Alcohol Ethoxylates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

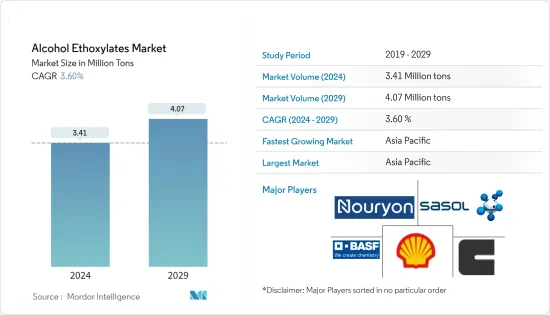

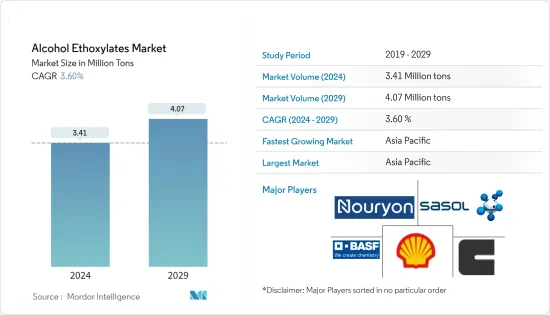

醇聚氧乙烯醚市场规模预计到2024年为341万吨,预计到2029年将达到407万吨,在预测期内(2024-2029年)复合年增长率为3.60%。

市场受到 COVID-19 的负面影响。受疫情影响,世界多个国家已进入封锁状态,以遏止病毒传播。许多企业和工厂的关闭扰乱了世界各地的供应网络,对全球生产、交货时间表和产品销售产生了负面影响。目前,市场已从 COVID-19感染疾病中恢復并正在显着增长。

主要亮点

- 短期内,亚太地区个人护理行业的成长和对工业清洁剂需求的增加将在预测期内推动市场发展。

- 然而,日益严重的环境问题和原材料成本的波动预计将严重限制预测期内醇聚氧乙烯醚市场的成长率。

- 儘管如此,生物基界面活性剂应用基础的扩大以及石油和天然气、油漆和涂料行业不断增长的需求可能会在不久的将来为全球市场创造利润丰厚的成长机会。

- 亚太地区主导全球市场,最大消费国是中国和印度,预计未来仍将如此。

醇聚氧乙烯醚市场趋势

个人护理行业需求增加

- 脂肪醇乙氧基化物是非离子界面活性剂,广泛用于个人保健产品,例如洗髮精和沐浴露。天然脂醇类的一个例子是月桂醇乙氧基化物。传统上,月桂醇乙氧基化物 (LAE) 在个人保健产品中充当发泡。

- 这些界面活性剂表现出高性能、低着色和高纯度,在洗髮精、固态露、香皂、洗手剂、乳液、护髮素、牙科、宠物护理和护肤应用中提供丰富的泡沫、温和性和优异的清洗特性。

- 近年来,由于生活品质的提高、美容和个人护理对自尊和社交的正面影响,以及消费者保持个人卫生意识的逐渐增强,对个人保健产品的需求不断增加。在预测期内,这可能会推动乙醇乙氧基化物市场远离个人保健产品。

- 欧莱雅报告显示,2025年全球美容及个人护理市场收益预计将达7,846亿美元。 2022年,美国在全球美容和个人护理市场创造了最多的收益,达到871.3亿美元。中国以 553 亿美元的收益紧随其后,日本以 385 亿美元的收益紧随其后。此外,德国以超过170亿美元位居欧洲国家之首。

- 巴西是全球第四大个人护理和美容产品市场,也是第三大产品发布国。巴西消费者越来越多地寻找物有所值的产品,这些产品天然且有益于皮肤,并以低于成本绩效的高价位提供抗老化、美白和保湿等昂贵高级产品的多种综合功效。 。国内个人护理产品领域的主要产品包括护髮产品、脸部保养产品、沐浴凝胶、口腔护理、男士洗护产品、除臭止汗剂、化妆品等。

- 据欧洲个人护理协会称,5亿欧洲消费者每天使用化妆品和个人保健产品来保护自己的健康、提高幸福感并增强自尊。它们的范围从止汗剂、香水、化妆品和洗髮精到肥皂、防晒油、牙膏和化妆品。

- 欧洲化妆品产业为开发中国家的天然成分出口商提供了巨大的机会。欧洲化妆品产业对天然成分的需求正在增加。这种扩张的主要驱动力是消费者对天然化妆品的认识不断增强,以及化妆品公司希望用天然替代品取代合成成分。

- 据Cosmetica Italia称,2022年药局洗髮精的支出约为1亿欧元,而香水店的数字达到近1,000万欧元。

- 预计所有上述因素将在未来几年推动个人保健部门对乙醇乙氧基化物的需求。

亚太地区主导市场

- 亚太地区是乙醇乙氧基化物的最大市场,肥皂和清洁剂、个人护理以及工业和机构清洗细分市场预计在未来几年将成长。

- 随着中国、印度和东南亚国协等个人护理行业的需求不断增加,预计亚太地区也将成为预测期内成长最快的市场。

- 中国和印度是全球最大的肥皂和清洁剂消费国。作为世界上人口最多的两个国家并且持续增长,这些国家的肥皂和清洁剂的消费量预计在预测期内将会增加。预计这种消费将增加未来几年对乙醇乙氧基化物的需求。

- 预计到2026年,中国家居洗衣业整体收益将增至229亿美元。洗衣护理领域预计仍将是市场上最大的领域,价值 144 亿美元。在中国,个人护理市场收益预计2023年也将达到452.2亿美元。

- 日本拥有 3,000 多家美容护理公司,其中包括资生堂、花王、高丝和POLA Orbis 等全球品牌。此外,日本美容业化妆品种类繁多,护肤、彩妆需求量大。

- 与已开发国家和其他新兴经济体相比,印度个人保健产品的普及相对较低。此外,所有人口群体卫生意识的提高也增加了对关键护肤、护髮和其他化妆品的需求。

- 预计这些因素将增加个人护理和美容行业对特种界面活性剂的需求,从而推动该国在预测期内对乙醇乙氧基化物的需求。

- 因此,在预测期内,各行业需求的成长预计将推动该地区的市场。

醇聚氧乙烯醚产业概况

醇乙氧基化物市场本质上是分散的。主要参与者包括(排名不分先后)BASF、科莱恩、沙索、诺力昂、壳牌等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 亚太地区个人护理产业的成长

- 工业清洁剂需求增加

- 其他司机

- 抑制因素

- 人们对环境问题的兴趣日益浓厚

- 原料成本波动

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 产地类型

- 油脂化学品

- 石化

- 目的

- 农业化学品

- 工业/设施清洗

- 油漆/涂料

- 个人护理

- 肥皂/清洁剂

- 纤维加工

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 其他亚太地区

- 北美洲

- 美国

- 墨西哥

- 加拿大

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- CLARIANT

- Dow

- Evonik Industries AG

- Huntsman International LLC

- India Glycols Limited

- Kemipex

- Mitsui Chemicals, Inc.

- Nouryon

- Oxiteno

- Procter & Gamble

- SABIC

- Sasol

- Shell Plc

- Solvay

- Stepan Company

- Thai Ethoxylate Co.,Ltd.(TEX)

第七章 市场机会及未来趋势

- 扩大生物基界面活性剂的应用基础

- 石油和天然气、油漆和涂料行业的需求增加

The Alcohol Ethoxylates Market size is estimated at 3.41 Million tons in 2024, and is expected to reach 4.07 Million tons by 2029, growing at a CAGR of 3.60% during the forecast period (2024-2029).

The market was negatively impacted due to COVID-19. Owing to the pandemic scenario, several countries around the world went into lockdown to curb the spread of the virus. The shutdown of numerous companies and factories has disrupted worldwide supply networks and harmed global production, delivery schedules, and product sales. Currently, the market has recovered from the COVID-19 pandemic and increasing at a significant rate.

Key Highlights

- Over the short term, the growing personal care industry in the Asia-Pacific region, and increasing demand for industrial cleaners are driving the market over the forecasted period.

- However, increasing environmental concerns and volatility in raw materials costs are expected to have major limitations on the growth rate of the alcohol ethoxylates market during the projected period.

- Nevertheless, expansion of application base for bio-based surfactants and rising demand from the oil & gas, and paints and coatings industry are likely to create lucrative growth opportunities for the global market soon.

- The Asia-Pacific region dominated the market globally, with the largest consumption coming from countries such as China and India, and this is expected to remain the same in the future.

Alcohol Ethoxylates Market Trends

Increasing Demand from Personal Care Industry

- The fatty alcohol ethoxylates are non-ionic surfactants that are widely used in, personal care products, such as shampoos, bath gels, and others. Examples of natural fatty alcohols are lauryl alcohol ethoxylates. Traditionally, Lauryl Alcohol Ethoxylates (LAE) function as a foaming agent in personal care products.

- These surfactants exhibit high performance, low color, and high purity which provide luxurious foam, mildness, and superior cleansing characteristics in shampoo, body wash, bar soap, hand soap, lotions, hair conditioner, dental, pet care, and skin care applications.

- In recent years, the demand for personal care products has increased due to the improving quality of life, the positive effects of beauty and personal care on self-esteem and social interaction, and the gradual growing awareness amongst the consumer for maintaining personal hygiene which is likely to propel the market for alcohol ethoxylates from the personal care products during the forecast period.

- According to the reports by L'Oreal, the global beauty & personal care market revenue is anticipated to ascend to USD 784.6 billion in 2025. The United States generated the most revenue from the global beauty and personal care market in 2022, with USD 87.13 billion followed by China generating a revenue of USD 55.3 billion, further followed by Japan with a revenue of USD 38.5 billion. Further, Germany ranked first among European nations, with over USD 17 billion.

- Brazil is the world's 4th largest market for personal care and beauty products and the 3rd country in terms of the number of product launches. Brazilian consumers are increasingly looking for value-for-money products that are natural and beneficial for the skin and provide a range of combined benefits of high-priced premium products like anti-aging, whitening, moisturizing, etc. at a lower than premium cost. Major products in the personal care segment in the country include hair care products, facial care products, shower gels, oral care, men's grooming products, deodorants and antiperspirants, cosmetics, and others

- According to Cosmetic Europe the personal care association, Europe's 500 million consumers use cosmetic and personal care products every day to protect their health, enhance their well-being and boost their self-esteem. Ranging from antiperspirants, fragrances, make-up, and shampoos, to soaps, sunscreens, and toothpaste, cosmetics.

- The European cosmetics industry provides great opportunities for developing-country exporters of natural ingredients. Demand for natural ingredients from the European cosmetics sector is increasing. The main drivers of this expansion are rising consumer awareness of natural cosmetics and cosmetics companies' desire to replace synthetic ingredients with natural alternatives.

- According to Cosmetica Italia, in 2022, the consumption of shampoos in pharmacies was worth roughly EUR 100 million, whereas this figure amounted to nearly EUR 10 million in perfume shops.

- All the abovementioned factors, in turn, are projected to drive the demand for alcohol ethoxylates in the personal care segment in the coming years.

Asia-Pacific Region to Dominate the Market

- The Asia Pacific region is the largest market for alcohol ethoxylates, with market segments, like soaps and detergents, personal care, and industrial and institutional cleaning, expected to grow in the coming years.

- Asia-Pacific is also expected to be the fastest-growing market during the forecast period, with increasing demand from segments like personal care, in China, India, and the ASEAN countries.

- China and India are the largest consumers of soaps and detergents across the world. Being the two largest populated countries in the world and growing, the consumption of soaps and detergents in these countries is expected to see a rise in the forecasted period. This consumption is expected to propel the demand for alcohol ethoxylates in the coming years.

- The overall Home & Laundry Care industry in China is anticipated to increase to a revenue of USD 22.9 billion by 2026. With USD 14.4 billion, the Laundry Care segment is expected to remain the biggest segment in the market. In China, revenue in the personal care market is also expected to reach USD 45.22 billion in 2023.

- Japan is home to more than 3,000 beauty care companies, including global brands of Shiseido, Kao, Kose, and Pola Orbis. Further, the Japanese beauty industry is carried by a wide range of cosmetic products, with skincare and makeup being in high demand.

- The penetration of personal care products in India is comparatively low compared to developed or other developing economies. Additionally, the rising awareness of hygiene across all population classes is boosting the demand for primary skin care, hair care, and other cosmetics.

- Such factors are expected to drive the demand for specialty surfactants from the personal care and beauty industry, thereby propelling the demand for alcohol ethoxylates in the country in the forecast period.

- Thus, the rising demand from various industries is expected to drive the market in the region, during the forecast period.

Alcohol Ethoxylates Industry Overview

The alcohol ethoxylates market is fragmented in nature. The major players include BASF SE, CLARIANT, Sasol, Nouryon, and Shell Plc, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Personal Care Industry in Asia-Pacific

- 4.1.2 Increasing Demand for Industrial Cleaners

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Environmental Concerns

- 4.2.2 Volatility in Raw Materials Costs

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Origin Type

- 5.1.1 Oleochemical

- 5.1.2 Petrochemical

- 5.2 Application

- 5.2.1 Agricultural Chemicals

- 5.2.2 Industrial and Institutional Cleaning

- 5.2.3 Paints and Coatings

- 5.2.4 Personal Care

- 5.2.5 Soaps and Detergents

- 5.2.6 Textile Processing

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Mexico

- 5.3.2.3 Canada

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 CLARIANT

- 6.4.3 Dow

- 6.4.4 Evonik Industries AG

- 6.4.5 Huntsman International LLC

- 6.4.6 India Glycols Limited

- 6.4.7 Kemipex

- 6.4.8 Mitsui Chemicals, Inc.

- 6.4.9 Nouryon

- 6.4.10 Oxiteno

- 6.4.11 Procter & Gamble

- 6.4.12 SABIC

- 6.4.13 Sasol

- 6.4.14 Shell Plc

- 6.4.15 Solvay

- 6.4.16 Stepan Company

- 6.4.17 Thai Ethoxylate Co.,Ltd. ( TEX )

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion of Application Base for Bio-based Surfactants

- 7.2 Rising Demand from the Oil & Gas, and Paints and Coatings Industry