|

市场调查报告书

商品编码

1435201

屋顶太阳能发电装置:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Rooftop Solar Photovoltaic Installation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

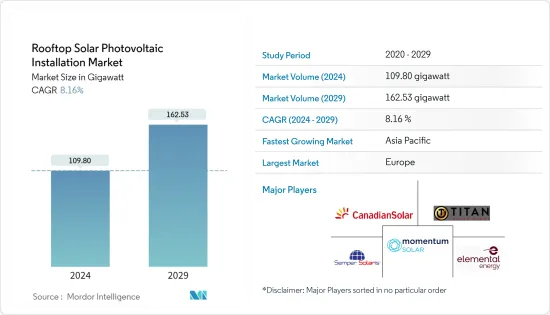

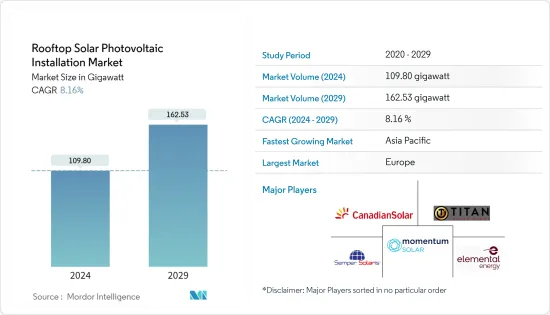

屋顶太阳能发电装置市场规模预计到2024年为109.80吉瓦,预计到2029年将达到162.53吉瓦,在预测期内(2024-2029年)复合年增长率为8.16%。

2020 年,市场受到 COVID-19 的负面影响。目前市场处于大流行前的水平。

主要亮点

- 从长远来看,政府的支持性政策(例如太阳能板安装的激励和税收优惠、太阳能光伏安装成本的降低以及电池板效率的提高)预计将在预测期内推动市场发展。

- 另一方面,中国和西方之间的地缘政治紧张局势使得太阳能供应链极易受到破坏。由于几个主要西方国家过度依赖中国的太阳能发电面板,导致进口禁令和关税增加的地缘政治事件预计将限制市场。

- 儘管如此,新的技术进步和钙钛矿太阳能电池的发展预计将为未来屋顶太阳能发电安装市场创造多个机会。

- 亚太地区是 2021 年屋顶太阳能装置的最大市场。此外,由于中国和印度等多个新兴经济体的存在,该地区可能是预测期内成长最快的市场。

屋顶太阳能发电(PV)安装市场趋势

住宅屋顶安装预计将主导市场

- 住宅部分包括个人住宅和多用户住宅。与商业和工业屋顶系统相比,住宅屋顶系统较小。住宅屋顶太阳能发电系统的容量范围通常高达 50 kW。

- 近年来,由于成本下降和政府支持政策,全球住宅屋顶太阳能发电系统的安装量大幅增加。住宅屋顶太阳能装置可以布置为较小的配置,以供迷你电网或个人使用。在各国,居住者需要方便、负担得起且可靠的电力选择,对住宅屋顶系统的需求不断增加。在许多国家,太阳能发电比从电网购买电力更具经济吸引力。

- 例如,近年来,美国住宅屋顶太阳能光电装置容量快速成长,住宅屋顶部分新增1,156兆瓦,特别是在2021年第四季。此外,根据太阳能产业协会的数据,屋顶太阳能安装商在 2021 年完成了超过 50 万个住宅计划。 2021年住宅太阳能装置量与前一年同期比较增30%,创下2015年以来的最高年度成长率。这种不断增长的需求导致了住宅太阳能需求的增加。太阳能发电工程可归因于较低的能源产出成本、极端天气事件、太阳能储存容量的增加以及全国家用电动车充电站数量的增加。 2017年,美国住宅太阳能装置总量约2.2吉瓦,2021年将增加至4.2吉瓦。

- 2022年5月,欧盟委员会主席乌苏拉·冯德莱恩宣布,到2029年,居民应在新住宅的屋顶安装太阳能。俄罗斯和乌克兰之间的衝突导致欧盟修改了其可再生能源目标,这可能是由于减少对石化燃料的依赖。此外,欧盟委员会将 2030 年可再生能源目标从 40% 提高到 45%。为了实现这一雄心勃勃的目标,政府计划为主要可再生地区提供更快的许可流程。目前,许可过程需要六到九年的时间,但预计将缩短至一年。

- 欧盟也在推动太阳能板的本地生产。例如,Enel Green Power 与欧盟签署了一项协议,扩建其在义大利的太阳能板超级工厂。在欧盟的资助下,Enel Green Power 的目标是将其发电量从目前的 200 兆瓦增加 15 倍,达到 3 吉瓦。该生产设施预计将于 2024 年 7 月运作。总投资约6亿欧元,其中欧盟的资金预计约为1.18亿欧元。这也将有助于在不久的将来降低屋顶太阳能板的成本,预计这将增加欧洲对住宅屋顶太阳能係统的需求。

- 近年来,中国、印度和澳洲等国政府大力推广住宅领域太阳能计划并降低安装成本,增加了对住宅屋顶的需求。

- 例如,印度政府启动了新能源和可再生能源部(MNRE)第二阶段併网屋顶太阳能发电计画。根据该计划,2022年4月,泰米尔南都能源发展局发布竞标,在泰米尔南都安装12兆瓦併网住宅屋顶太阳能光电系统。同样,特伦甘纳邦可再生能源委员会公司已竞标指定供应商兴建50兆瓦併网住宅屋顶太阳能发电工程。

- 因此,由于上述几点,预计住宅屋顶太阳能安装市场将在预测期内占据主导地位。

预计亚太地区将主导市场

- 近年来,亚太地区已成为太阳能装置的主要市场。过去 10 年来,太阳能发电的平准化能源成本 (LCOE) 降低了 88% 以上。因此,印尼、马来西亚和越南等该地区的新兴国家增加了太阳能发电能力。总能源结构。

- 中国几乎拥有全球所有最大的光伏(PV)製造公司和设施,全球近70%的光伏(PV)製造能力集中在中国。这些公司也控制多晶硅、硅锭和晶圆製造等其他业务,这些业务构成了太阳能板供应链不可或缺的一部分。与其他国家的太阳能设备製造商相比,全球太阳能供应链的卓越管理使中国製造商具有显着优势。

- 汉能迅速扩大了分散式屋顶太阳能发电能力,特别是在需求旺盛的东部沿海地区。然而,在78吉瓦的分散式太阳能发电容量中,只有20吉瓦来自住宅,约58吉瓦来自办公大楼和工业建筑。就工商业建筑而言,投资者通常会租用屋顶,以折扣价向建筑物业主供电,然后将其余部分出售给电网。

- 2021年6月,国家能源局发布关于进行分散式太阳能发电地市级试点的通知,旨在增加屋顶太阳能发电量。 75个地级政府将选择企业安装分散式太阳能发电并开始测试。根据国家能源局的说法,所有拥有足够屋顶、良好电网以及部署该计划的技术和财政能力的县都将有资格参加该计划,该计划将以连通性和网路升级的形式提供支持。表示将得到电网公司的支持。出口能源。此外,全县党建筑屋顶比例不低于50%,医院、学校等其他公共建筑屋顶比例不低于0%,适合安装屋顶太阳能。

- 据印度新能源和可再生能源部称,截至2020年3月,总合36.69吉瓦的太阳能发电工程正在进行中,已发出意向书(LoI)但尚未委託,约18.47吉瓦的竞标已发出但尚未投产。意向书尚未发出。 2020-21年,印度进口了价值25亿美元的太阳能硅片、电池、模组和逆变器。

- 屋顶太阳能在该国的普及不断提高,可归因于工商业消费者的高零售电价、有利的净计量政策、企业社会责任计划以及消费者意识的增强。

- 因此,由于上述几点,亚太地区预计将在预测期内主导屋顶太阳能发电安装市场。

屋顶光电安装产业概况

屋顶太阳能发电市场本质上是整合的。市场主要企业包括(排名不分先后)Titan Solar Power NV Inc.、Momentum Solar、Canadian Solar Inc.、Elemental Energy Inc.和Semper Solaris Construction Inc.。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(金额)

- 2027 年屋顶光伏 (PV) 市场(数量)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 抑制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 安装位置

- 住宅

- 商业/工业

- 地区

- 北美洲

- 亚太地区

- 欧洲

- 南美洲

- 中东/非洲

第六章 竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Titan Solar Power NV Inc.

- Momentum Solar

- Canadian Solar Inc.

- Elemental Energy Inc.

- Semper Solaris Construction Inc.

- Pink Energy

- ReVision Energy LLC

- ADT Solar

- Baker Electric Home Energy

- Infinity Energy Inc.

第七章 市场机会及未来趋势

The Rooftop Solar Photovoltaic Installation Market size is estimated at 109.80 gigawatt in 2024, and is expected to reach 162.53 gigawatt by 2029, growing at a CAGR of 8.16% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the long term, supportive government policies in the form of incentives and tax benefits for solar panel installation, declining PV installation costs, and rising panel efficiencies are expected to drive the market during the forecast period

- On the other hand, owing to the geopolitical tensions between China and western countries, the solar PV supply chain is highly vulnerable to disruptions. Geopolitical events leading to import bans and higher tariffs are expected to restrain the market, as several major western countries are overdependent on China for solar PV panels.

- Nevertheless, New technological advancements and development of perovskite solar cells are expected to create several opportunities for rooftop solar PV installation market in the future.

- Asia-Pacific was the largest market for rooftop solar PV installation in 2021. The region is also likely to be the fastest-growing market during the forecast period due to the presence of several developing economies, such as China and India.

Rooftop Solar Photovoltaic (PV) Installation Market Trends

Residential Rooftop Installation Expected to Dominate the Market

- The residential segment includes individual houses and residential building complexes. Residential rooftop mounted systems are small compared to commercial and industrial rooftop systems. The residential rooftop solar PV system typically has a capacity range of up to 50 kW.

- The deployment of residential rooftop solar PV systems has increased significantly in recent years across the world, owing to the declining costs and the government's supportive policies. Residential rooftop solar PV installations can be arranged in smaller configurations for mini-grids or personal use. There is a rise in demand for residential rooftop systems from various countries where residents need accessible, affordable, and reliable electricity options. In many countries, the electricity generated from solar PV electricity is more economically attractive than buying electricity from the grid.

- For instance, in the past couple of years, the United States experienced rapid growth in residential rooftop solar installed capacity, particularly in the fourth quarter of 2021, the residential rooftop segment added 1,156 MW. Furthermore, as per the solar energy industries association, rooftop solar installers completed more than 500,000 residential projects in 2021. Residential solar installations grew 30% year-over-year in 2021, the highest annual growth rate since 2015. This rise in demand for residential solar projects can be attributed to the reducing cost of energy generation cost, extreme weather events, improved solar storage capacity, and an increased number of home EV charging stations across the country. In 2017, the total residential solar PV installation in the United States was around 2.2 GW, which increased to 4.2 GW in 2021.

- In May 2022, the President of the European Commission, Ursula von der Leyen, announced residents to install the rooftop solar for new residential buildings by 2029. Due to the Russia-Ukraine conflict, the European Union has revised its renewable energy targets, which can be ascribed to the lowering the dependency on fossil fuels. Furthermore, the European Commission increased its renewable energy target for 2030 from 40% to 45%. To achieve this ambitious target, the government is planning to provide renewable go-to-areas where governments can give a quicker permitting process. Currently, the permitting process takes six to nine years, which is expected to bring down to one year.

- The European Union is also promoting the local manufacturing of solar panels. For instance, Enel Green Power signed a deal with the European Union to scale up a solar panel Gigafactory in Italy. Enel Green Power, with funding from European Union, aims to raise its production by fifteen-fold to 3 GW from the current 200 MW. The production facility is expected to be commissioned by July 2024. The total investment is around EUR 600 million, and European Union funding will likely be around EUR 118 million. This will also help to reduce the rooftop solar panel cost in the near future, which is expected to boost the demand for residential rooftop solar systems in Europe.

- The demand for residential rooftops has increased in countries, such as China, India, and Australia, in the past couple of years due to government initiatives to promote solar energy projects in the residential sector and reduced installation costs.

- For instance, the Government of India initiated phase II of the Ministry of New and Renewable Energy's (MNRE) grid-connected rooftop solar program. Under this program, in April 2022, the Tamil Nandu energy development agency issued a tender to install 12 MW of grid-connected residential rooftop solar systems in Tamil Nandu. Similarly, Telangana state's Renewable Energy Department Corporation invited bids to appoint suppliers to build 50 MW of grid-connected residential rooftop solar projects.

- Therefore, owing to the above points, residential rooftop solar PV installation market is expected to dominate the market during the forecast period.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific, in recent years, has been the primary market for solar energy installations. The Levelized Cost of Energy (LCOE) for solar PV in the last decade reduced by more than 88%, because of which developing countries in the region, such as Indonesia, Malaysia, and Vietnam, saw an increase in solar energy installation capacity in their total energy mix.

- China is home to nearly all the largest solar photovoltaic (PV) manufacturing companies and facilities globally, with nearly 70% of the global solar PV manufacturing capacity situated in China. These companies also dominate other businesses such as polysilicon, ingot, and wafer-making, which form an integral part of the solar panel supply chain. This extraordinary control of the global solar PV supply chain puts Chinese manufacturers at a greater advantage when compared to solar equipment manufacturers from other countries.

- hina has been rapidly expanding distributed rooftop solar PV capacity, especially in the eastern coastal regions, where the demand is higher. However, only 20 GW of the 78 GW of distributed solar capacity is residential, and around 58 GW is generated on offices and industrial buildings. For C&I buildings, investors will usually lease a rooftop, provide power to the building owner at a discount, and sell the remainder to the grid.

- In June 2021, China's National Energy Administration (NEA) published a notice on county-level trials of distributed solar power generation, designed to boost rooftop solar. 75 county-level governments have picked firms to install distributed solar and are set to start trials. According to the NEA, any county equipped with appropriate rooftops, good grid access and the technical and financial capacity to roll out the programme will be eligible for the program and will be helped by electricity grid companies in the form of provision of connections and network upgradations to export energy. Additionally, at least 50% of the rooftops of a county's Party and government buildings and 0% of other public buildings such as hospitals and schools should be suitable for the installation of rooftop solar PV.

- According to the Indian Ministry of New and Renewable Energy, as of March 2020, 36.69 GW of total solar projects are in the pipeline for which Letter of Intent (LoI) has been issued but not commissioned and for around 18.47 GW tenders have been issued but LoI are yet to be issued.. In 2020-21, India imported solar wafers, cells, modules and inverters worth USD 2.5 billion.

- The increased adoption of rooftop solar in the country can be attributed to high retail tariffs for C&I consumers, favorable net metering policies, corporate social responsibility programs and increased consumer awareness.

- Therefore, owing to the above points, Asia-Pacific is expeceted to dominate the rooftop solar PV installation market during the forecast period.

Rooftop Solar Photovoltaic (PV) Installation Industry Overview

The rooftop solar installations market is consolidated in nature. Some of the key players in the market (in no particular order) include Titan Solar Power NV Inc, Momentum Solar, Canadian Solar Inc., Elemental Energy Inc., and Semper Solaris Construction Inc among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Rooftop Solar Photovoltaic (PV) Installed Market in GW, till 2027

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Residential

- 5.1.2 Commercial and Industrial

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Asia-Pacific

- 5.2.3 Europe

- 5.2.4 South America

- 5.2.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Titan Solar Power NV Inc.

- 6.3.2 Momentum Solar

- 6.3.3 Canadian Solar Inc.

- 6.3.4 Elemental Energy Inc.

- 6.3.5 Semper Solaris Construction Inc.

- 6.3.6 Pink Energy

- 6.3.7 ReVision Energy LLC

- 6.3.8 ADT Solar

- 6.3.9 Baker Electric Home Energy

- 6.3.10 Infinity Energy Inc.