|

市场调查报告书

商品编码

1435207

抗菌纺织品:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Antimicrobial Textile - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

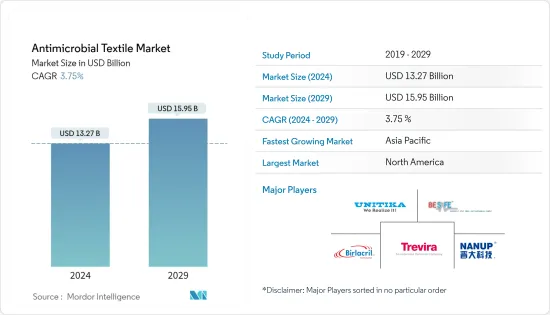

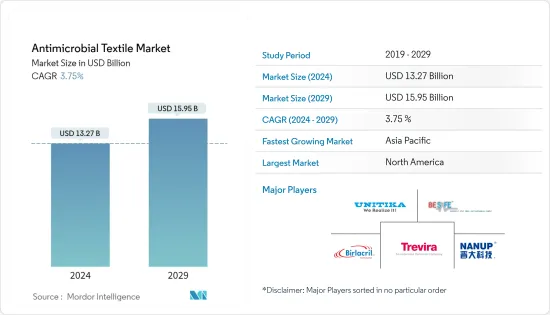

抗菌纺织品市场规模预计2024年为132.7亿美元,预计到2029年将达到159.5亿美元,在预测期内(2024-2029年)复合年增长率为3.75%增长。

2020年,由于COVID-19的感染疾病,对微生物纤维的需求增加。从那时起,世界各地对各种应用的卫生和防护纺织品的需求不断增加。

主要亮点

- 医疗保健行业需求的成长和运动服装应用的增加等因素正在推动市场成长。

- 然而,严格的环境法规正在阻碍市场成长。

- 无毒性和生物相容性产品的开发是预测期内市场成长的机会。

- 北美主导了全球市场,其中美国的消费量最高。

抗菌纺织品市场趋势

医用纺织品的应用不断增加

- 抗生素用于杀死微生物或抑制其生长。抗菌纺织品是在纤维表面或内部涂布抗菌剂的纺织品。

- 在纺丝或挤出过程中将抗菌剂引入纤维中,与染料或颜料结合,或作为整理过程应用。您选择的方法取决于多种因素,包括织物的最终用途、製造商的能力和您的预算。

- 医疗保健产业在抗菌纺织品的使用方面处于领先地位。这些纤维用于製造医用窗帘、床单、枕头套、床垫套和床单以及帮助检查基材上微生物生长的医院罩衣。

- 在美国,一座计划价值50亿美元的新医院于2022年第四季在内华达州开工。根据美国医院协会统计,截至2022年,全美总合6129家医院。

- 此外,由于新型冠状病毒感染疾病(COVID-19)的爆发,中国政府建造了多家医院来容纳不断增加的患者人数。一座包含国际肿瘤中心的新医疗大楼计划于 2023 年在中国西部竣工。

- 不同国家的此类新计划预计将在预测期内增加工作人员和患者对抗菌纺织品的需求。

亚太地区将成为成长最快的地区

- 预计亚太地区将成为预测期内抗菌纺织品成长最快的市场。由于公众健康意识的提高,中国、印度和日本等国家对抗菌纺织品的需求和使用正在扩大预测期内抗菌纺织品市场的范围。

- 最大的抗菌纺织品生产商位于亚太地区。生产抗菌纺织品的一些领先公司包括 Unitika Trading、Birlacryl、Zindananotech(厦门)、Surgicotfab Textiles Pvt. Ltd 和 Sanitized AG。

- 2022 年 8 月,一家拥有 2,600 个床位的私立医院在印度法里达巴德开业,配备了最尖端科技,包括集中式全自动技术。

- 此外,2022 年 9 月,菲律宾武装部队 (AFP) 开始在奎松卢塞纳建造一座新的三层医院。该医院将拥有25张床位,提供住院、门诊病人、急诊服务和附加服务。

- 由于该地区的这些趋势,预计该地区对抗菌纺织品的需求在预测期内将会增加。

抗菌纺织业概况

全球抗菌纺织品市场高度分散,一些公司占据了较小的市场份额。部分企业包括(排名不分先后)Birlacril、金达奈米科技(厦门)、Surgicotfab Textiles Pvt Ltd.、Trevira GmbH、UNITIKA LTD等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 医疗保健产业的需求不断增长

- 扩大用途到运动服

- 其他司机

- 抑制因素

- 严格的环境法规

- 其他限制因素

- 价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 类型

- 季铵盐

- 三氯生

- 环糊精

- 几丁聚醣

- 其他的

- 目的

- 医用纺织产品

- 服饰

- 家用纺织品

- 产业用纺织品

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Birlacril

- Herculite

- Jinda Nano Tech(Xiamen)Co.,Ltd

- LifeThreads

- Microban International

- Milliken Pivots Textile Manufacturing

- Sanitized AG

- Sinterama SpA

- Surgicotfab Textiles Pvt Ltd.

- Trevira GmbH

- UNITIKA LTD.

第七章 市场机会及未来趋势

- 开发无毒且生物相容性产品

- 其他机会

The Antimicrobial Textile Market size is estimated at USD 13.27 billion in 2024, and is expected to reach USD 15.95 billion by 2029, growing at a CAGR of 3.75% during the forecast period (2024-2029).

In the year 2020, due to the breakdown of Covid-19, the demand for microbial textiles increased. Since then, the demand for hygienic and protective textiles is increasing for various applications all over the globe.

Key Highlights

- Factors such as growing demand from the healthcare industry and increasing application in sportswear are driving market growth.

- However, stringent environmental regulations are hindering the market growth.

- The development of non-toxic and bio-compatible products will act as an opportunity for the growth of the market during the forecast period.

- North America dominated the market across the globe with the largest consumption from the United States.

Antimicrobial Textiles Market Trends

Increasing Application in Medical Textiles

- Antimicrobial agents are used to kill microorganisms or to inhibit their growth. Antimicrobial fibers are textiles to which antimicrobial agents have been applied, either at the surface or within the fibers.

- Antimicrobial agents are introduced to the fiber during spinning or extrusion, combined with dyes or pigments, or applied as a finishing process. The chosen method is determined by a variety of factors including the final use of the fabric, the capability of the manufacturer, and the budget.

- The healthcare industry leads in the usage of antimicrobial textiles. These textiles are used in making medical curtains, bed sheets, and pillow coverings, mattress covers and linens, hospital gowns which help to check microbe's growth on the substrate.

- In the United States, in the fourth quarter of 2022, a new hospital construction started with a project value of USD 5,000 million in Nevada. As of 2022, according to the American Hospital Association, there are a total of 6,129 hospitals in the country.

- Further, due to the outbreak of Covid-19, in China the government built various hospitals to cater to growing number of patients. A new medical building which comprises of International Oncology Center is set to be completed in 2023 in West China.

- Such new proejcts across various countries will increase the demand for antimircobial textiles for the staff and patients over the forecast period.

Asia-Pacific Region to be the Fastest Growing Region

- The Asia-Pacific region is expected to be the fastest-growing market for antimicrobial textiles during the forecast period. In countries like China, India, and Japan because of growing public health awareness, the demand and utilization of antimicrobial textiles has been increasing the scope of the Antimicrobial Textile Market during the forecast period.

- The largest producers of antimicrobial textiles are located in the Asia-Pacific region. Some of the leading companies in the production of antimicrobial textiles are Unitika Trading Co. Ltd, Birlacril, Jinda Nano Tech (Xiamen) Co., Ltd, Surgicotfab Textiles Pvt.Ltd, and Sanitized AG among others.

- In August 2022, in Faridabad, India, a 2,600-bed private hospital was inaugurated which is equipped with cutting-edge technology, including a centralized fully-automated technology.

- Further, in September 2022, the Armed Forces of the Philippines (AFP) started the construction of a new three-storey hospital building in Lucena, Quezon. This hospital will feature 25 beds and offers in-patient, outpatient, emergency, and additional services.

- Such trends in the region will increase the demand for anitmicrobial textiles in the region over the forecast period.

Antimicrobial Textiles Industry Overview

The global antimicrobial textiles market is highly fragmented with players accounting for a marginal share of the market. A few companies include (not in any particular order) Birlacril, Jinda Nano Tech (Xiamen) Co., Ltd, Surgicotfab Textiles Pvt Ltd., Trevira GmbH, and UNITIKA LTD among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Healthcare Industry

- 4.1.2 Increasing Application in Sportswear

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulatuions

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Quaternary Ammonium

- 5.1.2 Triclosan

- 5.1.3 Cyclodextrin

- 5.1.4 Chitosan

- 5.1.5 Others

- 5.2 Application

- 5.2.1 Medical Textiles

- 5.2.2 Apparel

- 5.2.3 Home Textiles

- 5.2.4 Industrial Textiles

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Birlacril

- 6.4.2 Herculite

- 6.4.3 Jinda Nano Tech(Xiamen) Co.,Ltd

- 6.4.4 LifeThreads

- 6.4.5 Microban International

- 6.4.6 Milliken Pivots Textile Manufacturing

- 6.4.7 Sanitized AG

- 6.4.8 Sinterama S.p.A.

- 6.4.9 Surgicotfab Textiles Pvt Ltd.

- 6.4.10 Trevira GmbH

- 6.4.11 UNITIKA LTD.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Non-Toxic and Bio-Compatible Products

- 7.2 Other Opportunities