|

市场调查报告书

商品编码

1435215

工业用盐:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Industrial Salts - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

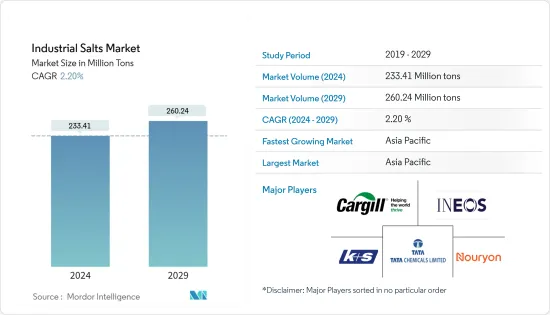

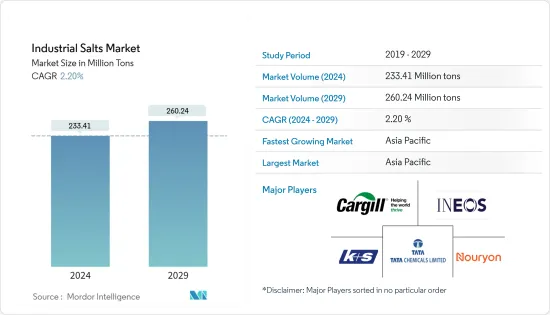

预计2024年工业盐市场规模为23,341万吨,预计2029年将达26024万吨,在预测期内(2024-2029年)增长2.20%,预计复合年增长率为

2020 年市场受到冠状病毒感染疾病(COVID-19) 的负面影响。工业用盐用于製造氯和苛性钠等化学品。由于疫情的影响,化学品製造业在政府实施的封锁期间暂时停顿,导致化学品加工所需原料的需求减少。此外,造纸过程中也会消耗工业用盐。根据欧洲造纸工业联合会(CEPA)统计,2020年Cepi成员国的纸和纸板产量与前一年同期比较下降5%。这主要是由于新型冠状病毒感染疾病(COVID-19)大流行对全球需求产生负面影响。影响所研究市场的需求。但考虑到个人卫生和清洁环境,以工业盐为原料的肥皂和清洁剂在生产过程中的使用量大幅增加,刺激了工业盐市场的需求。

主要亮点

- 短期内,化学加工和水处理应用对工业盐的需求不断增加预计将推动市场成长。

- 另一方面,环保署(EPA)实施的严格法规预计将阻碍市场成长。

- 从应用来看,由于碱灰、苛性钠和氯的生产用量不断增加,化学加工领域预计将主导市场。

- 亚太地区主导全球市场,最大的消费来自中国和印度等国家。

工业盐市场趋势

对化学加工应用的需求增加

- 工业盐是透过传统采矿、太阳能蒸发或真空蒸发从岩盐或天然盐水中生产的。

- 化学加工应用占工业盐总需求的50%以上。工业盐因其产量大、成本低而被广泛用于氯气、碱灰、苛性钠的生产。

- 在缺乏具有成本效益的替代品的情况下,工业盐被积极用于氯碱製程生产二氯乙烷等产品,刺激了对工业盐的需求。

- 根据美国化学理事会预测, 与前一年同期比较美国化学工业年产量成长率可能年增约12.3%。预计2021年化工资本投资总额将增加至335亿美元,与前一年同期比较增15.7%,可望刺激工业盐市场需求。

- 工业用盐用于生产聚氯乙烯、肥皂、清洁剂、除草剂和杀虫剂等塑胶。它也用于生产二氧化钛等无机化学品,推动工业盐市场的成长。

- 洗衣护理产业也消耗工业盐来生产清洁剂、肥皂和其他洗衣护理产品。 2019年美国洗衣护理市场价值约128亿美元,2020年达到约131亿美元,成长率约2%,刺激了研究市场的需求。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

亚太地区主导市场

- 由于该地区工业化程度不断提高,预计亚太地区将在预测期内主导工业盐市场。在中国、印度和日本等国家,由于工业用盐在工业加工工业中的使用,其需求不断增加。

- 2019年,日本化学工业规模约2,000亿美元,与前一年同期比较成长率约2.5%,正在拉动工业用盐的市场需求。

- 在大雪国家,工业盐被广泛用于清除道路上的冰。工业用盐的除冰特性也有助于延迟冰的再形成一段时间。

- 在水处理厂中,工业盐用于水的软化和净化过程。印度和中国等国家正在建造许多水处理计划,这可能会在预测期内促进工业盐的成长。

- 塑胶部门使用工业用盐生产聚氯乙烯(PVC)。 PVC广泛应用于建设产业的各种应用,如管道、PVC板等。 2019年,中国建设产业市场规模达1,0929亿美元,与前一年同期比较增14.71%。

- 此外,2019年日本新建住宅总数约1,2,755万平方公尺,2020年达到约1,1374万平方公尺,下降幅度约10.5%。这减少了PVC建材的消费量,并刺激了工业用盐市场的需求。

- 在亚太地区开展业务的主要企业包括嘉吉 (Cargill)、K+S Aktiengesellschaft 和塔塔化学有限公司 (Tata Chemicals Ltd)。

- 因此,预计上述因素将在未来几年对市场产生重大影响。

工业盐业概况

工业用盐市场较为分散,前五名企业所占市占率较小。该市场的主要企业包括嘉吉公司、K+S Aktiengesellschaft、塔塔化学有限公司、英力士和诺力昂。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 化学加工需求增加

- 水处理领域需求不断扩大

- 抑制因素

- 严格的政府法规

- 由于 COVID-19 的影响,情况不利

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 起源

- 岩盐

- 天然盐水

- 製造过程

- 日晒干燥

- 真空蒸发

- 常规采矿

- 目的

- 化学处理

- 水处理

- 除冰

- 农业

- 食品加工

- 油和气

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率/排名分析

- 主要企业策略

- 公司简介

- Archean Group

- Cargill Incorporated

- Compass Minerals

- Delmon Group of Companies

- Dominion Salt Limited

- Donald Brown Group

- Exportadora de Sal de CV

- INEOS

- K+S Aktiengesellschaft

- MITSUI & CO. LTD

- Morton Salt Inc.

- Nouryon

- Rio Tinto

- Salins IAA

- Tata Chemicals Ltd

第七章 市场机会及未来趋势

The Industrial Salts Market size is estimated at 233.41 Million tons in 2024, and is expected to reach 260.24 Million tons by 2029, growing at a CAGR of 2.20% during the forecast period (2024-2029).

The market was negatively impacted by COVID-19 in 2020. Industrial salts are used to produce chemicals like chlorine and caustic soda. Owing to the pandemic scenario, the chemical manufacturing units were on a temporary halt during the government-imposed lockdown, thus leading to a decrease in the demand for raw material needed in chemical processing. Furthermore, industrial salts are also consumed in paper manufacturing. According to the CONFEDERATION OF EUROPEAN PAPER INDUSTRIES (CEPA), the paper and board production by Cepi member countries decreased by 5% in 2020 compared to the previous year, mainly due to global demand impacted by the COVID-19 pandemic, which in turn negatively impacts the demand for the studied market. However, the usage of soaps and detergents that use industrial salts as a raw material during production has significantly increased during this situation, considering the personal hygiene and clean surrounding, which in turn stimulates the demand for the industrial salts market.

Key Highlights

- Over the short term, the increasing demand for industrial salts for chemical processing and water treatment applications is expected to drive the market's growth.

- On the flip side, strict regulations imposed by the environmental protection agency (EPA) are expected to hinder the growth of the market.

- By application, the chemical processing segment is expected to dominate the market, owing to the increasing usage in manufacturing soda ash, caustic soda, and chlorine.

- The Asia-Pacific region dominated the market across the world, with the largest consumption from countries such as China and India.

Industrial Salts Market Trends

Increasing Demand from Chemicals Processing Application

- Industrial salts are manufactured from rock salt or natural brine by conventional mining, solar evaporation, and vacuum evaporation.

- Chemical processing applications account for over 50% of the total industrial salts demand. Industrial salts are widely used for manufacturing chlorine, soda ash, and caustic soda, owing to their availability in large quantities and cost-effectiveness.

- Due to the lack of cost-effective substitutes, industrial salts are actively used in the chloralkali process to manufacture products such as ethylene dichloride, which is stimulating the demand for industrial salts.

- According to the American Chemistry Council, the annual production growth of the chemical industry in the United States is likely to rise by about 12.3% in 2021 compared to the previous year. The total chemical capital expenditure is likely to rise to USD 33.5 billion by 2021, with a growth rate of 15.7% compared to the previous year, which in turn is expected to stimulate the market demand for industrial salts.

- Industrial salts are used in the production of plastics, including polyvinyl chloride, soaps, detergents, herbicides, and pesticides. It is also used in the production of inorganic chemicals like titanium dioxide, enhancing the growth of the industrial salts market.

- The laundry care segment also consumes industrial salts for manufacturing detergents, soaps, and other laundry care products. The US laundry care market was valued at about USD 12.8 billion in 2019 and reached about USD 13.1 billion in 2020, with a growth rate of about 2%, stimulating the demand for the studied market.

- Therefore, the aforementioned factors are expected to significantly impact the market in the coming years.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for industrial salts during the forecast period, owing to the growing industrialization in the region. In countries like China, India, and Japan, due to the usage of industrial salts in the chemicals processing industry, the demand for industrial salts has been increasing.

- The Japanese chemical industry was valued at about USD 200 billion in 2019, with a growth rate of about 2.5% compared to the previous year, which in turn stimulates the market demand for industrial salts.

- Industrial salts are widely used for de-icing for clearing roadways in countries with heavy snowfall. De-icing property of industrial salts also helps to delay the reformation of ice for a certain period of time.

- In water treatment plants, industrial salts are used for the water softening and purification process. In countries like India and China, many water treatment projects are being constructed, which is likely to help stimulate the growth of industrial salts over the forecast period.

- The plastic segment uses industrial salts to produce polyvinyl chloride (PVC), which are widely used in the construction industry for different applications, including piping, PVC boards, and others. China was leading the construction industry with market size of USD 1,092.9 billion in 2019, registering a growth rate of 14.71% compared to the previous year.

- Furthermore, the total new construction in Japan accounted for about 127.55 million sq. m in 2019 and reached about 113.74 million sq. m in 2020, with a decline rate of about 10.5%. This led to a decrease in consumption of PVC-made construction materials, in turn stimulating the demand for the industrial salts market.

- Some major companies operating in the Asia-Pacific region include Cargill Incorporated, K+S Aktiengesellschaft, and Tata Chemicals Ltd.

- Therefore, the aforementioned factors are expected to significantly impact the market in the coming years.

Industrial Salts Industry Overview

The industrial salts market is fragmented, with the top five players accounting for a marginal share of the market. Some key players in the market include Cargill Incorporated, K+S Aktiengesellschaft, Tata Chemicals Ltd, INEOS, and Nouryon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand in Chemical Processing

- 4.1.2 Growing Demand from Water Treatment

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Unfavorable Conditions Arising due to the Impact of COVID-19

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Rock Salt

- 5.1.2 Natural Brine

- 5.2 Manufacturing Process

- 5.2.1 Solar Evaporation

- 5.2.2 Vacuum Evaporation

- 5.2.3 Conventional Mining

- 5.3 Application

- 5.3.1 Chemical Processing

- 5.3.2 Water Treatment

- 5.3.3 De-icing

- 5.3.4 Agriculture

- 5.3.5 Food Processing

- 5.3.6 Oil and Gas

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Archean Group

- 6.4.2 Cargill Incorporated

- 6.4.3 Compass Minerals

- 6.4.4 Delmon Group of Companies

- 6.4.5 Dominion Salt Limited

- 6.4.6 Donald Brown Group

- 6.4.7 Exportadora de Sal de CV

- 6.4.8 INEOS

- 6.4.9 K+S Aktiengesellschaft

- 6.4.10 MITSUI & CO. LTD

- 6.4.11 Morton Salt Inc.

- 6.4.12 Nouryon

- 6.4.13 Rio Tinto

- 6.4.14 Salins IAA

- 6.4.15 Tata Chemicals Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements to Produce High Purity Salts

- 7.2 Other Opportunities