|

市场调查报告书

商品编码

1435234

工厂资产管理:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Plant Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

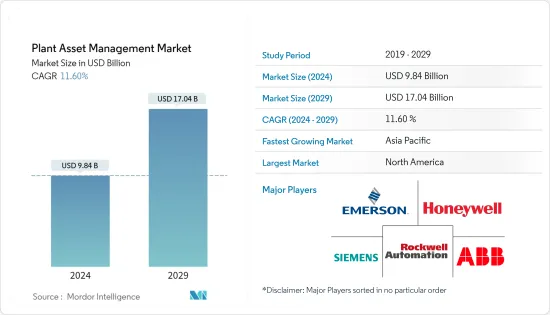

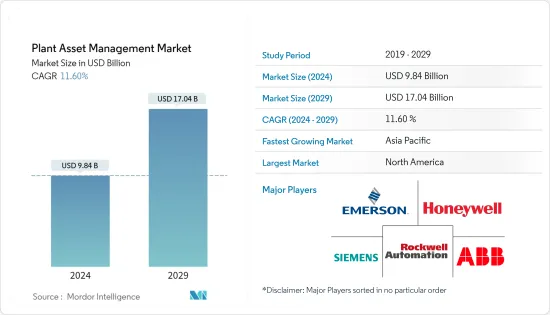

预计2024年工厂资产管理市场规模为98.4亿美元,预计到2029年将达到170.4亿美元,在预测期内(2024-2029年)成长11.60%,预计将以复合年增长率成长。

製造公司可以使用基于工厂的资产管理系统进行定期设备检查,以减少故障的可能性。工厂资产管理系统使公司能够追踪使用机械的每个位置。现场技术人员可以使用即时位置追踪来规范设备的使用,并确保授权员工可以使用设备。位置追踪还确保设备的处理符合工厂的生产安全准则。

Advantage Automotive Analytics 推出 Revo Asset Management,这是一个基于位置的创新技术平台。该应用程式即时追踪、监控和识别有价值的资产。该应用程式使用低成本智慧 GPS 技术来保护施工机械、发电机和其他贵重物品。

设备突然停机可能会影响生产计划、延迟订单履行、导致客户不满意并导致收入损失。有鑑于这项挑战,Aptean 实施了云端基础的企业资产管理解决方案 (EAM) 来处理工作订单、自动化核准、追踪备件库存、安排预防性保养维护、寻找合适的技术纯熟劳工、分配并进行行动合规检查。 CoreFx 是 Aptean EAM 的早期采用者,观察到整体事件较少,车间停机时间也较少。

如果公司保留或使用保固状态的资产,则可以透过支付不必要的维修费用为公司节省大量资金。根据 ServiceChannel 的一项研究,企业因支付超出保固期的设备维修费用而损失了近 35% 的潜在保固节省。这些预设设定可以使用资产管理软体进行管理。

资料安全可能会影响工厂资产管理市场的成长。云端设施是储存大量资料的好方法,但如果管理得当,它们就不会被盗。公司不仅遭受经济损失,负面宣传也会损害公司的声誉。

由于冠状病毒感染疾病(COVID-19) 的爆发以及世界各地实施封锁,大多数行业都遭受了收益损失。建设产业就是这样的行业之一,由于该行业需要资料主导,该行业的企业受到了沉重打击。一些公司已经认识到这项挑战,并采用了资产管理软体,例如 Go Codes 工具追踪软体。该应用程式列出了有关您公司资产的所有信息,以提高您的工作效率。例如,技术人员可以透过应用程式签入来即时检查设备的可用性。

工厂资产管理市场的趋势

石油和天然气将推动市场显着成长

石油和天然气是国际上交易并用于多个行业的高性能资产。手动追踪此交易中从采购到销售的所有活动变得很复杂。资产管理软体在这里发挥关键作用,可以略微降低营运成本。预测性维护是一项重要的资产管理功能,可协助您追踪和安排维修週期、降低人事费用并利用公司资金。

在石油和天然气行业,该行业使用的大多数设备都是公司拥有或租赁的,因此即时监控所有资产的位置、性能和安全非常重要。压力控制设备、检查设备、储存容器、管道、铁路道口等都是需要持续监控和维护的设备,以确保您的日常业务和业务顺利运作。

石油和天然气行业的加工厂非常复杂,由昂贵且关键的设备组成。由于各种因素造成的磨损,工厂的健康状况和性能会随着时间的推移而恶化,对生产和相关成本产生负面影响。资产管理策略旨在透过系统地监控设备状况、避免计划外生产停机以及透过优化维护计划来降低营运成本来应对这种影响。

上游油气产业公司每年至少经历27天的非计画停机,造成3,800万美元的损失。预测分析使用机器学习 (ML) 技术来预测机械和设备何时需要维修。因此,整体停机成本降低,企业节省大量不必要的开支。

借助有效的维护计划和资产登记,可以避免生产设施中的石油洩漏和其他事故等环境风险。透过预防性保养,企业可节省高达 18% 的费用。英国石油公司 (BP) 与微软合作开发 Azure 人工智慧 (AI) 和机器学习解决方案,以实现石油和天然气营运转型。人工智慧 (AI) 增强了远端员工的安全措施。

去年,贝克休斯与C3 AI、Accenture和微软签署协议,为能源和工业领域的客户提供工业资产管理(IAM)解决方案。此解决方案的增强数位技术提高了工业机械、现场设备和其他实体资产的安全性、效率和排放状况。

北美占有很大的市场占有率

去年,北美地区共有122份石油和天然气合同,其中美国贡献最多,有113份,占所有石油和天然气合同的93%,其次是墨西哥,占3%,加拿大仅占2%。共用。其中 99 份合约涉及营运和维护,显示石油和天然气公司正在投资资产管理。

根据 Westwood 的陆上管道预测,预计 2022 年至 2028 年各公司将投资约 3,700 亿美元建设新石油和天然气管道。预计此期间将新建油气管道31万公里。预计中国和北美将发挥领导作用。在天然气管道总长度中,北美将占20.5万公里。由于俄罗斯和乌克兰衝突,欧洲和亚洲的需求急剧增加,北美去年成为最大的LNG(液化天然气)出口国。

云端技术的进步使该地区的工厂资产管理变得更加容易。这些解决方案可协助工厂调整维护计划以降低成本、追踪和管理库存和设备使用、适应劳动力短缺等。企业正在实施旨在提高生产力的新云端解决方案。

总部位于美国的Honeywell推出了用于监测和优化碳排放的永续性解决方案。基于感测器的解决方案使组织能够近乎即时地监控和可视化排放。工业部门在努力减少温室气体(GHG)排放和实现碳减排目标的过程中将受益于新的关键措施。

工厂资产管理行业概览

与多家财富管理服务提供者的竞争非常激烈。主要参与者包括 ABB 集团、艾默生电气公司、西门子公司、罗克韦尔自动化和霍尼韦尔国际公司。製造业正在大力投资人工智慧(AI),增加了对资产管理服务的需求。为了保持业务一致性并进一步扩展其服务,资产管理提供者收购并投资新公司和技术。

2022 年 11 月 - 医疗保健绩效改善公司 Vizient 与医疗保健供应链分析公司 Handle Global 合作,使 Vizient 成员医疗保健组织能够透过资本资产管理系统管理资本支出和设备。该系统为医疗保健组织提供资料、分析和见解,以改善设备生命週期规划、采购、资产利用率,并最终降低成本。

2023 年 2 月 - 自然和建筑资产设计和咨询组织 Arcadis 与加拿大数位科技新兴企业Niricson 合作。 Arcadis 利用机器人技术、电脑视觉、声学和人工智慧 (AI) 使桥樑基础设施的预测性维护更安全、更快速且更具成本效益。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 采用即时资料分析

- 采用精实製造方法

- 市场限制因素

- 缺乏熟练人才

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 提供

- 软体

- 服务

- 部署

- 本地

- 云

- 最终用户

- 能源/电力

- 油和气

- 石油化学

- 矿业/金属

- 航太/国防

- 车

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 公司简介

- ABB Group

- Emerson Electric Co.

- Honeywell International Inc.

- Rockwell Automation, Inc.

- Siemens AG

- SFK Group

- Ramco Systems

- General Electric Co.

- Endress+Hauser AG

- Schneider Electric SE

- 投资分析

第七章 市场机会及未来趋势

The Plant Asset Management Market size is estimated at USD 9.84 billion in 2024, and is expected to reach USD 17.04 billion by 2029, growing at a CAGR of 11.60% during the forecast period (2024-2029).

Using plant-based asset management systems, manufacturing firms may conduct routine equipment inspections to reduce the likelihood of failures. A plant asset management system enables companies to track every location where machines are being used. Field technicians can regulate equipment usage and ensure it stays with the authorized employees using real-time location tracking. The ability to track locations also ensures the equipment is handled within the plant's safety guidelines for production.

Advantage Automotive Analytics launched Revo Asset Management, a platform for innovative location-based technology. The application will track, monitor and locate valuable assets in real-time. The application safeguards construction equipment, generators, and other valuables with low-cost, smart GPS technology.

Sudden equipment downtime can affect production schedules, which can delay order fulfillment, lead to unhappy customers, and result in income loss. Recognizing this challenge, Aptean introduced a cloud-based enterprise asset management solution (EAM) to handle work orders, automate approvals, track spare parts inventories, schedule preventative maintenance, allocate appropriately skilled workers, and conduct mobile compliance inspections. CoreFx, the early adopters of Aptean EAM, observed a reduction in overall accidents leading to less downtime on the floor.

If a company keeps assets of the warranty status or avail assets, it could save the business real money by paying for unnecessary repairs. According to ServiceChannel research, firms lose almost 35% of potential warranty savings from paying for repair on under-warranty equipment. Such defaults can be managed with the help of Asset management software.

Data Security can affect the growth of the Plant Asset Management Market. Cloud facilities are a great way to store enormous amounts of data, but if managed well, it is safe from theft. The company can not only suffer financial loss, but a negative reputation can also damage a company's profile.

With lockdowns around the globe, most industries suffered a loss of revenue during the COVID-19 outbreak. One such sector was the construction business, where companies were hit hard because the industry needed to be data-driven. Some companies recognized this challenge and adopted asset management software like Go Codes tool tracking software. The app listed all the information about company assets for better productivity. For instance, a technician could check equipment availability in real time by checking in the app.

Plant Asset Management Market Trends

Oil and Gas Accounts For Significant Market Growth

Oil and gas are high-functioning assets traded internationally and used across multiple industries. It becomes complicated to manually track all the activities of this trade, from procurement to selling. The asset management software plays an important role here, ensuring operational costs are kept marginally low. Predictive maintenance is a crucial asset management feature that helps track and schedule repair cycles, lowering labor costs and utilizing company funds.

Real-time monitoring of all assets' location, performance, and safety is critical in the oil and gas industry, as most of the equipment used in this sector is owned or leased by the companies. Pressure control equipment, logging equipment, storage containers, pipes, and crossings are some of the instruments that require constant monitoring and maintenance for the smooth functioning of day-to-day operations and business.

The process plants in the oil and gas industry are complex and consist of expensive and critical equipment. As the plant's condition and performance degrade over time due to wear from several factors, this harms the production and the associated costs. Asset management strategies aim to counter this impact by systematically monitoring equipment conditions, avoiding unplanned production downtime, and reducing operational expenses by optimizing maintenance planning.

The upstream oil and gas industry companies undergo at least 27 days of unplanned downtime each year, costing them 38 million USD. Predictive Analysis uses Machine learning (ML) techniques to forecast when machinery and equipment need repairs. Thus it can reduce the overall downtime cost, thereby saving a lot of unnecessary expenses for the company.

Environmental risks, like oil spills or any other accident at the production facility, can be averted with the help of effective maintenance plans and asset registries. A company can save up to 18% with the help of preventive maintenance. British Petroleum (BP) has partnered with Microsoft for its Azure artificial intelligence (AI) and Machine Learning solutions to transform oil and gas operations. Artificial intelligence (AI) will increase safety measures for employees working in remote locations.

In the previous year, Baker Hughes signed a contract with C3 AI, Accenture, and Microsoft to provide industrial asset management (IAM) solutions for clients in the energy and industrial sectors. The enhanced digital technologies of the solution will improve the safety, efficiency, and emissions profile of industrial machines, field equipment, and other physical assets.

North America to Hold Significant Market Share

There were 122 oil and gas contracts in North America in the previous year, US contribution being the highest with 113 contracts, representing a 93% share of all the oil and gas contracts, followed by Mexico at 3% and Canada at only a 2% share. Operations & maintenance covered 99 of these contracts, which shows Oil and Gas companies are investing in asset management.

According to Westwood's onshore pipeline forecast, companies are expected to invest around 370 billion USD between 2022 and 2028 on new oil and gas pipelines. It is projected 310,000km of new oil and gas pipelines will be built during this period. China and North America are expected to lead the charge. North America will account for 205,000km of total installments for gas pipelines. North America became the largest LNG (liquified natural gas) exporter in the previous year, as the demand surged from Europe and Asia due to the Russia- Ukraine conflict.

Plant Asset Management is becoming more accessible due to advancements in the cloud in this region. These solutions can help plants refine maintenance schedules to cut costs, track and manage inventory and equipment usage, adapt to labor shortages, and more. Companies are introducing new cloud solutions exhibiting to improve productivity.

US-based Honeywell introduced a sustainability solution for carbon emissions monitoring and optimization. The sensor-based solution will enable organizations to monitor and visualize emissions in near real-time. Industrial sectors will benefit from the new key as they work to cut their greenhouse gas (GHG) emissions and achieve their carbon reduction targets.

Plant Asset Management Industry Overview

There is intense competition with several providers of Asset Management Services. The major players include ABB Group, Emerson Electric Co., Siemens AG, Rockwell Automation, and Honeywell International. Because manufacturing sectors invest extensively in artificial intelligence (AI), there is a high demand for Asset Management Services. To maintain consistency in the business and expand services further, asset management providers are making acquisitions and investments in new companies and technologies.

November 2022 - Vizient, the healthcare performance improvement company, collaborated with Handle Global, the healthcare supply chain analytics, to help Vizient member healthcare organizations manage their capital expenses and equipment through the capital asset management system. This system will offer healthcare organizations data, analytics, and insights for improved equipment lifecycle planning, procurement, and asset utilization that will ultimately reduce costs.

February 2023 - Arcadis design and consultancy organization for natural and built assets collaborated with Canada-based digital technology start-up Niricson. Using robotics, computer vision, and acoustic technology with artificial intelligence (AI), Arcadis can make predictive maintenance of bridge infrastructure safer, faster, and more cost-effective.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption Of Real-Time Data Analytics

- 4.2.2 Adoption of Lean Manufacturing Practices

- 4.3 Market Restraints

- 4.3.1 Lack of Skilled Personnel

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Offerings

- 5.1.1 Software

- 5.1.2 Services

- 5.2 Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 End-User

- 5.3.1 Energy and Power

- 5.3.2 Oil & Gas

- 5.3.3 Petrochemical

- 5.3.4 Mining & Metal

- 5.3.5 Aerospace & Defense

- 5.3.6 Automotive

- 5.3.7 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Group

- 6.1.2 Emerson Electric Co.

- 6.1.3 Honeywell International Inc.

- 6.1.4 Rockwell Automation, Inc.

- 6.1.5 Siemens AG

- 6.1.6 SFK Group

- 6.1.7 Ramco Systems

- 6.1.8 General Electric Co.

- 6.1.9 Endress+Hauser AG

- 6.1.10 Schneider Electric SE

- 6.2 Investment Analysis