|

市场调查报告书

商品编码

1435235

工业齿轮箱:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Industrial Gearbox - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

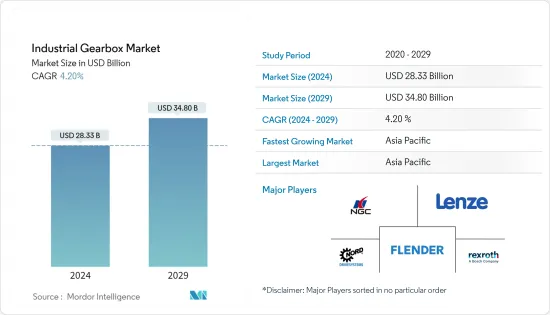

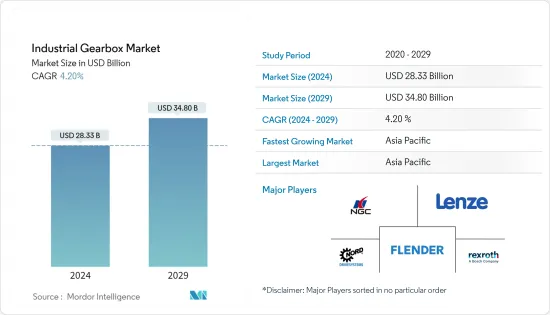

工业齿轮箱市场规模预计2024年为283.3亿美元,预计到2029年将达到348亿美元,在预测期内(2024-2029年)增长4.20%,以复合年增长率增长。

工业齿轮箱市场规模预计将从2023年的271.9亿美元成长到2028年的334亿美元,预测期内复合年增长率为4.20%。

主要亮点

- 从中期来看,製造业、钢铁、食品和饮料等各个工业领域越来越多地采用工业自动化等因素预计将在预测期内推动市场发展。

- 另一方面,经济和工业活动放缓预计将对工业齿轮箱市场产生负面影响并抑制市场成长。

- 儘管如此,对节能齿轮箱的需求激增预计将在未来几年为全球工业齿轮箱市场创造巨大机会。

工业齿轮箱市场趋势

螺旋变速器类型细分市场占据主导地位

- 在螺旋变速器中,斜齿轮齿是与齿轮面对角地切割的。当两个齿开始嚙合时,从齿的一端逐渐开始接触并保持接触,直到齿轮完全嚙合时旋转。实现平稳运转和高推力输出。此齿轮最常用于汽车变速箱并产生很大的推力。

- 螺旋变速器的特点包括非常高的输出扭力、安静的运作和较长的使用寿命。螺旋变速器是业界製造的效率最高的变速箱,运作效率高达 98%,仅次于行星齿轮变速器。由于其高效率和高推力产生能力,螺旋变速器应用于化肥、汽车、钢铁、轧延、电力和港口工业等主要行业以及纺织、塑胶和食品等製造业。

- 螺旋变速器用于中型和重型工业应用的汽车变速箱,因为它们可以处理高速和高负载。模组化设计和构造提供了许多工程和性能优势,包括零件和子组件的高度相容性。这提供了显着的生产经济性,同时保持了组件完整性的最高标准。

- 汽车产量的进一步增加增加了对螺旋齿轮的需求。根据国际汽车製造商组织的数据,2022 年全球汽车产量约 8,500 万辆。与前一年相比,这一数字大幅成长,增幅超过6%。

- 因此,基于上述因素,螺旋变速器类型预计将在预测期内主导市场。

亚太地区主导市场

- 由于製造业、电力业等各种应用对变速箱的需求不断增加,预计亚太地区将在 2022 年占据工业变速箱市场的主要份额。印度、中国、日本、韩国和澳洲等国家是该地区的主要贡献者。

- 中国已成为全球製造业成长不可或缺的一部分。该国是钢铁、化工、电力和水泥行业的领导者,也是石化和精製行业的主要企业之一。

- 此外,中国也是全球最大的粗钢生产国和出口国,产量占全球一半以上。 2022年全国粗钢产量约101795.9万吨。中国的「一带一路」计划弥合了地区基础设施差距,预计将提振钢铁需求。

- 此外,合资伙伴阿美公司、北方工业集团和盘锦新城工业集团计划于2023年3月在中国东北地区开始建造大型炼油化工综合体。因此,炼油厂和石化业务的扩张以及即将建造的燃煤发电厂预计将在预测期内增加能源领域工业齿轮箱的安装量。

- 以装置容量计算,印度也是全球第四大陆上风电市场,截至2022年风力发电容量达41.93吉瓦。该国风电市场的成长得益于两个基本因素:不断增长的能源需求和政府目标。印度目前也正在寻求利用尚未开发的风力发电潜力来扩大其绿色能源组合。因此,如果真正的潜力得以实现,风电领域对工业齿轮箱的需求预计在未来几年将会增加。

- 同样,日本是世界上最大的液化天然气进口国之一,其次是中国和韩国。随着天然气基础设施的发展和清洁能源的进步,该国有兴趣发展液化天然气基础设施以增加全球液化天然气需求。齿轮箱用于安装在LNG接收站的涡轮机,齿轮箱安装在液化天然气处理终端的高速泵浦驱动器、螺旋桨驱动器或压缩机驱动器中。

- 因此,基于上述因素,亚太地区预计将在预测期内主导工业齿轮箱市场。

工业齿轮箱产业概况

工业齿轮箱市场正在慢慢整合。市场主要企业包括(排名不分先后)南京高精度驱动设备製造集团、Lenze SE、Flender Ltd、Getriebebau NORD GmbH &Co. KG、Bosch Rexroth AG。

目录

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

年表

第一章简介

- 调查范围

- 合作公寓市场 合作公寓市场

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2028年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 工业自动化在各工业领域的采用率不断提高

- 全球汽车销售成长

- 经济和工业活动停滞

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场区隔

- 蜗轮箱

- 螺旋变速器

- 锥齿轮-斜螺旋变速器

- 行星齿轮变速器

- 原厂变速箱

- 生产

- -电力产业

- 钢铁工业

- 采矿业

- 污水处理业

- 製造业

- 其他用途

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争形势

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Nanjing High Accurate Drive Equipment Manufacturing Group Co. Ltd

- Lenze SE

- Flender Ltd.

- Getriebebau NORD GmbH & Co. KG

- Bosch Rexroth AG

- Zollern GmbH & Co. KG

- INGECO GEARS Pvt Ltd.

- Sew-Eurodrive GmbH & Co KG

- Essential Power Transmission Pvt Ltd.

- Bonfiglioli Drives Co. Ltd.

- Kngear

- Elecon Engineering Company Limited

第七章 市场机会及未来趋势

- 节能齿轮箱的需求快速成长

The Industrial Gearbox Market size is estimated at USD 28.33 billion in 2024, and is expected to reach USD 34.80 billion by 2029, growing at a CAGR of 4.20% during the forecast period (2024-2029).

The Industrial Gearbox Market size is expected to grow from USD 27.19 billion in 2023 to USD 33.40 billion by 2028, registering a CAGR of 4.20% during the forecast period.

Key Highlights

- Over the medium term, factors such as the growing adoption of industrial automation across various industrial sectors, like manufacturing, steel, and food and beverages, are expected to drive the market during the forecast period.

- On the other hand, the slowdown in economic and industrial activities is expected to negatively impact the industrial gearbox market, thus restraining market growth.

- Nevertheless, soaring demand for energy-efficient gearboxes is expected to create immense opportunities for the global industrial gearbox market in the coming years.

Industrial Gearbox Market Trends

Helical Gearbox Type Segment to Dominate the Market

- In a helical gearbox, the teeth on a helical gear are cut at an angle to the face of the gear. When two teeth start to engage, the contact gradually begins at one end of the tooth and maintains contact as the gear rotates in full engagement. It offers the capacity to conduct a smooth operation and high thrust outputs. It is the most used gear in automobile transmissions, generating large amounts of thrust.

- Defining features of helical gearboxes include extremely high output torques, silent operation, and long service life. Helical Gearboxes are the most efficient gearboxes manufactured in the industry and work at 98% efficiency, after Planetary Gearboxes. Due to their high efficiency and high thrust generating capabilities, helical gearboxes are utilized in major industries, like fertilizer, automobiles, steel, rolling mills, power and port industries, and manufacturing sectors, such as textile, plastics, and food.

- Helical Gearbox is used in automobile transmissions in medium and heavy-duty industrial applications, as it can handle high speeds and loads. Modular design and construction offer many engineering and performance benefits, including a high degree of interchangeability of parts and sub-assemblies. This, in turn, provides considerable economies of production while maintaining the highest standard of component integrity.

- Further increasing automobile production is driving the demand for helical gears. According to the International Organization of Motor Vehicle Manufacturers, in 2022, around 85 million motor vehicles were produced worldwide. This represents a significant increase of more than 6% compared to the previous year.

- Therefore, based on the above factors, the helical gearbox type segment is expected to dominate the market during the forecast period.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region accounted for a significant share of the industrial gearbox market in 2022, owing to the increasing demand for gearboxes in various applications like the manufacturing sector, power industry, etc. Countries such as India, China, Japan, Korea, and Australia, are the key contributing nations in the region.

- China has been an essential factor in the growth of the manufacturing sector worldwide. The country is the leader in the steel, chemical, power, and cement industries and is one of the top players in the petrochemical and refining industries.

- Moreover, China has been the biggest crude steel producer and exporter, accounting for more than half of global production. In 2022 the country's crude steel production was around 1017.959 million tonnes. China's One Belt One Road project to bridge the infrastructure gap in the region is expected to boost the steel demand.

- Furthermore, In March 2023, Aramco and NORINCO Group and Panjin Xincheng Industrial Group, joint venture partners, planned to begin construction of a significant integrated refinery and petrochemical complex in northeast China. Hence, with the expansion of refineries and petrochemical businesses and the upcoming coal-fired plants, the country is expected to witness an increase in industrial gearbox installations in the energy sector during the forecast period.

- Also, India was the world's fourth-largest onshore wind market by installations, with 41.93 GW of wind capacity as of 2022. The wind power market in the country has been growing by two fundamental drivers: rising energy demand and governmental targets. Also, India is presently trying to expand its green energy portfolio by harnessing the unexploited offshore wind energy potential. Hence, once the true potential is realized, the demand for industrial gearboxes in the wind power sector is expected to increase in the upcoming years.

- Similarly, Japan is one of the largest LNG importers worldwide, followed by China and South Korea. With the developed gas infrastructure and progression toward cleaner energy, the country is interested in developing the LNG infrastructure to enhance the global LNG demand. The gearbox is used in turbines fitted in LNG terminals, or the gearbox is installed in high-speed pump drives, propellor drives, or compressor drives in LNG processing terminals.

- Therefore, based on the above-mentioned factors, Asia-Pacific is expected to dominate the industrial gearbox market during the forecast period.

Industrial Gearbox Industry Overview

The industrial gearbox market is moderately consolidated. Some of the major players in market (not in particular order) include Nanjing High Accurate Drive Equipment Manufacturing Group Co. Ltd, Lenze SE, Flender Ltd, Getriebebau NORD GmbH & Co. KG, and Bosch Rexroth AG., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Industrial Automation across Various Industrial Sectors

- 4.5.1.2 Rising Sales for Automobiles across the World

- 4.5.2 Restraints

- 4.5.2.1 Slow Down in Economic and Industrial Activities

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Worm Gearbox

- 5.1.2 Helical Gearbox

- 5.1.3 Bevel Helical Gearbox

- 5.1.4 Planetary Gearbox

- 5.1.5 Other Types

- 5.2 Application

- 5.2.1 Power Industry

- 5.2.2 Steel Industry

- 5.2.3 Mines and Minerals Industry

- 5.2.4 Wastewater Treatment Industry

- 5.2.5 Manufacturing Industry

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nanjing High Accurate Drive Equipment Manufacturing Group Co. Ltd

- 6.3.2 Lenze SE

- 6.3.3 Flender Ltd.

- 6.3.4 Getriebebau NORD GmbH & Co. KG

- 6.3.5 Bosch Rexroth AG

- 6.3.6 Zollern GmbH & Co. KG

- 6.3.7 INGECO GEARS Pvt Ltd.

- 6.3.8 Sew-Eurodrive GmbH & Co KG

- 6.3.9 Essential Power Transmission Pvt Ltd.

- 6.3.10 Bonfiglioli Drives Co. Ltd.

- 6.3.11 Kngear

- 6.3.12 Elecon Engineering Company Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Soaring Demand for Energy Efficient Gearboxes