|

市场调查报告书

商品编码

1689850

几丁聚醣:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Chitosan - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

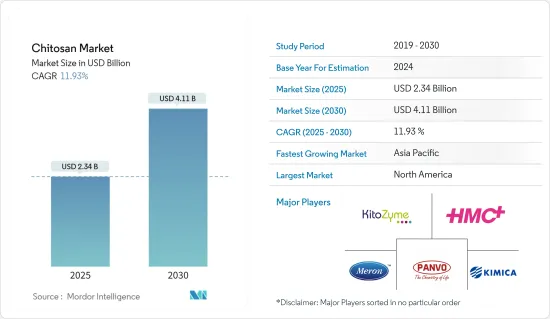

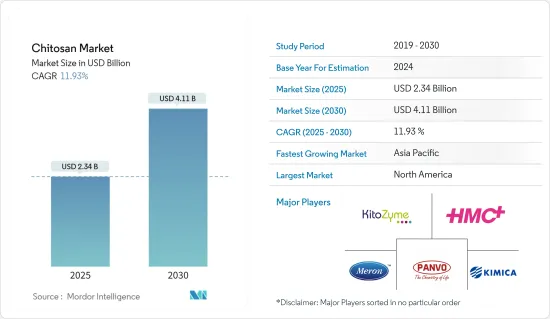

几丁聚醣市场规模预计在 2025 年为 23.4 亿美元,预计到 2030 年将达到 41.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.93%。

市场正在经历显着的成长率,有几个关键因素决定其发展轨迹。这些市场驱动因素与几丁聚醣在水处理、生物医学和製药行业以及食品和饮料行业等行业日益广泛的应用密切相关。

塑造市场的大趋势对永续和环保材料的日益关注以及不断增长的医疗需求是推动几丁聚醣产业发展的主要大市场趋势。各产业对天然材料的需求不断成长,将进一步提升几丁聚醣的市场地位。几丁聚醣的多功能性可应对全球挑战,为从环境修復到医疗保健创新等广泛领域提供解决方案。

增加水处理活动:水质管理已成为全球的重大挑战,对有效处理解决方案的需求也随之增加。几丁聚醣由于其羟基和胺基而具有金属离子吸附能力,对去除重金属和油等污染物非常有效。几丁聚醣广泛用于水处理中作为絮凝助剂,可增强传统凝聚剂的效能。氧化石墨烯/几丁聚醣吸附剂等复合材料已被证明能有效去除污水中的金属离子。几丁聚醣(TMC) 和其他几丁聚醣衍生物等创新技术可望缓解淡水水源中蓝菌繁殖等环境问题。

扩大在生物医药、化妆品以及食品饮料行业的产品应用:几丁聚醣的多功能性使其被广泛应用于各个行业。市场分析显示,几丁聚醣广泛应用于生物医学应用,包括伤口敷料、药物传递、组织工程和基因治疗。几丁聚醣的抗菌、抗氧化和生物黏附特性使其在药物传输和伤口护理有效。在癌症治疗中,几丁聚醣透过在肿瘤部位积聚并诱导免疫反应来增强免疫疗法。在化妆品中,几丁聚醣预防发炎反应和感染疾病的能力使其在护肤配方中具有重要价值。在食品工业中,几丁聚醣越来越多地用作食品添加剂和抗菌剂,并已在日本、韩国等主要市场核准。

医疗保健和医疗行业的强劲进步:利用几丁聚醣独特性能的技术创新不断增加,特别是在药物传输和组织工程方面,有助于增加几丁聚醣在医疗保健领域的市场占有率。根据市场分析,以几丁聚醣为基础的奈米粒子正在推动标靶药物输送,特别是在癌症治疗领域。在牙科领域,几丁聚醣复合材料可改善细胞黏附和骨再生,为人工植牙和珐琅质保存提供了新的可能性。几丁聚醣的生物相容性在组织工程中变得越来越重要,其在皮肤、骨骼和软骨再生的应用也越来越普遍。这些进步支持了几丁聚醣在医疗保健领域中的作用不断扩大。

几丁聚醣市场趋势

虾源几丁聚醣:主宰供应商

细分市场概况:虾源几丁聚醣仍是市场的基石,占几丁聚醣市场占有率的42%。该领域的主导地位归功于虾几丁聚醣的卓越品质和可用性,它在生物医学、水处理和食品保鲜等领域具有宝贵的应用。

成长动力:虾类衍生的几丁聚醣满足了全球对永续材料的需求,推动了其在各个产业的应用。水产养殖业的成长,尤其是亚太地区的成长,确保了原料的稳定供应,而生物医学和环境管理应用对高品质几丁聚醣的需求也不断增加。

竞争格局:市场领导和参与者正在采用垂直整合策略来维持其在虾源几丁聚醣的主导地位。萃取技术的创新也是一个关键的区别因素,公司专注于提高几丁聚醣的品质和纯度。正在开发永续的养殖方法,以减少对虾养殖对环境的影响,确保持续成长、增加市场占有率和在该领域的领导地位。

亚太地区:几丁聚醣市场成长的中心

区域动态:亚太地区是全球几丁聚醣市场成长最快的地区,预计 2024 年至 2029 年的复合年增长率为 12.38%。快速的工业化、研发投资和对几丁聚醣应用的认识不断提高正在推动亚太地区市场的成长。

成长催化剂:中国和印度等国家蓬勃发展的製药和生物医药产业以及不断增加的医疗保健基础设施投资是市场成长的主要驱动力。随着这些快速发展中国家对先进水处理解决方案的需求增加,几丁聚醣的应用范围也不断扩大。此外,消费者对化妆品和食品中天然成分的偏好日益增长,也推动了这些产业对几丁聚醣的需求。

策略问题:产业参与者正致力于建立本地伙伴关係和分销网络,以渗透多元化的亚太市场。公司也在日本和韩国等国家设立研发中心,专门开发针对该地区的产品。了解亚洲复杂的监管环境和解决永续性问题对于长期成功至关重要。

几丁聚醣产业概况

市场特征 市场分散,参与者多样

全球市场高度分散,大公司与众多中小型公司并存。例如 Panvo Organics Pvt. Ltd、KitoZyme LLC 和 KIMICA Corporation 是知名公司,各自专门生产不同的基于几丁聚醣的产品。

市场领导:创新与多元化推动成功

工业和KIMICA株式会社等主要市场领导透过创新和多元化取得了成功。这些公司正在大力投资研发以发现几丁聚醣的新应用,并致力于扩大产品系列以满足各行业的需求。我们对永续性和高品质生产流程的承诺使我们在竞争中脱颖而出。

为未来成功、永续性和市场扩张进行策略研究

未来市场的成功将取决于加强研发力度以发现新颖的生物医学和製药应用。公司必须注重永续的生产方法并解决与几丁聚醣提取相关的环境问题。扩张新兴市场,特别是亚太市场,是策略要务。本地伙伴关係关係加上区域产品开发将成为未来几年市场发展的驱动力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 活性化水处理活动

- 扩大生物医药、化妆品、食品饮料产业的产品应用

- 医疗保健/医疗产业取得长足进步

- 市场限制

- 法律规范

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按来源

- 虾

- 虾

- 螃蟹

- 其他来源

- 按应用

- 水处理

- 化妆品

- 製药和生物医学

- 饮食

- 其他用途

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 公司简介

- Panvo Organics Pvt Ltd

- GTC Bio Corporation

- Dupont Corporation

- KitoZyme SA

- KIMICA Corporation

- Dainichiseika Color & Chemicals Mfg Co. Ltd

- Heppe Medical Chitosan GmbH

- Meron Biopolymers

- Qingdao Yunzhou

- Biophrame Technologies

- ChitoTech

- Marshal Marine

- BIO21 Co. Ltd

- Austanz Chitin Pty Ltd

- KiOmed Pharma

第七章 市场机会与未来趋势

The Chitosan Market size is estimated at USD 2.34 billion in 2025, and is expected to reach USD 4.11 billion by 2030, at a CAGR of 11.93% during the forecast period (2025-2030).

It is experiencing a significant growth rate, driven by several key factors shaping its trajectory. These market drivers are closely tied to the expanding applications of chitosan across industries like water treatment, biomedical, pharmaceutical sectors, and the food and beverage industry.

Megatrends Shaping the Market: Increasing focus on sustainable, eco-friendly materials and growing healthcare needs are key mega market trends propelling the Chitosan industry. Rising demand for natural ingredients across industries further boosts Chitosan's market position. Chitosan's versatility aligns with global challenges, offering solutions in sectors ranging from environmental remediation to healthcare innovation.

Rising Water Treatment Activities: Water quality management is becoming a critical concern globally, driving demand for effective treatment solutions. Chitosan's ability to adsorb metal ions due to its hydroxyl and amino groups makes it highly effective in removing contaminants like heavy metals and oils. Chitosan is widely used as a coagulant aid in water treatment, enhancing the effectiveness of traditional coagulants. Composite materials, such as graphene oxide/chitosan adsorbents, are emerging as highly effective in removing metal ions from wastewater. Innovations like chitosan derivatives, including trimethyl chitosan (TMC), show promise in mitigating environmental issues, such as cyanobacterial blooms, in freshwater sources.

Growing Product Application in Biomedical, Cosmetics, and Food and Beverage Industries: Chitosan's versatility has led to its adoption in various industries. Market analysis highlights its widespread use in biomedical applications, within which, it is used for wound dressing, drug delivery, tissue engineering, and gene therapy. Chitosan's antibacterial, antioxidant, and bio adhesive properties make it effective for drug delivery and wound care. In cancer therapy, chitosan enhances immunotherapy by accumulating at tumor sites, triggering immune responses. In cosmetics, chitosan's ability to prevent inflammatory reactions and infections makes it valuable in skin care formulations. In the food industry, chitosan is increasingly used as a food additive and antimicrobial agent, with approvals in key markets such as Japan and Korea.

Strong Advancements in Healthcare and Medical Industry: The market share of chitosan is rising in healthcare sector as the sector is innovating around chitosan's unique properties, particularly in drug delivery and tissue engineering. Market analysis reveals that Chitosan-based nanoparticles are advancing targeted drug delivery, especially in cancer treatments. In dentistry, chitosan composites improve cell adhesion and bone regeneration, offering new possibilities in dental implants and enamel preservation. Chitosan's biocompatibility is increasingly important in tissue engineering, with applications in skin, bone, and cartilage regeneration becoming more common. These advancements underscore Chitosan's growing role in healthcare.

Chitosan Market Trends

Shrimp-Derived Chitosan: Dominating the Source Landscape

Segment Overview: Shrimp-derived chitosan remains the cornerstone of the market, commanding 42% of the chitosan market share. This segment's dominance is driven by the superior quality and availability of shrimp chitosan, making it valuable across sectors like biomedical, water treatment, and food preservation.

Growth Drivers: Shrimp-derived chitosan aligns with the global demand for sustainable materials, driving its adoption across industries. The growing aquaculture industry, particularly in Asia-Pacific, ensures a steady supply of raw materials, while the demand for high-quality chitosan for applications in biomedicine and environmental management continues to rise.

Competitive Landscape: Market leaders and players are adopting vertical integration strategies to maintain their dominance in shrimp-derived chitosan. Innovations in extraction techniques are also key differentiators, with companies focusing on increasing chitosan quality and purity. Sustainable farming practices are being developed to mitigate the environmental impact of shrimp aquaculture, ensuring continued growth, rising market share and leadership in this segment.

Asia-Pacific: The Epicenter of Chitosan Market Growth

Regional Dynamics: Asia-Pacific stands out as the fastest-growing segment in the global chitosan market, with a projected CAGR of 12.38% between 2024 and 2029. Rapid industrialization, R&D investments, and increasing awareness of chitosan applications are driving the regional APAC market growth.

Growth Catalysts: The booming pharmaceutical and biomedical industries in countries like China and India, alongside growing investments in healthcare infrastructure, are key market growth drivers. The need for advanced water treatment solutions in these rapidly developing nations is also expanding Chitosan's applications. Additionally, the rising consumer preference for natural ingredients in cosmetics and food is boosting chitosan demand in these industries.

Strategic Imperatives: Industry players are focusing on building local partnerships and distribution networks to penetrate diverse Asia-Pacific markets. Companies are also establishing R&D centers in countries like Japan and South Korea to develop region-specific products. Navigating Asia's complex regulatory landscape and addressing sustainability concerns are essential for long-term success.

Chitosan Industry Overview

Market Characteristics: Diverse Players in a Fragmented Market

This global market is highly fragmented, with numerous small to medium-sized enterprises alongside larger corporations. Companies like Panvo Organics Pvt. Ltd, KitoZyme LLC, and KIMICA Corporation are notable players, each specializing in different Chitosan-based products.

Market Leaders: Innovation and Diversification Drive Success

Key market leaders, such as Dainichiseika Color & Chemicals Mfg Co. Ltd and KIMICA Corporation, excel through innovation and diversification. These companies invest heavily in R&D to discover new chitosan applications and focus on expanding their product portfolios, catering to various industry needs. Their commitment to sustainability and high-quality production processes sets them apart in the competitive landscape.

Strategies for Future Success: Research, Sustainability, and Market Expansion

Future market success will depend on intensifying R&D efforts to discover novel biomedical and pharmaceutical applications. Companies must focus on sustainable production methods, addressing environmental concerns associated with chitosan extraction. Expanding into emerging markets, particularly in Asia-Pacific, is a strategic imperative. Local partnerships, coupled with region-specific product development, will drive market growth in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Water Treatment Activities

- 4.2.2 Growing Product Application in the Biomedical, Cosmetics, and Food and Beverage Industries

- 4.2.3 Strong Advancements in the Healthcare/Medical Industry

- 4.3 Market Restraints

- 4.3.1 Regulatory Framework

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Source

- 5.1.1 Shrimps

- 5.1.2 Prawns

- 5.1.3 Crabs

- 5.1.4 Other Sources

- 5.2 By Application

- 5.2.1 Water treatment

- 5.2.2 Cosmetics

- 5.2.3 Pharmaceutical and Biomedical

- 5.2.4 Food and Beverage

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Panvo Organics Pvt Ltd

- 6.1.2 GTC Bio Corporation

- 6.1.3 Dupont Corporation

- 6.1.4 KitoZyme SA

- 6.1.5 KIMICA Corporation

- 6.1.6 Dainichiseika Color & Chemicals Mfg Co. Ltd

- 6.1.7 Heppe Medical Chitosan GmbH

- 6.1.8 Meron Biopolymers

- 6.1.9 Qingdao Yunzhou

- 6.1.10 Biophrame Technologies

- 6.1.11 ChitoTech

- 6.1.12 Marshal Marine

- 6.1.13 BIO21 Co. Ltd

- 6.1.14 Austanz Chitin Pty Ltd

- 6.1.15 KiOmed Pharma