|

市场调查报告书

商品编码

1435525

装饰照明:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Decorative Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

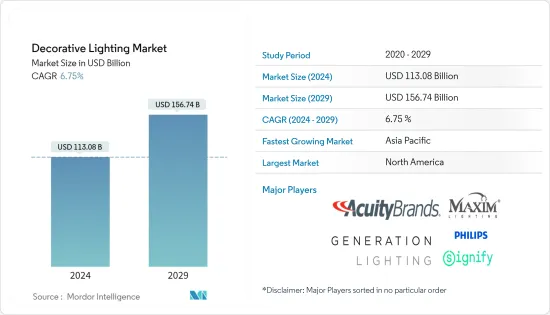

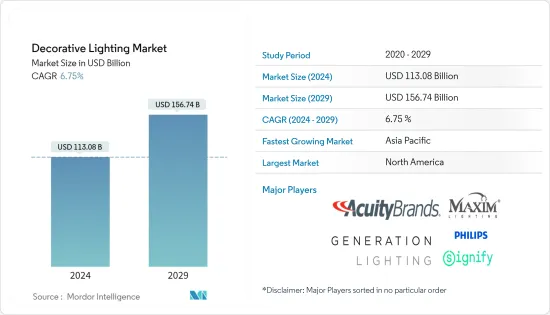

装饰照明市场规模预计到2024年为1130.8亿美元,预计到2029年将达到1567.4亿美元,在预测期内(2024-2029年)复合年增长率为6.75%,预计将会增长。

装饰照明市场的驱动力是透过使用照明来营造房间氛围,并预计将推动各种照明灯具的使用。这些灯光透过创造视觉动态空间来控制房间的实际尺寸。除此之外,适当的照明和设备让空间看起来舒适。

主要亮点

- 市场上的生产商在功能、设计、颜色等方面不断创新。如果明智地选择,现代装饰可以与您的地板、墙壁和家具相得益彰,为您的空间带来温暖、诱人和实用的感觉。推动市场成长的其他因素包括社群媒体和有关消费者家居装饰的网路系列。

- 设备有各种形状、尺寸、设计、颜色和材质。我们建议选择与墙壁和家具相匹配的颜色。市场普遍青睐纤维固定装置,但陶瓷、玻璃、竹子、木雕和织物的需求也不断增加。市场上最新的创新包括专注于物联网的智慧照明解决方案、智慧照明系统、XLamp XP-G3 皇家蓝 LED、带照明套件的吊扇等。

- 装饰灯应用范围广泛,包括商店、餐厅、家庭、水疗中心、购物中心、图书馆等。这些灯深受 Erica Reitman、Amy Storm、Lisa Abern、Anissa Zajac 等设计师的欢迎。克里斯蒂娜·林 (Christina Lin)、李·约翰逊 (Lee Johnson) 和安·塞奇 (Ann Sage) 对这些灯光的风格进行了实验,以营造一种美学氛围。

装饰照明市场趋势

LED光源主导装饰照明市场

LED 领域的成长得益于世界各国政府为节约资源所采取的监管政策。随着市场上的消费者开始使用艺术灯、水晶灯和照明灯具,这些产品正在取代传统光源。为了利用LED光源并取代传统方法,LED灯丝也进入市场填补空白。此外,这些产品节能,比其他能源来源节省更多能源,控制光强度,且不含汞,对环境友善。市场上有关智慧照明解决方案的大部分创新都发生在 LED 光源的使用中。

北美市占率最大,亚太地区成长最快

2018年,北美地区占全球市场收益比重超过35%。该地区国家(例如美国和加拿大)几乎所有家庭都能用上电,这在采用创新装饰物品方面发挥了关键作用。局部灯光。

同时,预计亚太地区在未来几年将继续提供有利的机会。中国和印度等新兴经济体的人口成长和都市化预计将为照明公司提供市场进入机会。马尔地夫、中国、印度和斯里兰卡政府开发旅游目的地等其他因素预计也将增加对主要使用装饰照明的饭店和餐厅的投资。

装饰照明行业概况

由于市场上存在许多全球和区域参与者,装饰照明市场呈现碎片化状态。製造商正在利用人工智慧和智慧解决方案将新产品推向市场。他们在新的固定装置、可以使用行动电话、远端感应器等控制的水晶灯方面进行创新。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 市场概况

- 市场驱动因素

- 市场限制因素

- 价值链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 洞察市场消费者购买行为

- 市场进出口趋势洞察

- 依照明产品类型(壁灯、嵌入式安装等)的见解

- 政府监管市场

- 市场的技术颠覆

第五章市场区隔

- 按光源分类

- LED

- 萤光

- 白炽灯

- 其他的

- 副产品

- 天花板

- 壁挂

- 其他的

- 按用途

- 商务用

- 家庭使用

- 按分销管道

- 线下(大卖场、超级市场、专卖店等)

- 在线的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章 竞争形势

- 市场集中度概览

- 公司简介

- Acuity Brands Lighting Inc.

- Generation Lighting

- Maxim Lighting

- GE Lighting

- Juno Lighting LLC

- Lowe's

- Osram

- Amerlux

- Littmann

- Columbia

- AZZ Inc.

- ETC

- 其他公司(Intense、LSI、Cree)

第七章投资分析(近期併购)

第八章市场未来性与机会

第九章 免责声明

The Decorative Lighting Market size is estimated at USD 113.08 billion in 2024, and is expected to reach USD 156.74 billion by 2029, growing at a CAGR of 6.75% during the forecast period (2024-2029).

The decorative lighting market is driven by the use of lighting that sets the ambiance of the room and is expected to promote the use of various lighting fixtures. These lights manipulate the actual size of the room by creating a visually dynamic space. Along with this, appropriate lighting and fixture give a pleasant look to a space.

Key Highlights

- Producers in the market are constantly innovating in terms of functionality, design, color, etc. Modern decor, when chosen wisely, complements the floor, wall, and furniture, and thus, gives a warm, inviting, and functional space. Other factors that are driving the growth of the market are social media and web series on home decor for consumers.

- Fixtures come in various shapes, sizes, designs, colors, and materials. Colors that complement the wall and furniture are preferred. Fiber fixtures are commonly preferred in the market but the demand for ceramic, glass, bamboo, carved wood, the fabric is also growing. Recent innovations in the market include smart lighting solutions concentrated on IoT, smart lighting systems, XLamp XP-G3 Royal Blue LED, ceiling fans with light kits, etc.

- Decorative lights find their applications in wide areas, including shops, restaurants, homes, spas, malls, libraries, etc. These lights have been gaining popularity from a large number of designers, such as Erica Reitman, Amy Storm, Lisa Abeln, Anissa Zajac, Kristina Lynne, Lea Johnson, and Anne Sage, who then experiment with the style of these lights to create aesthetic ambiance.

Decorative Lighting Market Trends

LED Source of Lights Dominated the Decorative Lighting Market

The growth of the LED segment is attributed to the regulatory policies made by governments all over the world to conserve resources. These products are replacing traditional light sources, as consumers in the market started using art lamps, chandeliers, and fixtures. To make use of LED sources of light and replace conventional methods, LED filament also entered the market to fill the gaps. Additionally, these products are more energy-efficient, save more energy than other sources, control the intensity of light, and are also environment-friendly as they do not contain mercury. Most of the innovations in the market, in terms of smart lighting solutions, are taking place in the use of LED light sources.

North America Held the Largest Share in the Market, while Asia-Pacific is the Fastest Growing Market

North America accounted for over 35% share in the global market revenues in 2018. Almost every household in the countries of the region, such as the United States and Canada, has access to electricity, which played a crucial role in the adoption of innovative decorative lights in the region.

Asia-Pacific, on the other hand, is expected to remain a lucrative opportunity in the next few years. Population growth and urbanization in developing economies, such as China and India, are expected to provide an opportunity for lighting fixture companies in the market. Other factors such as the development of tourist destinations by the governments of Maldives, China, India, and Sri Lanka, are also expected to increase the investment in hotels and restaurants, where decorative lights find their major use.

Decorative Lighting Industry Overview

The decorative lights market is fragmented due to the presence of a large number of global and regional players in the market. Manufacturers are introducing new products in the market using artificial intelligence and smart solutions. They are innovating in terms of new fixtures, chandeliers that can be controlled using mobiles, remote sensors, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights into Consumer Purchasing Behaviour in the Market

- 4.7 Insights into Exports and Imports Trends in the Market

- 4.8 Insights into Different Types of Lighting Products (Sconce, Flush Mount, etc.)

- 4.9 Government Regulations in the Market

- 4.10 Technological Disruption in the Market

5 MARKET SEGMENTATION

- 5.1 By Light Source

- 5.1.1 LED

- 5.1.2 Fluroscent

- 5.1.3 Incandescent

- 5.1.4 Other Light Sources

- 5.2 By Product

- 5.2.1 Ceiling

- 5.2.2 Wall Mounted

- 5.2.3 Other Products

- 5.3 By End Use

- 5.3.1 Commercial

- 5.3.2 Household

- 5.4 By Distribution Channel

- 5.4.1 Offline (Hypermarkets, Supermarkets, Specialty Stores, etc.)

- 5.4.2 Online

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Acuity Brands Lighting Inc.

- 6.2.2 Generation Lighting

- 6.2.3 Maxim Lighting

- 6.2.4 GE Lighting

- 6.2.5 Juno Lighting LLC

- 6.2.6 Lowe's

- 6.2.7 Osram

- 6.2.8 Amerlux

- 6.2.9 Littmann

- 6.2.10 Columbia

- 6.2.11 AZZ Inc.

- 6.2.12 ETC

- 6.2.13 Other Companies (Intense, LSI, Cree )