|

市场调查报告书

商品编码

1435541

螺纹钢:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Steel Rebar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

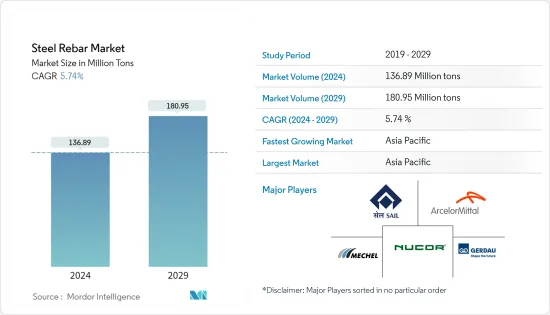

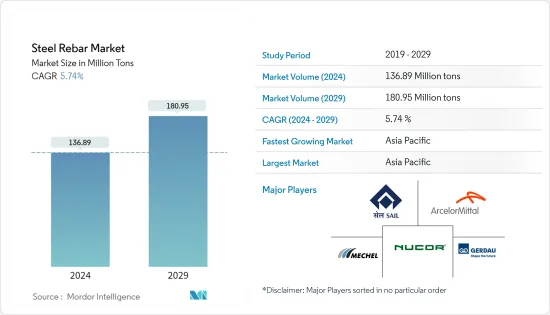

2024年螺纹钢市场规模预估为1,3689万吨,预估至2029年将达1,8095万吨,预测期内(2024-2029年)复合年增长率为5.74%。

由于新型冠状病毒感染疾病(COVID-19)的爆发,世界各地实施了全国范围的封锁,製造活动和供应链中断、生产停顿和劳动力短缺对螺纹钢市场产生了负面影响。然而,随着所研究市场的需求復苏,该产业在 2021 年出现復苏。

主要亮点

- 短期内,基础设施开发计划和建设活动投资的增加是推动所研究市场成长的一些因素。

- 相反,较便宜的螺纹钢替代品的可用性可能会阻碍所研究市场的成长。

- 然而,新兴国家基础设施活动的增加预计将在预测期内提供许多机会。

- 由于该地区各国基础设施扩建新计划建设的投资增加,亚太地区主导了市场。

螺纹钢市场趋势

非住宅领域的需求不断成长

- 随着都市化进程的进步,钢筋广泛应用于石油天然气工业、基础建设、商业建筑、企业建筑等非住宅领域。

- 美国拥有庞大的建筑业,截至 2023 年 1 月僱用人数超过 990 万人。美国建筑业在商业和非住宅建筑中发挥重要作用,对国家经济做出了重大贡献。由于美国住宅建设活动的增加,预计国内螺纹钢消费量将增加。

- 根据美国人口普查局的数据,2022 年 12 月美国新建设产值达到 17,929 亿美元。 2023年3月,非住宅领域价值9,971.4亿美元,较全球成长18.8%。去年同期。

- 此外,根据美国人口普查局的数据,2022 年 6 月私人和公共建筑非住宅支出为 4,926.8 亿美元,比 2021 年 6 月的 4,842.6 亿美元增长 1.74%。因此,该国私人和公共非住宅建筑支出的增加预计将为螺纹钢市场创造上行需求。

- 另外,红牛美国还计划在北卡罗来纳州康科德市建设占地 200 万平方英尺的加工和分销设施,进行各种建设和商业计划,价值 7.4 亿美元。酪农合作社 Dairgold 位于华盛顿州帕斯科港的加工设施占地 40 万平方英尺,价值 5 亿美元(计画于 2023 年竣工)。 Biotics Research Corporation 将在德克萨斯州罗森伯格建造一座 88,000 平方英尺的仓库、实验室和办公设施,价值 900 万美元(计划于 2023 年竣工)。

- 此外,沙乌地阿拉伯正在进行许多商业计划,这可能会导致该国建造更多商业建筑。耗资 5000 亿美元的未来特大城市 Neom计划(红海计划一期)计划于2025 年完工,将包括五个岛屿、两个内陆度假村、Qudiya 娱乐城、超豪华健康目的地Amara 和14 个拥有3,000 间客房的饭店让·努维尔 (Jean Nouvel) 位于埃尔奥拉 (AlUla) 的夏兰度假村 (Sharan Resort) 对面设有豪华和超豪华酒店。

- 预计印度将继续成为G20经济体成长最快的国家。印度政府宣布三年(2023-2025年)基础建设投资目标为3,765亿美元,其中1,205亿美元用于发展27个产业丛集,753亿美元用于公路、铁路和港口互联互通计划。

- 所有上述因素预计将在预测期内推动钢筋的需求。

亚太地区主导市场

- 亚太地区预计将主导全球市场占有率。由于印度、中国、菲律宾、越南和印尼等国家住宅和商业建筑投资的增加,螺纹钢市场预计在未来几年将成长。

- 中国庞大的建筑业对钢筋的使用产生了巨大的需求。此外,中国近年来一直是世界基础设施的主要投资者之一,并做出了重要贡献。例如,根据中国国家统计局(NBS)的数据,2022年中国建筑业产值将达到27.63兆元(41.08581亿美元),比2021年增长6.6%。

- 此外,由于政府的支持和倡议,印度的住宅产业正在崛起,需求进一步增加。据印度品牌股权基金会(IBEF)称,住房与城市发展部(MoHUA)已在2022-2023年预算中拨出98亿日元用于建造住宅,并设立基金以完成停滞的计划,并拨款5000万美元。

- 此外,印尼预计在第二季开始为数千名公务员建造价值27亿美元的公寓,迁往婆罗洲岛的新首都。此外,印尼政府计划透过外国投资筹集80%的资金。因此,预计这将导致该国住宅建筑对钢筋的消耗产生上升需求。

- 印尼计划在北加里曼丹省(卡卢特勒)卡延河开发价值10亿美元的900兆瓦水力发电发电工程。该计划目前处于EPC阶段,计划于2022年开工。计划计划于2025年竣工后投入运作。

- 随着2025年大阪世博会的举办,日本的建设产业可望蓬勃发展。此外,ESR Cayman、大阪 OS Cosmo Square资料中心计划是日本最大的建设计划,价值 20 亿美元,将于 2022 年第四季开始施工。 ESR 开曼、OS Cosmo Square资料中心、大阪计划于 2021 年第二季宣布。大阪市大坝建设计画于 2026 年第一季完成。第二大计划爱知县的Shitara水坝开发项目,计划价值5.7亿美元,于2022年第四季开始开发。日本国土交通省的爱知县设乐大坝开发计划位于日本,于 2022 年第三季宣布,预计竣工日期为 2034 年第四季。

- 因此,在预测期内,各国需求的成长预计将推动该地区的市场研究。

钢筋产业概况

螺纹钢市场本质上是细分的。该市场的主要企业(排名不分先后)包括ArcelorMittal、Gerdau S/A、Nucor Corporation、Mechel、SAIL等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 亚太地区建筑业快速成长

- 商业建筑增加

- 其他司机

- 抑制因素

- 钢筋替代品的可用性

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 类型

- 形变

- 温和的

- 最终用户产业

- 住宅

- 非住宅

- 商业的

- 基础设施

- 设施

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- ArcelorMittal

- Celsa Steel(UK)Ltd

- Contractors Materials Company(CMC)

- Daido Steel Co., Ltd.

- Essar

- Gerdau S/A

- HYUNDAI STEEL

- JFE Steel Corporation

- Jiangsu Shagang Group

- KOBE STEEL, LTD.

- Mechel

- NIPPON STEEL CORPORATION

- Nucor Corporation

- SAIL

- Sohar Steel Group

- Tata Steel

第七章 市场机会及未来趋势

- 新兴国家基础建设活动活性化导致需求增加

- 其他机会

The Steel Rebar Market size is estimated at 136.89 Million tons in 2024, and is expected to reach 180.95 Million tons by 2029, growing at a CAGR of 5.74% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, production halts, and labor unavailability have negatively impacted the steel rebar market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the short term, rising investments in infrastructure development projects and construction activities are some of the factors driving the growth of the market studied.

- On the flip side, the availability of cheap substitutes for steel rebar is likely to hinder the growth of the market studied.

- However, rising infrastructural activities in developing countries are anticipated to provide numerous opportunities over the forecast period.

- Asia-Pacific region dominated the market, owing to the increasing investments in constructing new projects for infrastructural expansion across various countries in the region.

Steel Rebar Market Trends

Growing Demand from the Non-Residential Sector

- With increasing urbanization, steel rebars are experiencing extensive utilization from the non-residential segment, like the oil and gas industry, infrastructure, commercial construction, corporate buildings, etc.

- The United States boasts a colossal construction sector that employs over 9.9 million employees as of January 2023. Playing a prominent role in commercial and non-residential construction, the United States construction sector exhibits a significant contribution to the country's economy. Due to increasing non-residential construction activities in the United States the consumption of steel rebar in the country is expected to increase.

- According to the United States Census Bureau, the value of new construction output in the United States amounted to USD 1,792.9 billion in December 2022. The non-residential sector accounted for USD 997.14 billion in March 2023, registering a growth of 18.8% compared to the same period the previous year.

- Moreover, according to the United States Census Bureau, the private and public construction nonresidential spending in June 2022 was 492.68 billion, which showed an increase of 1.74% compared to June 2021, which amounted to USD 484.26 billion. Therefore, increasing in the spending on private and public non-residential constructions in the country is expected to create an upside demand for steel rebar market.

- Apart from that, there are various construction commercial projects scheduled in the United States Red Bull North America's USD 740 million worth 2 million-square-foot processing and distribution facility in Concord, North Carolina; Dairy cooperative DairgoldUSD 500 million worth 400,000-square-foot processing facility in Port of Pasco, Washington (completion scheduled for 2023); Biotics Research Corporation USD 9 million worth 88,000-square-foot warehouse, laboratory, and office facility in Rosenberg, Texas (completion scheduled for 2023).

- Furthermore, Saudi Arabia is working on a lot of commercial projects, which will likely lead to more commercial buildinings in the country.The USD 500 billion futuristic mega-city "Neom" project, the Red Sea Project - Phase 1, which is expected to be completed by 2025 and has 14 luxury and hyper-luxury hotels with 3,000 rooms spread across five islands and two inland resorts, Qiddiya Entertainment City, Amaala - the uber-luxury wellness tourism destination, and Jean Nouvel's Sharaan resort in Al-Ula.

- India is anticipated to remain the fastest-growing G20 economy. The Indian government announced a target of USD 376.5 billion in infrastructure investment over three years (2023-2025), including USD 120.5 billion for developing 27 industrial clusters and USD 75.3 billion for road, railway, and port connectivity projects.

- All the above-mentioned factors are expected to propel the demand for steel rebar during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is anticipated to dominate the global market share. With growing investments in residential and commercial construction in the countries, such as India, China, the Philippines, Vietnam, and Indonesia, the market for steel rebars is expected to grow in the coming years.

- China's massive construction sector has generated significant demand for the use of steel rebars. Moreover, China is a huge contributor, as it has been one of the leading investors in infrastructure worldwide over the past few years. For instance, according to the National Bureau of Statistics (NBS) of China, in 2022, the output value of construction works in China amounted to 27.63 trillion yuan (USD 4108.581 billion), an increase of 6.6% compared with 2021.

- Moreover, the residential sector in India is on an increasing trend, with government support and initiatives further boosting the demand. According to the India Brand Equity Foundation (IBEF), the Ministry of Housing and Urban Development (MoHUA) allocated USD 9.85 billion in the 2022-2023 budget to construct houses and create funds to complete the halted projects.

- Furthermore, Indonesia expects to begin construction in the second quarter on apartments worth USD 2.7 billion for thousands of civil servants due to move to its new capital city on Borneo island. Moreover, tndonesian government intends to finance it for 80% through foreign investments. Therefore, this is expected to create an upside demand for the consumption of steel rebars from the contry's residential construction.

- Indonesia plans to develop a USD 1 billion worth 900 MW hydropower project in Kayan River in the North Kalimantan (Kaltara) province. The project stands at the EPC stage, with a startup date planned for 2022. The project is expected to be commissioned after the completion of the construction in 2025.

- The Japanese construction industry is expected to be booming as the country will host the World Expo in 2025 in Osaka, Japan. Furthermore, the ESR Cayman, OS Cosmosquare Data Centre, Osaka project, valued at USD 2,000 million, was Japan's largest building project, on which construction started in Q4 2022. The ESR Cayman, OS Cosmosquare Data Centre, Osaka project was announced in Q2 2021 in Osaka (City), Japan, with a completion date of Q1 2026. The second-largest project, the MLIT Japan, Shitara Dam Development, Aichi, with a project value of USD 570 million, began development in Q4 2022. The MLIT Japan, Shitara Dam Development, Aichi project is located in Japan and was announced in Q3 2022, with a completion date of Q4 2034.

- Thus, rising demand from various countries is expected to drive the market studied in the region during the forecast period.

Steel Rebar Industry Overview

The Steel Rebar market is partially fragmented in nature. The major players in this market (not in a particular order) include ArcelorMittal, Gerdau S/A, Nucor Corporation, Mechel, and SAIL, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Growing Construction Industry in Asia-Pacific Region

- 4.1.2 Increasing Commercial Construction

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes for Steel Rebar

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Deformed

- 5.1.2 Mild

- 5.2 End-user Industry

- 5.2.1 Residential

- 5.2.2 Non-Residential

- 5.2.2.1 Commercial

- 5.2.2.2 Infrastructure

- 5.2.2.3 Institutional

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 Celsa Steel (UK) Ltd

- 6.4.3 Contractors Materials Company (CMC)

- 6.4.4 Daido Steel Co., Ltd.

- 6.4.5 Essar

- 6.4.6 Gerdau S/A

- 6.4.7 HYUNDAI STEEL

- 6.4.8 JFE Steel Corporation

- 6.4.9 Jiangsu Shagang Group

- 6.4.10 KOBE STEEL, LTD.

- 6.4.11 Mechel

- 6.4.12 NIPPON STEEL CORPORATION

- 6.4.13 Nucor Corporation

- 6.4.14 SAIL

- 6.4.15 Sohar Steel Group

- 6.4.16 Tata Steel

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand Due to Rising Infrastructural Activities in Developing Countries

- 7.2 Other Opportunities