|

市场调查报告书

商品编码

1435768

陶瓷基板:市场占有率分析、产业趋势、成长预测(2024-2029)Ceramic Substrate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

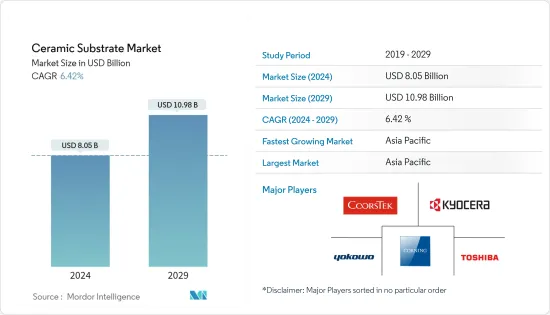

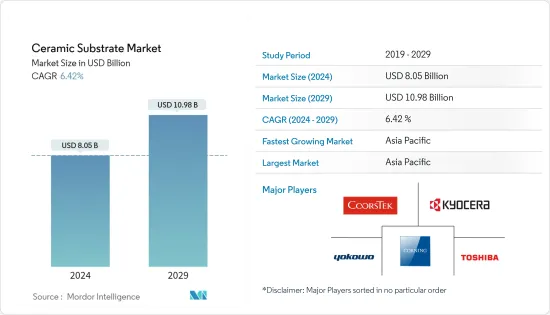

陶瓷基板市场规模预计到2024年为80.5亿美元,预计到2029年将达到109.8亿美元,在预测期内(2024-2029年)复合年增长率为6.42%,预计将会增长。

2020年,陶瓷基板市场受到新型冠状病毒感染疾病(COVID-19)的负面影响。然而,在COVID-19感染疾病之后,该行业迅速復苏,预计未来几年将出现成长,这有望刺激陶瓷基板市场的需求。

主要亮点

- 推动市场研究的关键因素是陶瓷基板相对金属的需求不断增长,以及陶瓷基板在电子应用中的采用不断增加。

- 陶瓷基板的使用成本高、易于损坏以及组装和测试过程中需要小心处理,预计将成为预测期内陶瓷基板市场的限制因素。

- 医疗产业和汽车行业新兴应用需求的增加是预测期内陶瓷基板市场的机会。

- 亚太地区是最大的市场,由于中国、印度和日本等国家的消费量不断增加,预计亚太地区将成为预测期内成长最快的市场。

陶瓷基板市场趋势

半导体产业需求增加

- 陶瓷基板透过其在製造中的重要作用,对促进半导体产业的发展发挥关键作用。

- 半导体製造商使用陶瓷基板,例如氧化铝、氧化铍和氮化铝。这些材料因其硬度、耐磨性、高温下耐强酸强碱、良好的导热性、非常高的体积电阻率以及非常低的介电常数和损耗角正切等特性而被用于半导体工业。

- 由于自动驾驶、人工智慧等技术的需求,全球半导体产业近年来稳步成长。

- 根据半导体产业协会(SIA)的数据,2022年全球半导体销售额达5,740亿美元,较2021年的5,559亿美元成长3.3%。

- 根据世界半导体贸易统计 (WSTS),2022 年所有地理区域的半导体贸易呈现两位数成长。美洲销售额成长 17.0%,欧洲销售额成长 12.6%,日本销售额成长 10.0%。然而,同年亚太地区的成长率却下降了2.0%。

- 因此,不断增长的半导体产业预计将在未来几年增加对陶瓷基板的需求。

亚太地区主导市场

- 预计亚太地区将占据最大的市场,也预计将成为预测期内陶瓷基板成长最快的地区。

- 预计中国将在未来几年成为电子和半导体产品的最大市场。国际产业科技策略中心(ISTI)表示,由于人工智慧应用对积体电路(IC)元件的需求增加,台湾半导体产业产值预计将大幅成长。

- 中国政府推出了「中国製造2025」政策,目标是到2025年将积体电路生产自给率提高到70%。

- 根据半导体产业协会(SIA)的数据,中国在半导体市场占据主导地位,2022年销售额为1804亿美元,较2021年下降6.2%。

- 印度电子与半导体协会预计,到2025年,该国半导体元件市场规模预计将达到323.5亿美元,复合年增长率为10.1%。此外,政府正在进行的「印度製造」计画预计将刺激对该国半导体产业的投资。

- 此外,印度电子和半导体协会(IESA)与新加坡半导体行业协会(SSIA)签署了一份谅解备忘录,以建立和发展两国电子和半导体行业之间的贸易和技术合作。这有望带动各种突破性半导体製造技术的发展,进一步扩大印度半导体製造中陶瓷基板的消费范围。

- 目前,日本半导体製造业约有30家公司,涉及製造各类半导体晶片。日本的半导体供应链提供了全球三分之一的半导体製造设备和一半以上的产业材料。

- 此外,菲律宾和韩国等国家也为最近研究的市场成长做出了贡献。

- 上述因素预计将在预测期内进一步推动亚太陶瓷基板市场的需求。

陶瓷基板产业概况

由于市场上存在重要竞争对手,全球陶瓷基板市场部分已整合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对陶瓷基板的需求超过金属基板

- 电子应用中越来越多地采用陶瓷基板

- 其他司机

- 抑制因素

- 与使用陶瓷基板相关的高成本

- 容易损坏,在组装和测试过程中需要小心处理

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 原料分析

第五章市场区隔(以金额为准的市场规模)

- 类型

- 氧化铝

- 氮化铝

- 氮化硅

- 氧化铍

- 其他的

- 最终用户产业

- 消费性电子产品

- 航太/国防

- 车

- 半导体

- 通讯

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- CeramTec GmbH

- CoorsTek Inc.

- Corning Incorporated

- ICP TECHNOLOGY Co.,LTD

- KOA Speer Electronics INC.

- KYOCERA Corporation

- LEATEC Fine Ceramics Co,.Ltd.

- MARUWA Co., Ltd.

- NEOTech

- NIPPON CARBIDE INDUSTRIES CO., INC.

- Niterra Co., Ltd.

- Ortech Advanced Ceramics

- TOSHIBA MATERIALS Co. LTD.,

- TTM Technologies Inc.

- Yokowo co., ltd.

第七章 市场机会及未来趋势

The Ceramic Substrate Market size is estimated at USD 8.05 billion in 2024, and is expected to reach USD 10.98 billion by 2029, growing at a CAGR of 6.42% during the forecast period (2024-2029).

The ceramic substrate market was negatively impacted by COVID-19 in 2020. However, post-COVID-19 pandemic, the industries are recovering fast and are estimated to rise in the coming years, which will stimulate the demand for the ceramic substrate market.

Key Highlights

- The major factor driving the market studied are the increasing demand for ceramic substrates over metal and the rise in the adoption of ceramic substrates in electronics applications.

- The high cost associated with the use of ceramic substrate and prone to damage and need careful handling during assembly and testing is expected to act as a restraint for the ceramic substrate market during the forecast period.

- Increasing demand from the medical industry and emerging applications in the automotive industry is an opportunity for ceramic substrate market during the forecast period.

- Asia-Pacific region represents the largest market and is also expected to be the fastest-growing market over the forecast period owing to the increasing consumption from countries such as China, India, and Japan.

Ceramic Substrate Market Trends

Increasing Demand from the Semiconductor Industry

- Ceramic substrate plays an important role in enabling developments in the semiconductor industry through their essential role in manufacturing.

- Semiconductor manufacturers use ceramic substrates such as alumina, beryllium oxide, and aluminum nitride. These materials are used in the semiconductor industry owing to their properties such as hard and resistant to wear, resistant to strong acid and alkali at high temperatures, good thermal conductivity, extremely high bulk resistivity, very low dielectric constant and loss tangent among others.

- The global semiconductor industry is growing at a healthy rate in recent times, owing to the demand for technologies such as autonomous driving, artificial intelligence, etc.

- According to the Semiconductor Industry Association (SIA), in 2022, the worldwide sales of semiconductors reached to USD 574 billion which was increase by 3.3% compared to 2021 at USD 555.9 billion.

- According to World Semiconductor Trade Statistics (WSTS), In 2022, all geographical regions exhibited double-digit growth in trade of semiconductors. The Americas region has increased by 17.0%, Europe by 12.6%, and Japan by 10.0%. However, The growth of Asia-Pacific has declined by 2.0% in the same year.

- Therefore, the growing semiconductor industry is expected to boost the demand for ceramic substrates incoming years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to account for the largest market and is also forecasted to be the fastest-growing region for ceramic substrates during the forecast period.

- China is expected to become the largest market for electronics and semiconductor products over the coming years. According to the Industry, Science and Technology International Strategy Center (ISTI), the production value of Taiwan's semiconductor industry is anticipated to grow substantially, owing to the increasing demand for integrated circuit (IC) devices for artificial intelligence applications.

- The Chinese government has introduced the 'Made in China 2025' policy to increase the nation's self-sufficiency in integrated circuits production to 70% by 2025.

- According to Semiconductor Industry Association (SIA), in 2022, China dominated the semiconductor market with sales of USD 180.4 billion which declined as compared to 2021 by 6.2%.

- According to India Electronics and Semiconductor Association, the semiconductor component market in the country is expected to be worth USD 32.35 billion by 2025, displaying a CAGR of 10.1%. In addition, the ongoing Make in India initiative by the government is expected to result in investments in the semiconductor industry in the country.

- Additionally, India Electronics and Semiconductor Association (IESA) signed a MoU with Singapore Semiconductor Industry Association (SSIA) to establish and develop trade and technical cooperation between the electronics and semiconductor industries of both the countries. This is expected to result in development of various break-through semiconductor manufacturing technologies that would further increase the scope for the consumption of ceramic substrate in semiconductor manufacturing in India.

- Japan currently has about 30 semiconductor fabrication industries, which are involved in manufacturing of various types of semiconductor chips. Japan's semiconductor supply chain provides one third of the world's semiconductor manufacturing equipment and more than half of the industry's materials.

- Furthermore, countries such as Philippines and South Korea have also been contributing to the growth of the market studied lately.

- The above mentioned factors are expected to further drive the demand for ceramic substrate market in Asia-Pacific over the forecast period.

Ceramic Substrate Industry Overview

The Global Ceramic Substrate market is partially consolidated with the presence of significant competitors in the market. The major companies in the market are Corning Incorporated, CoorsTek Inc. TOSHIBA MATERIALS Co. LTD., KYOCERA Corporation, and Yokowo co., ltd. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Ceramic Substrates Over Metal

- 4.1.2 Rise in the Adoption of Ceramic Substrates in Electronics Application

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost Associated with the Use of Ceramic Substrate

- 4.2.2 Prone to Damage and Need Careful Handling During Assembly and Testing

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Alumina

- 5.1.2 Aluminum Nitride

- 5.1.3 Silicon Nitride

- 5.1.4 Beryllium Oxide

- 5.1.5 Others

- 5.2 End-user Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Aerospace & Defense

- 5.2.3 Automotive

- 5.2.4 Semiconductor

- 5.2.5 Telecommunication

- 5.2.6 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 CeramTec GmbH

- 6.4.2 CoorsTek Inc.

- 6.4.3 Corning Incorporated

- 6.4.4 ICP TECHNOLOGY Co.,LTD

- 6.4.5 KOA Speer Electronics INC.

- 6.4.6 KYOCERA Corporation

- 6.4.7 LEATEC Fine Ceramics Co,.Ltd.

- 6.4.8 MARUWA Co., Ltd.

- 6.4.9 NEOTech

- 6.4.10 NIPPON CARBIDE INDUSTRIES CO.,INC.

- 6.4.11 Niterra Co., Ltd.

- 6.4.12 Ortech Advanced Ceramics

- 6.4.13 TOSHIBA MATERIALS Co. LTD.,

- 6.4.14 TTM Technologies Inc.

- 6.4.15 Yokowo co., ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand From Medical Industry

- 7.2 Emerging Applications in Automotive Industry