|

市场调查报告书

商品编码

1435771

松香:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Gum Rosin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

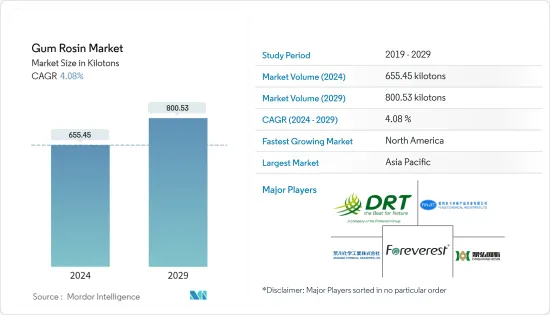

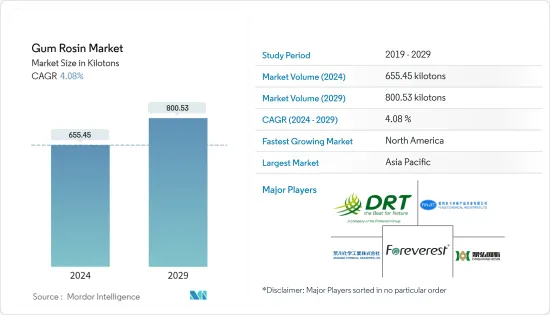

2024年松香市场规模预估为655,450吨,预估至2029年将达800,530吨,预测期(2024-2029年)复合年增长率为4.08%。

主要亮点

- 松香市场受到冠状病毒感染疾病(COVID-19)大流行的负面影响。但疫情过后,由于黏剂、密封剂、印刷油墨等应用的增加,市场出现明显反弹。

- 对生物基黏剂和密封剂的需求不断增长以及纸包装行业的快速增长可能是中期松香市场成长的主要驱动力。

- 另一方面,人们对妥尔油松香基酚醛树脂的兴趣转移预计将限製松香市场的成长。

- 儘管如此,体育场地板防滑材料的需求不断增长以及製药行业的新应用可能很快就会为全球市场创造利润丰厚的成长机会。

- 由于中国、印度和日本等国家的庞大消费量,预计亚太地区在预测期内将占据最大的市场份额。

松香市场趋势

黏剂和密封剂产业预计将主导市场

- 几十年来,松香一直是黏剂和密封剂产业价值链的关键组成部分之一,因为它是黏剂的优异增黏剂。

- 脂松香广泛用作黏剂、压敏黏着剂、橡胶黏剂的原料。这种松香主要用于增加黏剂的强度、可塑性和黏度。

- 黏剂是鞋子、汽车、纸箱、家具、不织布和许多其他产品的重要组成部分。黏剂和密封剂在许多行业都有应用,包括建筑、製药、包装等。

- 根据牛津经济研究院预测,到2025年,全球建筑业规模预计将达到13.3兆美元,从2020年起的五年内产量将增加2.6兆美元。中国、印度、美国和印尼的建设业预计将显着成长。未来几年的行业。光是中国就将占全球成长的26.1%。印度预计将占全球经济成长的14.1%,美国为11.1%,印尼为7.0%。

- 美国人口普查局数据显示,2022年该国商业建筑价值为1,147.9亿美元,与前一年同期比较成长21.4%。

- 由于食品和包装安全是世界各地黏剂和密封剂製造商关注的问题,松香产业正在寻找合作机会并与黏剂和密封剂产业建立伙伴关係。

- 由于国内电商收入上升等因素,中国已成为全球最大的包装材料消费国。据印度塑胶工业协会称,印度的包装工业位居世界第五,每年以22-25%左右的速度成长。由于高技术纯熟劳工和低廉的人事费用,食品包装和加工成本可比欧洲低40%。

- 根据印度包装工业协会(PIAI)预测,印度包装产业在预测期内预计将成长 22%。此外,到2025年,印度包装市场预计将达到2,048.1亿美元,2020-2025年复合年增长率为26.7%。

- 由于对环境污染的日益关注以及根据黏剂所需性能定制松香树脂的能力,由于在生物基黏剂和密封剂中的应用,预计未来几年对松香的市场需求将增加。

亚太地区主导市场

- 由于汽车行业的快速增长以及中国和印度建设活动的增加,预计亚太地区将在预测期内主导松香市场。

- 根据全球油漆和涂料工业协会估计,2022 年亚太地区油漆和涂料行业的价值预计将达到 630 亿美元。该地区的市场以中国为主,复合年增长率为 5.8%。预计2022年中国市场将成长5.7%。依照目前趋势,2022年中国油漆涂料总销售额将超过450亿美元。在东亚,中国占最大的市场占有率,达78%。

- 截至2022年,印度是世界第四大橡胶消费国。印度人均橡胶使用量目前为 1.2 公斤,而世界人均橡胶使用量为 3.2 公斤。印度橡胶工业的收益约为 1200 亿印度卢比(约 14 亿美元)。

- 在汽车工业中,松香被用来製造涂料和油漆,因为它很容易溶解在汽油、松节油和酒精等有机溶剂中。根据中国工业协会统计,中国拥有全球最大的汽车生产基地,2022年汽车产量将达2,700万辆,比去年的2,600万辆成长3.4%。此外,2022年1-7月,全国汽车产量1,457万辆,与前一年同期比较成长31.5%。

- 在建设产业中,松香主要用作混凝土的发泡和地砖的黏剂。印度政府正在积极推动住宅建设,目标是为约13亿人提供住宅。预计未来七年该国将投资约1.3兆美元用于住宅建设,从而建造6000万套新住宅。预计到 2024 年,该国经济适用住宅的供应量将增加约 70%。

- 上述因素可能会增加预测期内对松香的需求。

松香产业概况

全球松香市场本质上高度分散。主要参与者包括(排名不分先后)广西鼎红树脂、Finjet Chemical Industries、Foreverest Resources Ltd、Arakawa Chemical Industries Ltd 和 DRT。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对生物基黏剂和密封剂的需求不断增长

- 纸包装产业快速成长

- 其他司机

- 抑制因素

- 兴趣转向Tall oil松香基酚醛树脂

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 目的

- 纸张尺寸

- 印刷油墨

- 黏剂和密封剂

- 橡皮

- 画

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Arakawa Chemical Industries Ltd

- DRT(Derives Resiniques et Terpeniques)

- Finjetchemical Co. Ltd

- Forestar Chemical Co. Ltd

- Foreverest Resources Ltd

- Guangxi Dinghong Resin Co. Ltd

- Guangxi Tone Resin Chemical Co. Ltd

- Harima Chemicals Group Inc.

- Kemipex

- KH Chemicals

- Novotrade Invest AS

- PT INDOPICRI(Indonesia Pine Chemical Industri)

- Silver Fern Chemical Inc.

- United Resins

- Wuzhou Sun Shine Forestry and Chemicals Co. Ltd

第七章 市场机会及未来趋势

- 体育场地坪防滑剂需求不断成长

- 製药业的新应用

简介目录

Product Code: 69132

The Gum Rosin Market size is estimated at 655.45 kilotons in 2024, and is expected to reach 800.53 kilotons by 2029, growing at a CAGR of 4.08% during the forecast period (2024-2029).

Key Highlights

- The gum rosin market was negatively impacted by the COVID-19 pandemic. However, the market recovered significantly after the pandemic, owing to rising applications in adhesives, sealants, printing inks, and others.

- The growing demand for bio-based adhesives and sealants and the burgeoning paper packaging industry are likely to be the main drivers of the gum rosin market's growth over the medium term.

- On the flip side, the shift of interest toward tall oil rosin-based phenolic resins is expected to limit the growth of the gum rosin market.

- Nevertheless, growth in demand for anti-slip agents for floors in stadiums and emerging applications in the pharmaceutical industry are likely to create lucrative growth opportunities for the global market soon.

- The Asia-Pacific region is expected to account for the largest share of the market over the forecast period, owing to the huge consumption from countries such as China, India, and Japan.

Gum Rosin Market Trends

The Adhesives and Sealants Segment is Expected to Dominate the Market

- For decades, gum rosin has become one of the vital components of the adhesives and sealants industry value chain, as it serves as an excellent tackifier for adhesives.

- Gum rosin is widely used as an ingredient for heat-melt adhesives, pressure-sensitive adhesives, and rubber adhesives. This rosin is mainly used to enhance the strength, plasticity, and viscosity of adhesives.

- Adhesives are essential components of shoes, automobiles, cartons, furniture, non-woven fabrics, and a host of other products. Adhesives and sealants have applications in numerous industries, including construction, pharmaceutical, packaging, and others.

- According to Oxford Economics, the global construction industry is expected to reach USD 13.3 trillion by 2025 - adding USD 2.6 trillion to output in five years from 2020. China, India, the United States, and Indonesia are expected to record significant growth in the construction industry in the coming years. China alone will account for 26.1% of global growth. India is expected to account for 14.1% and the United States for 11.1%, while Indonesia is expected to account for 7.0% of global growth.

- According to the United States Census Bureau, the value of commercial construction in the year 2022 in the country was USD 114.79 billion, registering a growth rate of 21.4% compared to the previous year.

- The gum rosin industry seeks to identify collaboration opportunities and build partnerships with the adhesives and sealants industry, as food and packaging safety is of concern to adhesives and sealants manufacturers worldwide.

- China is the world's largest packaging consumer across the world owing to the factors such as growing per capita income, coupled with rising e-commerce giants in the country. India's packaging industry is the fifth-largest in the world, and it is growing at about 22-25% per year, as per the Plastics Industry Association of India. Costs of packaging and processing food can be 40% lower than in Europe because of highly skilled labor and cheap labor costs.

- According to the Packaging Industry Association of India (PIAI), the Indian packaging industry is expected to grow at a rate of 22% during the forecast period. Moreover, the Indian packaging market is expected to reach USD 204.81 billion by 2025, registering a CAGR of 26.7% between 2020 and 2025.

- With increasing concerns related to environmental pollution and the ability to tailor gum rosin resin according to the desired properties of adhesives, the applications of bio-based adhesives and sealants are likely to increase the market demand for gum rosin in the coming years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the gum rosin market during the forecast period due to the fast-growing automotive sector and the rise in construction activities in China and India.

- In 2022, according to the World Paint & Coatings Industry Association, the Asia-Pacific paints and coatings industry was estimated to be worth USD 63 billion. China dominated the region's market, which is growing at a CAGR of 5.8%. In 2022, the Chinese market is expected to have grown by 5.7%. According to current trends, China's total sales of paints and coatings exceeded USD 45 billion in 2022. In East Asia, the country had the largest market share of 78%.

- India is the fourth-largest consumer of rubber in the world as of 2022. Rubber usage per capita in India is currently 1.2 kilograms, compared to 3.2 kilograms globally. The rubber industry in India generates revenue of approximately INR 12,000 crores (~USD 1.4 billion).

- In automobile industries, gum rosin is used in the manufacturing of coatings and paints as they can easily dissolve in organic solvents, including gasoline, turpentine, alcohol, and others. According to the China Association of Automobile Manufacturers (CAAM), China has the largest automotive production base in the world, with a total vehicle production of 27 million units in 2022, registering an increase of 3.4 % compared to 26 million units produced last year. Further, in the first 7 months of 2022, the country has produced 14.57 million units of cars, registering a growth rate of 31.5% Year on Year.

- In the construction industry, gum rosin is mainly used as a concrete frothing agent and floor-tiling adhesive. The Indian government has been actively boosting housing construction, as it aims to provide houses to about 1.3 billion people. The country is likely to witness around USD 1.3 trillion of investment in housing over the next seven years, to witness the construction of 60 million new houses in the country. The availability of affordable housing in the country is expected to increase by around 70% by 2024.

- The aforementioned factors are likely to increase the demand for gum rosin during the forecast period.

Gum Rosin Industry Overview

The global gum rosin market is highly fragmented in nature. The major players include Guangxi Dinghong Resin Co. Ltd, Finjet chemical industries, Foreverest Resources Ltd, Arakawa Chemical Industries Ltd, and DRT, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Bio-based Adhesives and Sealants

- 4.1.2 Burgeoning Paper Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Shift of Interest toward Tall Oil Rosin-based Phenolic Resins

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Paper Sizing

- 5.1.2 Printing Ink

- 5.1.3 Adhesives and Sealants

- 5.1.4 Rubber

- 5.1.5 Paints and Coatings

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arakawa Chemical Industries Ltd

- 6.4.2 DRT (Derives Resiniques et Terpeniques)

- 6.4.3 Finjetchemical Co. Ltd

- 6.4.4 Forestar Chemical Co. Ltd

- 6.4.5 Foreverest Resources Ltd

- 6.4.6 Guangxi Dinghong Resin Co. Ltd

- 6.4.7 Guangxi Tone Resin Chemical Co. Ltd

- 6.4.8 Harima Chemicals Group Inc.

- 6.4.9 Kemipex

- 6.4.10 KH Chemicals

- 6.4.11 Novotrade Invest AS

- 6.4.12 PT INDOPICRI ( Indonesia Pine Chemical Industri )

- 6.4.13 Silver Fern Chemical Inc.

- 6.4.14 United Resins

- 6.4.15 Wuzhou Sun Shine Forestry and Chemicals Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in Demand for Anti-slip Agents for Floors in Stadiums

- 7.2 Emerging Applications in the Pharmaceutical Industry

02-2729-4219

+886-2-2729-4219