|

市场调查报告书

商品编码

1689888

坚固耐用显示器:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Rugged Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

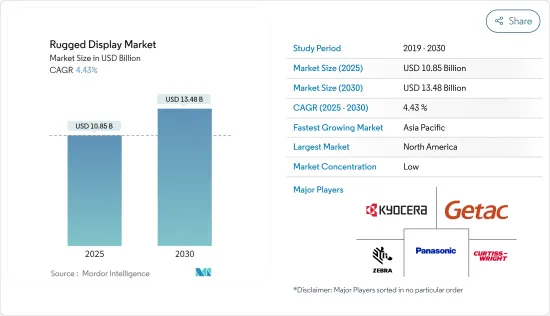

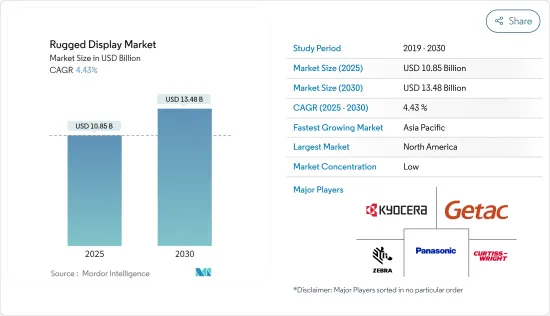

坚固耐用显示器市场规模预计在 2025 年为 108.5 亿美元,预计到 2030 年将达到 134.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.43%。

由于各个终端用户行业的需求不断增加,预计市场在预测期内将出现令人兴奋的成长。

主要亮点

- 例如,石油和天然气公司需要监控和维护覆盖大片陆地和海洋的资产。这些公司需要确保其资产的完整性,并以快速有效的方式主动检测和管理潜在问题。这对于最大限度地减少停机时间、最大限度地提高生产力和确保连续运行是必要的,因此需要坚固的显示设备。

- 加强型显示装置具有抗衝击性、耐用性、防尘防潮、可读性、宽温度范围、提高的对比度、增加的显示亮度、低功耗等各种先进特性,可对全球市场产生积极影响。

- 市场成长的关键驱动因素是与恶劣环境下的消费级设备相比,加固产品所提供的总拥有成本(TCO)降低,以及各个工业领域对 HMI 和 IoT 的需求快速成长。

- 然而,COVID-19 已影响多个行业的业务,阻碍了自动化和工业製程控制。这影响了 HMI、SCADA 和分散式控制系统的使用。 COVID-19 对这项工业控制系统生态系统的影响正在对坚固耐用的工业显示器市场提出挑战。

坚固型显示器市场的趋势

坚固耐用的平板电脑有望占据主导地位

- 坚固型平板电脑是经过专门设计的计算机,可以承受恶劣的环境,即使在极端温度、强烈振动、干燥或潮湿等恶劣条件下也可以轻鬆运作。真正坚固的平板电脑内部结构坚固,能够承受沙子、灰尘、污垢、冰、水和其他极端条件。

- 由于在阳光直射下仍可读、完全密封的关键字以限制灰尘和液体进入、强度高、耐用且易于安装在各种汽车和国防机械中等诸多优势,我们看到国防、医疗保健、交通运输、零售和农业等领域对坚固型平板电脑的购买量显着增加。

- 全款固型平板电脑是三种类型中销量最好的强固型平板电脑。然而,高成本、日益激烈的竞争是限制强固型平板电脑发展的一些障碍。

- 美国在全球三防平板电脑市场占据主导地位。斑马和Panasonic是美国最受欢迎和销售最高的两个品牌。 2019 年 7 月,斑马技术公司推出了全新高性能 L10 Android 超坚固平板电脑,这是斑马广泛的政府和企业平板电脑产品组合的一部分,也是专为严苛的仓库、製造、建筑和现场工作环境而设计的行动计算机。

亚太地区可望成为成长最快的市场

- 全部区域智慧城市等基础设施的现代化和发展,以及政府、国防、交通运输和石油天然气行业中尚未开发的坚固型显示设备的应用,正在推动该地区坚固型显示器的成长。此外,近年来汽车、运输和製造业的大幅成长也推动了市场的成长。

- 中国、印度等国家不断增加的国防预算进一步推动了亚太地区航太和国防工业市场的成长。例如,印度空军正在投入大量资金采购新飞机,这可能会对市场成长产生正面影响。

- 此外,越来越多的日本汽车製造商和供应商正在采用坚固耐用的设备来克服库存管理、流程监控和控制方面的挑战。

坚固耐用显示器产业概况

坚固耐用显示器市场竞争激烈,由多家大型公司组成。从市场占有率来看,其中少数几家公司占据着市场主导地位。由于显示技术的快速发展,以及多家公司专注于研发活动,致力于在坚固型显示器市场开发创新解决方案,市场竞争在过去几年中变得激烈。

- 2019年4月,定鼎科技推出了两款新型三防平板电脑DT380CR和DT380Q。这款平板电脑专为军事用途设计,重量不到 2 磅,萤幕大、亮度高。

- 2019年2月,Trimble Inc.宣布推出一款名为Trimble T17的新型坚固型平板电脑。这款平板电脑具有许多优点,包括在阳光下良好的可视性、易于缩放、64 位元四核心处理器和锂离子电池。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 主要研究结果和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 市场驱动因素

- 降低总拥有成本 (TCO)

- 各行业对 HMI 和物联网的需求日益增加

- 市场限制

- 消费级设备在工业应用上的采用

- COVID-19 工业影响评估

第五章 市场区隔

- 产品类型

- 智慧型手机和手持电脑

- 平板电脑

- 笔记型电脑

- 航空电子显示器

- 车上电脑

- 平板电脑和关键任务显示器

- 稳健性水准

- 半坚固

- 全坚固

- 超坚固

- 作业系统

- Android

- Windows

- 其他作业系统

- 最终用户

- 石油和天然气

- 政府、国防、航太

- 产业

- 汽车与运输

- 卫生保健

- 其他最终用户

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Curtiss-Wright Corp.

- General Dynamics Corp.

- L3 Technologies Inc.

- Esterline Technologies Corp.

- Xplore Technologies Corp.

- Beijer Electronics AB

- Kyocera Corp.

- Sparton Corp.

- Panasonic Corporation

- Zebra Technologies Corp.

- Getac Technology Corp.

- Dell Inc.

第七章投资分析

第 8 章市场趋势与未来机会

The Rugged Display Market size is estimated at USD 10.85 billion in 2025, and is expected to reach USD 13.48 billion by 2030, at a CAGR of 4.43% during the forecast period (2025-2030).

The market is anticipated to witness a stimulating growth during the forecast period, owing to an increasing demand from various end-user industries.

Key Highlights

- For instance, oil and gas companies need to monitor and maintain assets that cover vast tracts of land both onshore and offshore. These companies need to guarantee asset integrity and proactively spot and manage potential issues in a fast and effective manner. This is required to minimize downtime and maximize productivity, ensuring continuous operation, thus, needs rugged display devices.

- Rugged display devices come with various advance features, such as improved impact resistance, durability, dust and moisture resistance, readability, wide temperature range, improved contrast ratio, higher display brightness, and low-power consumption, which may positively impact the global market.

- The key drivers that have driven the market growth are cut in the total cost of ownership (TCO) offered by ruggedized products, when compared to consumer-grade devices in rough environments and rapid growth in the demand for HMI and IoT in different industrial sectors.

- However, COVID-19 has impacted businesses of several industries, hampering automation and industrial process control. This has impacted the use of HMI, SCADA, and distributed control systems. The impact of COVID-19 on this ecosystem of industrial control systems has challenged the rugged industrial displays market.

Rugged Display Market Trends

Rugged Tablets are Expected to Hold Major Share

- Rugged tablets are specially designed computers that can sustain harsh environments and can be easily operated in rough conditions, such as extreme temperatures, strong vibrations, dry or wet conditions. True rugged tablets are built sturdy inside out, therefore, have the ability to withstand sand, dust, dirt, ice, water, and other extremities.

- Owing to many advantages, such as readability in direct sun, fully sealed keywords to restrict intrusion of dust or any liquids, strength, durability, along with easy installations in various automotive and defense machinery, there is a substantial increase in the purchase for rugged tablets in sectors, such as defense, healthcare, transportation, retail, agriculture.

- Fully rugged tablets are the highest selling rugged tablets among the three types. However, high costs and increasing cut-throat competition are a few of the obstacles, which are restricting the growth of rugged tablets.

- America is the dominating player in the global market for rugged tablets. Zebra and Panasonic are the two popular and highest manufacturing brands in the United States. In July 2019, Zebra Technologies Corporation introduced its new high-performance L10 Android ultra-rugged tablet as a part of Zebra's extensive portfolio of government and enterprise tablets as well as purpose-built mobile computers for the rigors of challenging warehouse, manufacturing, construction, and field operations environments.

Asia Pacific is Expected to be The Highest Growing Market

- The modernization and development of infrastructure, such as smart cities, across the region and the untapped rugged display device applications in government, defense, transportation, and oil and gas industries are driving the growth of rugged displays in this region. In addition, the significant growth of the automotive, transportation, and manufacturing sectors in recent years is also driving the growth of the market.

- The increasing defense budgets in countries, such as China and India, further drive the growth of the market for the aerospace and defense industry in Asia-Pacific. For instance, the Indian Air Force is making huge investments in the procurement of new aircraft, which may positively impact the growth of the market.

- Moreover, Japan has the majority of automotive manufacturers and suppliers who are increasingly adopting rugged devices to overcome the challenges regarding inventory management, process monitoring, and control, etc.

Rugged Display Industry Overview

The rugged display market is highly competitive and consists of several major players. In terms of market share, several of these players majorly control the market. The market has become highly competitive in the past few years, owing to the rapid pace of development of display technologies and the presence of several companies that are focused on R&D efforts aimed at the development of innovative solutions in the rugged display market.

- In April 2019, DT Research launched two new rugged tablets named DT380CR and DT380Q, specially designed for military applications and weigh less than two pounds with large screens and high brightness.

- In February 2019, Trimble Inc. announced the launch of a new rugged tablet named Trimble T17, specifically designed to work in harsh conditions. The tablet offers various benefits, such as readability in sun, easy to zoom, 64-bit quad-core processor, and a lithium-ion battery.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Key Study Deliverables and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Reduced Total Cost of Ownership (TCO)

- 4.4.2 Rising Demand for HMI and IoT in Various Industries

- 4.5 Market Restraints

- 4.5.1 Adoption of Consumer-grade Devices for Industrial Applications

- 4.6 Assessment of Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Smartphone and Handheld Computer

- 5.1.2 Tablet PC

- 5.1.3 Laptop and Notebook

- 5.1.4 Avionics Display

- 5.1.5 Vehicle-mounted Computer

- 5.1.6 Panel PC and Mission-critical Display

- 5.2 Level of Ruggedness

- 5.2.1 Semi-rugged

- 5.2.2 Fully-rugged

- 5.2.3 Ultra-rugged

- 5.3 Operating System

- 5.3.1 Android

- 5.3.2 Windows

- 5.3.3 Other Operating Systems

- 5.4 End User

- 5.4.1 Oil and Gas

- 5.4.2 Government, Defense, and Aerospace

- 5.4.3 Industrial

- 5.4.4 Automotive and Transportation

- 5.4.5 Healthcare

- 5.4.6 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Curtiss-Wright Corp.

- 6.1.2 General Dynamics Corp.

- 6.1.3 L3 Technologies Inc.

- 6.1.4 Esterline Technologies Corp.

- 6.1.5 Xplore Technologies Corp.

- 6.1.6 Beijer Electronics AB

- 6.1.7 Kyocera Corp.

- 6.1.8 Sparton Corp.

- 6.1.9 Panasonic Corporation

- 6.1.10 Zebra Technologies Corp.

- 6.1.11 Getac Technology Corp.

- 6.1.12 Dell Inc.