|

市场调查报告书

商品编码

1435777

低摩擦涂料:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Low Friction Coating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

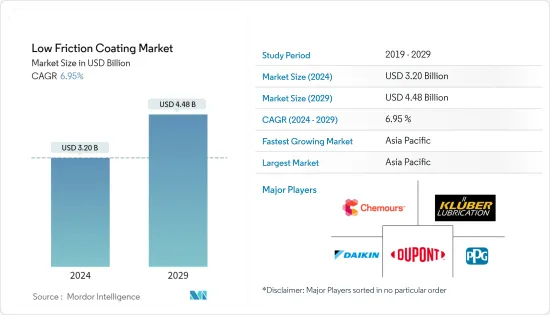

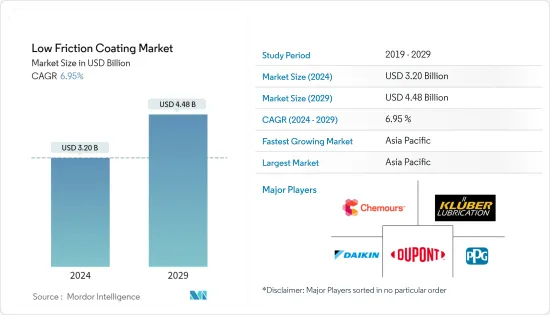

低摩擦涂料市场规模预计到 2024 年为 32 亿美元,预计到 2029 年将达到 44.8 亿美元,预测期内(2024-2029 年)复合年增长率为 6.95%。

由于新冠肺炎 (COVID-19) 疫情的爆发,2020 年全国范围内的封锁、製造活动和供应链中断以及生产停顿影响了全球市场。然而,情况在 2021 年开始復苏,并在预测期内恢復了市场成长轨迹。

主要亮点

- 推动市场的主要因素之一是航太工业对低摩擦涂层的需求不断增加,以及主要经济体汽车工业的应用不断增加。

- 然而,政府有关过热 PTFE 毒性的法规预计将阻碍市场成长。

- 医疗保健产业对流体摩擦涂层的需求不断增长,可能代表未来几年探索市场的机会。

- 从最终用户产业来看,汽车产业预计将在预测期内主导市场。

- 预计亚太地区将主导市场,其中中国、印度和日本等国家的消费量最大。

低摩擦涂料市场趋势

汽车和运输业对低摩擦涂料的需求增加

- 低摩擦涂层可提高性能和使用寿命,同时无需在需要防热、合成材料或无尘室条件的工作环境中进行湿式润滑。

- 汽车产业引入低摩擦和超硬涂层可减少表面摩擦,提高燃油效率、耐用性,并提高先进引擎系统的环境相容性。

- 美国还拥有北美最大的汽车工业。根据OICA的数据,2021年汽车产量为9,167,214辆,比2020年的8,822,399辆成长4%。

- 根据IEA 2021年展望,2021年全球电动车销量翻倍,达到660万辆。 2022年销量大幅成长,2022年第一季全球电动车销量达200万辆。

- 预计汽车产业在未来几年将显着成长。数位技术的进步、不断变化的客户情绪以及经济健康状况在汽车製造的非商业业务实践中发挥了关键作用。

- 因此,由于上述因素,低摩擦涂层在汽车产业的应用很可能在预测期内成为主流。

亚太地区主导市场

- 预计亚太地区将在预测期内主导市场。由于中国和印度等国家汽车和医疗保健行业的发展,对低摩擦涂料的需求不断增长,预计将增加该地区对低摩擦涂料的需求。

- 最大的低摩擦涂料製造商位于亚太地区。生产低摩擦涂料的领先公司包括 VITRACOAT、CARL BECHEM GMBH、科慕公司、陶氏化学和 ASV Multichemie Private Limited。

- 根据OICA统计,中国是全球最具影响力的汽车生产基地,2021年汽车总产量为2,608万辆,较去年的2,523万辆成长3%。此外,根据中国工业协会统计,2022年1-7月,我国汽车持有1,457万辆,较去年与前一年同期比较成长31.5%。

- 根据波音《2021-2040年商业展望》,预计2040年中国将新增交付,市场服务价值将达到1.8兆美元。

- OICA报告显示,2021年印度汽车产量成长30%。印度汽车製造商协会 (SIAM) 的报告显示,2021 年印度小客车和轻型汽车产量为 4,399,112 辆。

- 印度亚太航空中心(CAPA)在题为《2022年印度航空展望》的报告中预测,2022年国内空中交通量将增加52%,国际空中交通量将增加60%。他表示,这已经做到了。 2022财年国内航空旅客人数为4,822万人次。此外,预计 2021 年印度旅客在航空运输上的支出将达到 1,360 亿美元。政府正试图透过增加国内机场的数量来适应空中交通。

- 由于上述因素,亚太地区低摩擦涂料市场预计在研究期间将显着成长。

低摩擦涂料产业概况

全球低摩擦涂层本质上是整合的。市场主要企业包括PPG工业公司、科慕公司、杜邦公司、克鲁勃润滑油公司、大金工业公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大在汽车产业的应用

- 航太工业对低摩擦涂层的需求不断增长

- 其他司机

- 抑制因素

- 关于过热 PTFE 毒性的政府法规

- 价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 种类

- 二硫化钼

- 二硫化钨

- 聚四氟乙烯 (PTFE)

- 其他类型

- 最终用户产业

- 汽车和交通

- 航太/国防

- 卫生保健

- 建造

- 油和气

- 其他最终用户产业

- 目的

- 轴承

- 汽车零件

- 电力传输

- 阀门零件和致动器

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- AFT Fluorotec Ltd

- ASV Multichemie Pvt Ltd

- Carl Bechem GmBH

- Daikin Industries

- DuPont

- Endura Coatings

- Everlube(Curtiss-Wright)

- FUCHS

- GGB

- IHI HAUZER BV

- IKV Tribology Limited

- Impreglon UK Limited

- Indestructible Paint Limited

- Kluber Lubrication

- Micro Surface Corp

- Poeton

- PPG Industries Inc.

- The Chemours Company

- VITRACOAT

第七章 市场机会及未来趋势

- 医疗保健产业对低摩擦涂层的需求不断增长

The Low Friction Coating Market size is estimated at USD 3.20 billion in 2024, and is expected to reach USD 4.48 billion by 2029, growing at a CAGR of 6.95% during the forecast period (2024-2029).

Due to the COVID-19 outbreak, nationwide lockdowns around the globe, disruption in manufacturing activities and supply chains, and production halts impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory during the forecast period.

Key Highlights

- One of the major factors driving the market is the increasing demand for low-friction coating in the aerospace industry and increasing applications in the automotive industry across major economies.

- However, government regulations on the toxicity of overheated PTFE are expected to hinder the market's growth.

- The growing demand for flow-friction coating in the healthcare industry will likely act as an opportunity for the market studied in the coming years.

- By the end-user industry the automotive industry is expected to dominate the market over the forecast period.

- Asia-Pacific region is expected to dominate the market with the largest consumption from countries such as China, India, and Japan.

Low Friction Coating Market Trends

Increasing Demand Low Friction Coating in Automotive and Transportation Industry

- Low friction coatings give improved performance and service life while dispensing with the requirement for wet lubricants in a working environment that expects protection from heat, synthetic substances, or cleanroom conditions.

- Implementing low-friction and super-hard coatings in the automotive industry provides a low-friction surface, increased fuel economy, durability, and environmental compatibility of advanced engine systems.

- The United States also has one of the largest automotive industries in North America. According to OICA, automotive production in 2021 accounted for 91,67,214 units, an increase of 4% compared to the show in 2020, which was reported to be 88,22,399 units.

- According to the IEA 2021 Outlook, worldwide electric car sales doubled in 2021 and reached 6.6 million. The sales increased strongly in 2022, with 2 million electric cars sold across the globe in the first quarter of 2022.

- The automotive industry is expected to grow significantly over the coming years. Evolving digital technology, changes in customer sentiment, and economic health have played a vital role in non-commercial business practices of manufacturing vehicles.

- Hence, owing to the factors mentioned above, the application of low-friction coating in the automotive industry is likely to dominate during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market during the forecast period. The rising demand for low-friction coating with the growing automotive and healthcare industry in countries like China and India is expected to drive the demand for low-friction coating in this region.

- The largest producers of low-friction coating are based in the Asia-Pacific region. Some of the leading companies in the production of low-friction coating are VITRACOAT, CARL BECHEM GMBH, The Chemours Company, Dow, and ASV Multichemie Private Limited, among others.

- According to OICA, China has the world's most influential automotive production base, with a total vehicle production of 26.08 million units in 2021, registering an increase of 3% compared to 25.23 million units produced last year. Further, according to the China Association of Automobile Manufacturers (CAAM), in the first seven months of 2022, the country had 14.57 million units of cars, registering a growth rate of 31.5% Y-o-Y.

- According to the Boeing Commercial Outlook 2021-2040, in China, around 8,700 new deliveries will be made by 2040, with a market service value of USD 1,800 billion.

- According to reports by the OICA, automotive production in India witnessed a 30% growth in 2021. As per the reports by the Society of Indian Automobile Manufacturers, SIAM, the country produced 4,399,112 units of passenger cars and light vehicles in 2021.

- In a report titled India Airline Outlook 2022, The Centre for Asia Pacific Aviation (CAPA) India indicated that 2022 is expected to see a surge of 52% in domestic and 60% in international air traffic. The air passenger traffic in FY 2022 stood at 48.22 million in the country. Furthermore, the estimated expenditure of Indian travelers through air transport stood at USD 136 billion in 2021. The government is trying to cater to air traffic by increasing the number of airports in the country.

- Owing to the above-mentioned factors, the market for low friction coating in the Asia-Pacific region is projected to grow significantly during the study period.

Low Friction Coating Industry Overview

The global low-friction coating is consolidated in nature. Some of the major companies in the market include PPG Industries Inc., The Chemours Company, DuPont, Kluber Lubrication, and Daikin Industries, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in the Automotive Industry

- 4.1.2 Growing Demand for Low-friction Coating in Aerospace Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Government Regulation on Toxicity of Overheated PTFE

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Molybdenum Disulphide

- 5.1.2 Tungsten Disulphide

- 5.1.3 Polytetrafluoroethylene (PTFE)

- 5.1.4 Other Types

- 5.2 End-User Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Aerospace and Defense

- 5.2.3 Healthcare

- 5.2.4 Construction

- 5.2.5 Oil and Gas

- 5.2.6 Others End-User Industries

- 5.3 Application

- 5.3.1 Bearings

- 5.3.2 Automotive Parts

- 5.3.3 Power Transmission Items

- 5.3.4 Valve Components and Actuators

- 5.3.5 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Russia

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AFT Fluorotec Ltd

- 6.4.2 ASV Multichemie Pvt Ltd

- 6.4.3 Carl Bechem GmBH

- 6.4.4 Daikin Industries

- 6.4.5 DuPont

- 6.4.6 Endura Coatings

- 6.4.7 Everlube (Curtiss-Wright)

- 6.4.8 FUCHS

- 6.4.9 GGB

- 6.4.10 IHI HAUZER BV

- 6.4.11 IKV Tribology Limited

- 6.4.12 Impreglon UK Limited

- 6.4.13 Indestructible Paint Limited

- 6.4.14 Kluber Lubrication

- 6.4.15 Micro Surface Corp

- 6.4.16 Poeton

- 6.4.17 PPG Industries Inc.

- 6.4.18 The Chemours Company

- 6.4.19 VITRACOAT

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand of Low Friction Coating in Healthcare Industry