|

市场调查报告书

商品编码

1435778

MulteFire:市场占有率分析、产业趋势/统计、成长预测(2024-2029)MulteFire - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

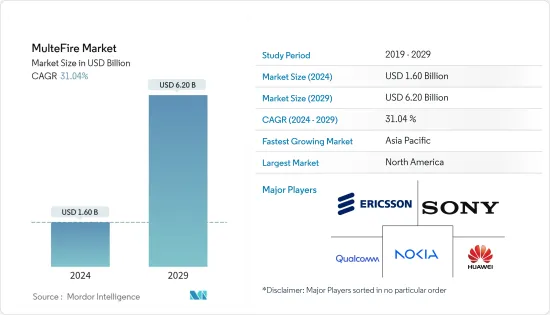

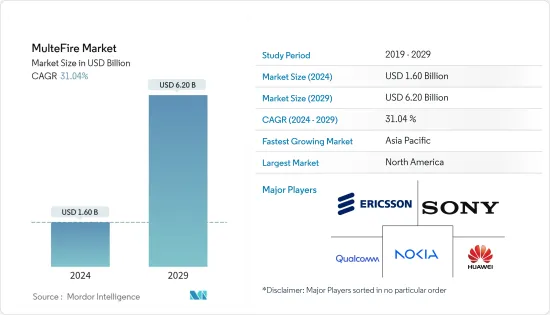

MulteFire市场规模预计到2024年为16亿美元,预计到2029年将达到62亿美元,在预测期内(2024-2029年)复合年增长率为31.04%。

为了向数量不断增加的设备提供丰富的信息,越来越依赖无线连接,但网路容量有限。因此,这促使了 MulteFire 的创建,它旨在成为解决日益增长的行动资料流量问题的关键组成部分。

主要亮点

- MulteFire 将成为关键推动者,使企业能够在全球免许可区域和全球频宽部署 LTE 专用网络,而无需行动网路营运商的参与。其中包括 2.4 GHz 和 5 GHz 全球频宽,以及 800/900 MHz 和 1.9 MHz 区域频宽。

- 凭藉其独立功能,MulteFire向许多新参与者开放了免许可频谱,包括无线ISP、全球企业、专业部门,甚至网路营运商,允许所有企业部署基于MulteFire的LTE专用网路。

- MulteFire 将 LTE 的增强效能与免许可频谱的部署简单性相结合,使增强的宽频服务能够在更多位置部署。 MulteFire 基于 LTE,因此它可以在更宽的频宽上运行,支援高达 20 MHz,支援高容量和低延迟,并且能够实现高达 400 Mbps 的峰值资料速率。

- MulteFire 可以允许企业和有线电视供应商使用未经许可的频谱来建立自己的 LTE 网路。与增强安全性等 LTE 功能相结合,这将有助于缺乏许可频谱并希望比Wi-Fi 通常提供的移动性更高的主要组织,特别是航运港口、矿山和机场。预计MulteFire 将在以下领域得到采用工业领域。此外,MulteFire 预计将成为物联网部署的连接选择。

- 工业物联网 (IIoT) 应用对更具可扩展性和先进网路连接的需求不断增长,这是预计在预测期内推动 MultiFire 市场扩张的关键因素之一。此外,对高效能和易于部署的无线连接网路日益增长的需求预计将推动多火市场的扩张。

- 然而,对高容量和具有成本效益的网路不断增长的需求预计将限制多火市场的扩张。另一方面,预计这段时期多火市场的成长将因共用频谱利用决策的延迟而进一步受到阻碍。

- COVID-19 对 Multefire 市场产生了重大影响。各种製造公司和企业的迅速倒闭对市场产生了重大影响。第一阶段中期,由于COVID-19感染疾病,各地根据互联网品质的伺服器监控的互联网使用情况和下载速度发生了变化,流量有所增加。在学校停课和居家令等官方政策宣布后,几乎所有地方的交通流量都出现了最显着的成长。

MulteFire 市场趋势

工业物联网 (IIoT) 应用对更好、可扩展的网路连接的需求不断增长

- MulteFire 可以允许企业和有线电视供应商使用未经许可的频谱来建立自己的 LTE 网路。与增强安全性等 LTE 功能相结合,这将有助于缺乏许可频谱并希望比Wi-Fi 通常提供的移动性更高的主要组织,特别是航运港口、矿山和机场。预计MulteFire 将在以下领域得到采用工业领域。此外,MulteFire 预计将成为物联网部署中的连接选择,从而推动市场成长。

- 此外,MulteFire 联盟认为,企业和工业物联网专用 LTE 网路是受益于 MulteFire 技术的关键用例。该联盟欢迎与工业互联网联盟 (AII) 的此次合作,以进一步实现其在共用、免许可频谱中采用 LTE 和下一代蜂窝技术的目标。此类倡议将大大推动市场成长。

- 此外,行动性和安全性被认为是评估物联网部署连接替代方案的关键业务。 MulteFire 等专用 LTE 网路可以满足这两个要求,同时保持无需许可或仅使用共用频谱。对于专注于基于感测器的物联网设备的规模和扩充性的行业来说,这是一个理想的网路选择。 MulteFire 对于物联网网路架构至关重要,因为它透过提供频谱共用和共存来促进私有 LTE 安装。

- 此外,根据爱立信的报告,2022年物联网连接总数估计约为132亿。这些技术预计将在 2021 年大幅增加连网装置的数量,到年终将达到约 5 亿个。网路能力的提升,使得海量物联网与FDD中的4G、5G频谱共用,促进海量物联网技术的发展。乐队。物联网连接的增加很大程度上构成了工业物联网技术,从而推动了市场成长。

北美占最大市场占有率

- 北美是部署基于 MulteFire 技术的网路最重要的地区之一。 MulteFire Alliance 致力于探索将 LTE 技术用于非授权频宽的可能性,以应用于多个行业的各种应用,包括工业製造、采矿、医疗保健和商业,这是MulteFire 成长的关键推动力。它可以成为推动力。市场。

- MulteFire 联盟成员中的许多重要公司都位于该地区,包括高通、英特尔、Wave Wireless、SpiderCloud Wireless、TMobile 和 Verizon。该地区此类知名企业的存在极大地促进了相当大的市场占有率,从而增加了该地区在预测期内创造机会的机会。

- 该地区的 5G NR 在非授权频谱中的运作标准化程度不断提高,这可以实现专用网路的快速扩展。这称为独立 NR-U,类似于 LTE MulteFire 中的独立 NR-U。 NR在免授权频谱上独立运行,成为MulteFire向5G演进的路径,美国见证了5G网路的大规模部署。

- MulteFire 的市场预计将受益于物联网设备、工业 4.0 解决方案和智慧製造解决方案的日益使用,这些解决方案都推动了对可靠、安全的资料传输网路的需求。例如,国际工程服务公司 L&T Technology Services Limited 于 2023 年 2 月宣布,将利用人工智慧的最新进展,为交通、医疗设备和先进技术进步等关键产业开发工业解决方案。专注于 4.0 技术的产品套件。智慧型 (AI)、机器人、3D 视觉系统和连网机器。这些技术的整合将极大地推动MulteFire技术提供增强的服务,从而增加市场占有率。

- 此外,该地区还见证了私有物联网网路的部署,使企业能够利用透过非授权频谱提供的 LTE 功能。此外,预计该地区用于追踪货物和货柜、提供安全和环境资讯以及监控运输网路的新兴工业IoT应用也将推动 MulteFire 的使用,以开发下一代营运。

MulteFire 产业概览

MulteFire市场相对集中,由高通、诺基亚和华为等少数知名公司占据较大市场占有率。两家公司都积极致力于创新和合作,以增加市场占有率。此外,该市场中的所有公司都是 MulteFire 联盟的成员。着名的市场参与者包括高通技术公司、诺基亚公司、华为技术公司、Telefonaktiebolaget LM Ericsson、索尼公司等。

2023 年 2 月 - 诺基亚与 Kyndryl 的合作伙伴关係将使用 4G/5G 专用无线网路和多接取边缘运算(MEC) 技术实现工厂自动化,该合作伙伴关係已再延长三年。两家公司都认为,随着政府为工业用途分配许可频谱以及引入非许可无线网路解决方案(例如美国的 CBRS 和 MulteFire),可用频谱的短缺现象将迅速减少。他们声称正在这样做。

2023 年 1 月 - 德国电信宣布将部署更多小型基地台以加强其 5G 网路。通讯业者透露,小型基地台将改善市场、零售商场、铁路和公车站等人口稠密地区的网路品质。德国电信宣布,到 2025 年将把约 3,000 部旧公用电话转换为 5G小型基地台。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 共用和免许可频宽的可用性

- 工业物联网 (IIoT) 应用对更好、可扩展的网路连接的需求不断增长

- 低成本部署,无需频谱许可

- 市场限制因素

- 相较于Wi-Fi技术在接取通路上的劣势

- 关于共用频谱利用的决策延迟

- 技术简介

第六章市场区隔

- 设备类型

- 小型基地台

- 转变

- 控制器

- 最终用户产业

- 商业/机构设施

- 供应链和分销

- 零售

- 款待

- 公共设施

- 卫生保健

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东/非洲

- 北美洲

第七章 竞争形势

- 公司简介

- Qualcomm Technologies, Inc.

- Nokia Corporation

- Huawei Technologies Co., Ltd.

- Telefonaktiebolaget LM Ericsson

- Sony Corporation

- Intel Corporation

- Samsung Electronics Co Ltd

- InterDigital Inc.

- Baicells Technologies

- DEKRA India Private Limited

第八章投资分析

第九章 市场机会及未来趋势

The MulteFire Market size is estimated at USD 1.60 billion in 2024, and is expected to reach USD 6.20 billion by 2029, growing at a CAGR of 31.04% during the forecast period (2024-2029).

The network's capacity has become limited as a result of the rising reliance on wireless connections to provide rich information to an ever-growing number of devices. Therefore, this encouraged the creation of MulteFire, which was intended to be a vital component of the solution to the growing mobile data traffic issue.

Key Highlights

- MulteFire will be a critical enabler allowing enterprises to deploy LTE private networks without the involvement of a mobile network operator in unlicensed regional and global spectrum bands around the world, which includes the 2.4 GHz and 5 GHz global bands and the 800/900 MHz and 1.9 MHz regional bands.

- MulteFire, with its standalone feature, will open up an unlicensed spectrum to a host of new players, including wireless ISPs, global enterprises, specialist verticals, and even network operators, where all can deploy MulteFire-based LTE private networks.

- MulteFire enables the deployment of enhanced broadband services in more places with the combination of the enhanced performance of LTE with the deployment simplicity of the unlicensed spectrum. Since MulteFire is based on LTE, it will operate in wider bandwidths that support up to 20 MHz to support high capacity and low latency, capable of peak data rates up to 400 Mbps.

- The use of unlicensed spectrum by businesses or cable providers to create their own LTE networks may be made possible by MulteFire. When paired with LTE features like increased security, major organizations that lack licensed spectrum and desire greater mobility than Wi-Fi generally offers are expected to embrace MulteFire in industrial sectors like shipping ports, mines, and airports, among others. Additionally, MulteFire is predicted to be a connection choice for IoT deployments.

- The rise in the need for more scalable and advanced network connectivity for industrial IoT (IIoT) applications is one of the key factors anticipated to propel multefire market expansion over the projected period. Additionally, the increased need for high-performance and simple-to-deploy wireless connection networks is expected to fuel the multefire market's expansion.

- However, the increased need for high-capacity, cost-effective networks is predicted to limit the multefire market's expansion. On the other side, the growth of the multefire market in the timeframe period is further anticipated to be hampered by the delay in decisions relating to the utilization of shared spectrum.

- The COVID-19 has had a significant impact on the Multefire market. The rapid closure of various manufacturing firms and businesses significantly impacted the market. During the mid-first phase, the COVID-19 outbreak has caused changes in internet usage and download speeds monitored on servers based on internet quality to be seen in various places, increasing traffic volume. The most significant increases in traffic volume were observed practically everywhere immediately following announcements of official policies, such as school closings and instructions to stay at home.

MulteFire Market Trends

Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications

- The use of unlicensed spectrum by businesses or cable providers to create their own LTE networks may be made possible by MulteFire. When paired with LTE features like increased security, major organizations that lack licensed spectrum and desire greater mobility than Wi-Fi generally offers are expected to embrace MulteFire in industrial sectors like shipping ports, mines, and airports, among others. Additionally, MulteFire is expected to be a connection choice for IoT deployments, thereby driving market growth.

- Moreover, the MulteFire Alliance considers private LTE networks for enterprise and industrial IoT to be critical use cases that will benefit from MulteFire technology. The alliance welcomed this collaboration with the Alliance of Industrial Internet (AII) to advance its goal of employing LTE and next-gen cellular technologies in unlicensed and shared spectrum. Such initiatives significantly drive growth in the market.

- Further, mobility and security are considered significant businesses that assess connectivity alternatives for their IoT deployments. Private LTE networks like MulteFire meet both requirements while solely employing unlicensed or shared spectrum. This is an ideal network option for sectors concerned about the size and extensiveness of their sensor-based IoT devices. MulteFire is essential in the IoT network architecture because it makes private LTE installations easier by providing spectrum sharing and coexistence.

- Furthermore, according to Ericsson's report, in 2022, the total IoT connections were reported to be valued at around 13.2 billion. These technologies enabled a significant increase in the number of connected devices in 2021, projected to reach about 500 million by the end of 2022. Increased network capabilities promote the development of Massive IoT technologies by enabling spectrum sharing between Massive IoT and 4G and 5G in FDD bands. Such rise in IoT connections would significantly comprise IIoT technologies, thereby driving the market growth.

North America to Hold a Largest Market Share

- North America would be among the most significant regions for deploying MulteFire technology-based networks. The MulteFire Alliance's initiatives to investigate possibilities for making LTE technologies available in the unlicensed band for a variety of applications in several verticals, such as industrial manufacturing, mining, healthcare, and commercial, are likely to be a driving force behind the growth of the MulteFire market.

- Numerous significant businesses that are MulteFire Alliance members are based in the region, including Qualcomm, Intel, Wave Wireless, SpiderCloud Wireless, TMobile, and Verizon. Such prominent player presence in the region significantly contributes to the considerable market share, thereby enhancing the potential of the region in creating opportunities during the forecast period.

- The region is witnessing standardization in the operation of 5G NR in an unlicensed spectrum, and this has the potential to enable private networks to expand rapidly. This is called standalone NR-U and is analogous to standalone NR-U in MulteFire for LTE. The NR operating standalone in the unlicensed spectrum will become the MulteFire evolution path to 5G, and the United States witnessed a massive rollout of the 5G network.

- The market for MulteFire is anticipated to benefit from the rising usage of IoT devices, industry 4.0 solutions, and smart manufacturing solutions, which have increased the demand for a dependable and secure network for data transfers. For instance, in February 2023, L&T Technology Services Limited, an international engineering services firm, introduced a new suite of offerings focused on Industry 4.0 technologies for crucial verticals like transportation, medical devices, and high technological advancements, using the most recent advances in Artificial Intelligence (AI), robotics, 3D-vision systems, and connected machines. Such tehnology integrations would significantly drive the MulteFire technology in offering enhanced services, thereby increasing the region's market share.

- Futhermore, the region is also witnessing the deployment of Private IoT networks where enterprises can take advantage of the capabilities of LTE delivered over the unlicensed spectrum. Moreover, emerging Industrial IoT applications in the region to track goods and containers, provide safety and environmental information, and monitor transportation networks is also expected to boost the usage of MulteFire to develop next-generation operations.

MulteFire Industry Overview

The MulteFire market is relatively consolidated with a few prominent companies, such as Qualcomm, Nokia, and Huawei, which account for a significant market share. The companies significantly engage in innovations and partnerships to enhance their market shares. Moreover, all the companies in this market are a part of The MulteFire Alliance. A few of the prominent market players include Qualcomm Technologies, Inc., Nokia Corporation, Huawei Technologies Co., Ltd., Telefonaktiebolaget LM Ericsson, Sony Corporation, etc.

February 2023 - the partnership between Nokia and Kyndryl, which automates factories utilizing 4G/5G private wireless networks and multi-access edge computing (MEC) technology, has been extended for another three years. The companies claimed that the lack of spectrum availability is rapidly declining due to governments distributing licensed spectrum for industrial usage and the introduction of unlicensed wireless networking solutions (such as CBRS in the US and MulteFire).

January 2023 - Deutsche Telekom stated that the firm would deploy additional small cells to strengthen its 5G network. The carrier clarified that small cells enhance network quality in densely populated regions like markets, retail malls, and railway or bus stops. By 2025, Deutsche Telekom stated it would convert about 3,000 outdated public payphones into 5G small cells.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Availability of Shared and Unlicensed Spectrum Bands

- 5.1.2 Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications

- 5.1.3 Low Cost of Deployment that doesn't Require Spectrum License

- 5.2 Market Restraints

- 5.2.1 Disadvantage Compared to Wi-Fi Technologies in Accessing the Channel

- 5.2.2 Delay in Decision-Making Regarding Use of Shared Spectrum

- 5.3 Technology Snapshot

6 MARKET SEGMENTATION

- 6.1 Equipment Type

- 6.1.1 Small Cells

- 6.1.2 Switches

- 6.1.3 Controllers

- 6.2 End User Vertical

- 6.2.1 Commercial & Institutional Buildings

- 6.2.2 Supply Chain and Distribution

- 6.2.3 Retail

- 6.2.4 Hospitality

- 6.2.5 Public Venues

- 6.2.6 Healthcare

- 6.2.7 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Qualcomm Technologies, Inc.

- 7.1.2 Nokia Corporation

- 7.1.3 Huawei Technologies Co., Ltd.

- 7.1.4 Telefonaktiebolaget LM Ericsson

- 7.1.5 Sony Corporation

- 7.1.6 Intel Corporation

- 7.1.7 Samsung Electronics Co Ltd

- 7.1.8 InterDigital Inc.

- 7.1.9 Baicells Technologies

- 7.1.10 DEKRA India Private Limited