|

市场调查报告书

商品编码

1435779

陶瓷膜:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Ceramic Membranes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

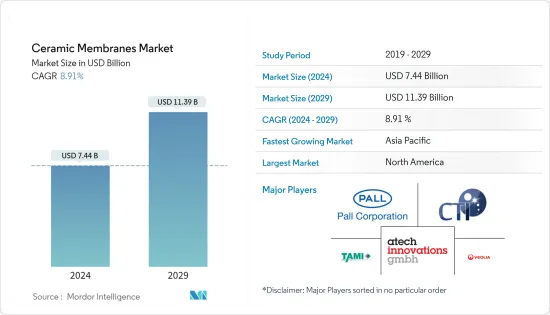

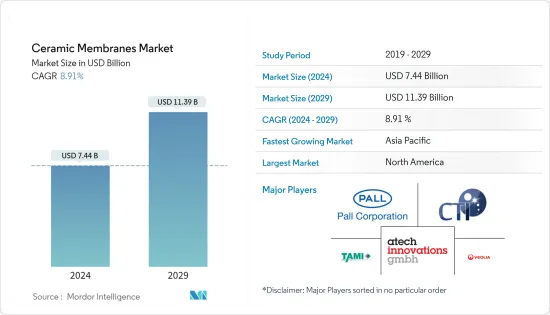

陶瓷膜市场规模预计2024年为74.4亿美元,预计到2029年将达到113.9亿美元,在预测期内(2024-2029年)复合年增长率为8.91%增长。

推动市场的主要因素是食品和饮料行业需求的成长。另一方面,高成本和 COVID-19感染疾病造成的不利条件正在阻碍市场成长。

主要亮点

- 预计在预测期内,水和废水处理产业将主导全球陶瓷膜市场。

- 由于中国、印度和日本等国家的消费量不断增加,亚太地区是预测期内成长最快的市场。

陶瓷膜市场趋势

水和废水处理产业的需求不断增长

- 在水处理製程中,陶瓷膜常用于高付加产品,导致与传统製程相比成本较高。

- 过滤时保留水中有益矿物质,去除细菌、铁锈、重金属离子等,不造成二次污染。

- 用于水和污水处理过程的陶瓷薄膜过滤系统可去除原河水和井水中的浊度,去除杂质(隐孢子虫等细菌),并产生清洁的自来水。

- 此外,陶瓷膜过滤系统还提供长寿命和低成本的水处理系统。

- 陶瓷膜还具有化学稳定性、机械稳定性和热稳定性、反冲洗性、高耐磨性、高耐用性、抗菌性以及清洗后的干燥储存性。

- 预计这些因素将推动水处理过程中对陶瓷膜的需求,并在预测期内促进市场成长。

亚太地区主导市场

- 预计亚太地区将在预测期内成为陶瓷膜成长最快的地区。

- 化学和製药行业的成长以及该地区对污水处理技术的兴趣日益浓厚,正在扩大该地区陶瓷膜市场的成长范围。

- 此外,推动各种最终用户产业成长的其他主要因素包括生活水准的提高、污水处理问题的严格监管、快速工业化以及未来几年的人口成长。

- 中国、印度、日本等新兴国家采用了许多净化技术来减少污染水的使用,这对健康造成了严重危害,而这些技术大多依赖过滤效率高的陶瓷膜,我正在使用。浪费。

- 中国医药产业目前价值约1,450亿美元,是最大的新兴市场,预计到2022年将成长约2,000亿美元,市场范围不断扩大。

- 上述因素和政府支持正在推动预测期内陶瓷膜市场需求的增加。

陶瓷膜产业概况

由于市场上存在不同的参与者,全球陶瓷膜市场本质上是细分的。陶瓷膜市场的主要企业包括Atech Innovations GmbH、CTI Salindres、Pall Corporation、TAMI Industries、Veolia Water Technologies等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 食品和饮料行业的需求增加

- 其他司机

- 抑制因素

- 製造成本高

- COVID-19 疫情造成的不利情况

- 产业价值链分析

- 波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 材料类型

- 氧化铝

- 二氧化硅

- 二氧化钛

- 氧化锆

- 其他的

- 最终用户产业

- 水处理/污水处理

- 食品和饮料

- 化学

- 製药

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Atech Innovations GmbH

- CTI Salindres

- GEA Group Aktiengesellschaft

- Hyflux Ltd

- ItN Water Filtration

- JIANGSU JIUWU HI-TECH CO. LTD

- METAWATER. CO. LTD

- Pall Corporation

- SIVA

- TAMI Industries

- Veolia Water Technologies

第七章 市场机会及未来趋势

The Ceramic Membranes Market size is estimated at USD 7.44 billion in 2024, and is expected to reach USD 11.39 billion by 2029, growing at a CAGR of 8.91% during the forecast period (2024-2029).

The major factor driving the market is the increasing demand from the food & beverage industry. On the flip side, high costs associated with manufacturing and unfavorable conditions arising due to the COVID-19 outbreak are hindering the growth of the market.

Key Highlights

- The water and wastewater treatment industry is expected to dominate the global ceramic membranes market over the forecast period.

- Asia-Pacific region represents the fastest-growing market over the forecast period, owing to the increasing consumption from countries such as China, India, and Japan.

Ceramic Membranes Market Trends

Growing Demand from Water and Wastewater Treatment Industry

- In the water treatment processes, ceramic membranes are generally used for high value-added products, with a higher cost than that of conventional processes.

- They can retain beneficial minerals in water during filtration, remove bacteria, rust, heavy metal ions, etc. and do not produces secondary pollution.

- The ceramic membrane filtration system in water and wastewater treatment processes helps to generate clean and clear tap water by eliminating impurities (bacteria such as Cryptosporidium) and for removing turbidity in raw water from river systems and well water.

- Additionally, the ceramic membrane filtration system also offers a low-cost water treatment system with a long service life.

- Ceramic membranes also provide chemical, mechanical as well as thermal stability, backflushing, high abrasion resistance, high durability, bacteria resistance, and dry storage after cleaning, among various others.

- Such factors are expected to drive the demand for ceramic membranes in water treatment processes, thus increasing the growth of the market during the forecast period.

The Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to account for the fastest-growth for ceramic membranes during the forecast period.

- Growth in the chemical and pharmaceutical industry associated with a rise in concern toward wastewater treatment techniques in this region is increasing the scope for the growth of the ceramic membrane market in the region.

- Moreover, other major factors responsible for driving the growth of various end-user industries are improving living standards, stringent regulations toward the concerns for wastewater treatment, rapid industrialization, as well as the growing population through the upcoming years.

- In developing countries, like China, India, and Japan, to reduce the usage of polluted water, which acts as a severe health hazard many purification techniques are being adopted most of these techniques use ceramic membranes, owing to its high efficiency in filtering off the waste.

- The Chinese pharmaceutical industry, which is valued at about ~USD 145 billion currently, represents the biggest emerging market with growth tipped to reach about ~USD 200 billion by 2022, thus increasing the scope of the market.

- The aforementioned factors, coupled with government support, are contributing to the increasing demand for the ceramic membrane market during the forecast period.

Ceramic Membranes Industry Overview

The global ceramic membranes market is partially fragmented in nature with the presence of various players in the market. Some of the major companies in ceramic membranes market includes Atech Innovations GmbH, CTI Salindres, Pall Corporation, TAMI Industries, Veolia Water Technologies, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Food and Beverage Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Costs Associated with Manufacturing

- 4.2.2 Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Material Type

- 5.1.1 Alumina

- 5.1.2 Silica

- 5.1.3 Titania

- 5.1.4 Zirconium Oxide

- 5.1.5 Others

- 5.2 End-user Industry

- 5.2.1 Water and Wastewater Treatment

- 5.2.2 Food and Beverage

- 5.2.3 Chemical Industry

- 5.2.4 Pharmaceutical

- 5.2.5 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Atech Innovations GmbH

- 6.4.2 CTI Salindres

- 6.4.3 GEA Group Aktiengesellschaft

- 6.4.4 Hyflux Ltd

- 6.4.5 ItN Water Filtration

- 6.4.6 JIANGSU JIUWU HI-TECH CO. LTD

- 6.4.7 METAWATER. CO. LTD

- 6.4.8 Pall Corporation

- 6.4.9 SIVA

- 6.4.10 TAMI Industries

- 6.4.11 Veolia Water Technologies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Concerns towards Water and Wastewater Treatment

- 7.2 Other Opportunities