|

市场调查报告书

商品编码

1435794

高锰酸钾:市场占有率分析、产业趋势与统计、成长预测(2024-2029)Potassium Permanganate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

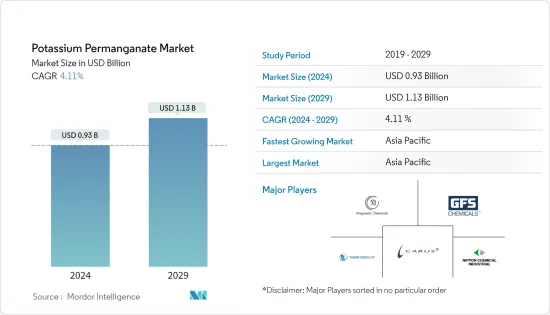

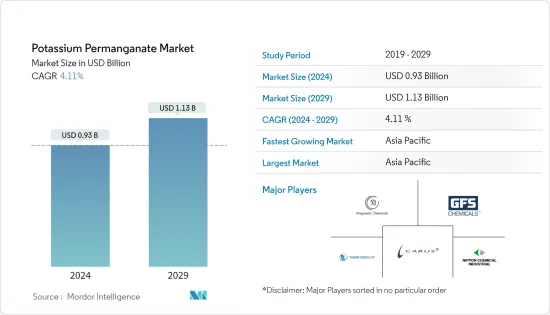

预计2024年高锰酸钾市场规模为9.3亿美元,预计到2029年将达到11.3亿美元,在预测期内(2024-2029年)增加41.1亿美元,复合年增长率为%。

冠状病毒感染疾病(COVID-19)的爆发对农业、水处理和其他最终用户行业等各个行业产生了短期和长期影响,从而影响了高锰酸钾市场。农业产业受到供应链中断和化学品製造公司停产的广泛影响。这是由于封锁和劳动力短缺,对高锰酸钾市场产生了不利影响。例如,在世界各地,欧洲的封锁严重扰乱了食品供应链。据先正达称,欧洲约 46% 的大型农业企业受到了 COVID-19 大流行的影响。因此,COVID-19封锁对上述产业的营运和成长的负面影响减少了这些产业对高锰酸钾的需求。

主要亮点

- 从长远来看,对高品质水处理的需求不断增长以及作为化学品中间体的使用不断增加正在推动市场成长。

- 与使用高锰酸钾相关的健康风险预计将阻碍市场成长。

高锰酸钾市场走势

製药业需求不断成长

- 高锰酸钾越来越多地用于医学,特别是用于防腐目的。高锰酸钾可治疗各种皮肤病,如皮肤炎、湿疹、痤疮和其他真菌感染疾病。

- 医生建议有丘疹和水泡的人使用高锰酸钾。高锰酸钾的氧化作用会破坏正在生长的真菌。因此,运动员通常会将其涂在脚上以减轻疼痛。

- 据Astra Zeneca称,2024年北美将占据药品销售的主要份额,预计为6,330亿美元。欧盟(不包括英国)以 2,870 亿美元位居第二,其次是东南亚和东亚,预计将达到创纪录的 2,320 亿美元。

- 德国是世界上最大的製药工业中心之一,约有 400 家公司驻扎于此。此外,根据欧洲製药工业协会联合会的数据,2022年德国在製药业的研发支出方面将超过瑞士、英国和法国,以84.66亿欧元(约89.21亿美元)位居第一。花时间研究。

- 德国医药市场被世界领先的医药製造公司视为最有前途的子部门,这些公司正在向德国扩张,以巩固其在全球市场的地位。例如,2022年8月,全球领先的製药公司拜耳投资2.75亿欧元(约2.87亿美元)在勒沃库森基地开发Solida-1药品生产设施。该设施计划于 2024 年投入运作。

- 全球製药公司辉瑞透露,2022年其总收益将有史以来首次突破1,000亿美元,创下全球製药製造商的纪录。该公司预计2022年总收益约为1,003.3亿美元。

- 因此,不断扩大的药品产能和对药品的高需求预计将在预测期内推动高锰酸钾的发展。

亚太地区主导市场

- 由于亚太地区高度发展的医疗保健产业以及多年来对水处理和农业领域的持续投资,亚太地区可能会主导全球市场。

- 近年来,该地区纺织业使用的高锰酸钾有所增加。高锰酸钾喷雾剂主要用于丹宁布料布漂白、漂白,使其光泽。

- 高锰酸钾用于水处理应用,以去除毒素和玫瑰藻。在亚太地区,预计清洁水需求的增加和水处理设施的扩建将支持高锰酸钾的未来使用。

- 印度药品出口促进委员会(Pharmexcil)秘书长表示,2021-22年印度出口了价值约246.2亿美元的医药产品,包括原料药成分/药物中间体。此外,2022年4月至10月,印度药品出口成长4.22%,达145.7亿美元。上一财年同期出口额为139.8亿美元。

- 根据全印度原产地化学家和经销商透露的资料,印度製药业的销售额到 2022 年 11 月将与前一年同期比较健康增长 17.3%,到 2022 年 12 月将与前一年同期比较10.4%。我做到了这一点。 2022年12月,产量成长1.5%。与前一年同期比较成长%,其中药品价格上涨6.8%。预计2022-23财年剩余三个月医药产业成长率将持续上升9-10%。这与2022-23年前9个月9.1%的平均与前一年同期比较成长率相符。

- 此外,根据中国国家统计局的数据,2023年农作物生产总产值预计将达到1.23兆美元。 2021年中国农业生产收益为1.13兆美元,2022年为1.18兆美元。到 2025 年,收益预计将达到 1.3 兆美元。

- 预计上述因素将在预测期内推动该地区的市场。

高锰酸钾产业概况

高锰酸钾市场部分分散,参与者众多。主要企业包括重庆长园集团有限公司、Carus Group Inc.、Organic Industries Pvt Ltd.、GFS Chemicals, Inc.、广东航新科技有限公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 对高品质水处理的需求不断增长

- 製药业的使用增加

- 其他司机

- 抑制因素

- 相关健康问题

- 其他阻碍因素

- 价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 按最终用户产业

- 药品

- 水处理

- 食品和饮料

- 农业

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- Carus Group Inc.

- Changsha Yonta

- Chongqing Changyuan Group Limited.

- GFS Chemicals, Inc.

- Guangdong Hangxin Technology Co., Ltd

- Libox Chem(India)Pvt. Ltd.

- Magnesia

- Milport Enterprises, Inc.

- Nippon Chemical Industrial CO., LTD.

- Otto Chemie Pvt. Ltd.

- Univar Solutions Inc.

- Universal Chemicals & Industries Pvt. Ltd.

第七章 市场机会及未来趋势

The Potassium Permanganate Market size is estimated at USD 0.93 billion in 2024, and is expected to reach USD 1.13 billion by 2029, growing at a CAGR of 4.11% during the forecast period (2024-2029).

The COVID-19 outbreak brought several short-term and long-term consequences in various industries, such as agriculture, water treatment, and other end-user industries, affecting the potassium permanganate market. The agriculture industry was widely impacted due to supply chain disruption and a halt in the production of chemical manufacturing companies. It is due to lockdown and workforce shortages, thus, adversely affecting the potassium permanganate market. For instance, worldwide, the lockdowns in Europe greatly disrupted food supply chains. According to Syngenta, about 46% of large European farming businesses were impacted by the COVID-19 pandemic. Hence, the negative impact of the COVID-19 lockdown on the operations and growth of the industries mentioned above declined the demand for potassium permanganate in these industries.

Key Highlights

- Over the long term, the growing need for high-quality water treatment and the increasing usage as an intermediate in chemicals are driving the market growth.

- The associated health risks of using potassium permanganate are expected to hinder market growth.

Potassium Permanganate Market Trends

Growing Demand from Pharmaceutical Industry

- Potassium permanganate is increasingly used in medicine, particularly for antiseptic purposes. Potassium permanganate treats various skin illnesses, including dermatitis, eczema, acne, and other fungal infections.

- Doctors recommend potassium permanganate for those who include gushing wounds and blisters. The oxidizing action of potassium permanganate destroys the growing fungus. Hence athletes typically use it on their feet for pain alleviation.

- According to AstraZeneca, the projected pharmaceutical sales in 2024 are expected to be USD 633 billion for North America, holding the major share. It is followed by the European Union (excluding the United Kingdom) with USD 287 billion at the second position, and then Southeast and East Asia is expected to register USD 232 billion.

- Germany is one of the world's largest locations in the pharmaceutical industry, with nearly 400 companies. Furthermore, as of 2022, according to the European Federation of Pharmaceutical Industries and Associations, Germany led the way in terms of pharma industry R&D spending, ahead of Switzerland, the United Kingdom, and France, with EUR 8,466 million (~USD 8,921 million) spend on research.

- The pharmaceutical market in Germany is identified as a top-prospect sub-sector by world-leading pharmaceutical manufacturing companies, which are expanding into the country to strengthen their position in the global market. For instance, in August 2022, the key global pharmaceutical player, Bayer, underwent the development of the Solida-1 pharmaceutical production facility at its site in Leverkusen for an investment of EUR 275 million (~USD 287 million). The facility is expected to come on stream in 2024.

- Pfizer, a global pharmaceutical company, revealed that its total revenue exceeded USD 100 billion in 2022 for the first time in its history, a record among global drug manufacturers. The company estimated a total revenue of approximately USD 100,330 million in 2022.

- Therefore, the continuously expanding pharmaceutical production capabilities and the high demand for pharmaceuticals are expected to drive the potassium permanganate forward during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific will likely dominate the global market due to the region's highly developed healthcare sector and ongoing investments in the water treatment and agriculture sectors over the years.

- Potassium permanganate used in the region's textile sector increased in recent years. Potassium permanganate spray is mostly used to brighten denim textiles by decolorizing and bleaching them.

- Potassium permanganate is used in water treatment applications to remove toxins and algae rose. The Asia-Pacific region's growing need for clean water and expanding water treatment facilities are projected to support potassium permanganate used in the future.

- According to the Director General of the Pharmaceutical Export Promotion Council of India (Pharmexcil), India exported INR 1,75,040 crore (~USD 24.62 billion) worth of pharmaceutical products, including bulk drugs/drug intermediates, in FY 2021-22. Furthermore, India's pharmaceutical exports increased by 4.22% from April to October 2022, reaching USD 14.57 billion. The exports were valued at USD 13.98 billion during the same period in the previous fiscal.

- As per the data revealed by the All-Indian Origin Chemists and Distributors, the sales of the Indian pharmaceutical industry delivered a healthy growth of 17.3% y-o-y in November 2022 and 10.4% y-o-y in December 2022. In December 2022, the production volume registered 1.5% y-o-y growth while prices of the pharma products climbed 6.8%. The growth figures in the pharmaceutical industry during the remaining 3 months of FY 2022-23 are expected to stay up by 9-10%. They are in line with the average growth rate of 9.1% y-o-y in the first nine months of FY 2022-23.

- Moreover, according to the National Bureau of Statistics of China, the gross production value in crop production is projected to amount to USD 1.23 trillion in 2023. The revenue from crop production in China accounted for USD 1.13 trillion in 2021 and USD 1.18 trillion in 2022. It is estimated that the revenue will reach USD 1.30 trillion in 2025.

- The factors above are expected to drive the market in the region during the forecast period.

Potassium Permanganate Industry Overview

The potassium permanganate market is partially fragmented, with several players. Some major companies are Chongqing Changyuan Group Limited, Carus Group Inc., Organic Industries Pvt Ltd., GFS Chemicals, Inc., and Guangdong Hangxin Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Need for High-Quality Water Treatment

- 4.1.2 Increasing Usage in the Pharmaceutical Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Associated Health Issues

- 4.2.2 Others Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By End-user Industry

- 5.1.1 Pharmaceutical

- 5.1.2 Water Treatment

- 5.1.3 Food and Beverage

- 5.1.4 Agriculture

- 5.1.5 Other End-user Industries

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Carus Group Inc.

- 6.4.2 Changsha Yonta

- 6.4.3 Chongqing Changyuan Group Limited.

- 6.4.4 GFS Chemicals, Inc.

- 6.4.5 Guangdong Hangxin Technology Co., Ltd

- 6.4.6 Libox Chem (India) Pvt. Ltd.

- 6.4.7 Magnesia

- 6.4.8 Milport Enterprises, Inc.

- 6.4.9 Nippon Chemical Industrial CO., LTD.

- 6.4.10 Otto Chemie Pvt. Ltd.

- 6.4.11 Univar Solutions Inc.

- 6.4.12 Universal Chemicals & Industries Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Government Initiatives Focusing on the Supply of Treated Soft Water

- 7.2 Other Opportunities