|

市场调查报告书

商品编码

1435796

1,6-己二醇:市场占有率分析、产业趋势/统计、成长预测(2024-2029)1,6-Hexanediol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

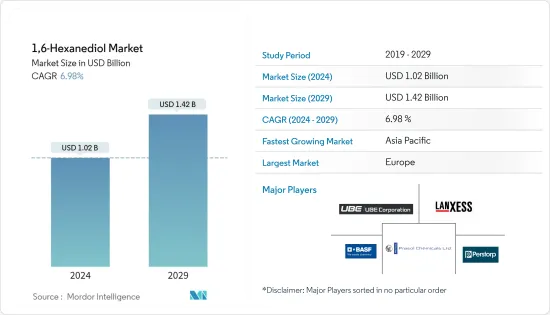

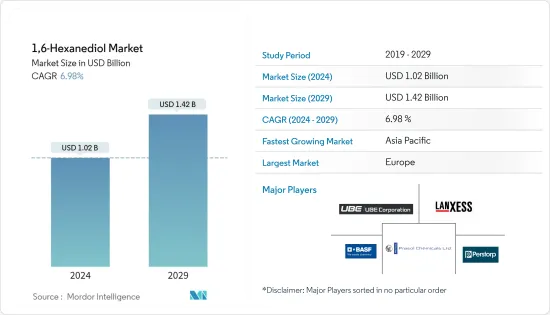

1,6-己二醇市场规模预计到2024年为10.2亿美元,预计到2029年将达到14.2亿美元,在预测期内(2024-2029年)复合年增长率为6.98%。

COVID-19 的爆发对多个行业产生了负面影响,包括在涂料中使用 1,6-己二醇的建设产业。这对市场产生负面影响。然而,市场在 2021 年和 2022 年获得动力,导致疫情前对 1,6-己二醇的需求增加。

主要亮点

- 推动所研究市场的主要因素是化合物生产原料的使用量增加以及风力发电产业需求的增加。

- 另一方面,丁二醇和戊二醇等替代品的供应阻碍了市场的成长。

- 技术进步和生物基原料的开发预计将为1,6-己二醇市场提供新的机会。

- 欧洲地区是最大的市场,消费来自德国和英国国家。

1,6-己二醇市场趋势

聚氨酯和涂料领域的需求增加

- 聚氨酯的成长是由对油漆和涂料、合成橡胶和泡沫的高需求所推动的。 1,6-己二醇在聚氨酯应用领域用作扩链剂。这将聚氨酯转化为具有显着更高耐腐蚀的改性聚氨酯。

- 它也渗透了聚氨酯的各种性能,如机械强度高、玻璃化转变温度低、耐热性高等。

- 聚氨酯成长的关键因素是各地区对合成橡胶、涂料、泡沫等热塑性聚氨酯的子应用和衍生的需求。与油漆、涂料和黏剂相关的扩建计划正在世界各地进行,以满足各行业不断增长的需求。

- 2022 年 8 月,Tiger Dryra 宣布将在其位于美国伊利诺州圣查尔斯的现有工厂进行扩建计划。该公司旨在透过该扩建计划扩大其粉末涂料业务。

- 此外,Pearl 聚氨酯系统公司于 2023 年 4 月推出了一种名为 PearlBond黏剂的新型聚氨酯黏剂。这种黏剂可用作慢跑道、儿童游乐场垫和花园瓷砖的黏合剂。它也可用作夹芯板隔热隔热材料中的层压黏剂、结构上用作木材黏合剂以及各种建筑应用中的屋顶黏剂。

- 此外,根据美国人口普查局的数据,2022 年国内商业建筑总价值为 1,147 亿美元,而 2021 年为 945 亿美元。建设产业的这种趋势可能会增加对油漆和涂料的需求,从而增加预测期内对用于製造油漆的 1,6-己二醇的需求。

- 因此,这些因素和趋势可能会增加预测期内对1,6-己二醇的需求。

亚太地区是成长最快的市场

- 亚太地区是 1,6-己二醇 成长最快的市场,并将继续如此,黏剂、织物柔软剂、清漆、丙烯酸树脂和其他几种消费品製造商的消费量将保持稳定。预计成长将继续。 1,6-己二醇市场。

- 化学品在丙烯酸酯生产中的使用在欧洲尤其明显。德国和义大利是该地区的主要进口国之一,这主要是由于汽车应用对聚氨酯的需求不断增加。

- 2023年5月,Sirca Paints India Limited与Sirca SpA(义大利)签署协议,在印度生产10种聚氨酯木器涂料产品。此举旨在减少Sirca Paints India Limited的进口依赖,并满足印度对聚氨酯油漆和涂料不断增长的需求。

- 此外,BASF公司于2022年8月推出了新型隐形热塑性聚氨酯(TPU)漆面保护膜(PPF),以更好地服务亚太地区的汽车产业。

- 所有这些因素都可能增加该地区1,6-己二醇市场的需求。

1,6-己二醇产业概况

全球1,6-己二醇市场本质上是部分一体化的,少数大型企业控制很大一部分市场。主要参与者包括(排名不分先后)BASFSE、朗盛、UBE Corporation、Perstorp Holding AB 和 Prasol Chemicals Limited。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 越来越多地用作生产化合物的原料

- 风力发电产业需求增加

- 其他司机

- 抑制因素

- 替代品的可用性

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 价格走势分析

第五章市场区隔(以金额为准的市场规模)

- 原料

- 环己烷

- 己二酸

- 目的

- 聚氨酯

- 涂层

- 丙烯酸酯

- 黏剂

- 聚酯树脂

- 塑化剂

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争形势

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- BASF SE

- Central Drug House

- Hefei TNJ Chemical Industry Co., Ltd.

- LANXESS

- Perstorp(PETRONAS Chemicals Group Berhad)

- Prasol Chemicals Limited

- UBE Corporation

- YUANLI SCIENCE AND TECHNOLOGY

- Zhejiang Lishui Nanming Chemical Co.,Ltd.

- Zhengzhou Meiya Chemical Products Co., Ltd.

第七章 市场机会及未来趋势

The 1,6-Hexanediol Market size is estimated at USD 1.02 billion in 2024, and is expected to reach USD 1.42 billion by 2029, growing at a CAGR of 6.98% during the forecast period (2024-2029).

The Covid-19 outbreak had a negative impact on various industries including the construction industry where 1,6-Hexanediol is used in the coatings. This has a negative impact on the market. However, in 2021 and 2022, the market has gained momentum which has led to pre-pandemic demand for 1,6-Hexanediol.

Key Highlights

- Major factors driving the market studied are the increasing usage as feedstock for manufacturing chemical compounds and rising demand from the wind energy sector.

- On the other side, the availability of substitutes such as butanediol and pentanediol is hindering the growth of the market.

- Advancement in technology and the development of bio-based raw materials is expected to provide new opportunities for the 1,6-Hexanediol market.

- Europe region represents the largest market owing to the consumption from countries such as Germany and the United Kingdom.

1,6-Hexanediol Market Trends

Increasing Demand from the Polyurethane and Coatings Segment

- The growth of polyurethanes is attributed to the high demand for paint and coatings, elastomers, and foams. 1,6-hexanediol is used as a chain extender in the polyurethane application segment. It converts the polyurethane into a modified polyurethane with substantially high corrosion resistance.

- Also, it permeates different properties in polyurethanes, such as high mechanical strength, low glass transition temperature, and high heat resistance.

- A key factor for the growth of polyurethanes is the demand for their sub-applications or derivatives, such as thermoplastic polyurethanes elastomers, coatings, and foams, across varied regions. To serve the growing demand from several industries, expansion projects related to paints, coating, and adhesives are being carried out globally.

- In August 2022, TIGER Drylacannounced an expansion project that will be carried out at its existing facility in St. Charles Illinois in the United States. Through this expansion project, the company aims to expand its powder coatings business.

- Further, Pearl Polyurethane Systems launched a new polyurethane-based adhesive by the name PearlBond adhesive in April 2023. This adhesive can be used in jogging tracks, kids' playground mats, and garden tiles as a binder. It can also be used in the construction of sandwich panel insulation as a lamination adhesive, for structural purposes as wood binders, and as a roofing adhesive for a variety of construction uses.

- Further, according to the United States Census Bureau, in the year 2022, the total value of commerical construction in the country was valued at USD 114.7 billion while in the year 2021, it was USD 94.5 billion. Such trends in the construction industry are likely to boost the demand for paints and coatings and hence the demand for 1,6-Hexanediol used in the production of paints over the forecast period.

- Hence, such factors and trends are likely to boost the demand for 1,6-Hexanediol over the forecast period.

Asia-Pacific is the Fastest Growing Market

- Asia-Pacific is the fastest-growing market for 1,6-hexanediol and is projected to remain so owing to steady consumption by manufacturers of adhesives, softening agents, lacquers, acrylics, and several other consumer products, which are driving the growth of the 1,6-hexanediol market.

- The use of chemicals in the manufacturing of acrylates will be particularly notable in Europe. Germany and Italy are among the key importers in the region mainly attributable to the increasing demand for Polyurethane in automobile applications.

- In May 2023, Sirca Paints India Limited signed an agreement with Sirca S.p.A (Italy) to manufacture 10 different Polyurethane wood coating products in India. This step comes towards reducing the import dependency of Sirca Paints India Limited and meeting the growing demand for polyurethane paints and coatings in India.

- Further, in August 2022, BASF SE launched a new invisible Thermoplastic Polyurethane (TPU) Paint Protection Film (PPF) to better serve the automotive industry in the Asia-Pacific region.

- All such aforementioned factors are likely to enhance the demand for 1,6-hexanediol market in the region.

1,6-Hexanediol Industry Overview

The global 1,6-hexanediol market is partially consolidated in nature with a few major players dominating a significant portion of the market. Some of the major players (not in any particular order) are BASF SE, LANXESS, UBE Corporation, Perstorp Holding AB, and Prasol Chemicals Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage as Feedstock for Manufacturing Chemical Compounds

- 4.1.2 Rising Demand from the Wind Energy Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Trend Analysis

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Raw Material

- 5.1.1 Cyclohexane

- 5.1.2 Adipic Acid

- 5.2 Application

- 5.2.1 Polyurethane

- 5.2.2 Coatings

- 5.2.3 Acrylates

- 5.2.4 Adhesives

- 5.2.5 Polyester Resins

- 5.2.6 Plasticizers

- 5.2.7 Others

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Central Drug House

- 6.4.3 Hefei TNJ Chemical Industry Co., Ltd.

- 6.4.4 LANXESS

- 6.4.5 Perstorp (PETRONAS Chemicals Group Berhad)

- 6.4.6 Prasol Chemicals Limited

- 6.4.7 UBE Corporation

- 6.4.8 YUANLI SCIENCE AND TECHNOLOGY

- 6.4.9 Zhejiang Lishui Nanming Chemical Co.,Ltd.

- 6.4.10 Zhengzhou Meiya Chemical Products Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Advancement in Technology and Development of Bio-Based Raw Material

- 7.2 Other Opportunities